Justin Sullivan/Getty Images News

Investment Thesis

NVIDIA (NASDAQ: NASDAQ:NVDA) initially started as a manufacturer of Graphics Processing Unit (GPU), and saw massive success as the gaming industry grew. Leveraging their superior GPU architecture and significant resources (technology, human capital, and cash), they branched out into scientific computing, artificial intelligence, data platforms, robotics, and other related fields. In particular, their GPU-accelerated computing has the best shot at answering the growing demand for computing power. The recent market volatility has lowered NVIDIA stock below its intrinsic value, and investors should take advantage because:

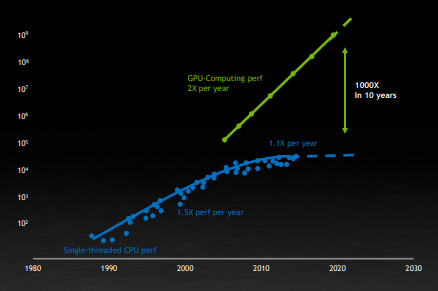

- Global demand for computing power is growing at an exponential rate, but CPU capacity isn’t keeping pace. It is no longer following Moore’s law of doubling every two years. NVIDIA’s GPU-accelerated computing has the best shot at meeting the exponential growth in computing power.

- Revenue growth is accelerating for the data center and professional visualization segments, while demand for gaming products remains outstanding.

- Thanks to their superior products and economic moat, they enjoy outstanding profitability and massive cash flow.

Solution for Post Moore’s law Era

As we are all aware, the need for computing power is increasing at a rapid pace. Today, high-performance computing is being used in just about every industry, and the growth of block-chain technology, artificial intelligence, health care data usage, and data science are all contributing to the massive growth in demand for computing power. The unfortunate part is that the Central Processing Unit (CPU)’s capacity no longer follows Moore’s law anymore, and the growth rate has slowed from its historical trend.

Leveraging their superior GPU architecture and advanced technology, NVIDIA became a leader in GPU-accelerated computing, and they have the best shot at meeting the exponentially growing demand for computing power. Currently, NVIDIA’s GPU and networking are able to accelerate many of the fastest supercomputers around the world. Also, their massively parallel computing architecture and associated software are well suited for deep learning, machine learning, and other artificial intelligence-related fields. The detail of the architecture is given in the next segment. Given their dominant leadership position in the GPU segment, superb R&D team, and massive financial and technology resources, I expect them to remain a superpower in the high-performance computing industry.

Death of Moore’s Law and GPU-Computing Performance (NVIDIA Investor Relations)

Why is GPU-accelerated computing better than a traditional CPU?

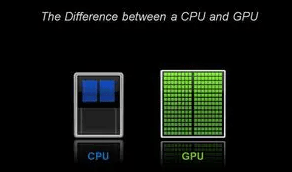

GPU is better able to meet higher computational demands than a CPU. Compared to a CPU, GPU has a lot more cores and is capable of much higher data processing throughput. Therefore, a GPU can break complex problems into thousands of separate tasks and work all at once (parallel computing). In contrast, CPU has low latency and zips through a series of problems at a much faster pace.

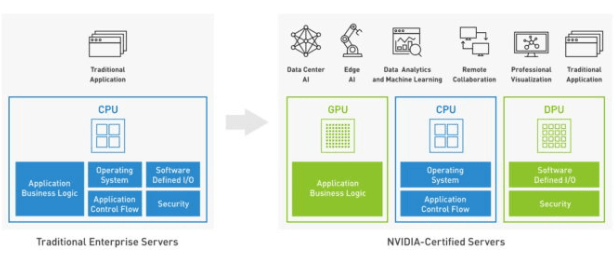

NVIDIA is the pioneer in GPU-accelerated computing platform. They have built a very powerful computation platform by combining the CPU and GPU to get the strengths of both. CPU acts as the quarterback of the system to host the unified and balanced system, the GPU accelerates the computing power with its high throughput capacity, and the Data Processing Units (DPUs) provide enhanced and accelerated networking. Leveraging their expertise in the GPU processing, I expect them to keep the lead in high-performance computing for a while.

