Justin Sullivan

How quickly things change in the market? It was a few short months ago that NVIDIA Corporation (NASDAQ:NVDA) could do nothing wrong. The stock market in general and the company in particular were both soaring to dizzying heights towards the end of 2021. In fact, things were so great that CEO Jensen Huang made it to Time Magazine’s top 100 most influential list. Some contrarian investors that we know called that as the top for the company back then.

Fast forward to the present. Long gone are the days where the company was expected to be the next trillion dollar empire. As of this writing, the market cap is well below the $300 Billion mark. What is an investor to do?

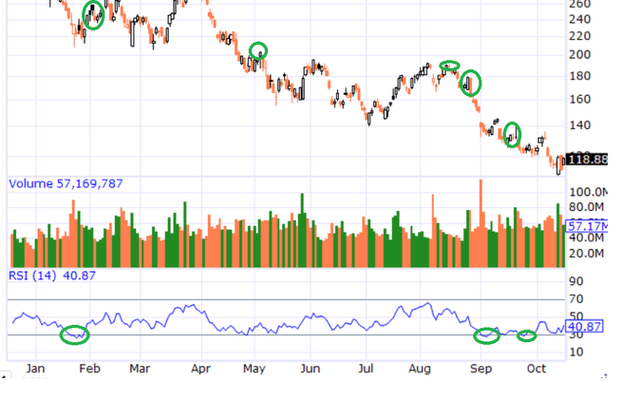

Things are looking up just a bit for NVIDIA on the technical side. The stock is not entirely out of the woods, obviously, as it is trading below all of its moving averages (5, 10, 20, 50, 100, 200), but a few things are in its favor.

- NVIDIA has RSI of 32 as of this writing. This is textbook condition to identify an oversold stock. The more important point is that as shown in the chart below, despite constant selling pressure this year, NVIDIA has bounced back each time the RSI went below 30.

- Outside of moving averages and RSI, another commonly used technical indicator is MACD, which stands for Moving Average Convergence Divergence. A MACD above 0 is considered bullish while anything below 0 is bearish. As one might expect with a stock trying to break out of its downtrend, NVIDIA has a slightly positive MACD at .280. This indicates an upward momentum.

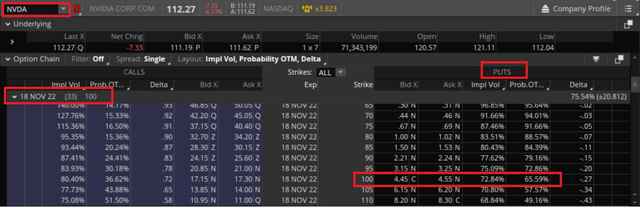

With the above in mind, if you are interested in NVIDIA but would like to get it lower, then consider selling cash secured puts as shown/explained below.

Key data points

- Strike Price: $100

- Expiration Date: November 18th, 2022, almost exactly a month from today.

- Premium: $4.50/share, for a total of $450.

In simple words, the put seller collects $450 immediately to buy 100 shares of NVIDIA at $100 if the stock reaches $100 or below by November 18th, 2022.

What’s the expected return and possible outcomes?

Return: The premium collected ($450) for setting aside $10,000 represents a 4.50% return for a month. This is a handy return anytime and even more so in the current market environment. At this time, the market assigns at 65% probability that NVIDIA remains above $100 by expiration on November 18th.

Outcome #1: If NVIDIA stays above $100 by the expiration date, the option seller just retains the premium mentioned above. The option seller will not be obligated to buy the shares. The RSI and MACD mentioned above indicate that the put seller is unlikely to get assigned the shares and can retain the premium of 4.50% for a month’s commitment to buy at $100. Again, not a bad deal for a month.

Outcome #2: If NVIDIA goes below $100 by the expiration date, the option seller will be forced to buy 100 shares at $100, irrespective of where the stock trades at that time. Keeping the premium netted in mind, the average cost, in this case, will be $95.50 ($100 minus $4.50).

Outcome #3: As an option seller, one can “buy to close” anytime instead of waiting till the expiration date. That may be appealing to those who have the time and patience to play short-dated options many times over. But we typically let the option expire before choosing another chain (or another stock).

Outcome #4: Let’s say the stock price plummets below $100 before the expiration. In this scenario, the premium you got paid when selling the put will be lower than the price you’d need to pay to “Buy to close” in outcome #3. Let’s say you don’t want to get assigned yet but at the same would like to remain in the game to acquire NVIDIA lower. Then “rolling” your cash secured put is an option. We have not executed this put on NVIDIA yet and are not able to share a screenshot from our own account. But, this article explains the steps and the scenarios very well.

Why we are confident about this trade?

