FinkAvenue/iStock Editorial via Getty Images

Thesis

NXP Semiconductors’ (NASDAQ:NXPI) FQ2 earnings card demonstrated the strength of its diversified and robust portfolio, leveraging the growth cadence of its automotive and industrial segments.

Management continues to see robust demand from its auto customers, even as macro worries and inflation concerns hit auto manufacturers markedly in 2022. As a result, the market de-rated the auto OEMs, adjusting their expectations for large-expense consumer discretionary spending.

Notwithstanding, we believe NXP is in the early stages of riding the secular transformation to EVs, coupled with the current tight supply/demand dynamics. Notwithstanding, concerns regarding excessive inventory buildup on NXP and its customers’ potential double ordering have continued to weigh on NXPI.

However, management has remained committed to keeping its inventory “lean” to provide better clarity to its risk-adjusted guidance.

We believe that the sell-off in June that sent NXPI to its July lows formed a robust bear trap (indicating the market decisively denied further selling downside). The price action has played out accordingly, as NXPI recovered remarkably since its early July lows.

Given the recent surge, we believe the risk/reward profile has gotten more well-balanced. Therefore, we think investors should consider waiting for its next retracement before adding exposure to improve their chances of market outperformance.

Management Remains Optimistic On Its Automotive Growth Momentum

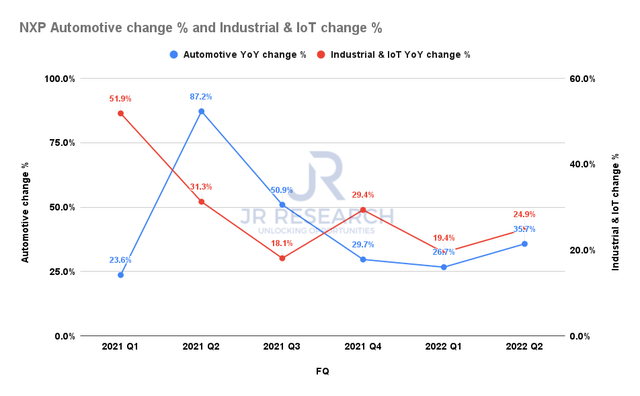

NXP automotive and industrial & IoT revenue change % (Company filings)

NXP has continued its remarkable growth cadence in its auto segment, as revenue grew by 35.7% YoY, up from FQ1’s 26.7%. Industrials & IoT also gained strength from Q1’s performance, as revenue increased by 24.9%, up from last quarter’s 19.4%.

As a result, the company has largely avoided the PC and mobile headwinds that afflicted its peers with significant exposure to the consumer markets. CEO Kurt Sievers accentuated:

When we look at demand signals, we have a high level of confidence in the intermediate-term outlook. This is especially true in terms of demand trends in the Automotive and Industrial markets, which account for the majority of our total revenue. While there is a well-documented weakness in the low-end Android handset market, it is important to note that our Mobile business is more biased towards the premium-tier vendors. And in aggregate, our Mobile business accounts for only about 12% of our total revenue. In terms of the PC and broad consumer electronics markets, there are much smaller contributors in the IoT portion of our Industrial & IoT segment. (NXP FQ2’22 earnings call)

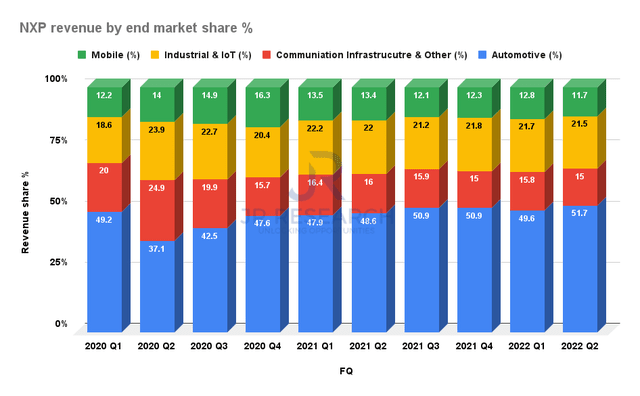

NXP revenue share by end market % (Company filings)

Therefore, the company’s focus on automotive has been successful, as automotive accounted for 51.7% of its Q2 revenue, driving its revenue upside. On the other hand, mobile’s revenue share has been falling consistently from the highs of 2020, reaching 11.7% in FQ2.

