Justin Sullivan/Getty Images News

Nvidia (NASDAQ:NVDA) had very successful GTC and Investor Day events recently. The stock has run up significantly as investors found the events and the company narrative exciting. As such, there is little doubt that Nvidia is a terrific company and continues to execute well on the technology front and continues to raise the bar.

The highlights for the day were its two key chip announcements – Hopper datacenter GPU and Grace ARM-based CPU. The company also made several very nice system-level announcements. This article will not get into depth on technology, but instead focus on the investor and the management narrative – especially about the TAM.

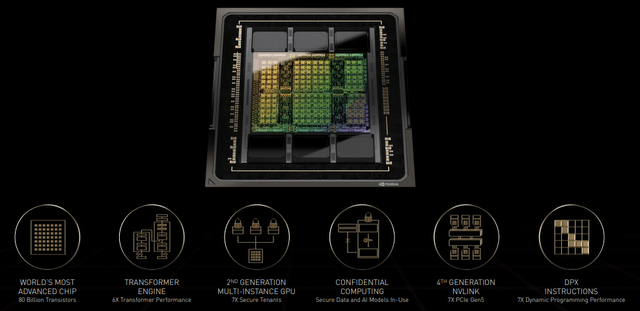

Hopper Is A Strong GPU

The biggest highlight was Hopper, a much anticipated next-generation data center GPU (image below).

Nvidia

Hopper uses the cutting-edge TSMC (TSM) N4 process (widely referred to as 4nm). This is a surprise as the previous expectations were for Nvidia to use TSMC N5 (or 5nm) process. Note that Nvidia has traditionally not pushed the process technology and mostly released products using older processes. Nvidia of the past would not even have used N5 but a cheaper process. It is clear that the Company is starting to feel the heat from competitors including Advanced Micro Devices (AMD) and in-house solutions from Google (GOOG) (GOOGL) and Amazon (AMZN). In particular, AMD continues to come from behind and close the GPU technology gap with Nvidia. Note that AMD’s Aldebaran GPUs last year bested Nvidia Ampere specifications in several aspects. In this aspect, we have to give credit to Nvidia for moving quickly and not falling asleep at the wheel like Intel (INTC). Remember that when AMD accelerated its CPU roadmap, Intel stuck with its inferior internal process and did not move to the most advanced TSMC process thus yielding ground to AMD that it should not have.

Even using the N4 process, Nvidia maximized the die size. At 800+ mm2, it is close to reticle size. What this large die size means is that this GPU, while performing well, will be expensive to manufacture. If AMD can deliver comparable performance with CDNA3, then Nvidia is likely to be under tremendous cost pressure. On the upside, it is possible that Nvidia surprised AMD with the N4 process. Time will tell how the Nvidia and AMD competition will play out in the Hopper versus CDNA3 generation.

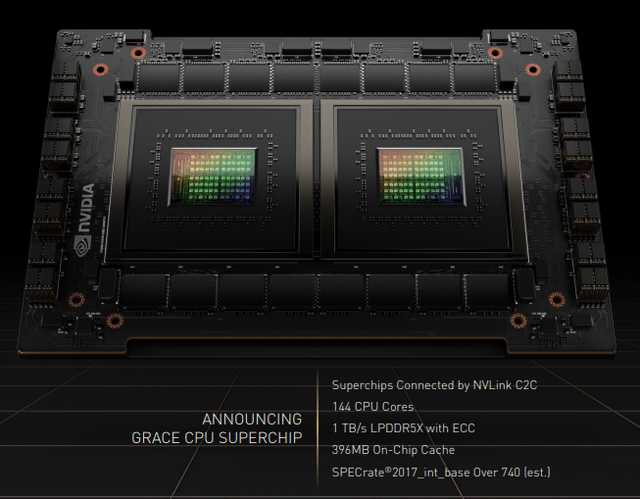

Grace is More Hype Than Substance

Nvidia also unveiled some details about its upcoming Grace CPU (image below).

