Justin Sullivan

In the last two years, NVIDIA Corporation (NASDAQ:NVDA) and Advanced Micro Devices, Inc. (AMD) have both put up much better than expected results due to strong demand for processors and graphic processing units which was fueled by an unprecedented global pandemic and a simultaneous cryptocurrency mining boom. While the sale of GPUs is only one part of Nvidia’s business, the pre-release of second-quarter results strongly indicate that Nvidia’s growth and margins have peaked. Going forward, I expect a continual slowdown in topline growth and gross margins and, for that reason, have sold my Nvidia shares!

Nvidia: FQ2’23 pre-release was a horror show

The first warning that the PC market is in much worse shape than expected came from Intel (INTC) a short while ago when the company submitted a terrifying outlook for FY 2022 due to slowing PC shipments. According to consulting company Gartner, the global PC market contracted 12.6% in Q2’22 and makers of CPUs and GPUs are starting to feel the pain, including Nvidia.

Nvidia supplied preliminary results for its second fiscal quarter on Monday that showed a dramatic deceleration in the chipmaker’s growth. Companies typically submit preliminary earnings to inform the market about material changes in their operating and financial conditions, and this is exactly what happened here.

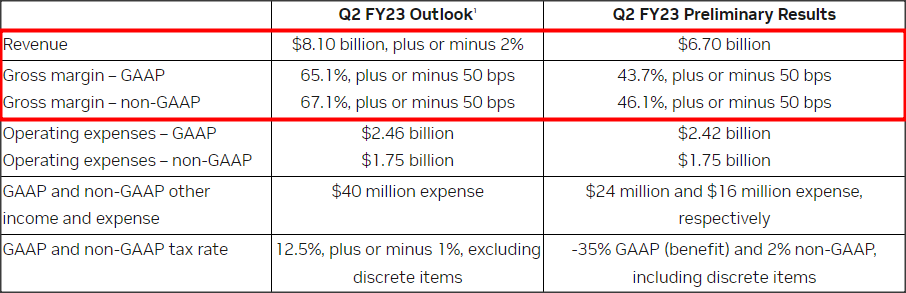

Nvidia announced a 17% shortfall in revenues – relative to the company’s May guidance – and is now expecting to report a topline of $6.7B as opposed to $8.1B +/- $162M for FQ2’23. Besides a material deceleration of Nvidia’s revenue growth, the company is seeing a massive and simultaneous collapse in its gross margins as well… a strong indication that the current expansion cycle is ending and that Nvidia’s margins have peaked. According to Nvidia’s May guidance, the company expected to generate an FQ2’23 non-GAAP gross margin of 67.1% +/- 50 basis points. Nvidia’s preliminary results indicate a non-GAAP gross margin of just 46.1%… which represents a huge and totally unexpected 21 PP decrease in margins relative to Nvidia’s guidance from just three months ago. The implication is that the PC market is turning down much more rapidly than expected and it could result in serious pricing weakness for Nvidia’s GPU products going forward.

Nvidia: FQ2’23 Preliminary Results

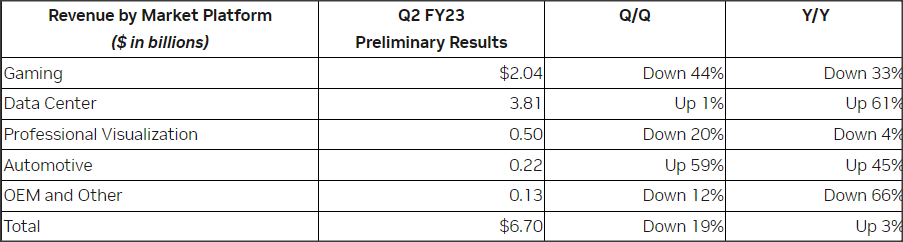

The slowdown in Nvidia’s revenue growth is driven chiefly by the Gaming segment, which is dependent on strong sales of Nvidia’s branded graphics cards such as the RTX 30 series, which enjoys huge popularity with gamers. Nvidia’s Gaming segment saw a 33% decrease in revenues compared to the year-earlier period and is set to report just $2.04B in revenues for FQ2’23. Because of the drop in Gaming revenues, the Data Center business is now generating almost twice as many revenues as Gaming… a segment that Data Centers only overtook in FQ1’23.

