ImagineGolf/iStock via Getty Images

Introduction

NuVista Energy (OTCPK:NUVSF) is a Canadian producer of natural gas, which accounts for just over 50% of its production profile with oil, NGL and condensate as its other main products. The company is taking excellent advantage of the strong natural gas price and this allowed it to pursue aggressive growth while keeping an eye on balance sheet strength.

NuVista has a primary listing on the Toronto Stock Exchange where it’s trading with NVA as ticker symbol. With an average daily volume of in excess of 1.2 million shares, the TSX listing clearly is the better option to trade in the company’s securities.

Ending the year on a strong note thanks to a high natural gas price

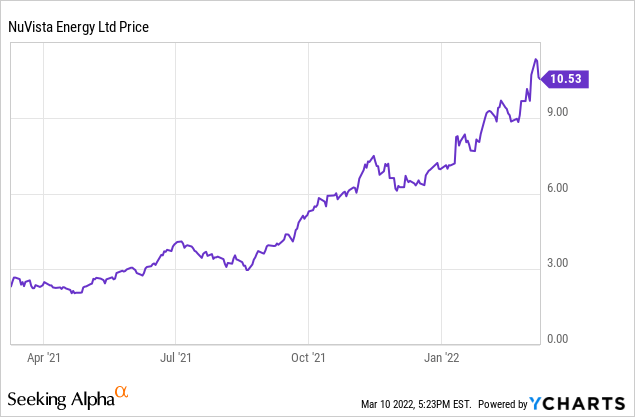

NuVista ended the year on a strong note thanks to its investment of almost C$300M in capital expenditures throughout the year. Whereas the average production rate throughout 2021 was “just” over 52,300 barrels of oil-equivalent per day, the company’s final quarter was the best quarter with an average production rate of just under 61,000 barrels of oil-equivalent per day. Approximately 55% of the Q4 production consisted of natural gas with condensate and oil products representing approximately 35% of the oil-equivalent production rate.

NuVista Investor Relations

The final quarter of the year was excellent in terms of revenue, income and adjusted funds flow thanks to the combination of a higher production rate and a higher received price for the commodities produced by NuVista. The average received natural gas price exceeded C$6/Mcf and this was a tremendous help to push the adjusted funds flow to in excess of C$150M for the quarter.

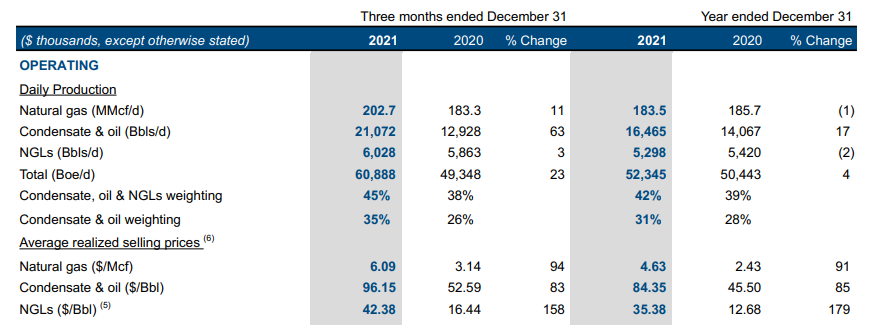

Looking at the full-year results, the company reported an operating cash flow of C$339M but this included a C$23.1M contribution from changes in the working capital position, while we should also deduct the C$3.9M in lease payments. On an adjusted basis, the operating cash flow was approximately C$311M. Please note this includes a realized loss on the hedge book of in excess of C$100M so on an underlying basis, the performance is much stronger.

NuVista Investor Relations

The total capex was almost C$288M which means NuVista generated approximately C$24M in free cash flow. That sounds disappointing but keep in mind a large portion of the C$288M in capex was related to boosting the production rate. We can also see this in the FY 2022 guidance. The company plans to grow the production rate to 65-68,000 boe/day (up 9-13% compared to the Q4 production rate) and has earmarked a budget of approximately C$300M to achieve this goal. As we also know the capital efficiency is approximately C$9,100/boe/day, the sustaining capex is likely just under C$200M.

