Justin Sullivan

Nvidia (NASDAQ:NVDA) stock is down about 60% from its all-time highs, and it would appear that much of the bad news is already out at this point. Is the stock a good buy at the current levels?

This article makes a case for why the stock has the potential to drop down another 60% or more in the coming year. Beyond The Hype’s Nvidia thesis update has to do with the recent headwinds that the Company is seeing in its second-largest market – China.

A new set of restrictions by the US government on what compute accelerators can and cannot be exported without a license sent a shockwave through the markets last week. Per Nvidia, which put out an 8-K on the subject last Wednesday evening:

“On August 26, 2022, the U.S. government, or USG, informed NVIDIA Corporation, or the Company, that the USG has imposed a new license requirement, effective immediately, for any future export to China (including Hong Kong) and Russia of the Company’s A100 and forthcoming H100 integrated circuits. DGX or any other systems which incorporate A100 or H100 integrated circuits and the A100X are also covered by the new license requirement. The license requirement also includes any future NVIDIA integrated circuit achieving both peak performance and chip-to-chip I/O performance equal to or greater than thresholds that are roughly equivalent to the A100, as well as any system that includes those circuits. A license is required to export technology to support or develop covered products. The USG indicated that the new license requirement will address the risk that the covered products may be used in, or diverted to, a ‘military end use’ or ‘military end user’ in China and Russia. The Company does not sell products to customers in Russia.

The new license requirement may impact the Company’s ability to complete its development of H100 in a timely manner or support existing customers of A100 and may require the Company to transition certain operations out of China. The Company is engaged with the USG and is seeking exemptions for the Company’s internal development and support activities.

In addition, the Company is engaging with customers in China and is seeking to satisfy their planned or future purchases of the Company’s Data Center products with products not subject to the new license requirement. To the extent that a customer requires products covered by the new license requirement, the Company may seek a license for the customer but has no assurance that the USG will grant any exemptions or licenses for any customer, or that the USG will act on them in a timely manner.

The Company’s outlook for its third fiscal quarter provided on August 24, 2022 included approximately $400 million in potential sales to China which may be subject to the new license requirement if customers do not want to purchase the Company’s alternative product offerings or if the USG does not grant licenses in a timely manner or denies licenses to significant customers.”

Nvidia’s peer in the accelerator space, Advanced Micro Devices (AMD) indicated that it too received a similar notice from the US government, and its MI-200 family of accelerators is affected. However, since MI-200 accelerators are relatively new and do not have much business in China, there is no material impact on the company’s business.

Subsequently, on Thursday morning, Nvidia made yet another 8-K filing in which the Company indicated that it received a reprieve on the original US government order in a limited way.

“The U.S. government has authorized exports, reexports, and in-country transfers needed to continue NVIDIA Corporation’s, or the Company’s, development of H100 integrated circuits after the Company filed its Current Report on Form 8-K with the U.S. Securities and Exchange

Commission on August 31, 2022. The authorization also allows the Company to perform exports needed to provide support for U.S. customers of A100 through March 1, 2023. Additionally, the U.S. government authorized A100 and H100 order fulfillment and logistics through the Company’s Hong Kong facility through September 1, 2023.”

Based on this disclosure as well as previous similar restrictions, the US government is likely to issue licenses to many of Nvidia’s customers. It is likely that beyond a few weeks or a few months delay at the front end, Nvidia will be able to retain much of the affected $400M business. It is also entirely possible that many customers will use substitute lower-end products and rush to stockpile the impacted chips procuring them directly or indirectly and thus generating a burst of demand for Nvidia. For the current quarter as well as the next quarter or two it would not be surprising to see Nvidia fare particularly well in China.

In other words, in the short term, this US government restriction may not be as big as the worst-case scenario presented by Nvidia, and it could even be a positive. However, in the long term, the impact of the restrictions could be very harmful to Nvidia.

Why Should Nvidia’s China Business Be Affected In The Long Term?

Chinese customers are unlikely to be constrained by the restrictions of the US government on what hardware they can and cannot use. The Chinese government is also likely to strongly encourage Chinese companies to look for domestic alternatives.

Looking at the competitive space, we can see that there are several up-and-coming Chinese efforts in ML silicon solutions. The most promising and interesting of this bunch may be Biren. At the recent Hot Chips conference, Biren unveiled its competitive BR100 GPGPU solution. Reviews of this chip can be found around the web.