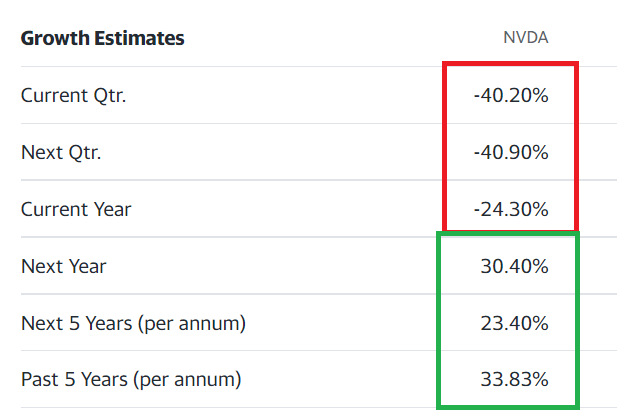

- Valuation: At $100, NVIDIA’s forward multiple will be ~29. Investors who look for safety and better valuation may rightly point out that is still expensive in a declining market, especially with the semiconductor demand shrinking in the short to medium term. Fair enough. But when you factor in the expected earnings growth rate, at $100 per share, NVIDIA will possess a respectable PEG of 1.25% should the 5 year growth rate materialize. Since the stock has already been hammered for the items in red, it is fair to expect being rewarded for the items in green. The estimates and actual earnings are more likely to go down in the near future but the larger point is that a rebound will be also be powerful.

NVDA Estimates (Yahoo Finance)

- How much is too much? At $100, NVIDIA would have lost 71% from its current 52 week high of $346. Obviously, the stock market and parts of the World are in a different state now compared to this time last year but each investor should answer this question for their own self. How much is too much before you buy a stock? For us, a 71% decline in an industry leader that is unlikely to get wiped out is compelling enough. If anyone had doubts about the company’s financial strength, Cash on hand is double that of long term debt.

- Below the lowest bear: Analysts and price targets come in all size, shape, and form. Most retail investors brush off these price targets and rightly so. No one can predict to the dollar and cent. But a range is quite helpful. As pointed here, at present, NVIDIA’s price target for next 12 months ranges from $110 to $325. At $100 strike price, NVIDIA will be trading 9% below the lowest price target.

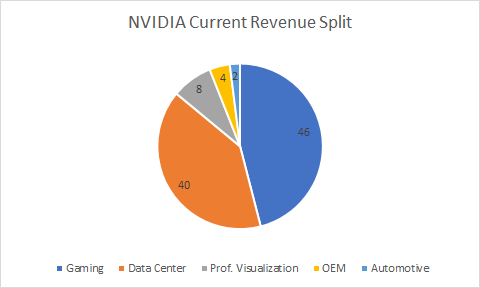

- Future Dollar for Pennies?: As well outlined in this article, NVIDIA’s current revenue is split among 5 core markets as shown in the pie chart below. Gaming and Data center segments, unsurprisingly, dominate the current mix. But looking ahead into the future, is the market completely discounting the potential $300 Billion Automotive market? And the $40 Billion OEM market? It certainly appears like it. And these are not just plans or castles in the air right now. NVIDIA’s partners include Mercedes, Hyundai, and Toyota to name a few.

NVDA Revenue Split (Author, referencing SA Article)

Be aware of your risks and choices

- The market is really choppy and is looking for reasons to sell off. Your strike price may be reached quicker than usual. Be very sure of a few things including but not limiting to liking the underlying stock and being comfortable owning at the strike price. In a down trending market, a stock is likely to go below any buying price, whether you use market buy or limit orders or use strike prices through options. It takes a lot of discipline and long term conviction to actually believe in a company long-term and not react adversely to the stock going lower from your buying price.

- Please note that NVIDIA is set to report earnings on November 23rd. Even though this is after the expiration of this chain, things could get a bit volatile this close to earnings. The fact that NVIDIA’s earnings estimates have been falling at rates not seen since 2008 may mean the worst is already priced in but the market tends to overshoot in both directions.

- Foreign policies, especially with respect to China, has already adversely impacted the stock. Even though the company came out with a defending statement that China still presents an opportunity, expect more downside pressure than upward tailwinds in this regard in the short term.

Conclusion

When things turn around, the best of breed names will be the first ones to benefit. NVIDIA is still the strongest semiconductor brand out there. If you plan to own less than 100 shares of NVIDIA for your long term portfolio, this strategy may not be for you. But if you plan on holding more than 100 shares for your long term, consider selling puts using the suggested chain or another you may like. This will ensure you stay in the game but also don’t go all in at once. Not to mention the 4.50% return in this example.

What is your opinion on NVIDIA here and at $100? Please leave your comments below.

Be the first to comment