Just_Super/iStock via Getty Images

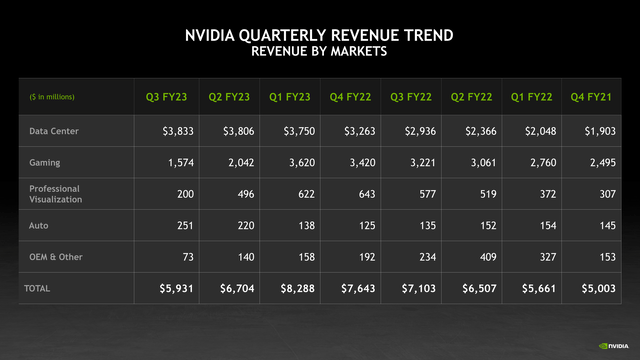

Nvidia (NASDAQ:NVDA) announced its third quarter earnings last week, which were roughly in line with analyst expectations: $5.93B revenue and a Q4 guidance of $6.00B with a 2% deviation. Notably, the earnings call was able to identify some clear trends about where future revenue growth will come from.

Especially with Bitcoin trading at a spot price of $16.7K and demand for graphics cards in the gaming segment declining. We will outline why Nvidia is considered a buy by us based on EV/EBITDA and Free Cash Flow To Equity, focusing on Nvidia’s importance in the AI sector.

Investment Thesis

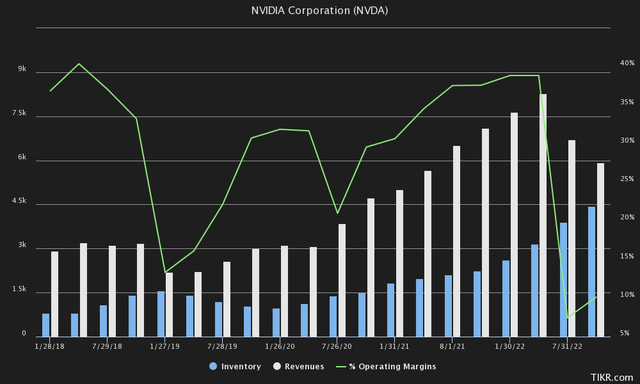

Demand in Nvidia’s gaming segment continues to decline, which we believe is due to a larger downturn in crypto, resulting in a severe supply-demand imbalance that currently results in excess inventory. Management believes that by the close of the fourth quarter, channel inventory should return to “normal levels.” We will discuss crypto and the key risks Nvidia faces with it in a subsequent segment.

“We believe Channel inventories are on track to approach normal levels as we exit Q4.” (Q3 Earnings Call)

Still, Nvidia continued to show resilience in its data center category, even with declining demand in China and a curb on its H100 and A100 chips.

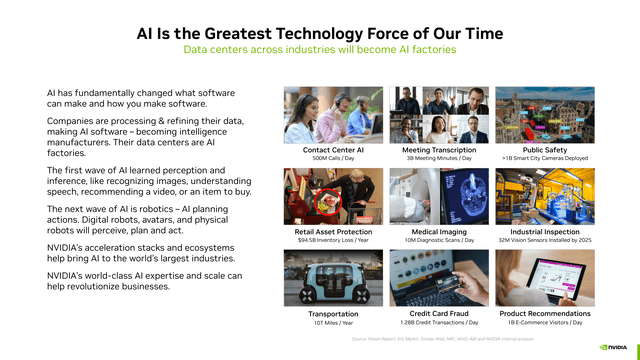

The company’s management also said during its Q3 earnings call that it sees increasing demand for AI. For example, deep recommendation systems, which are essential for recommending an item or product to someone using a device such as a cell phone or interacting with a computer via voice. Other very important AI applications used in people’s daily lives are large language models such as GPT-3. AI is also used in the language of biology and chemistry, for example, to capitalize and train on large sequences of the human genome.