Nvidia

This CPU, set for H1 2023 release, has 72 functional cores per chip and 144 cores for the “super chip” which consists of packaging two dies or chips together. At 72 cores, Grace is not much of an improvement over AMD’s Rome and Milan generations which have 64 cores per chip. The performance data from the image also suggests that, surprisingly, even the 144 core Grace is in a class similar to Milan. Note that AMD is expected to have its 128 core Bergamo chip by the time Grace launches. Nvidia may have some surprises ahead, but, unless Grace’s performance data is off by almost 100%, it seems unlikely that Nvidia’s solution will be competitive with Bergamo in 2023.

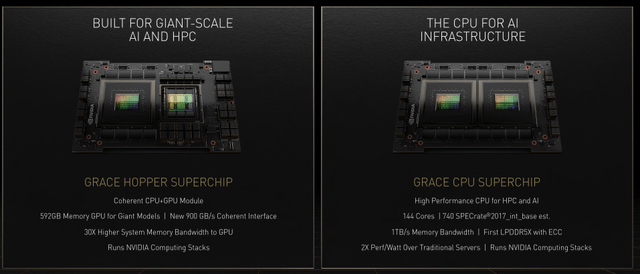

Nvidia also announced that it will be creating a chip that combines Grace with Hopper (see image below). AMD is also rumored to have a similar CPU plus GPU solution for the HPC and datacenter spaces in 2023. While Nvidia’s chips use NV Link interconnect, AMD’s chips will likely use its next-generation Infinity Fabric interconnect.

Grace will allow Nvidia to bundle its own CPU and GPUs together for several niche applications in the HPC space. Given that several CSPs are developing their own ARM CPUs, it is unclear what role Grace will have to play outside of niche applications. Volume deployment seems unlikely.

Nvidia

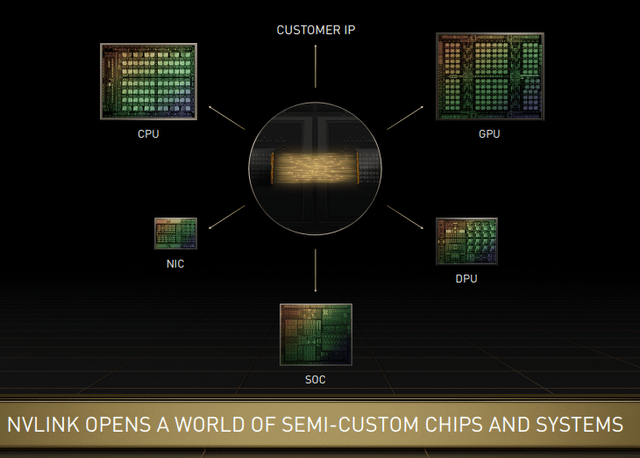

Nvidia Is Also Going The Semi-custom Route

A strong recent trend has been that semiconductor vendors are starting to go after semi-custom business to accommodate CSPs who are starting to develop their own solutions. The idea behind the semi-custom path is to create solutions that blend chip company IP with customer IP to develop solutions that these high-volume CSPs desire.

Semi-custom business tends to be a lower-margin business and is not something that Nvidia’s CEO Jensen Huang likes. Nvidia has, for the first time we can remember, announced that it too is going down this path (image below).

Nvidia

There are a few headwinds for Nvidia on this path. The first is that Nvidia is historically not set up for this type of business. Secondly, NV Link is seen as a proprietary interconnect and many CSPs will be reluctant to go down that path. Thirdly, Nvidia could be a bit handicapped here due to the lack of FPGA IP – something that AMD believes datacenter customers want and something which AMD and Intel own.

TAM Hype Is Not Credible

Beyond what is discussed above, management also talked about the new Spectrum 4 400G Ethernet Switch from the Mellanox division, an improved NV Link switch, and updated system and software solutions. All things considered; it is safe to say that Nvidia had a terrific technology presentation.

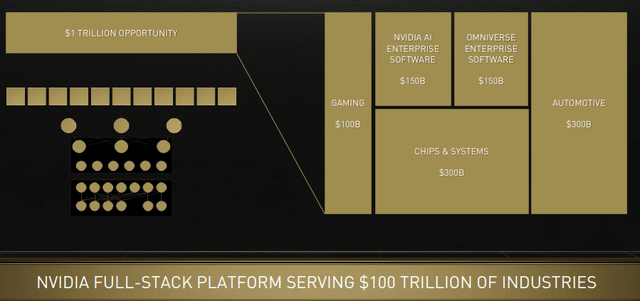

The problem with Nvidia’s pitch was mostly regarding management hype about the $1T TAM that Nvidia now addresses (image below).

