alvarez

It is certainly not news to anyone reading this that one of the biggest challenges facing the market and the American economy today is the extremely high inflation that is straining the budgets of many families. This inflation has naturally been causing the market to decline as fears of an economic slowdown intensify and the Federal Reserve raises interest rates in an effort to contain the inflation. The combination of rising prices and shrinking portfolios has likely left many retirees wondering what they can do to preserve and even grow their wealth in the face of this inflation.

One possible option is real estate, since real estate typically acts as a store of wealth and it can be rented out to generate an income. However, many people have neither the capital nor the motivation to put together a real estate portfolio nor to actually manage properties themselves. One possible solution to this problem is to invest in a closed-end fund (“CEF”) that specializes in real estate investment trusts. These funds provide investors with the benefit of professional management and can in many cases deliver a higher yield than any individual trust in the portfolio possibly can.

In this article, we will look at one such fund, the Neuberger Berman Real Estate Securities Income Fund (NYSE:NRO). I have discussed this 11.63%-yielding fund before, but a year has passed since then so obviously a great many things have changed. This article will focus specifically on those changes as well as provide an updated analysis of the fund’s finances in order to help an investor determine if it could deserve a place in their portfolio.

About The Fund

According to the fund’s webpage, the Neuberger Berman Real Estate Securities Income Fund has the stated objective of providing its investors with a high level of current income. This is unlikely to come as a huge surprise, since one of the primary reasons why investors purchase real estate investment trusts is because of the relatively high yields that they pay out.

Indeed, as of the time of writing the iShares U.S. Real Estate ETF (IYR) yields 3.65%, which is quite a bit higher than the 1.73% current yield of the S&P 500 index (SPY). As the name of the fund implies, the Neuberger Berman Real Estate Securities Income Fund seeks to achieve its objective by investing in real estate securities. Unfortunately, the fund’s official objective does not provide any more detail than this. It does not, for example, specify whether it is limited to investing in common stocks issued by real estate investment trusts or if it can also purchase their preferred stocks and bonds.

If it can indeed purchase more than simply the common stocks, it could prove to be a significant advantage. This is because preferred stock typically has a higher yield than the common stock issued by the same company. In many cases, the debt securities issued by these companies also have a higher yield than common equity, although the difference is much less pronounced here. In addition, both debt and preferred equity tend to have less volatility than common equity, which could help to reduce the risk of the overall portfolio if these securities were included.

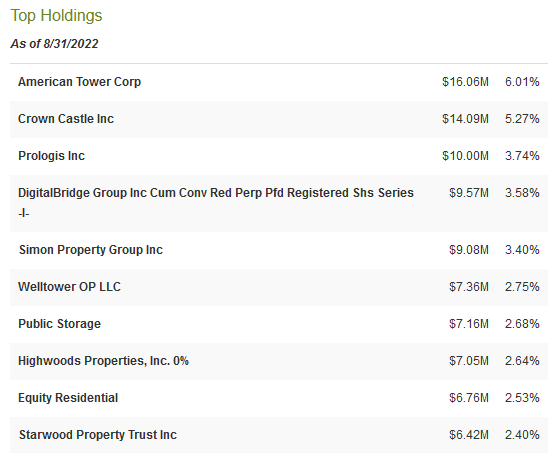

The largest positions in the fund are likely to be familiar to most investors that are interested in real estate investment trusts:

CEF Connect

There are quite a few changes to this list since the last time that we looked at the fund. In fact, the only companies that have remained among the fund’s largest holdings over the past year are American Tower (AMT), Crown Castle Inc. (CCI), the DigitalBridge preferred shares, Simon Property Group (SPG), and Public Storage (PSA). Even among these holdings, the weightings have changed considerably, which could mean a lot of things. We will discuss this in just a minute. All of the other positions here are new to the fund’s largest positions list.

One thing that we do note here is that the companies here represent a variety of different types of real estate. For example, both American Tower and Crown Castle own cellular towers that are leased out to network operators, Simon Property Group owns shopping malls, and Equity Residential owns apartment buildings. This is something that is fairly nice to see since each of these different types of real estate has very different fundamentals. For example, apartment buildings tend to be more durable in recessions since people will stop going to a shopping mall when money gets tight but they are much less likely to give up their homes. When we consider that the United States has already seen two consecutive quarters of negative gross domestic product growth, it is essentially certain that the nation is in a recession even if politicians and the media do not want to call it one.