AI may appear to be a buzzword at the moment, but we are convinced that the consequences of advancing AI will be profound in the future. One sector in which it is already disruptive is the automotive industry. Tesla (TSLA) and GM’s (GM) Cruise Automation, for example, have used Nvidia GPUs to build their self-driving platforms. Cruise automation and Waymo (GOOG) have already recently been running fully autonomous driverless vehicles in San Francisco.

The economic impact of scaling up such a low-maintenance, battery-powered, driverless fleet could make the price per mile so low that personal car ownership will disappear for most use cases. Estimates for the price per mile range from $0.15 per mile to $0.30 per mile. Compare that to ride-hail platforms like Uber (UBER) and Lyft (LYFT), which cost roughly between $1 and $2 per mile. This means you can ride anywhere for 10% of the current cost.

The overall AI market is expected to reach between $1.59T and $1.81T by 2030, growing at a whopping 38.1%+ CAGR from 2022. The Robotaxi market, which is currently very small, is expected to grow at a CAGR of 80.8% between now and 2030, from $1.71BN to $108.0BN.

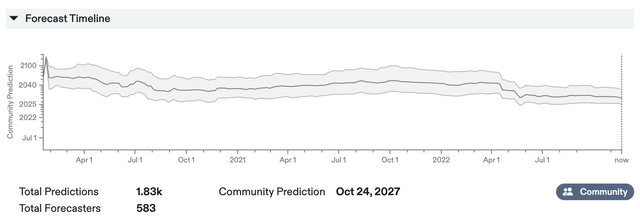

It is difficult to predict the true market size of AI, as applications can be used anywhere in everyday life. The speed at which AI develops is also usually underestimated. For example, the popular community forecasting website Metaculus estimated in March 2020 that a “Weakly General AI” would be “Publicly Known” by 2055. That prediction has now shrunk to October 2027.

Metaculus has previously been praised for its relatively accurate predictions by virtue of being community/group driven with a special points system. Users on Metaculus earn points for successful predictions (or lose points for failed predictions) and track their own prediction progress. Points are awarded for being right and for being more right than the community. On average, the prediction with point’s system outperforms the median of the community’s predictions.

Another example is OpenAI’s DALL-E 2, which generates very realistic digital images from natural language descriptions, offering a lot of possibilities in graphic design. Graphics cards are at the heart of AI, Deep Learning, and Machine Learning. And Nvidia is arguably one of the front-runners when it comes to GPUs.

Crypto Armageddon is Here!

Regarding risk, we think the main risk factor is already largely off the table. Along with many analysts, we were concerned about the impact of Ethereum’s transition to a proof-of-stake network because it significantly reduces the amount of computing power required, which negatively impacts demand for graphics cards. Nvidia does not specify how many graphics cards are sold and used for mining, because the cards used for mining are usually also used for gamers, and placed in the gaming category.

“We are unable to accurately quantify the extent to which reduced crypto mining contributed to the decline in gaming demand.” (Q2 Earnings Call)

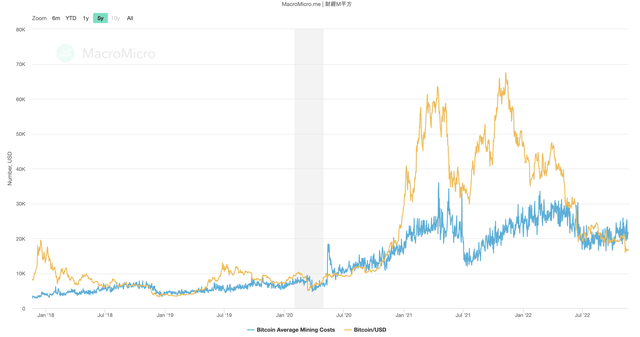

Now in the aftermath, after Bitcoin tumbled from about US$69K to US$16.6K today, it has become unprofitable for many miners to mine cryptocurrencies for immediate profit and security, resulting in a flood of Graphics Cards becoming available on the 2nd hand market. During the mining boom in March 2021, for example, their RTX 3080 graphics card sold 2nd hand for $2,160 while the retail price was only $699. That’s a 209.01% premium.

