BING-JHEN HONG

It’s hard to find an Nvidia (NASDAQ:NVDA) article on Seeking Alpha and not see the blame of crypto mining for Nvidia’s poor quarter and below consensus guidance. But is crypto really at the heart of the issue? Can it not also be the economic slowdown in retail, seen in many other areas, including semiconductors? Can it not be a drop in demand for a now-generation-behind GPU lineup with a new architecture ready to be released? If you’re asking “who cares,” the answer is it all determines when to invest in Nvidia, if at all, moving forward.

As I alluded to in my last article just a few days ago, where I outlined the Trade War 2.0 impacts on AMD (AMD) and Nvidia, I needed to detail why Nvidia’s woes are not entirely, or even majorly, tied to cryptocurrencies and crypto mining.

Here you go.

To set the stage, Nvidia preannounced its earnings two-and-a-half weeks before its report, saying it expects $6.7B in revenue instead of the guidance for $8.1B it released in May – a sharp $1.4B shortfall. It attributed the shortfall to Gaming revenue as management expected it to fall 44% quarter-over-quarter and 33% year-over-year. When the report was officially released, the number didn’t change; $6.7B was still accurate. That was good for a 3% year-over-year growth in revenue, far from original expectations for almost 25% growth.

And, to finish this set construction, guidance was the real sticking point at $5.9B in revenue versus consensus estimates of $6.92B. But, my issue with this comparison is there were still stale analyst estimates built into that $6.92B. When I looked (not thinking to screenshot it), there were still high analyst estimates over $8.2B, clearly showing the average consensus was taking into account old, un-updated estimates prior to the preannouncement. This makes guidance look even worse. Taking those higher estimates out, I calculate the average would have dropped to $6.5B or thereabouts. This is still a $600M shortfall, but not the $1.02B it appeared to be.

But the crux of the matter is the source of the Gaming downfall. Understanding the reasons for the revenue deterioration in Gaming shapes the reasons to invest or not invest in NVDA at this time, and if investing is the answer, then when is the question.

To blame the entire miss on crypto reveals either straightforward narrative or agenda-driven perma-bear-type of writing. It’s a fact there are multiple variables at play for Nvidia’s retail-facing Gaming division. No one disputes a retail pullback in other retail industries like Target (TGT), or even in its home industry, with Micron (MU) and Western Digital (WDC) pointing the finger at the consumer. Heck, the industry doesn’t deny the deterioration of PC sales.

It’s well known.

To say it’s nearly all crypto assumes the other proven factors are non-existent, and the Ethereum (ETH-USD) fork to proof-of-stake is the culprit. In this case, unless miners were retooling for the 40XX RTX-series cards, the reasons to invest in NVDA are now perpetually weak as crypto demand is not likely to come back unless cryptocurrencies rebound massively and mining is diverted elsewhere.

But, we know retail is a factor, and we know waiting for 40XX-series cards is a factor. And the latter factor can be a factor in both retail and crypto.

No matter what, the through-line is still retail.

Comparing Crypto History

The crypto world has experienced drop-offs before. One was in 2018 when Bitcoin (BTC-USD) mining forever became no longer feasible with GPUs, plus the crash from nearly $20K to $3K, while the other was mid-last year when China banned mining in the country. The 2018 drop-off hurt Nvidia for multiple quarters. Since then, the company introduced hash-lite products to deter mining use, as the product is throttled when mining algorithms are used. These products are now the vast majority of all products sold. Getting a new non-hash-lite product is extremely difficult.

And, if you think hash-lite products don’t make any difference, ask the hackers who stole Nvidia’s files their ransom demands. One of them was to remove the hash-lite “feature.”

But the 2021 China ban stands out to me among these two events.

When China banned mining, the secondary market became flooded with used GPUs – the action in the secondary market was clear as day. The Ethereum hash rate also dropped anywhere from 21.4% to 26.6% (depending on the source), accordingly, from the May 2021 high to the June 2021 low. However, Nvidia’s Gaming division was up 85% in the May-July quarter of 2021, ahead of overall revenue growth of 68%. It also issued guidance for the August-October quarter (FQ3) ahead of consensus by $270M. Gaming revenue grew 42% in FQ3, slowing a bit as overall revenue grew 50%.

The entire country of China flooded the secondary GPU market, and Nvidia’s financials didn’t blink. Now, there might have been some impact in FQ3 as Gaming revenue grew slower than overall revenue, but, if anything, this is likely the indicator of crypto’s actual tug on Nvidia’s Gaming revenue. Regardless, Gaming revenue still grew over 5% sequentially.

So then, how can we believe today’s crypto market suddenly caused a – conservative – $2B shortfall in just two quarters?

