FatCamera/E+ via Getty Images

Thesis

I see NuCana (NASDAQ:NCNA) as a strong buy with great potential in oncology, and with a very interesting litigation wild-card which relates to billions worth of commercialized hepatitis drugs by Gilead (GILD).

The company’s current lead drug candidate, NU-3373, has shown to be much more efficacious than existing 5-FU chemotherapy, the standard of care in many cancers, which it intends to replace.

The second drug candidate, NUC-7738, shows equal promise as a novel treatment.

With chemotherapy in solid tumors likely to remain mainstream for years to come, and affordable drug candidates that build on the history of successes of the ProTide technology in other domains, I believe the market fully ignores NuCana’s potential.

There are multiple data readouts scheduled for the second half of 2022, probably in the beginning of September 2022 at the ESMO conference.

The company has also just put out a first press release on its European litigation against Gilead, in which it reports a second decision upholding its patent, this time rendered by the competent German court. The company had reported on this litigation since its 2020 annual report, but insofar as I have seen, this litigation has only been reported on some legal sites, not on investor-related channels.

Prodrug history

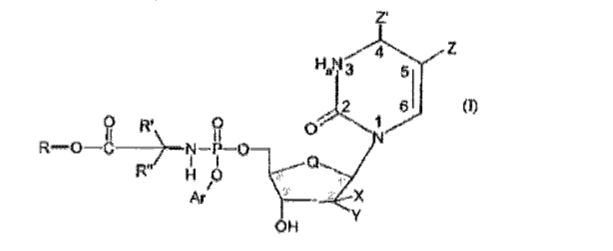

In mid-2015, the late professor Christopher McGuigan partly set aside his academic career at Cardiff University to become the CSO of NuCana. As the inventor of the ProTide technology, which is behind the creation of several blockbuster drugs, such as sofosbuvir, tenofovir alafenamide and remdesivir, professor McGuigan has been an important name in historical drug development.

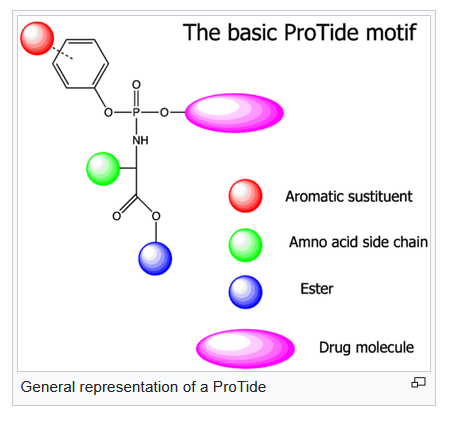

ProTide technology drawing (Wikipedia)

ProTide technology allows the active part of a drug to be delivered directly into the cell. This prevents multiple processes outside the cell, early breakdown, toxic metabolites and related adverse events. ProTide drugs pass through the cell membrane more easily, and are more easily activated. Finally, administration should be quicker and hence easier.

The first prodrug candidate for hepatitis C was developed by Inhibitex. After having been bought by Bristol-Myers Squibb (BMY) for $2.5 billion, it failed due to toxicity. It was Gilead that eventually turned the technology into multi-billion successes with Sovaldi and Harvoni for hepatitis, and Descovy, Genvoya and Odefsey for HIV. Cumulative sales for with the hepatitis franchise (Sovaldi/Harvoni/Epclusa/Vosevi) through 31 March 2022 were $67 billion. The HIV franchise (Genvoya/Descovy/Odefsey/Biktarvy/Symtuza) brought in another $63 billion in cumulative sales through 31 March 2022. And Veklury, remdesivir for Covid-19, another $10 billion. Total combined: $140 billion. NuCana phrases it as follows:

The Sovaldi and TAF franchises were the two most successful drug launches in the history of medicine as measured by their first twelve months of revenue post-launch. More recently Gilead’s ProTide remdesivir (Veklury®), was approved for the treatment of patients with COVID-19.

NuCana’s Mission in Oncology

NuCana was founded by professor McGuigan to apply the same technology to the field of oncology. As every ProTide grouping is different, thousands of compounds have been tested to identify those that work best.