We think this excess demand has significantly inflated Nvidia’s gaming revenues, although the same could be true of the oversupply right now, with graphics cards flooding the market. In our opinion, the current drop in demand in the gaming segment could be a result of those 2nd hand graphics cards flooding the market. It is possible that the segment will get a serious boost, back to its baseline, once graphics card prices have stabilized and become more anchored as in the past.

Yet, we still see a risk that does not seem to be coming to light: a Bitcoin death spiral. A Bitcoin death spiral is when the cost to mine Bitcoin (electricity) is more expensive than the spot price of Bitcoin for an extended period of time, causing more and more miners to cease operations. This death spiral could already be in effect, as the average price to mine a Bitcoin is currently US$21,444, compared to the spot price of US$16,702.

With the Federal Reserve continuing to raise interest rates and pull liquidity out of the markets, we think Bitcoin is in for a deep crypto winter. But we think most of the extreme imbalance between supply and demand is already behind us, with Ethereum going through a transition in early September and Bitcoin already trading below its price for immediate profitable mining.

“We don’t expect to see blockchain being an important part of our business down the road. There is always a resell market. The availability of secondhand and used graphics cards has always been there. And the inventory is never zero. And when the inventory is larger than usual, like all supply demand, it would likely drift lower price and affect the lower ends of our market.” (Q3 Earnings Call)

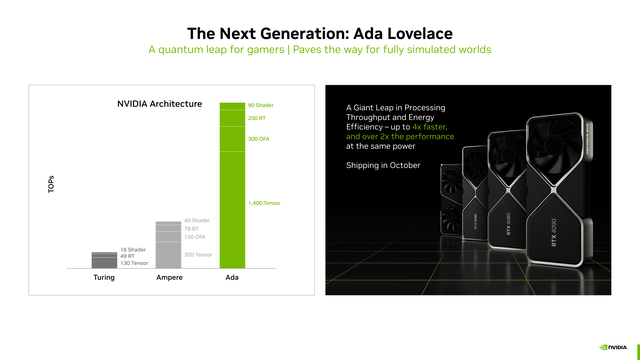

Their new Ada Lovelace architecture, in contrast, is clearly aimed at a higher end of the market. And it seems it is still in high demand among gamers.

“My sense is that where we’re going right now with Ada is targeting very clearly in the upper range, the top half of our market. And early signs are, and I’m sure you’re also seeing it, that the Ada launch was a home run.” (Q3 Earnings Call)

Apart from the gaming segment, there is also still a competitive risk from players such as AMD (AMD), Intel (INTC), and others. A decline in revenues in the Chinese market could also be a risk factor, due to economic stress and limitation of sales of its A100 and H100-based chips to China.

On the bright side, though, the impact was already priced in during the third quarter, as the stock moved positively as it was in line with expectations. Nvidia also offers alternative products to data center customers in China. However, there is a chance that the gaming segment could get an unexpected uptick in the fourth quarter as the holidays approach.

The Valuation

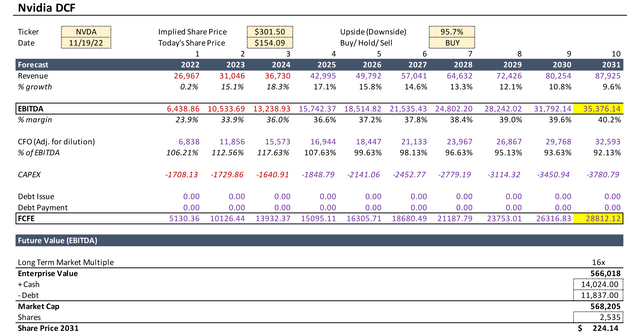

In our valuation model, we have based our revenue forecast through 2024 on the Wall Street consensus, with short-term forecasts generally close to the actual outcome. From 2025 to the end of our forecast in 2031, we have modeled growth closer to 10%. We think these estimates are relatively conservative, taking into account the huge growth of the AI market in the coming years and Nvidia’s dominant position in that market.