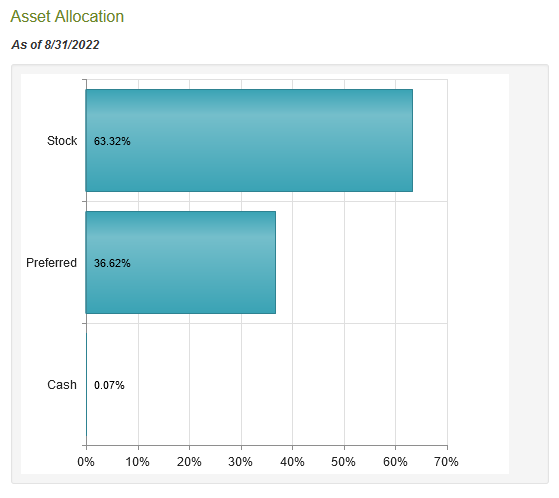

The fact that we see that the fund holds preferred stock in DigitalBridge Group (DBRG) confirms that the fund can hold preferred equity issued by real estate investment trusts. In fact, though, the fund holds far more than just these preferred shares. Indeed, fully 36.62% of the portfolio is invested in preferred stock:

CEF Connect

This is a substantially higher allocation to preferred equity than the 28.15% weighting that the fund had the last time that we looked at it. This may be a good thing, though, as preferred stock tends to be somewhat safer than common stock. This is because the preferred stock has a superior claim to the trust’s cash flow than common equity so the preferred stockholders must be paid if the real estate company intends to pay anything to the common stockholders. As most real estate investment trusts pride themselves on providing income to their common stockholders, we can therefore assume that they will generally do everything in their power to ensure that the preferred stockholders get paid.

In addition, the preferred stock tends to be more stable in terms of its pricing because the distribution is essentially the only return that shareholders are ever promised. The fact then that the fund is increasing its allocation to preferred stock is something that we should be able to appreciate as the economy descends into a recession as it should reduce the fund’s overall risk in such an environment.

As we have just seen, a good many of the fund’s positions have changed over the past year. Even among those companies that were on the list both last year and this year, the weightings have changed considerably. While the change in weightings could be caused by one stock outperforming another in the market, this situation still implies that the fund does a considerable amount of trading. However, its 22.00% annual turnover seems to disprove this. That is an incredibly low turnover for an equity closed-end fund, which is somewhat nice to see. This is because trading stocks or other assets cost money and thus a high turnover creates a drag on the fund’s performance. After all, it is ultimately the fund’s shareholders that are footing the bill for any of the fund’s expenses. This is one of the reasons why index funds have become so popular over the past several years as they do almost no trading and have minimal expenses. With that said, a high turnover does not necessarily mean that a given fund will underperform but it does create a hurdle that management has to jump over.

Unfortunately, the Neuberger Berman Real Estate Securities Income Fund has underperformed the index this year. As of the time of writing, the fund is down 38.89% compared to 33.09% of the real estate index. Once the distributions are included in the calculation, the difference between the two is negligible, however. That will undoubtedly not stop investors from shying away from investing in real estate considering this poor performance year-to-date, however.

The biggest reason for the poor performance is the Federal Reserve’s policy of raising interest rates. This has made it more expensive to take out mortgages and obtain financing to purchase real estate and thus reduced some of the demand for it. However, the fund has not cut its distribution and real estate still works pretty well as a hedge against inflation for reasons that we will discuss in just a few moments. This is ultimately the reason to consider this fund, although admittedly it may continue to lose value as the Federal Reserve continues with its planned interest rate hikes.

Real Estate As A Hedge Against Inflation

It is unlikely to be news to anyone reading this that inflation in the United States is currently at a 40-year high. The latest numbers released by the Bureau of Labor Statistics put inflation at 8.2% year-over-year and so far, the interest rate increases that the Federal Reserve has been employing to try and bring this rate down have had no real effect at reducing inflation. The root cause of this inflation is that the central bank has been printing money far in excess of the actual growth of economic production for the past decade.