Each of the assets NuCana has rights to is a ProTide version of a different molecule that has proven anticancer activity. In the case of NUC-3373, this is an improvement of the existing and widely used chemotherapy drug 5-Fluorouracil, a drug that is the standard of care in many cancer indications. In the case of NUC-7738, it concerns 3’-deoxyadenosine, a molecule derived from a Chinese plant with potent anticancer activity, has amply been studied by well-known institutions like John Hopkins, but has not been commercialized due to fast breakdown in the human body. NuCana solved that problem.

NUC-1031, or Acelarin, as the cause for the sell-off

NuCana’s first ProTide drug candidate was Acelarin. It appears to me this wasn’t the best compound to start out with. Acelarin was a ProTide version of the chemotherapy drug gemcitabine. Results weren’t so impressive, and after having decided in 2019 not to pursue trials of Acelarin in metastatic pancreatic cancer, the company announced in March 2022 that it would also discontinue its Phase 3 trial in biliary tract cancer and would not pursue efforts in ovarian cancer. There were favorable treatment results, but a futility analysis showed these did not lead to an overall benefit. High investor hopes had obviously been placed on NUC-1031 as a late-stage asset, and I assume the stock has been selling off as Acelarin did not deliver on its promise. It was still trading in the $10-$15 range throughout 1H2019.

The Share Price Now

The March 2022 decision, in the later phase of the biotech bear market, led to a robust sell-off, making it seems as if Acelarin was the only asset the company ever had. To me, the company’s share price comes as a bargain in light of what will be mentioned below.

The company now has a +$40 million market cap, which is more than 95% lower than where it was five years ago, and substantially under its cash position of $63.8 million (£52.8 million). For the years 2020 and 2021 respectively, its net loss was £30.7 million and £40.5 million respectively. The company considers it will have a cash runway until 2025.

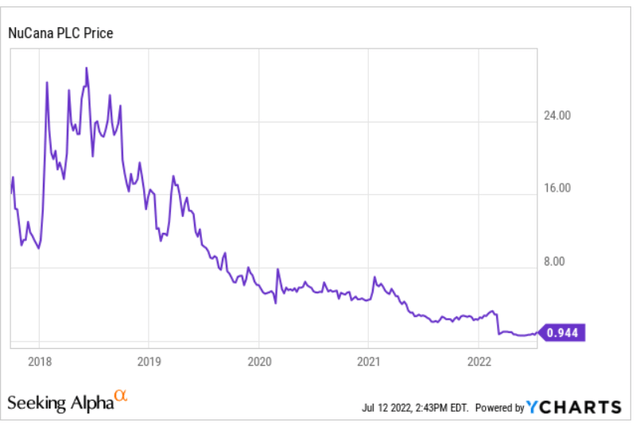

The five-year chart looks like this.

Five year chart (Ycharts)

The 52-week low was $0.52, at which point it could buy itself back and still have half of its cash at hand left.

There is no justification whatsoever for this particularly low share price. The sell-off should be finished, and some investors will have had the opportunity to accumulate shares. I believe the page on Acelarin can now be turned.

Current Pipeline: NUC-3373 and NUC-7738

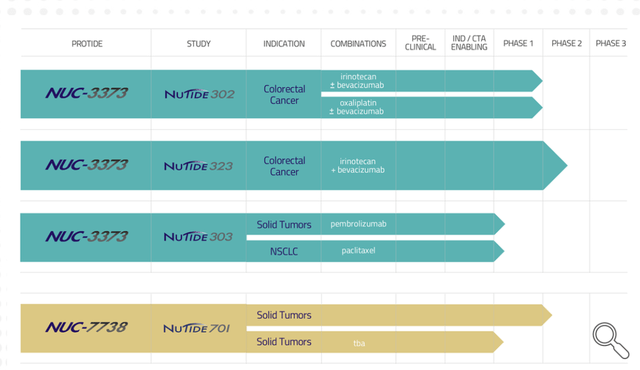

This is the company’s current pipeline.