Difference Between CPU and GPU (NVIDIA Blog) Comparison between traditional CPU vs. GPU accelerated computing (NVIDIA Blog)

Accelerating demand for their products

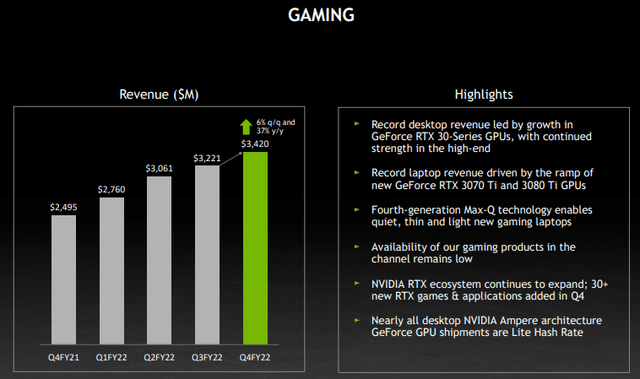

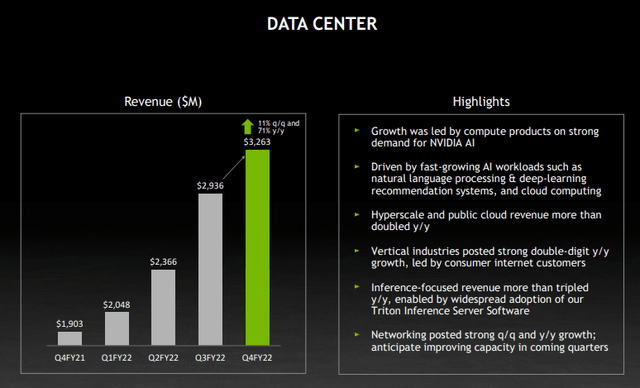

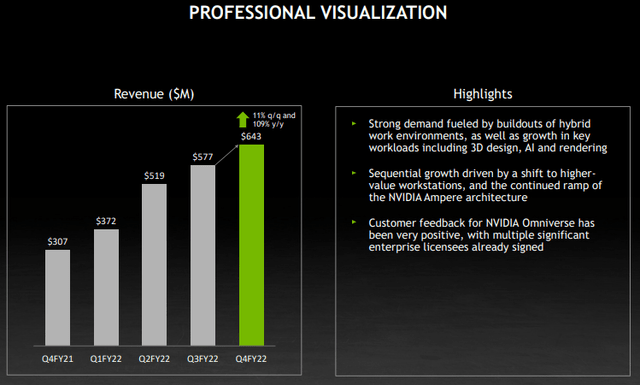

Thanks to their superior technology and performance, demand for their products is accelerating. The revenue growth for the data center and professional visualization segments achieved a staggering 71% and 109% YoY, respectively. The main growth drivers for the data center segment were a growing AI workload (deep learning, machine learning, and natural language processing) and cloud computing, while the drivers for professional visualization were the buildout of the hybrid work environment, 3D design, and rendering. The demand for their main segment, gaming, remained strong with 37% YoY growth.

Due to the increasing demand for automation and broadening applications for artificial intelligence, the market size for related fields will only continue to increase. Given their dominant leadership position in the GPU segment (83%) and superior computing platform design, I expect NVIDIA to maintain a superior growth trajectory across all three segments in the near future and achieve growth that is even higher than their historic levels (5 year average of 34%). They will certainly remain among my top picks for tech stocks for a while.

Gaming Segment Performance (NVIDIA Investor Relations)

Data Center Performance (NVIDIA Investor Relations)

Professional Visualization Performance (NVIDIA Investor Relations)

Outstanding profitability and cash flow

Superior technology and brand recognition provides an outstanding economic moat for NVIDIA, and this translates into the aforementioned superb market share and profitability. To give you a perspective of their dominance (market share of 83%), the market share of Microsoft Windows is about 75% on desktop, and the market share of Google is above 90% on search engine. NVIDIA is amongst impressive company. Also, given the increasing demand for computational power and NVIDIA’s leadership position in high-performance computing platform, I expect the market share may increase in the future.

