Obradovic

Investment Thesis

Nucor Corporation (NYSE:NUE) had preannounced that its EPS figures for Q2 2022 would be $8.80 at the midpoint. What did the figures actually end up being reported at for Q2 2022?

A whopping $9.67, up 91.8% y/y. For a business that is being priced at 4x my estimated 2022 adjusted EPS figures, this strikes me as a large discount from intrinsic value.

Arguably the most insightful takeaway from Nucor’s Q2 results was that its average sales price per ton in Q2 increased 3% compared with Q1 2022. This was during a period when steel prices had been thought of as particularly weak.

Hence, in sum, there’s a lot to like about this company’s potential. There’s strong growth combined with a cheap valuation and a very attractive capital allocation policy of 11.3%.

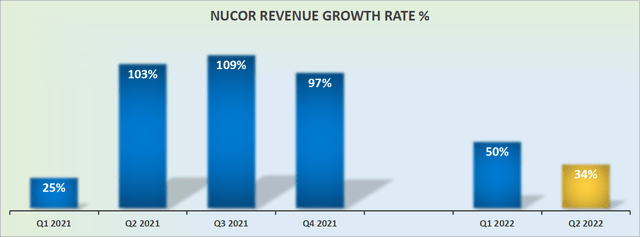

Nucor’s Revenue Growth Rates Come Out Strong

As you can see above, Nucor’s Q2 2022 delivered strong top-line growth. This revenue line had been mostly pre-announced and I had already covered this here.

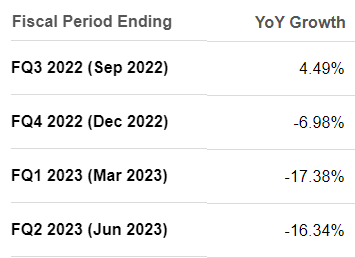

NUE analysts’ consensus estimates

Nevertheless, analysts continue to expect that Q2 will mark the high point of Nucor’s strongest revenue growth rates.

As you can see above, going forward over the next several quarters there’s the expectation that Nucor’s revenue growth rates will consistently decline and by the middle of 2023, there’s the expectation that Nucor’s revenue growth rates will be well into negative double digit growth rates as it compares against the first half of 2022.

Simply put, any time that investors believe that the best period is in the rearview mirror, this leads to investors fleeing the stock and the multiple on a company’s valuation to contract.

And that’s exactly what readers need to weigh up here.

Nucor’s Near-Term Prospects

Nucor manufacturers steel and steel products, including bars, sheets, and steel piling, to mention a few products.

Steel products are highly sensitive to the economic cycle. When economics are strong, demand for steel is high. But when economies are in a recession or bordering on a recession, steel demand rapidly falls and inventory piles up.

Then, what follows next is that steel pricing falls. And when Nucor faces a weak price environment, this will lead to its revenue growth rates rapidly decelerating and turning negative.

Then, if that wasn’t bad enough, Nucor is heavily exposed to high commodity input costs that will meaningfully compress Nucor’s profit margins.

Accordingly, there’s a myriad of factors coming together that will have a negative impact on Nucor’s bottom line profitability.

Combined Total Return Annualized at 11.3%

Any serious investors considering Nucor will know that Nucor has an unrivaled balance sheet when it comes to being compared against its North American peers.

Nucor holds a Baa1/A rating with the two leading investment houses, putting it at the high end of investment grade debt, just one notch below High Grade.

This strong balance sheet, when combined with its resounding H1 2022 free cash flows that reached circa $3.7 billion has allowed Nucor to declare a very strong capital allocation policy.

During the quarter, Nucor repurchased approximately $802 million worth of shares.

This means that Nucor’s combined yield of repurchases plus dividend in Q1 reached 2.8%, which annualized at 11.3%.

Here’s the math for this figure, $803 million worth of stock repurchases during Q2, plus $0.50 per share declared.

Next, we’ll discuss Nucor’s valuation.

NUE Stock Valuation – Priced at 4x EPS

For the first half of 2022, Nucor’s adjusted EPS figures reached $17.30. If we presume that for the second half of 2022, analysts’ estimates are vaguely right, this means that Nucor’s full-year EPS will reach $29.33.

That means that even if we build in the assumption that the second half of 2022 will be weaker than the first half, the stock is still being priced at approximately 4x its 2022 earnings.

This estimate is made even more attractive when we think that there are only over 4 months left to 2022. That means that after another 3 years at the current rate after 2022, an investment in Nucor will have paid for itself, with all its future free cash flows coming for free.

The Bottom Line

It’s not the case that Nucor is an outlier in the steel sector. There are other steel companies that are also being similarly priced. For example, Steel Dynamics (STLD) reported its results last night, and it’s being priced at a very similar multiple too.

Investors have come to believe that there’s a massive economic slump coming just around the corner in order to justify these very low valuations in the steel industry.

And while I don’t pretend to be able to predict economic cycles, I do have to argue even if we were to assume that over the coming years Nucor’s EPS figures would get split in half, that would still only leave Nucor priced at 8x next year’s EPS figure, which is still very attractive. Surely investors are being too gloomy here?

Be the first to comment