Company pipeline (Nucana corporate presentation)

The focus is completely on solid tumors, which makes sense as many other companies are focusing on hematological tumors, although most gains are to be made in solid tumors. When one takes a look at many companies developing new immuno-oncology treatments, one will at times see high valuations compared to a company like NuCana. The best example is Fate Therapeutics (FATE), with early-stage assets none of which are in Phase 2, mostly in hematological malignancies, and a market cap that has been over $7 billion in 2021, or 175x the current market cap of NuCana. NuCana has much higher chances of bringing a working, successful, affordable and commercially-scalable drug to market, in the harder to treat solid tumors.

NUC-3373, a ProTide transformation of 5-FU

Introduction

NUC-3373 is the first and foremost value-driver here. It is being tested in colorectal cancer and the entirety of solid tumors, with the colorectal cancer trial being in Phase 2.

NUC-3373 is the ProTide version of 5-fluorouracil, or 5-FU, the standard of care for 16 of 25 of the most common cancers. 5-FU has been the standard of care for decades. In the US alone, about 500,000 patients receive this drug each year.

NUC-3373 avoids breakdown of the active molecule, minimizes toxic metabolites, does not rely on membrane transporters such as 5-FU, and is pre-activated. It has a much longer half-life (6-14 hours) than 5-FU (8-14 minutes), and is much more easily dosed (2 hours vs. 46 hours continuous infusion).

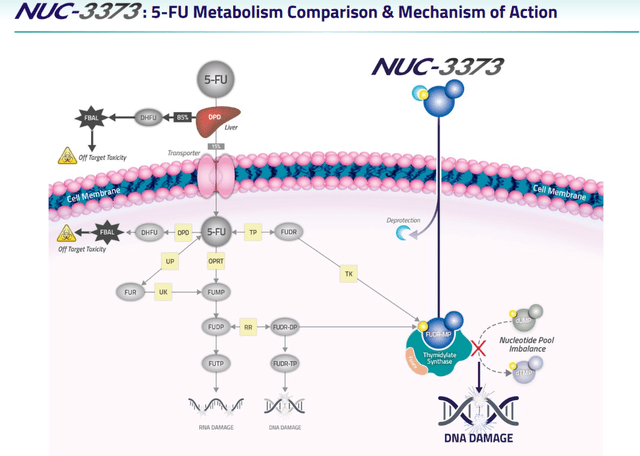

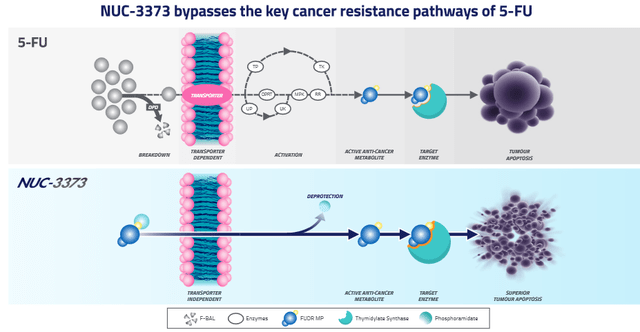

NUC-3373 mechanism of action (Company corporate presentation)

The left side of the above slide shows the processes 5-FU needs to go through to become active in the cell, and what can go wrong, including off-target toxicity both inside and outside the cell. The right side of the slide shows how NUC-3373 brings the active part of 5-FU, FUDR-MP, directly into the cell without additional processes or off-target toxicity.

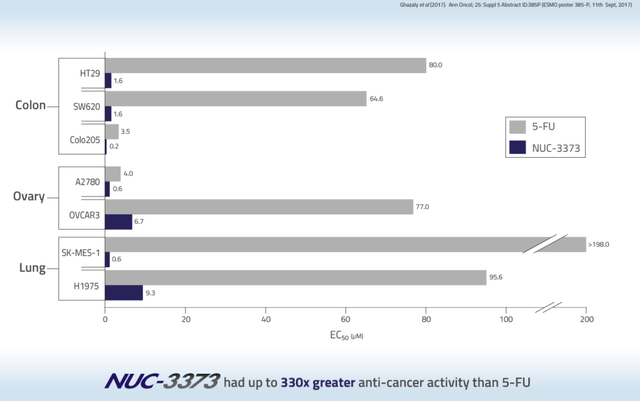

NUC-3373 was shown to have up to 330x greater anti-cancer activity than 5-FU in lung cancer.