Nvidia: FQ2’23 Preliminary Segment Performance

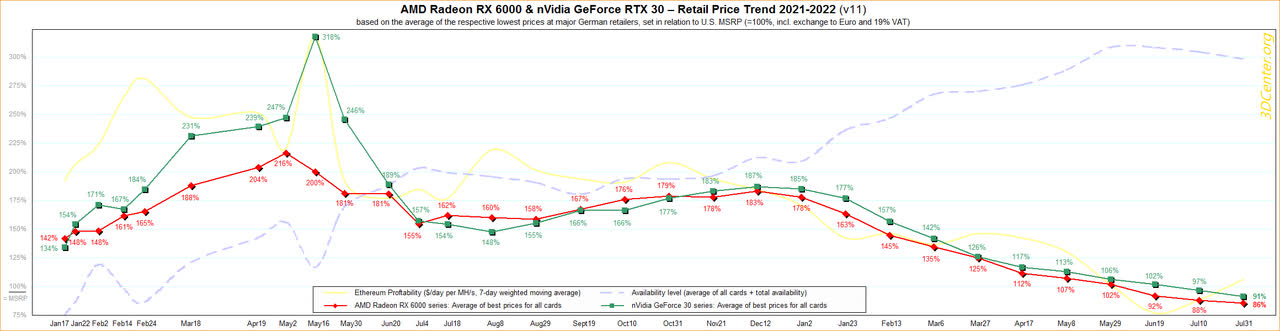

Gaming revenues are now Nvidia’s second-largest business after Data Centers regarding dollar contributions, so a slowdown in this segment is seriously clouding the firm’s growth prospects. The decline in Gaming revenues is related to the decline in PC shipments as well as a rapidly easing GPU supply crunch that has driven graphic card prices to record levels last year. Graphic cards are used by gamers, designers but also cryptocurrency miners which use GPUs to mine digital assets. With cryptocurrency prices crashing in 2022, demand for GPUs has normalized, and it looks as if the decline in GPU sales – and the deterioration of pricing power that accompanies it – is worse than expected.

Nvidia’s RTX 30 prices have fallen to 0.91x of the manufacturer’s recommended selling price in July and dropped from a peak of 3.20x in May of last year. Prices for GPUs have fallen for more than a year now, but I am surprised by the unexpectedly large decline in Nvidia’s second-quarter Gaming revenues, which indicates a massive drop-off in average selling prices for GPUs as well.

wccftech.com: GPU Pricing Trend

Why the downturn in Gaming?

There are three factors that have started to weigh on the PC market in the second quarter: (1) Demand for computers peaked during Covid-19 and PC sales hit a 20-year-high in Q1’21. Consumers upgraded their equipment during the pandemic to prepare for remote working and studying, which is now reducing the need for additional equipment upgrades; (2) cryptocurrency prices have crashed, limiting demand for GPUs dedicated to mining operations; and (3) inflation is likely causing consumers to be more careful about how they are spending money. All three factors combined may continue to weigh on Nvidia’s Gaming business for quite some time.

The market is in denial

The speed of the decline in Nvidia’s revenue and gross margin growth is a huge warning that things are about to get worse. It definitely and completely invalidates my arguments about a potential revenue acceleration this year.

Research company Gartner recently indicated that it expects a continual slowdown in the PC market for FY 2022 which could result in a total market contraction of 7.6%. AMD also warned that the PC market is turning down faster than expected, which led the company to submit a disappointing forecast for Q3’22.

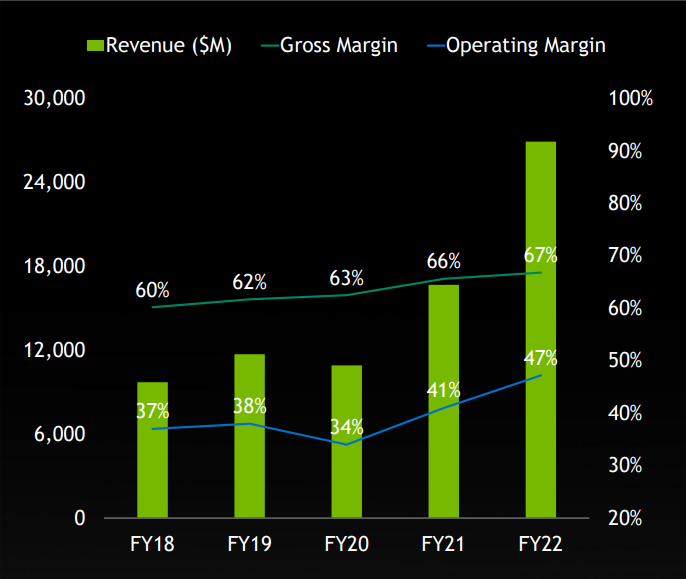

Due to Intel and AMD submitting much weaker forecasts than expected, Nvidia’s hand was forced to pre-release FQ2’23 earnings. Based off of Nvidia’s preliminary results, I assume that Nvidia’s gross margins have peaked in FQ1’23 and won’t return to the 60% level for quite a while. Nvidia’s gross margins have increased for five consecutive years due to strong demand for the company’s CPUs and GPUs.