As we can see from the linked Next Platform review, BR100 claims performance above the A100. Since A100 is the cutoff threshold from the US government, this solution can be very attractive to Chinese customers. Of course, the software for the BR100 will not be up to Nvidia standards, but software effort is something that China needs to undertake to overcome the limitations of the US government restrictions. Assuming Biren can deliver on the claims in a timely manner, there is a strong incentive for Chinese customers to adopt it.

Note that Biren is one of the many players in the field and a leading candidate that fits the bill. However, it does not have to be Biren – all that China needs is a viable local option. The risk to Nvidia from such a local competitor is huge. Once a viable player arises, Nvidia is likely to lose not only the restricted A100 and H100 business, but also its revenue stream from lower-performance products. While Nvidia does not disclose how much the total China Datacenter business may be, it could be double the $400M A100 revenues that Nvidia cites in the 8-K filing.

Do Not Underestimate The Possibility Of Losing Share To Local GPUs

A lot of investors may be skeptical about Chinese companies’ ability to deliver and pervade competitive accelerator solutions. But, they should not be.

Contrary to many investors’ and analysts’ beliefs, Nvidia’s moat in this GPGPU and accelerator business is being overestimated by the market. Beyond The Hype has long warned readers that the machine learning hardware market will not be dominated by Nvidia as it is today and that the market will be fragmented considerably with share taken by CSP verticals and other merchant silicon alternative vendors like AMD and Intel (INTC).

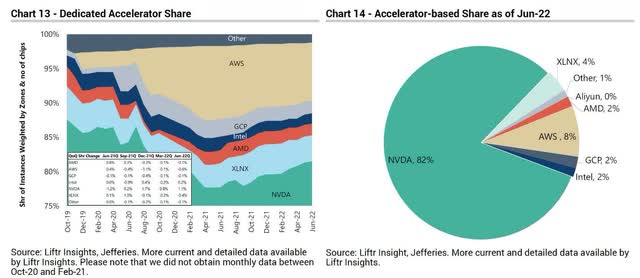

As a point of reference, note that there was no competition to Nvidia until Google (GOOG) (GOOGL) burst onto the scene with its TPU, and Nvidia used to have about 99% of the data center accelerator market until about five years back. However, as can be seen from recent data (see image below), Google’s and other solutions have slowly cut into Nvidia’s share which now stands at about 82%.

Granted, Nvidia’s loss of share in the US has been slow, but it could be much more rapid in China due to the trade war and China’s desire to be independent of US technology.

The point here is not that Nvidia will not be a strong player in the ML space, but that Nvidia’s ultimate share of the ML market will be much smaller than what many investors expect for competitive and geopolitical reasons.

Potential Economics Impact

If Biren or a different player can bring competitive products to market in 2022 or 2023, Nvidia could exit 2023 with its Datacenter business taking a loss of $400M to $800M in quarterly revenues. Given that Nvidia’s Gaming business is collapsing due to the crypto burst, and the Datacenter business has been relatively flat for the last couple of quarters, one has to wonder what a reasonable exit run rate for Nvidia is in CY2023!

Should China, Inc, deliver, a $6B to $7B quarterly revenue run rate exiting CY2023 is entirely possible. This estimate compares very poorly to the current expectations of about $9B in revenues in Q4 FY2024. The economic impact of such a revenue shortfall on Nvidia can be disproportional because Nvidia has prepaid for considerable (but unknown) fab and packaging capacity at the height of COVID and crypto bubbles. It seems likely that Nvidia would have to take yet another write-down on this count in the coming quarters.

Lower revenues, especially lower contribution from the lucrative Datacenter segment, also means that Nvidia’s margins will take a hit. Lower revenues, lower margins, and write-offs mean that Nvidia’s EPS could be due for a big hit in CY2023.

Needless to say, Nvidia continues to be grossly overvalued based on the myth of absolute ML silicon dominance, which is not likely to happen. Investors counting on hypergrowth may instead see negative growth in CY2023. Beyond The Hype estimates that FY2024 EPS estimate of $6.26 from the analyst community is far too high and, between crypto, COVID, and datacenter hits, Nvidia may deliver only about half of that EPS. What is the value of a Company with declining revenues, about $3 of EPS next year, and negative growth? Certainly not $135!

What is the fair value for Nvidia at this point? Beyond The Hype estimates it to be sub-$50 – that is a long way down from the current levels.

Be the first to comment