NUC-3373 anticancer activity slide (Nucana corporate presentation)

NUC-3373 bypasses key cancer resistance pathways of 5-FU in vitro.

NUC-3373 bypasses cancer resistance (NuCana corporate presentation)

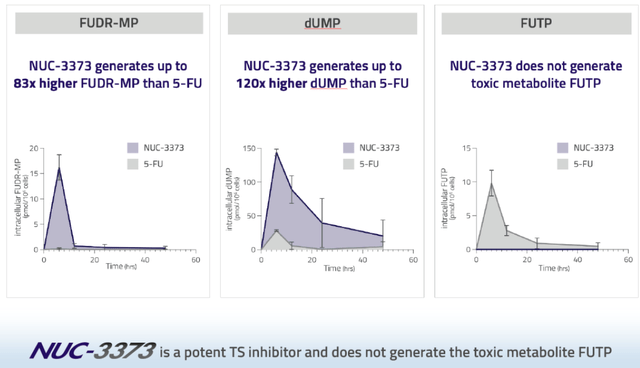

Compared to 5-FU, NUC-3373 leads to more DNA damage, to higher levels of the active compound of 5-FU in the cell, and does not lead to dose-limiting toxicities.

NUC-3373 efficacy slide (NuCana corporate presentation)

On the right slide, notice the blue almost invisible line of NUC-3373 on the bottom, showing it does not generate toxic metabolite FUTP.

The combination of NUC-3373 and Nivolumab, an anti-PD-1 antibody, furthermore enhanced the checkpoint inhibiting activity of the latter.

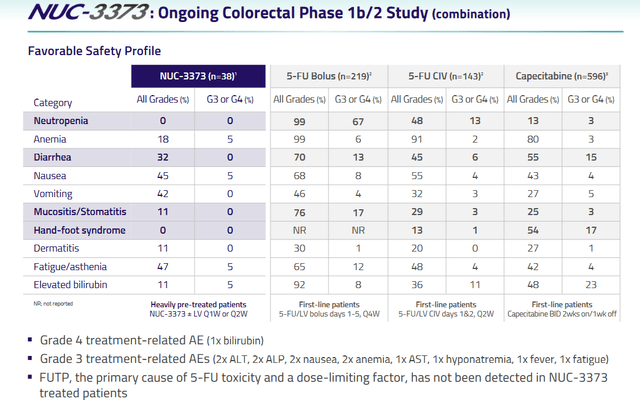

NUC-3373’s safety profile is encouraging. So far, it has not led to hand-foot syndrome, which is an adverse event present in about half of the patients treated with 5-FU.

NUC-3373 safety – mCRC trial (NuCana corporate presentation)

This is a chart from the study in colorectal cancer. Notice the large difference in adverse reactions here compared to different FU-5 treatments, either in bolus form, by continuous intravenous injection or orally (capecitabine).

The company has published eleven posters on its website regarding the ongoing trials.

Results so far in solid tumors

NuCana is doing a Phase 1 study of NUC-3373 in solid tumors.

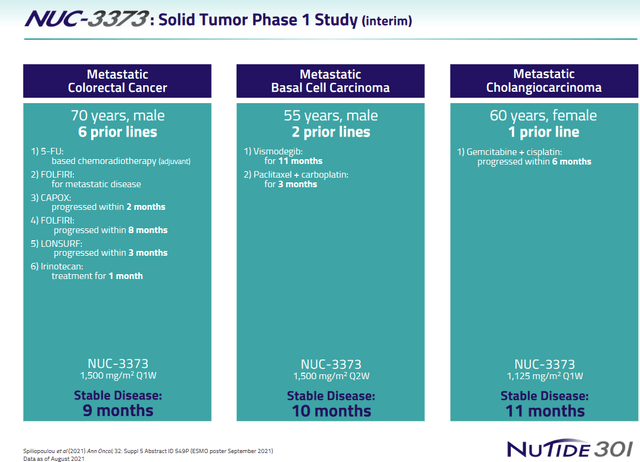

At ESMO 2021, final results of NUC-3373 as monotherapy in 59 heavily pretreated evaluable patients with advanced solid tumors (study NuTide:301) were presented. Of the 43 patients in part 1 of the study, 12 (26%) had durable stable disease. Of the 16 patients in part 2 of the study, 3 (19%) had stable disease. Three patients achieved stable disease over 9 months.