Nvidia

While there is no denying that Nvidia’s prospects in the space are good, the growth rates shown here are unsustainable. The frothy $10B number from the last year that was fueled by COVID dynamics, crypto bubble, and FED-driven liquidity is a long way from a $300B TAM that management claims. In the near term, there is even a tangible risk that the TAM may shrink as the current spending bubble bursts. Longer-term, while the data center business will continue to grow, management projected TAM appears hugely overstated.

The enterprise future also is based on unrealistic expectations. While there is no doubt that many companies will increase their cloud spending over time, the reality is that in enterprises, the IT spend is, and will continue to be, dominated by the client-side. This is simply a matter of deployment economics. For a single server, there are many clients. The sheer ratio of clients to servers tips the IT budgets in clients’ favor.

On the gaming front, market researchers have not found any meaningful uptick in gaming PC AIB business over the last decade. If anything, the unit growth has been slightly negative. Nvidia disclosed that ASPs increased at a rate of 13% per year for the last five years while the units have increased by 11% per year. In other words, the primary growth driver was ASP growth. The ASP growth and unit growth numbers are almost entirely driven by crypto which the Company fails to mention as the growth driver. With Ethereum Proof Of Stake likely imminent, with the world entering a post-COVID economy, with AMD gaming GPUs becoming stronger, and with Intel entering the GPU space, the growth narrative for this segment is entirely dubious.

The narrative on professional visualization is also questionable as that business too seems to have been driven more by crypto than Omniverse or any other emerging areas.

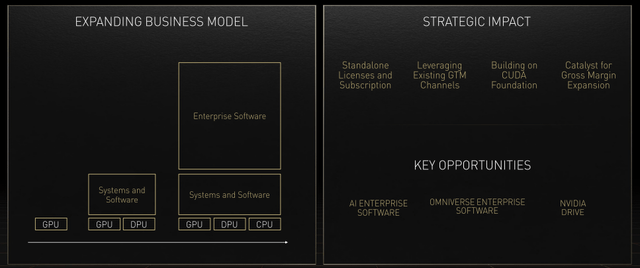

As far as software goes, Nvidia wants to expand its business model into its partner’s space (image below). But, if the software partners have strong chip-level solutions from competitors like AMD, will they continue to push Nvidia solutions?

Nvidia

The point is that Nvidia is projecting a massive TAM and big growth based on questionable moat while annoying its software partners. This may not play out so well for Nvidia.

The growth on the automotive front is also very much in doubt. While there is no doubt that Nvidia has done very well in this segment so far, note that these are all early-stage design wins when the market is small. As always happens with technology, mass adoption does not occur until the prices of the new technologies drop significantly. The reality is that autonomous technologies have yet to be proven at scale. By the time these technologies are proven, the value of the semiconductors involved in these applications will be much smaller than what Nvidia dreams.

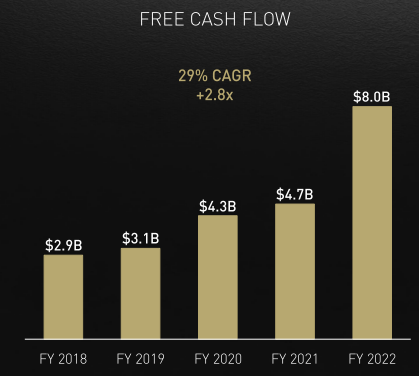

The problem with Nvidia’s narrative continues to be that its revenue growth and more importantly its cash flow growth (image below) are being driven by transient COVID and crypto mining dynamics.

Nvidia

The Company is selling an entire TAM and growth narrative based on this bubble. Investors need to beware. We are as little as two quarters from Nvidia growth bubble bursting. Investors are likely to do well steering clear of the impending growth crunch.

Be the first to comment