NuVista Investor Relations

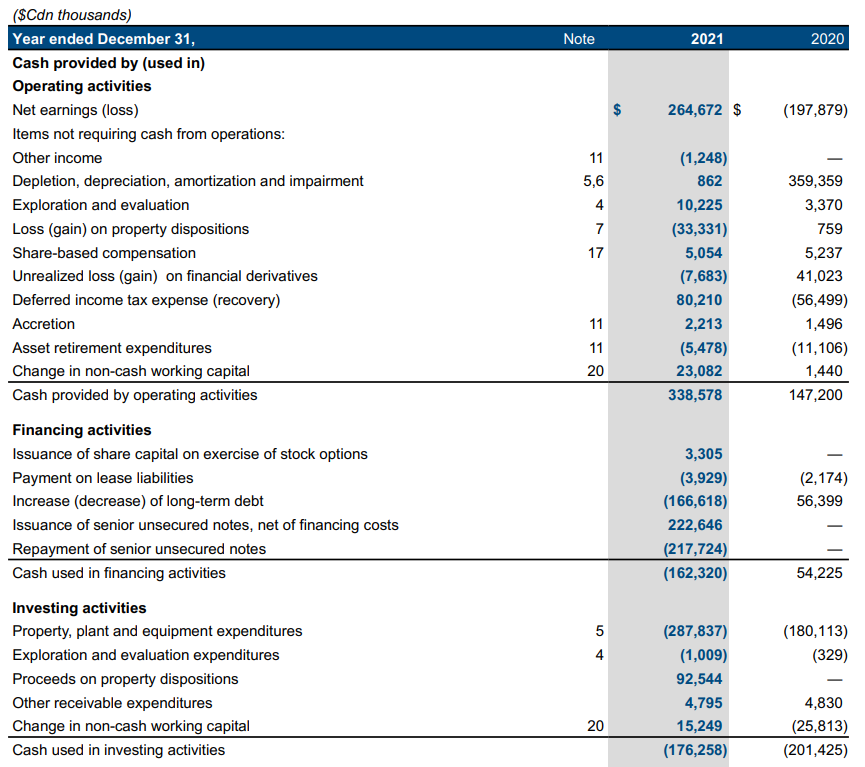

Also keep in mind the operating cash flow will increase in 2022 as the average production rate will indeed be roughly 30% higher. Using an oil price of $85 on a WTI basis and a natural gas price of $4/mmbtu, NuVista anticipates generating an FAFF of C$390M which means it’s essentially aiming for a full-year operating cash flow of approximately C$700M. This means the net debt will likely drop below the long-term target of C$200M (based on a maximum leverage ratio of 1X the AFF at$45 WTI and US$2 natural gas). As long as the net debt exceeds C$400M, the entire free cash flow result will be used to reduce the net debt. Once that target level has been reached, NuVista will start allocating monetary resources to additional growth and buybacks.

NuVista Investor Relations

Considering the current oil and gas prices are high, NuVista should reach that C$400M net debt target by the end of Q2 but this will also depend on the timing of the capital expenditures.

The current market cap is underpinned by the resent reserve update

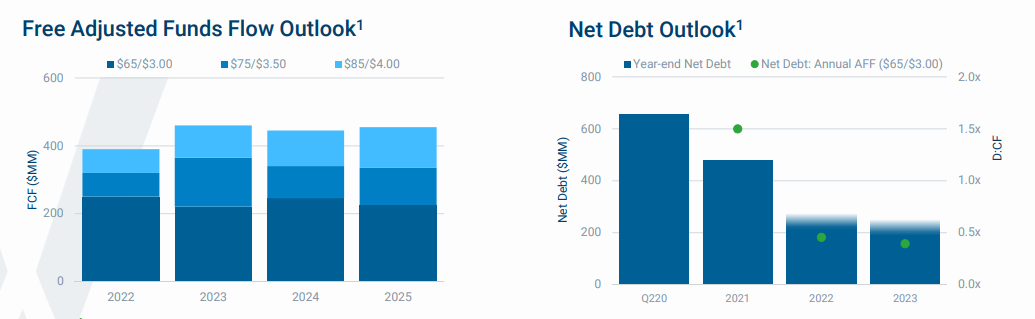

NuVista is currently trading with a market capitalization of in excess of C$2.3B which results in an enterprise value of approximately C$2.8B given the existing net debt. The share price has quadrupled in the past year so it’s always important to have a look at the reserve update and the PV10 calculation of future cash flows to make sure there’s enough value to back up the current valuation.

