franckreporter/E+ via Getty Images

Investment Thesis

Nucor (NYSE:NUE) had preannounced its Q3 earnings, so there weren’t too many negative surprises in this report.

Here’s what we now know. There are several crosswinds weighing on steel prices. The biggest consideration here is China and its Covid lockdown policy. Along these lines, there’s also the impact that China’s real estate market is in turmoil. Indeed, this will clearly have a lasting impact on steel prices.

The other big headwind here is that high energy prices are affecting steel profitability.

In sum, despite these crucial considerations, I remain bullish on NUE.

Q3 Results, Better Than Expected

Let’s get some context. NUE stated that its results were going to be grim. Recall, back in Q2 2022, NUE’s EPS was $9.67. This was a record EPS for NUE and all was good.

Then, out of nowhere, in mid-September, NUE states that its EPS for Q3 is expected to come in at around $6.35.

Around the same time, other North American steel peers preannounced their guidance and investors got worried. I believe that investors were expecting earnings to get rough. But what alarmed investors in the steel sector was the pace of change. At the time, the share price was approximately $140.

Now, when Q3 earnings have come out, NUE’s EPS figure was $6.50. Yes, from Q2 into Q3 that’s a substantial deceleration of 33%. Just 90 days is all it took for earnings to drop by a third.

But is there anything else worthwhile to consider here? I believe there is.

Nucor’s Near-Term Prospects

Before going further, allow me to provide some further context.

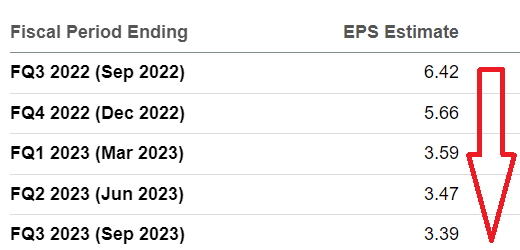

NUE EPS estimates

Analysts following NUE have been consistent in their outlook throughout 2022. There’s the expectation that Q2 marked the peak quarter for NUE. From here on out, the next several quarters will get considerably worse.

Financial Position in Focus

NUE has approximately $3.2 billion in net debt. That might sound like a material amount, but recall, NUE made $6.8 billion in net income last year. And NUE believes that it will surpass that figure in 2022!

That means that, in all likelihood, NUE is going to make close to $9 billion of net income this year.

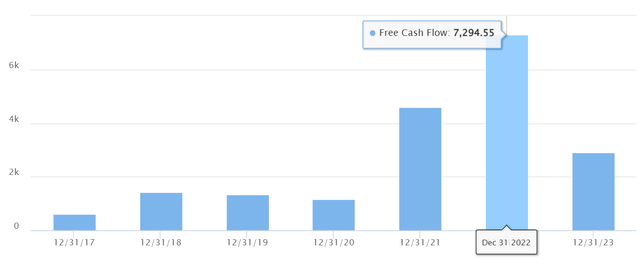

Yes, NUE has a lot of capex, meaning that its free cash flow in 2022 will probably be around $7 billion. But this clearly shows that if NUE wanted to pay down all its debt, it could pay it all back within two years.

Indeed, that’s part of the bullish appeal here. NUE has the strongest credit rating in the North American steel sector (Baa1/A-) with stable outlooks at both of the main investment houses.

NUE Stock Valuation – 11x Depressed Free Cash Flows

The graphic above highlights the bull and bear case that investors need to think about. Right now, we know that 2022 is going to be a record year for NUE.

But looking ahead to 2023, there are several overhanging concerns.

Namely, China is the biggest consumer of steel around the world. Also, the biggest sector using steel is China’s real estate market. And with China’s real estate market in a slump, it will take a while for supply and demand to return to balance.

In that case, it’s entirely likely that next year, NUE could end up seeing its free cash flows drop to $3 billion.

Assuming that’s where things end up, this stock trades for approximately 11x next year’s free cash flow. And it’s not such an exciting investment opportunity.

If on the other hand, steel prospects strengthen, perhaps on the back of the US’s infrastructure bill, or even perhaps China’s real estate market shows some strength, demand for steel could rapidly improve.

And perhaps, NUE could end up making approximately $4.5 billion of free cash flow, leaving NUE at 7x free cash flow.

The Bottom Line

The one-line takeaway is this, NUE is really cheap right now. The business is clearly profitable, even though concerns about an economic recession and manufacturing slowdown continue to impact very near-term steel prices.

Additionally, NUE’s balance sheet is clearly very strong and is viewed as investment grade by the two main investment houses.

Thus, in short, it’s just a question of exactly how much free cash flow will NUE make next year. And at somewhere around 7x to 11x next year’s free cash flow, I believe that the risk-reward here is compelling.

Be the first to comment