Some patients results are shown below.

NUC-3373 solid tumors patient examples (NuCana corporate presentation)

Results so far in mCRC

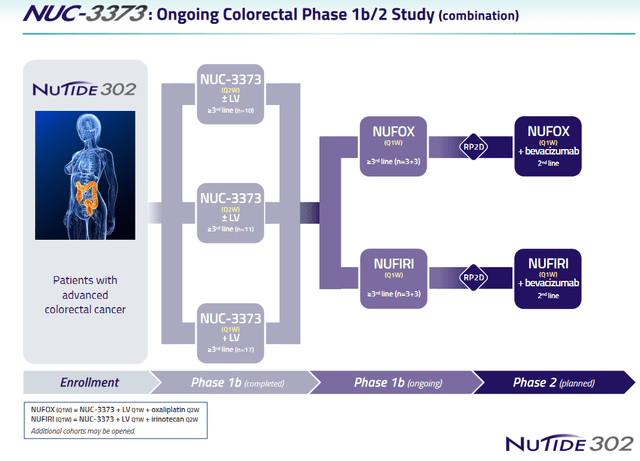

NuCana is doing a Phase 1b/2 study of NUC-3373 in mCRC, the first part of which is completed, with Phase 2 still to be started.

NUC-3373 colorectal study slide (NuCana corporate presentation)

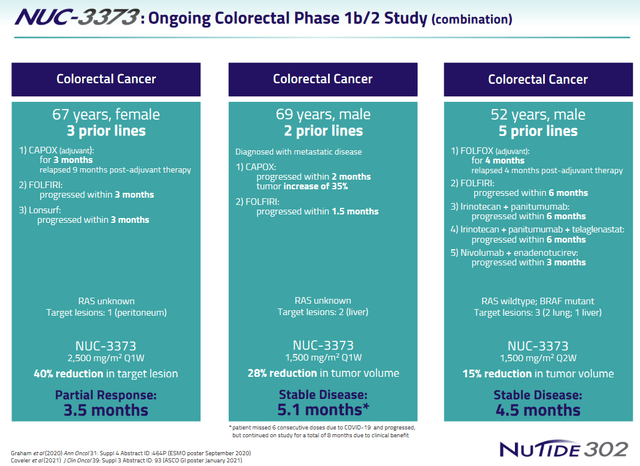

At ASCO 2021, NuCana had presented results of NUC-3373 in combination with standard therapies in advanced/metastatic colorectal cancer on 37 patients (study NuTide:302), showing a 62% disease control rate, considerably longer progression-free survival, and five patients experiencing tumor shrinkage. Notice, this is a trial with patients which have had not less than four lines of previous chemotherapy, which have all failed.

Some examples of patient treatments are shown below.

NUC-3373 colorectal patient examples (NuCana corporate presentation)

Conclusion and data readouts

NuCana is substantially improving standard of care that has been around for years, and will stay around. With its favorable safety profile, it has the potential to replace existing standard of care, and to be combined with other treatments.

NuCana is pursuing huge and already existing markets. For colorectal cancer alone, this concerns 1,900,000 new cases annually. If one were to model a modest 15,000 USD cost per patient, with a 10% worldwide market penetration, that would lead to $2.8 billion annual turnover. At a price of $45,000 per treatment, which was mentioned by an analyst, that would be $8.5 billion. Clearly the market at this time does not seem to expect these revenue levels, as the stock is trading at micro-cap levels.

NuCana nonetheless states:

We believe NUC-3373 has the potential to replace 5-FU as the standard of care in the treatment of patients with a wide range of cancers.