Nvidia: FY 2018-2022 Gross Margins

After the release of preliminary results, the market is primed to see serious revenue and EPS downgrades. What may make things worse is that Nvidia has about two weeks left until it officially presents FQ2’23 results, which creates a massive amount of uncertainty and negative sentiment overhang for Nvidia.

Nvidia’s shares skidded only 6.3% yesterday, which I believe is a percentage amount that doesn’t do justice to the extraordinarily steep decline in both revenues and gross margins.

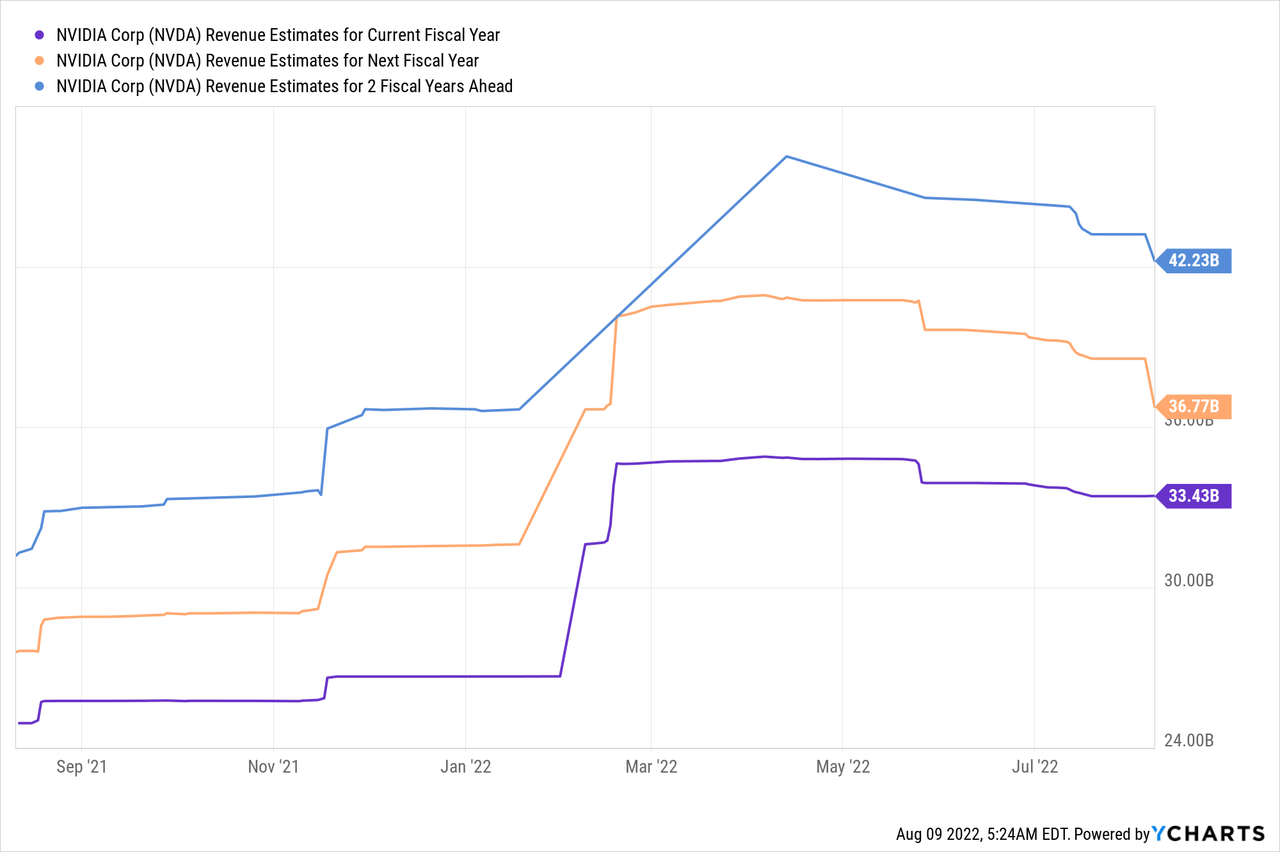

Revenue estimates have already started to fall, but it may get significantly worse from here.