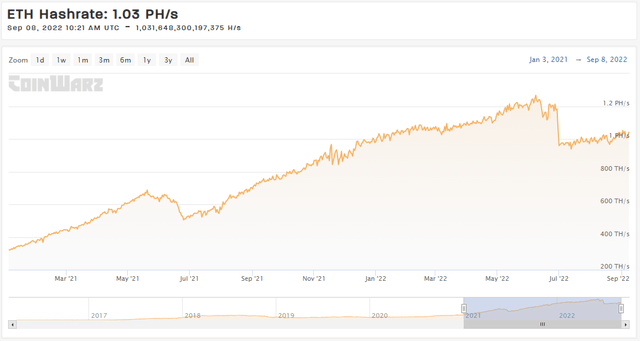

There’s a possibility the current Ethereum environment is different because of the upcoming transition to ETH 2.0, where it will move from the proof-of-work method to the proof-of-stake method, no longer requiring mining. But if that were the case, the hash rate for Ethereum should have fallen to historically low levels. Instead, it fell about 25%, less than the China event.

ETH Hash Rate Chart (CoinWarz)

It also recovered some since that low in June, down 17.8% as of today, with the rate currently at January 2022 levels. If miners fled the Ethereum network, the hash rate should have imploded. But instead, it has taken a dip, just like the China ban a year earlier.

That being said, the “difficulty bomb” set to go off when Ethereum finally makes the transition in a few weeks may change all of this. The idea is to clear all miners off the network by making it too difficult to mine. However, this does not preclude the flooding of the secondary market from being worthless since very few, if anyone, wants a used and abused GPU in their PC or their new mining rig.

And because no one wants a highly used, extremely abused GPU from a miner on the secondary market, it’s not like gamers’ demand is redirected to this low-quality market. The same mindset of “avoid, avoid, avoid” appeared in June of last year after China’s ban. Add to that the idea a gamer is more likely just to wait two months for 40XX series cards to be released before ever thinking about picking up a used 30XX card.

And not to beat a dead horse, but why did miners decide on June to dump everything? The equity and crypto markets all moved together. If anything, the crypto crash scared away miners who were no longer profitable, not ETH 2.0. Granted, the elephant in the room is future demand, meaning would-be miners are not gearing up as there appears to be a dead end with Ethereum mining coming. This is why I conclude crypto plays a role but not the primary one.

Additionally, I don’t believe crypto makes up 50% of Gaming division revenue (the 90% of the $2B shortfall against the reported quarter’s $2.04B Gaming revenue and expected $1.55B Gaming revenue in the current quarter). We would have seen a material impact in the summer quarter last year if it were the case.

Retail Is The Real Reason

So this leads me to two final reasons for Nvidia’s troubles. First, after an extremely high demand period for nearly two straight years – never before seen in Nvidia’s history – the transition to the next generation (Lovelace) will cause demand destruction for the current generation of GPUs (Ampere). Plus, Nvidia continually ramped supply each and every quarter for nearly eight straight quarters, growing supply as it couldn’t keep up. Second, the retail slump caused by the economic conditions is really mainly at fault for the considerable headwind and abrupt slowdown.

Think about it.

It caught Micron off guard – things slowed down materially in its retail-focused end markets during the quarter. Just like Nvidia. The downward revision for Micron was much smaller, with a $400M-$450M reduction in revenues for the upcoming earnings report. But Micron is diversified into end-markets Nvidia is not (such as mobile). There’s some synergistic give and take here as Micron supplies Nvidia’s GDDR memory, but Micron is seeing declines in NAND as well – memory not used in GPUs.

Don’t forget about Western Digital and its horrific guidance expecting $3.7B versus the consensus of $4.79B for its current quarter. There’s no product correlation between Western Digital and Nvidia – the latter doesn’t use NAND in its products, nor do crypto miners.

As the fiscal fourth quarter progressed, we saw consumer spending soften, impacting both retail Flash and HDD demand. This weakness has migrated to the consumer PC end market as we enter the second half of the calendar year.

David Goeckeler, WDC CEO, FQ4 ’22 Earnings call

But let’s blame crypto, right?

Therefore, the retail economic slowdown combined with the upcoming generational transition to the Lovelace architecture is likely the primary factor for why Nvidia missed its reported and current quarter’s expectations.

I don’t discount crypto played a role in the overall revenue picture. As I began this section, Gaming revenue slowed below overall company revenue the quarter after China’s ban. Crypto does have an effect on Nvidia, but the effect is not to the tune of $2B over two quarters when hash rates don’t drop more than the China ban. This is more of a perfect storm of demand destruction after two years of ramping supply to meet that demand combined with a slumping consumer.

How To Play It Then

One has to first understand the source of Nvidia’s woes. If one believes crypto is to blame, they’ll watch the rebound in the crypto market and look for hash rates to increase in altcoins away from Ethereum. This may or may not correlate with positive economic readings or macroeconomic policy. If it does, it’s likely to be merely correlation and not causation.

If the retail challenges in this economy are majorly to blame, then the strategy is to await the return of the consumer. However, since the market is forward-looking, it means being ahead of the economic turn by two or so quarters. By the time the lagging indicators of CPI, employment, and unemployment come across your screen, Nvidia will have lifted off its lows quite a bit.

As I told my subscribers, Nvidia is likely near the lows already, meaning it’s near the time the market starts sniffing out the consumer getting stronger. So wait for the inklings the consumer is bottoming; it means Nvidia is too.

Be the first to comment