Notably, the company also guided for automotive and industrial to continue leading the charge in moving forward. Management guided both segments to increase “in the low 20% range” in FQ3.

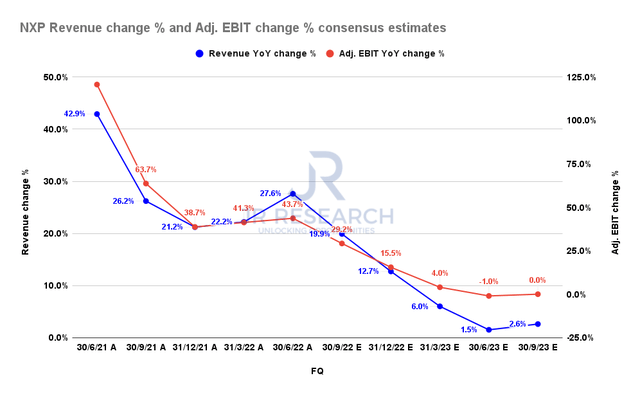

NXP revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The company also guided for overall revenue growth of 20% YoY in Q3, driven by its two key segments mentioned above. The consensus estimates (bullish) also concur with guidance, estimating 19.9% revenue growth in Q3.

Furthermore, the company’s inherent operating leverage is expected to continue driving operating profit growth, as adjusted EBIT is projected to increase by 29.2% YoY.

Notwithstanding, the Street remains unconvinced of NXP maintaining its current growth cadence, despite its massive TAM in automotive and industrials.

As seen above, NXP’s revenue growth is expected to moderate significantly through FY23, also impacting its adjusted EBIT growth markedly. BofA also highlighted in a recent commentary (edited):

Investors are likely to be cautious about automotive and industrial sales beyond the third quarter as caution remains around the disconnect between emerging consumer/cloud yellow-flags and infrastructure resilience. While NXPI noted demand in core markets is exceeding supply, we look for commentary pertaining to Q4/2023 visibility and thoughts on inventory positioning. Margins have been robust, but if a downturn were to happen, there could be some downside risk. – Seeking Alpha

We Think NXP Could Underperform At The Current Levels

| Stock | NXPI |

| Current market cap | $48.02B |

| Hurdle rate [CAGR] | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 7% |

| Assumed TTM FCF margin in CQ4’26 | 26% |

| Implied TTM revenue by CQ4’26 | $20.52B |

NXPI reverse cash flow valuation model. Data source: S&P Cap IQ, author

Investors should note that NXPI last traded at an NTM free cash flow (FCF) yield of 6.38%, in line with its 5Y mean of 6.01%. But, we expect NXP’s FCF margins to improve through FY24. Therefore, NXPI last posted an FY24 FCF yield of 7.91%.

However, the market rejected further buying upside at its December 2021 highs at an FY24 FCF yield of 6.03%. Therefore, the market appears to have de-rated NXPI, even though it traded in line with its 5Y mean.

With that in mind, we believe the market could likely be asking for higher FCF yields to compensate for a potential downcycle and inventory challenges moving ahead.

Hence, we applied an FCF yield of 7% in our model, which we believe is appropriate to model for these risks.

Also, using a market-perform hurdle rate of 11%, we require NXPI to post a TTM revenue of $20.52B by CQ4’26. However, we believe NXPI could miss our revenue target if its revenue growth continues moderating, despite robust FCF margins. Consequently, it suggests that NXPI would not meet the 11% hurdle rate in our model at the current valuation.

Therefore, we believe new investors should consider a retracement closer to its July lows before adding exposure.

Is NXPI Stock A Buy, Sell, Or Hold?

We rate NXPI as a Hold for now.

NXPI’s July lows should hold, given its bear trap. Therefore, we urge investors should wait for a re-test of its July lows, if they are conservative, before adding exposure. Those levels are attractive and can help investors to outperform the market.

Be the first to comment