There are two upcoming catalysts for NUC-3373:

– a further readout of the Phase 1b/2 trial of NUC-33733 in combination with leucovorin, irinotecan, and bevacizumab in colorectal cancer (study NuTide:302);

– a further readout of the Phase 1b/2 trial of NUC-3373 combination therapy with other agents in solid tumors (study: NuTide:303).

NUC-7738, a ProTide transformation of 3’-deoxyadenosine or cordycepin

Introduction

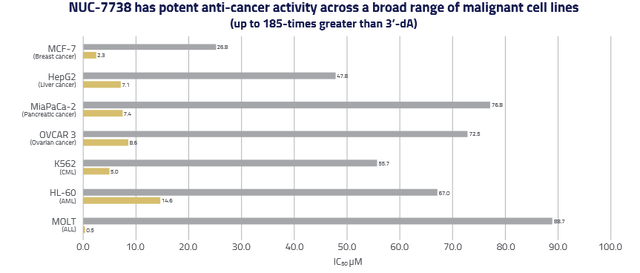

NUC-7738 is the ProTide version of 3’-deoxyadenosine, a molecule derived from a Chinese plant which showed potent anti-cancer activity, has been tried academically several times, but which has never been used in cancer therapy due to its rapid breakdown. NUC-7738 overcomes this limitation and shows potent anti-cancer activity over a multitude of cancers, including hematological malignancies.

In 16 of 20 non-clinical studies performed, NUC-7738 was found to be up to 185-times more potent than 3’-dA.

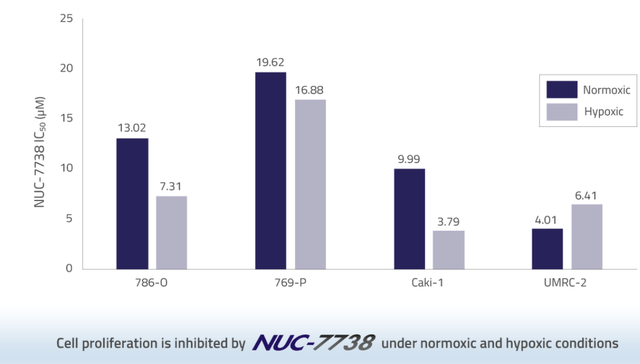

NUC-7738 anticancer activity (ESMO 2020 poster)

Importantly for solid tumors, NUC-7738 remains active in the hypoxic tumor micro-environment.

NUC-7738 efficacy in the TME (NuCana corporate presentation)

Results so far in solid tumors

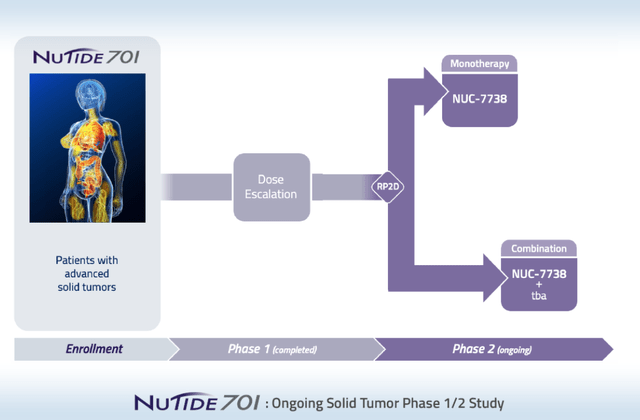

NuCana is doing a Phase 1/2 dose-escalation study of NUC-7738 in solid tumors, the Phase 1 of which is completed, while Phase 2 is still ongoing.

