Sundry Photography

Since I wrote my most recent cautious note about Nutanix Inc. (NASDAQ:NTNX), the shares are up about 54% against a loss of about 11% for the S&P 500. This outperformance was the result of a couple of stock price “pops” on the back of takeover rumours. I thought I’d review the name yet again to see if it would be worth buying based on these rumours. I’ll review the most recent financial performance, and I’ll look at the stock as a thing distinct from the underlying business. This recent price action may vindicate some of the analysts with whom I’ve disagreed with for so long, and who have been so wrong to date. Most interestingly to me, though, is the fact that this has demonstrated the powerful potential of call options as a way to capture upside at a fraction of the risk.

Welcome to the “thesis statement” portion of the article, where I regale you with the highlights of my thinking on a given topic. I think Nutanix remains financially troubled. Things have gotten so bad, in fact, that the firm actually broke a long term trend and spent less on stock based compensation in 2022 than they had for years. In spite of this, the price for the shares is even more excessive than it was when last I reviewed the name. For that reason, I would recommend that investors continue to eschew the name, in spite of all of the noise about buyout rumours. For those who insist on staying long, though, I would recommend calls. As I argue in this piece, these have proven their ability to offer superior risk adjusted returns. I think if you buy the stock at current prices, you’re engaging in the hope that you can find the proverbial “greater fool.” At least if you engage in this behaviour with options, you’re risking less.

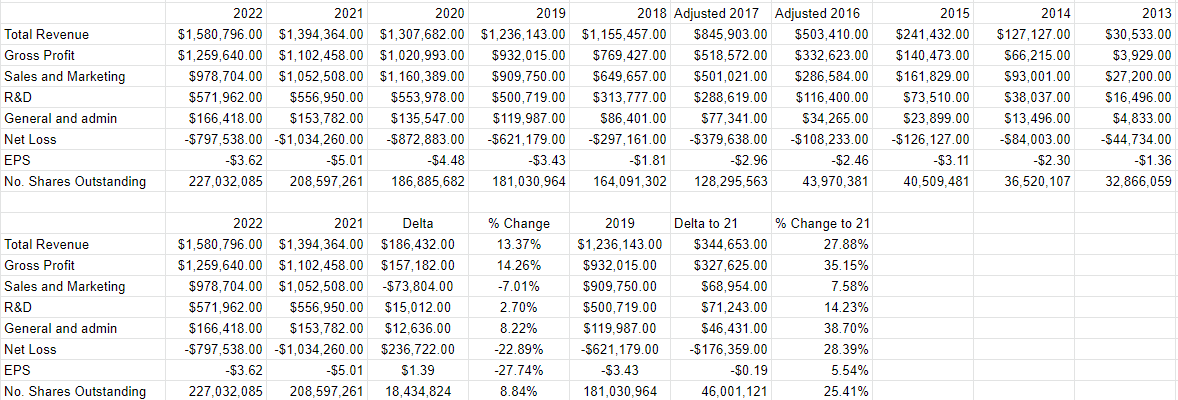

Nutanix Financial Snapshot

I can’t say much more about the financial performance here that I haven’t said since I started writing about this name. Yet again in 2022, revenue rose (by 13% relative to 2021 and by 27.9% relative to 2019) and net losses lingered. Specifically, net loss was $797.5 million in 2022 (which was admittedly $236 million less bad than it was in 2021). This compares badly to the net loss of 2019, which was “only” $621 million. I just computed the correlation between revenue and net income between 2013 and the present for you people again, and my conclusion is that there’s a strong negative relationship between revenue and profits. For the stats nerds out there, the value is r=-.893, which is an extraordinarily high negative relationship.

I noticed this previously, and it is one of the reasons I’ve been frequently cautious about the stock. Given possible changing circumstances in funding markets, though, the import of these ongoing losses may suddenly grow. In an environment where interest rates are rising, and where equity markets may no longer be willing to throw capital at companies that are, shall we say, “profits light”, these perennial losses may finally be noticed. That doesn’t lower the level of risk here in my view.

Finally, and this may be more bothersome to some of you than others, but I need to write about trends in stock based compensation yet again. In 2019 (a year when they posted a net loss of just over $621 million), the company spent “only” $306.7 million on stock based compensation, which worked out to $57,439 per employee. By 2021 (a year in which the let loss had ballooned to $1.034 billion), stock based compensation had also ballooned to $358,545 million, or $58,971 per employee. Perhaps troublingly, during the most recent financial year (when the company lost a mere $797.5 million, stock based compensation actually bucked the trend and fell by 4.2% to $343.246 million. This meant that last year, the per employee compensation from stock actually fell to a mere $53,216. In the past I’ve tried to offer shareholders some consolation from the fact that while this enterprise that they own is incurring ongoing losses, at least they can rest a bit easier that stock based compensation is quite high here. If trends persist, though, even this silver lining may diminish in the future.