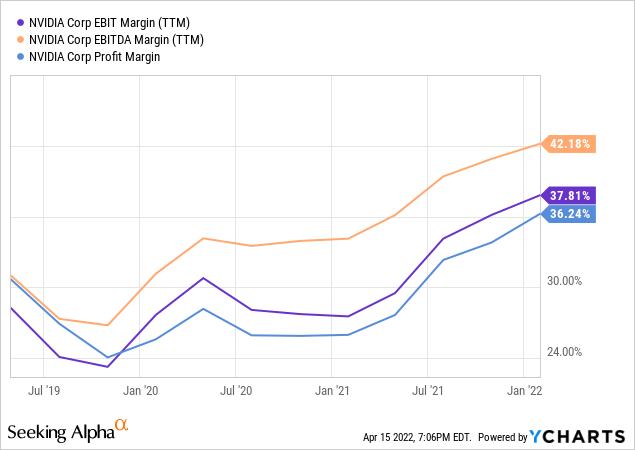

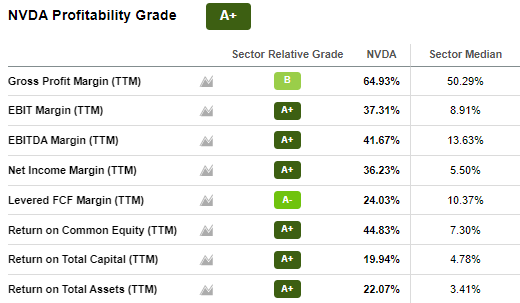

Leveraging their dominance, they can charge a steep premium on their products and services. This clearly shows up in their profit metrics. All of these metrics (EBIT margin, EBITDA margin, and Net income margin) are well above the sector median. Not only are the profit margins superior, but they have actually been increasing over the past three years, indicating that they are maintaining their superiority. Not surprisingly, given their superb profit margin and fast-rising revenue, they generate a massive operating cash flow ($9.1 B in 2021). I expect this to continue to be the case in the foreseeable future.

NVIDIA Profitability Metric (Seeking Alpha)

Intrinsic Value Estimation

I used DCF model to estimate the intrinsic value of NVIDIA. For the estimation, I utilized current operating cash flow ($9.1 B) and current WACC of 8.0% as the discount rate. For the base case, I assumed operating cash flow growth of 50% (mid point between historic value and most recent growth) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed cash flow growth of 52% and 55%, respectively, for the next 5 years and zero growth afterwards. Given the most recent revenue growth was 61.4%, the growth rate of 52% and 55% are well within reason.

The estimation revealed that the current stock price presents 10-20% upside. Current market volatility is providing a rare opportunity to grab NVIDIA shares at a discount, and I think investors should take advantage of the opportunity. Given their superiority and market dominance, the stock price will achieve its intrinsic value or even trade at a premium in the long run.

|

Price Target |

Upside |

|

|

Base Case |

$224.07 |

3% |

|

Bullish Case |

$238.43 |

9% |

|

Very Bullish Case |

$261.38 |

20% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Cash Flow Growth Rate: 50% (Base Case), 52% (Bullish Case), 55% (Very Bullish Case)

- Current Cash Flow: $9.1 B

- Current Stock Price: $221.98 (04/19/2022)

- Tax rate: 20%

Risk

Reflecting the popularity of the company and its high growth expectations, the valuation of NVIDIA remains high even after the market-wide sell off. The P/E ratio of NVIDIA (TTM) is at 55.22x, which is almost twice that of the sector median, 26.38x. The high valuation leaves little room for disappointment, and any miss on revenue or profit could result in a substantial drop in stock price. This is especially true during rising interest rates, which typically hits growth stocks the hardest. Therefore, the investor should monitor the macroeconomic indicators.

The fields in which NVIDIA competes (GPU, Artificial Intelligence, and computing) are highly competitive, and there is always a chance of a new entrant or existing superpower (e.g., Intel, Google, etc) emerging with new technology that disrupts the market. For example, Apple cut ties with Intel a couple of years ago and started manufacturing their own CPU, which has been performing very well. The investor must keep up with rapid changes within the highly competitive tech landscape.

Conclusion

NVIDIA has been a superb investment, and a darling of Wall Street, for several years at this point. Given their superb technology and outstanding products, I expect the trend to continue. Also, the ever-increasing demand for computing power will accelerate NVIDIA’s revenue growth for the foreseeable future. High valuation and the possibility of new technology may challenge NVIDIA, but they hold massive resources which should enable them to handle these threats. Overall, I expect 10-20% return in the long run.

Be the first to comment