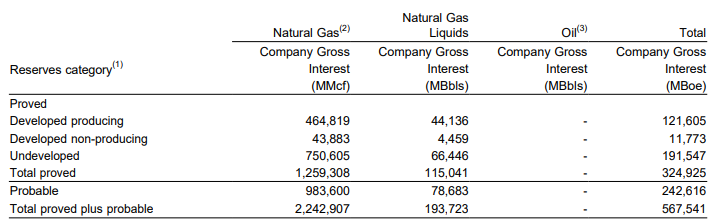

Fortunately the reserve statement was quite satisfying with a total 2P reserve of just over 567 million barrels of oil-equivalent. At an average production rate of 65,000 barrels of oil-equivalent per day, the 2P reserves underpin a reserve life index of in excess of 20 years.

NuVista Investor Relations

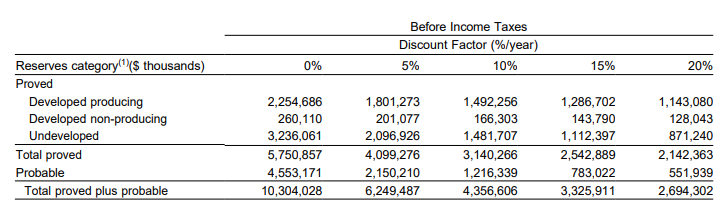

The company also publishes a PV10 value of the NGLs and natural gas in the ground. Using the traditional discount rate of 10%, the total value of the cash flows discounted by 10% but on a pre-tax basis is approximately C$4.36B. After deducting the net debt, this means there’s approximately C$2.9B in PV10 value attributable to NuVista’s equity.

NuVista Investor Relations

The table above also allows us to play around with numbers. Given the current strong natural gas price it’s perhaps not unreasonable to use a lower discount rate of 5% for the developed and producing reserves which would boost the PV by in excess of C$300M.

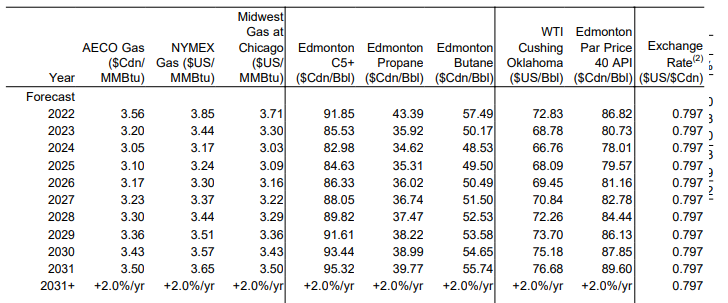

Keep in mind this appears to be a reasonably conservative estimate given the NYMEX natural gas price used by the independent consultants. As you can see below, the average natural gas price in the 2022-2024 time frame is just under $3.50 per MMbtu.

NuVista Investor Relations

Investment thesis

Natural gas plays in Canada are doing exceptionally well these days thanks to the strong natural gas price. Companies like NuVista Energy are now fully taking advantage of the higher demand for the fossil fuel and it looks like this will continue in the foreseeable future. The company also uses a prudent hedging position as it has already covered 37% of the expected liquids production this year and approximately 46% of the natural gas production (with a significantly higher portion of the summer production hedged at strong prices).

I already have quite a bit of exposure to natural gas through my positions in Spartan Delta (OTC:DALXF) and Topaz Energy (OTCPK:TPZEF). I’m not adding NuVista to my portfolio right now, not because I don’t like the company but because I already have exposure to the sector.

Be the first to comment