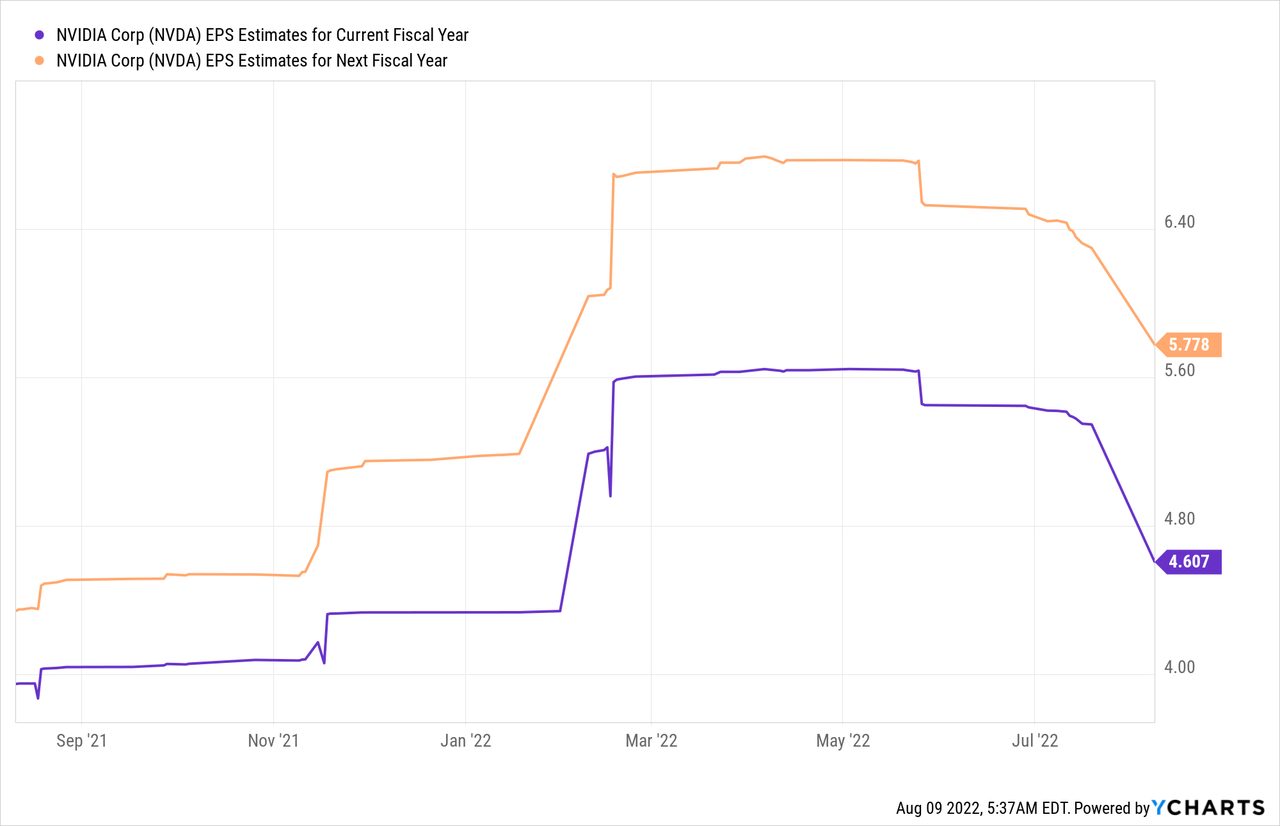

Nvidia’s EPS estimates for this year and next year are also falling sharply…

Risks with Nvidia

The biggest risk, obviously, is a continual revenue slowdown in Nvidia’s businesses, led by Gaming. A broad-based decline across Nvidia’s segments poses a big challenge for the company, but also for the stock because it has been chiefly evaluated based on Nvidia’s prospects for topline growth and the possibility of gross margin expansion. What would change my mind about Nvidia is if the company reported a reversal in gross margins as well as a rebound in revenue growth in the coming quarters.

Final thoughts

Shares of Nvidia dropped only 6.3% after a devastating release of preliminary FQ2’23 figures. The market is in denial about the rapid pace of the downturn in the PC market and the degree to which Nvidia is affected by it. I sold Nvidia yesterday due to three factors: (1) Nvidia’s revenue growth is seriously decelerating; (2) Gross margins have contracted 21 PP compared to guidance, indicating that a cyclical downturn has begun; and (3) Nvidia experiences broad-based revenue challenges, especially in the Gaming market where the company is likely to see significant weakness going forward. After the pre-release, the risk profile has fundamentally changed, and it is no longer skewed to the upside!

Be the first to comment