NUC-7738 trial slide (NuCana corporate presentation)

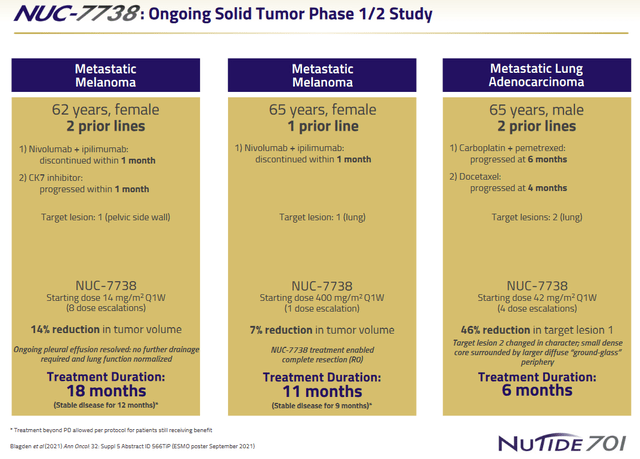

At ESMO 2020, with 14 patients treated, NuCana presented a case study of two patients. The first patient, a heavily pretreated 62-year old metastatic melanoma patient, with an ongoing treatment duration of 15 months at that time, and having received 7 dose-escalations. Her tumor showed a 14% reduction in volume after 8 weeks of treatment, and she had stable disease for 12 months. Treatment continued beyond progression due to ongoing clinical benefit, and disease-control was re-established from month 12 to 15. There were little treatment-related adverse events. The second patient was a 65-year old heavily pretreated male diagnosed with lung adenocarcinoma on treatment for 6 months, and presenting with two target lesions. After 4 dose-escalations, no treatment-related adverse events had been noted. His tumor volume increased between week 1 and Week 8, but reduced between week 8 and 16 in one lesion up to 46%, with reduction in core density and more diffuse periphery seen in the other lesion.

At AACR 2021, NuCana presented further results on 21 patients treated, with one additional case-study of a 65-year old metastatic melanoma patient having received a high 400 mg/m² starting dose and 9 months of treatment, which was ongoing. Her target lesion showed a 7% reduction. NUC-7738 continued to have a favorable safety profile.

At ESMO 2021, NuCana mentioned that tumor types in 29 patients treated were of all sorts, namely melanoma, colorectal, cervical, lung, breast, ovarian, pancreatic, gastric, oesophageal, biliary tract, leiomyosaracoma, mesothelioma, lejunal and endometrial cancer.

Some exemplary patient results are shown below.

NUC-7738 solid tumor patient examples (NuCana corporate presentation)

Conclusion and data readouts

NuCana is turning a previously failed but much studied drug candidate into an effective oncology drug with a favorable safety profile. The drug has the potential to replace existing standard of care, or to be combined with other existing or novel drugs.

Like NUC-3373, NUC-7738 has been shown to work and improve therapy across solid tumors, with little adverse events. I expect little barriers to approval or acceptance by therapists, and interest from big pharma at any given moment. NuCana’s current market cap prices in no success at all.

I distill two possible catalysts for NUC-7738 from the anticipated milestones for NUC-3373, as mentioned in the first quarter results of 2022:

– a readout of the Phase 1 part of the Phase 1b/2 trial of NUC-7738 in solid tumors;

– a readout of the Phase 2 part of the Phase 1b/2 trial of NUC-7738 in solid tumors.

The European patent litigation against Gilead: the wild card

With 893 granted patents and 337 pending applications, NuCana is not the average small biotech company.

Gilead has built a $140 billion business around its prodrugs, with $67 billion in turnover related to its hepatitis drugs. In its annual report of 2020, NuCana mentioned for the first time that it was in legal battles with Gilead about the latter potentially infringing a 2018 NuCana composition of matter patent with novelty claims going back to 2003, and hence predating Gilead’s commercialization of hepatitis drugs based on sofosbuvir by ten years. Sofosbuvir was FDA-approved in 2013 as the first effective hepatitis C treatment, and allowed Gilead to double its revenues in 2014. In 2015, Gilead raked in $25 billion in total revenues, with almost half of that being net income, and with $12.4 billion in sofosbuvir sales. After the NuCana patent grant, which occurred only in 2018, Gilead had filed claims to annul the patent, both before the European Patent Office (EPO) and the competent English court. NuCana had filed legal proceedings before the competent German court of Düsseldorf. Legal proceedings for damages in Europe need to be taken before each of the national courts; Germany is Europe’s biggest medicine market. Apart from legal coverage here and there, this has not been covered before on any investor-related website. The proceedings before the EPO are publicly accessible and provide good insight, as Gilead has filed documents from the German proceedings in these proceedings as well. Apparently the infringement claim relates to claim 1 of the patent:

Excerpt of legal submissions filed by Gilead (Epoline patent register)

On July 11, 2022, NuCana has made a first press release about this litigation, announcing that the German Court has upheld its patent and confirmed that Gilead infringed NuCana’s patent by commercialization of Sovaldi, Harvoni, Vosevi and Epclusa in Germany.