This was especially evident in 2020 and early 2021, which saw some of the largest spending bills in American history make their way through Congress. We can see this by looking at the M3 money supply, which is the most comprehensive measure of the money supply in a given economy. Back in January 2020, the M3 money supply of the United States stood at $15.4018 trillion but today it stands at $21.7092 trillion:

Federal Reserve Bank of St. Louis

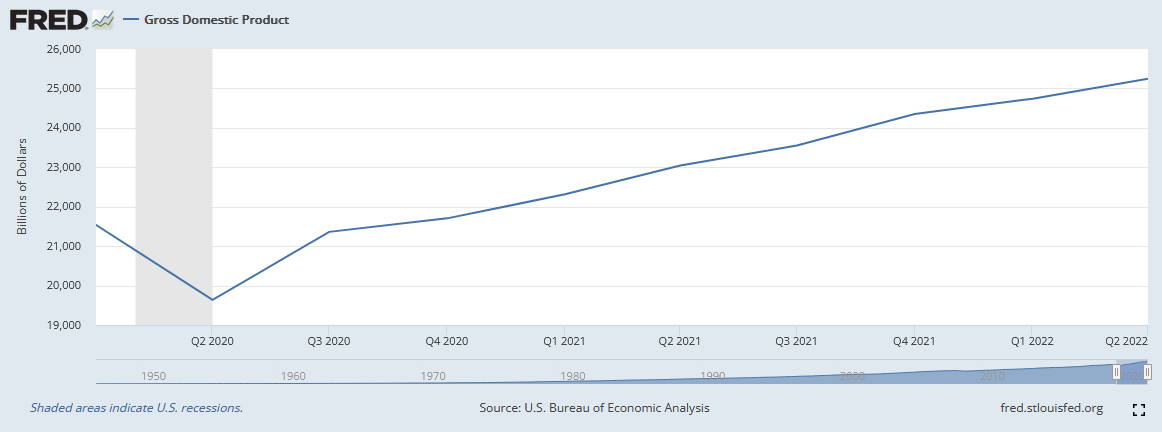

This is a 40.96% increase in just over two years. That is substantially higher than the increase in the production of goods and services in the country. In January 2020, American gross domestic product stood at $21.538032 trillion, which has risen to $25.248476 trillion today:

Federal Reserve Bank of St. Louis

This is a 17.23% increase, which is clearly substantially less than the increase in the money supply over the same period. It should be obvious why this dynamic leads to inflation. After all, there is more money attempting to purchase each unit of economic output so the price goes up as buyers bid against each other in the market.

Real estate has the same qualities as everything else that increases in price during inflationary times. For example, it is in limited supply and requires actual human effort to construct or improve. The government or the Federal Reserve cannot simply print new real estate to distribute to people. Thus, it should serve as a place to store your wealth over the long term. The Neuberger Berman Real Estate Securities Income Fund should thus benefit from rising inflation or at least help investors to protect their wealth over extended periods of time, even if rising interest rates have a detrimental effect in the short term.