EBITDA margins are down sharply this year in 2022 to an expected about 24%, down from 41.7% in 2021. We think those margins will return to base in 2023, once the inventory and supply-demand issues are resolved. Our EBITDA target for 2031 remains conservative and below the margins achieved in 2021. In CFO terms, we think Nvidia can realize about $32.59BN. CapEx between 2022 and 2024 is in line with the Wall Street consensus, and from 2025 onwards held at a constant historical average of 4.3% of revenue.

This brings us to an enterprise value of $566.02BN by 2030 at a 16x EV/EBITDA market multiple over the long term, which we believe is justified if Nvidia leaves 2030 with low-double-digit revenue growth. Taking into account cash and debt, our price target remains at $224.14.

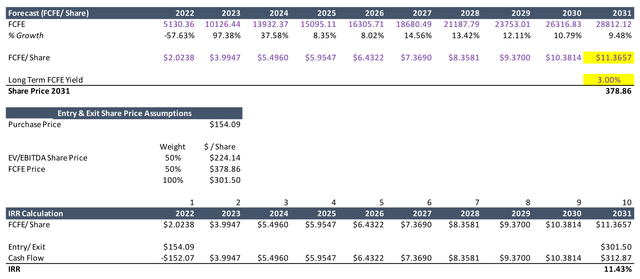

On an FCFE basis, we use a 3% yield, which is lower than the 1.96% yield at which Nvidia has been trading for the past 5 years on average. We took a more conservative return due to multiple compression in line with a weakening global macroeconomic picture. That means we derive a price target of $378.86 on an FCFE basis.

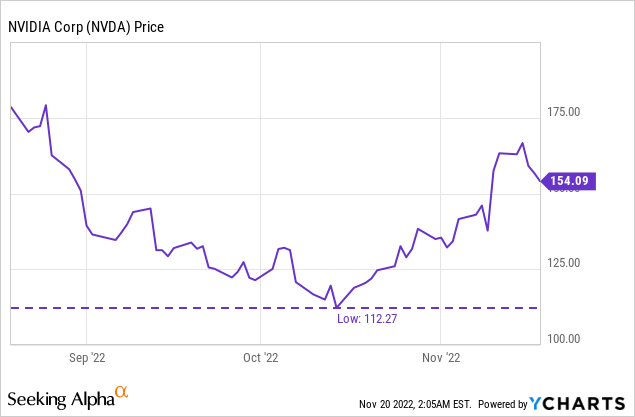

If we take both price targets into account, each weighted 50%, we are left with a final price target of $301.50. Plugging that into our IRR calculator, we get an IRR of 11.43%, if purchased at the current price of $154.09. We consider this an attractive return, potentially providing alpha above historical broad benchmarks.

In contrast, the return becomes much more favorable if the opportunity arises to buy Nvidia at a lower price. Last month, for example, Nvidia traded at a low of $112.27, which would have yielded a potential IRR of 16.05%.

The Bottom Line

Nvidia’s results were plus-minus, in line with expectations. We think the company is still dealing with the effects of supply and demand disruptions due to the pandemic and a boom in crypto mining, but expect that the worst should already be behind it. We also wrote an interesting piece on Michael Burry predicting these “bullwhip effects” in the supply chain, which you can read here.

While gaming and crypto revenues are hit hard, in our opinion, due to a flood of 2nd hand graphics cards, the company continues to exercise resilience when it comes to Data Centers, AI, Full Self Driving Applications and other areas of future interest. While some headwinds remain, such as a weakening Chinese (and U.S.) economy, and the blockage of A100 and H100 chips to China, we believe these will be resolved over the long term, and thus should be considered mostly noise for long-term investors.

At current levels, we see Nvidia as a buy, and it would become an even more attractive buying opportunity if it returns to the October lows of $112.

Be the first to comment