The opposition Gilead had filed against the NuCana had already been rejected by the EPO in June 2021. Gilead appealed that decision. The English proceeding is still ongoing as well.

There is no national ruling on damages yet, but the impact for NuCana could be huge. As mentioned above, worldwide sales of the sofosbuvir amounted to $67 billion. In Germany, Gilead had agreed to a price of €41,000 per treatment price. In France, a country with a smaller population than Germany with less spending on medical care, 17,000 people had been administered sofosbuvir in 2014. At Germany’s price, that would represent €697 million in revenues for one year. For five years, that would be $3.48 billion. Irrespective of punitive damages, at an industry-typical license fee of 6%, license fees would be $174 million for commercialization in Germany over only 5 years. From a European perspective, with Europe being responsible for 29% of worldwide pharmaceutical spending, one could roughly allocate $15.41 billion of the total worldwide sales of sofosbuvir to the European market. A 6% royalty would lead to $920 million. Adding a claim for punitive damages, I expect NuCana’s initial position in settlement negotiations to be higher than that.

Given the small market size of NuCana, trading below cash position, there is substantial potential value for investors here. NuCana has now been ruled to be right twice about this. At a given point, a ruling on damages will be forthcoming, unless parties settle. I consider the latter to be the most likely option.

Financials

NuCana has a low cash-burn rate and keeps on reiterating it has a cash runway into 2025 with its current cash. The company had cash and cash equivalents of £52.6 million, or $63.88 million, at the end of March 2022. Its net loss for the first quarter of 2022 was £8.4 million.

Risks

NuCana is an early-stage biotech company. In spite of the potential, it has still quite a way to go before it can go for approval of its drug. The road can be bumpy as the FDA could impose a clinical hold in light of drug toxicities, or because the competition has come up with better solutions for the cancer indications on trial in the meantime. Eventually, approval will depend on decision by regulatory authorities, the outcome of which is uncertain at present.

I furthermore believe biotech companies that have been oversold over the past few months are poised to go up, but from a macro-economic perspective, the outlook remains gloomy.

Conclusion

I believe there are few chances to acquire NuCana at much cheaper prices than right now. NuCana’s drug candidates aren’t the latest hip thing in oncology, but they improve lives, improve safety, should be affordable, and are likely to be approved and accepted by therapists around the world. They build on historical successes. Immuno-oncology, on the contrary, has yet to show success in solid tumors, is not commercially scalable (costs up to a million per patient), and is years away from being approved and becoming mainstream. The entry barrier of an improved chemotherapy at a reasonable price must be much lower than that of novel and unaffordable treatments. To me, the current story and share price are more than compelling. If results in the upcoming readout would however be only slightly above the standard of care, or would be waning over time, then I would be willing to reconsider my bullish stance here.

The company’s litigations against Gilead over the European sales of Sovaldi, Harvoni, Vosevi and Epclusa have just been the object of a first press release by the company. It concerns multi-billion sofosbuvir-related sales which Gilead may have made knowing the NuCana patent claims predated its own patent. Gilead has now lost twice, with NuCana’s patent having been upheld twice, and Gilead having been found to infringe that patent. With each gain, chances of a win or a favorable settlement for NuCana are improving. Then again, a loss at any time, certainly at the appeal level, would not be favorable for NuCana. I explain above how I see such settlement being worth several millions of dollars. There is little risk and great potential upside from a shareholder perspective, and hence this needed to be covered as part of NuCana’s investor analysis.

For all the reasons above, I rate NuCana as a strong buy at this time.

Be the first to comment