Distribution Analysis

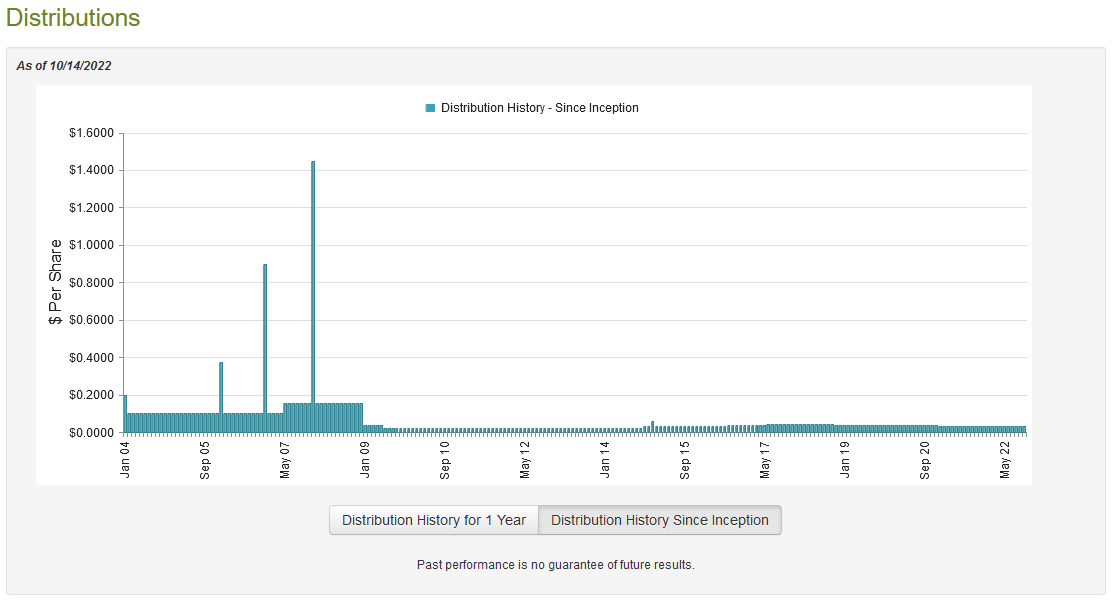

As stated earlier in this article, the primary objective of the Neuberger Berman Real Estate Securities Income Fund is to provide its investors with a high level of current income. In addition, most securities issued by real estate companies have reasonably high yields. Thus, we can assume that the fund has a comparatively high distribution yield. This is indeed the case as the fund pays out a monthly distribution of $0.0312 per share ($0.3744 per share annually), which gives the fund an 11.63% yield at the current price. The distribution has varied a bit over the years but overall, it has been reasonably consistent about this payout:

CEF Connect

The general consistency could appeal to those investors that are looking for a steady and secure source of income to pay their bills, even if the short-term performance of the fund has left something to be desired. As is always the case though, it is critical that we ensure that the fund can actually afford the distribution that it pays out. After all, we do not want to find ourselves as the victims of a distribution cut since that would reduce our income and probably cause the share price to decline even further.

Fortunately, we have a fairly recent report that we can consult for this purpose. The fund’s latest financial report corresponds to the six-month period ending June 27, 2022. This is a much more recent report than we had at the time of our last analysis of this fund. This report should also give us a pretty good idea of how well the fund performed during the early stages of the Federal Reserve’s interest rate hiking cycle. During the six-month period, the Neuberger Berman Real Estate Securities Income Fund brought in $5,319,408 in dividends and another $984 in interest from the assets in its portfolio. This gives it a total of $5,320,392 in income with which to cover its expenses. The fund naturally paid its expenses out of this amount, leaving it with $3,183,431 available for the shareholders. This was not nearly enough to cover the $8,881,201 that the fund paid out in distributions. This is certainly concerning for those that are looking for a secure source of income.

There are, however, other methods that the fund can use to earn the money that it needs to cover the distribution. Perhaps the most common of these methods is capital gains. The fund, unfortunately, failed to generate the needed money this way. During the six-month period, it realized $309,702 in capital gains but this was more than offset by $21,651,449 in unrealized capital losses. Overall, the fund’s assets declined by $27,039,517 during the period after including all of the capital gains, losses, and paid distributions. This is not something that we like to see and the fund will clearly have to turn its fortunes around in the near future as this distribution is not sustainable without such a turnaround.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Neuberger Berman Real Estate Securities Income Fund, the usual way to value it is by looking at its net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because that scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not really the case here. As of October 14, 2022 (the most recent date for which data is available), the Neuberger Berman Real Estate Securities Income Fund had a net asset value of $3.23 per share but it actually trades for $3.22 per share. Thus, the stock is currently trading for right about its net asset value. It has averaged a 2.59% discount to net asset value over the past month so the current price seems a little high. It may be better to wait until the shares can be acquired at a discount.

Conclusion

In conclusion, the Neuberger Berman Real Estate Securities Income Fund may offer a way to protect your wealth against the ravages of inflation over the long term. However, the short-term will almost certainly prove to be somewhat volatile as the Federal Reserve’s interest-hiking cycle will likely weigh on the market prices of real estate investment trusts and the fund. This is certainly not a fund for the short term at the moment. In addition, the fund’s current valuation is a bit high so it may be best to wait until a better entry opportunity presents itself.

Be the first to comment