Nutanix Financials (Nutanix investor relations)

The Stock

Just because the financial history here is unrelentingly bad in my estimation, doesn’t mean there isn’t potential to make some money in the stock. This has been demonstrated obviously by the recent price action. I either drive home or “drone on about”, depending on your perspective, the fact that the stock and the business are quite distinct, and Nutanix’s recent price action demonstrates the point in my view. The stock of this perennial money loser popped in price.

With that out of the way, it’s time to decide whether or not it makes sense to buy.

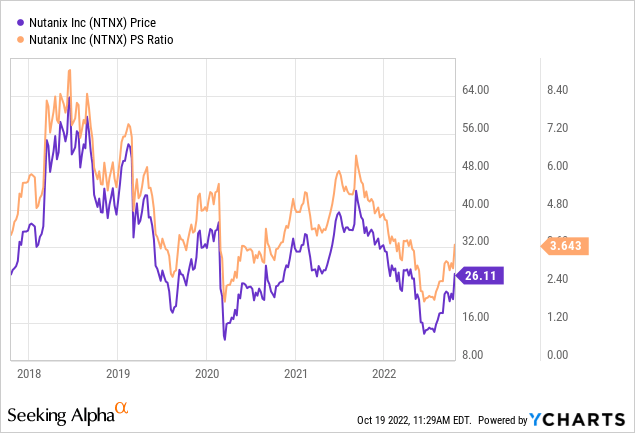

In my previous missive on this name, I recommended avoiding the stock because investors were paying ~$2.30 for $1 of sales. I wrote that sales are nice, but they’re almost pointless in this case because the company has a demonstrated inability to translate sales into profits. Fast forward to the present, and we have new financials and a new stock price. Unsurprisingly, the shares are even more expensive today, with the shares about 58% more expensive per the following:

If this was too expensive previously, it’s very, very much too expensive today. If someone buys this stock today, they are not “investing.” They are “speculating”, in this case on the probability that they can sell to a greater fool in future. If that’s a pastime of yours I won’t judge, because I play dungeons and dragons, so who am I, right? I do think you run the risk of capital loss, though. I think the evidence is pretty strong that the most recent price action is driven by takeover rumours, and if those go away, this stock will plummet in price. For that reason, I’m going to continue to recommend avoiding the shares. That said, I think there is an alternative if you absolutely insist on staying long this speculative name, which brings me nicely to my section on call options…

NTNX Stock – Calls As Alternative

In my previous article on this name, I suggested that Nutanix fits into that category of “earnings light” companies that will not pay a dividend in the near future. For that reason, if you insist on staying long this stock, I would recommend doing so via call options. I myself didn’t take this trade, but I recommended calls for those who had the temerity to disagree with my cautious stance on this stock. I think it would be helpful to truly drive the point home to review my two latest “switch to calls” trades here, and compare them to how the stockholders fared.

In the article before last I suggested people buy the January 2023 calls with a strike of $27.50 for $5.40. These last traded hands at $2.20, so the call holders have lost about $3.20 in value. On the surface, this compares unfavourably to the stockholder who has lost only about $1.70 per share. So the call owner put up a fraction of the capital, and lost a much bigger percentage of it. There’s a gargantuan caveat to this perspective, though. By the time my previous article had come out, the calls were down even further as the stock price collapsed. Specifically, the January 2023 calls with a strike of $27.50 had lost about $4.65 of their value. That’s painful, but it’s far less painful than the $11.08 that stockholders had lost to that point. Thus, these higher strike price calls have presented investor accounts with a much less wild ride simply because there are fewer dollars at risk. The superiority of calls is even more apparent when we review the most recent “switch to calls” trade.

In my previous article, I also recommended people who insist on staying long here buy the January 2023 calls with a strike of $17.50 for $3.50 each. I was (and remain) of the view that these offer much superior risk adjusted returns. Fast forward to the present and the calls with a strike of $17.50 that a speculator could have bought for $3.50 last traded at $9.00. This represents a $5.50 capital gain or a 157% return on capital for the call holder. Over the same time period, the stockholder earned a capital gain of about $9.10, for a 53% return. In my estimation, the call owner did relatively better in this case, because they achieved 60% of the dollar gain, while risking only ~21% of the capital.

Given the potential haircut the stock will take if the buyout speculation goes away, I think calls remain a preferred choice. They’ve demonstrated that they do less badly when shares drop in price, and at the end of the day, the speculator is risking less capital. Thus, I remain of the view that if you insist on staying long here, you should do so with call options.

If I were going to “play” this name based on the buyout rumours, I’d actually buy the December call (expiring December 16) with a strike of $25. These are currently priced at $2.25-$2.90, so for a fraction of the risk, you’ll earn much of the upside if this speculation about a $31-$32 price target proves accurate. If the speculation fervor dies down, you will have risked far less capital. While I won’t engage in such things myself, I would recommend that people who insist on staying long here do so via call options.

Be the first to comment