iamporpla

The energy crisis in Europe, coupled with the ongoing war in Ukraine, has prompted a desperate search for supplies of vital crop nutrients in the EU. That search has been a boon for U.S. fertilizer exporters, who shipped record levels of nitrogen to Europe this summer.

Among the biggest beneficiaries of the overseas scramble for fertilizer is Nutrien (NYSE:NTR), the world’s largest provider of crop inputs, services and solutions for commercial farmers. As the world’s biggest producer of potash and the third-largest nitrogen producer, the company is well positioned to fill the fertilizer supply gap in Europe after sanctions were placed on nitrogen produced by Russia (one of the world’s largest fertilizer exporters).

Among other factors, war-related sanctions have contributed to soaring prices for several key crop inputs this year, particularly nitrogen. Data from industry group The Fertilizer Institute (TFI) show that U.S. exports of nitrogen fertilizer jumped 370,000 short tons in August-more than twice the amount from the year-ago period. This was the highest monthly total since at least 2013, according to TFI.

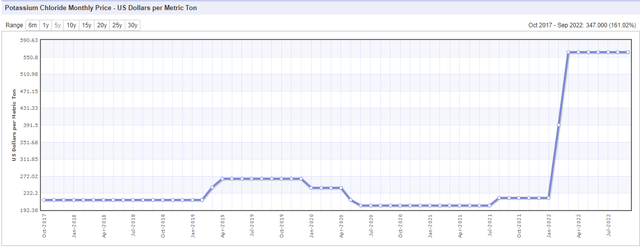

But while nitrogen fertilizer prices have since pulled back in the last six months, potash prices remain elevated and are at multi-year highs, which bodes well for Nutrien’s potassic fertilizer business.

Back in August, the company lowered potash and nitrogen sales volume guidance in reflection of lower North American application rates this past spring. Commenting on the Q2 results, Nutrien President and CEO Ken Seitz said:

North American fertilizer volumes were down in the first half to a combination of a very strong fall season in 2021, some crop mix shifts and a condensed application window this spring.

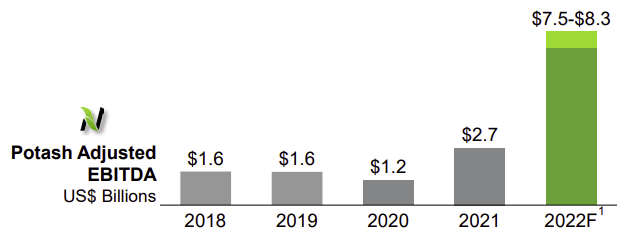

However, fertilizer sales outside North America were up in Q2, thanks in part to strong demand from Brazil. Potash adjusted EBITDA increased to $3.4 billion in the first half of 2022, thanks to “higher realized prices and record offshore sales volumes.”

Potash demand remains the key for Nutrien-and for the global fertilizer industry in the aggregate-going forward. A number of crop input producers, including Mosaic (MOS) and CF Industries (CF), believe grain and oilseed crop market tightness will continue for the foreseeable future, thanks in part to sanctions against Russia. In response, Nutrien has estimated record potash adjusted EBITDA for 2022.

Nutrien, IHS Markit

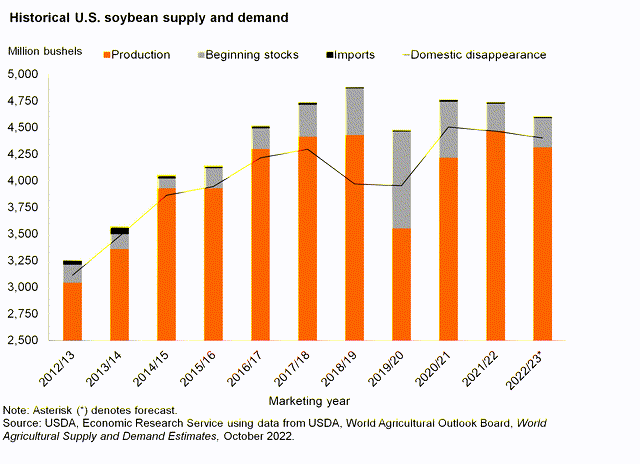

Indeed, there are already signs that crop prices may be on the cusp of another big move higher in the coming months. Both corn and soybean prices are hovering just under eight-year highs, while U.S. production for both crops is forecast to be down this year compared to 2021, according to USDA (an estimated 8% drop for corn and 3% decline for soybeans).

Both crops require a large amount of potash throughout the growing season, and with prices high and projected to continue rising, the demand for this nutrient is expected to increase. As Nutrien’s CEO noted in the Q2 report, shipments from Russia and Belarus were down an estimated 25% and 50%, respectively, in the first half of 2022, and while Russian potash isn’t sanctioned, it “has been impacted by restrictions on financing activities that facilitate exports.”

To meet the shortfall in Russian and Belarus supplies, Nutrien announced in May plans to increase output by around one million tons, to approximately 15 million tons, in 2022. Additionally, the firm said in the Q2 report that it’s working toward an “accelerated ramp of our production capability to 18 million tons by 2025.”

Unlike nitrogen-based fertilizers, which tend to be quite volatile, potash pricing is historically very stable over long periods of time. And this is where Nutrien has a big opportunity going forward. Management views the fundamentals for potash remaining very strong through 2023, and even after that, “it’s going to be a supply-constrained market,” according to CEO Seitz.

To be exact, Nutrien estimates Russia’s potash output will drop by around 4 million tons at the midpoint in 2022 (from an operational capacity of 15 million), while Belarus’ output is forecast to fall around 7 million tons at the midpoint from a 13-million-ton capacity. Nutrien’s chief economist Jason Newton, meanwhile, predicts the company will have additional potash tonnage for 2023 of between 1 to 2 million tons above this year’s level.

All told, with Nutrien ramping up its potash production, the firm will have plenty of additional volume to bring to market to fill the supply gaps arising from the eastern European war uncertainty.

On the financial front, when Nutrien reports Q3 earnings on Wednesday, November 2, the Seeking Alpha analyst consensus expects revenue to come in at $8.7 billion which, if realized, would amount to a 50% increase from the year-ago quarter. Per-share earnings of $3.98 are also expected (up 188% if realized).

The company has expressed confidence in the stability of its cash flows, in no small part due to the stability of its potash business, and recent stated an intent to return $6 billion in capital to shareholders this year (around 13% of its market cap), with about $1 billion of this in the dividend (current yield 2.2%).

It’s a cyclical story to be sure, but given the instabilities arising from the Russia/Ukraine war and growing concerns about global food security, fertilizer producers like Nutrien are poised to be prime beneficiaries from tighter supplies and higher demand for critical grain and oilseed crops.

Be the first to comment