felixmizioznikov

Company Overview

Founded in July 2004 as an investment trust in Maryland, CubeSmart (NYSE:CUBE) is a $9 billion Pennsylvania-based self-storage REIT that owns 607 facilities in 24 states plus the District of Columbia and manages 651 facilities for third parties, bringing the total number of stores to 1258.

According to IBISWorld, the company has a market share of 6.7%, the third largest in the self-storage sector, followed by Life Storage with a 4.0% market share. Management performed well in reducing their exposure to slow growth and low barriers to entry and expanding their focus on densely populated and high-income markets. Thus, Florida, Texas, California, and New York generated 51% of their revenue in 2021.

As opposed to the Great Recession, the company’s stock price has increased 143% from May 2020 to December 2021, partly due to the pandemic accelerating the need for self-storage space, given the government stimulus boosting Americans’ discretionary spending and low-interest rates. However, due to the high market competition in recent times and the presence of economic uncertainty, it is doubtful that the company will be able to sustain its growth levels.

Is the Self-Storage Industry Truly Recession-Resistant?

There is a perception that the self-storage sector is recession-resistant because the industry delivered 5% growth in 2008 despite all other commercial real estate segments losing 25% to 67% during the Great Recession. So, what made self-storage perform well? First, there is always a need for storage space, regardless of the state of the economy. During economic expansion, Americans increase their discretionary spending on possessions that require additional storage space, such as R.V.s, ATVs, appliances, seasonal decorations, electronics, etc. In times of market downturn, homeowners are forced to downsize or lose their homes through foreclosure, so they need a temporary place to store their belongings. In addition, a growing urban population, smaller living spaces in cities, and moving frequency, as well as death and divorce, have all contributed to the growth of self-storage in the U.S. This resulted in the self-storage market being valued at $48.02 billion in 2020, thus supporting Mordor Intelligence’s prediction of growth of $65 billion in 2026, which is a compound growth rate of 5.4%.

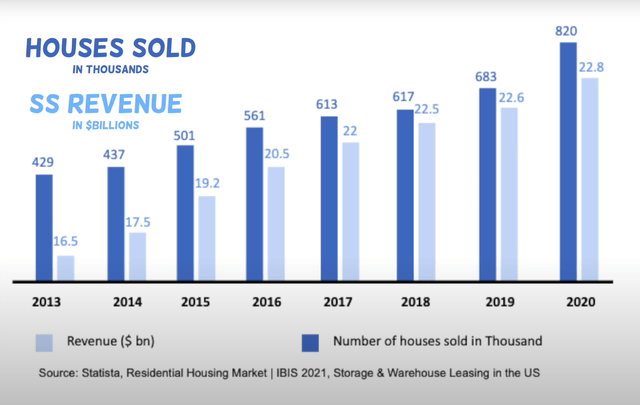

The self-storage sector has evolved over the years and has become one of the best-performing asset classes in the commercial real estate industry. Consequently, this sector has seen a large influx of capital since the Great Recession, and the annual revenue of self-storage has grown from $24 billion in 2013 to $48 billion in 2020, a rate of 10.41% CAGR according to Self-Storage Association.

Despite the sector growth in the last decade, the self-storage industry faces an oversupply issue. According to Inside Self-Storage, there are approximately 50,000 self-storage facilities in the United States and 7 square feet of storage space per capita. Since the self-storage business is driven by supply and demand, oversupply could be bearish news for the sector. In addition, oversupply by itself could increase stiff competition causing the rent per square and occupancy rates to decrease.

On top of that, the industry may face another challenge: recession. The media, politicians, and the Federal Reserve have all predicted a recession soon. Although self-storage businesses have historically been known to be resilient in times of recession, it could be challenging to face oversupply and market downturn simultaneously.

During the Great Recession, the sector experienced a rental demand decline and rental default rise. According to Inside Self Storage, occupancy declined by 11%, and default rates rose within the self-storage sector. As a result, many business owners lowered rents to attract new tenants. In addition, obtaining financing to support the business was also a significant challenge because of rising capitalization rates. Neal Gussis, a former Principal at Chicago-based Beacon Realty Capital, said mortgage terms shifted dramatically because lenders wanted more equity, with programs not exceeding 70 percent of a property’s value instead of 85 percent or even 90 percent before the Great Recession.

While several self-storage facilities performed well, expanding their market shares by acquiring self-storage facilities at a high cap rate during the Great Depression, those like CubeSmart, which relied heavily on finance for expansion, were financially troubled.

CubeSmart Struggled During The Great Recession

Though past performance does not guarantee future results, it can still guide the prediction of how the company might perform in the next recession. Therefore, I evaluated how the company performed during the Great Recession due to constant warnings from the media, politicians, and the Federal Reserve about an impending recession.

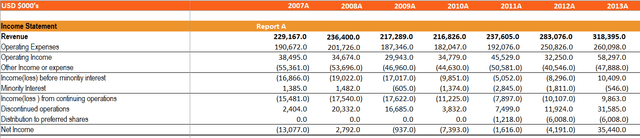

Exhibit 1

Author’s Spreadsheet/CubeSmart’s Annual Reports

Founded in 2004, the company had not fully stabilized their business when the Great Recession struck. Although the company generated a positive net income in 2008, as shown in exhibit 1, from 2009 to 2012, the company’s net income decreased YoY. Notably, in 2010, the company’s net income declined 689% compared to the previous year. As the company struggled to stay afloat, it issued more common shares, lowering the equity per share from $9.07 in 2008 to $7.84 in 2013. By the time dust settled in 2013, there were 141% more common shares than in 2008.

Furthermore, while the company diluted their shares, raising more capital to sustain their business, the ROE, ROI, and ROA remained negative from 2009 through 2012. That signifies the company was inefficient investing capital. Considering all these factors, the company was unprepared for the recession, resulting in inferior performance.

The Stellar Performance Of Extra Storage During The Great Recession

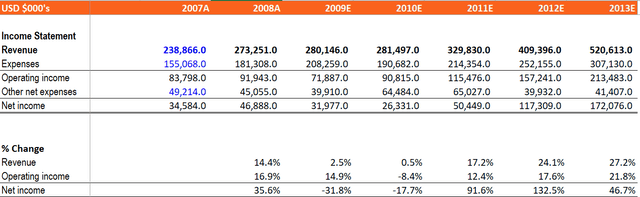

Exhibit 2

Author’s Spreadsheet/ Extra Space Storage Annual Report

After reviewing CubeSmart’s performance during the Great Recession, we are not convinced that the self-storage sector was either recession-proof or resilient. On the other hand, it is unfair to base that judgment on one company’s performance. Therefore, we analyzed Extra Space Storage’s (EXR) performance over the same period.

From 2007 to 2013, the company generated positive earnings every year. Although net income decreased YoY in 2009 and 2010, it increased 91.6% and 132.5% YoY in 2011 and 2012, respectively. However, operating income decreased by 8.4% YoY in 2010. Considering CubeSmart’s and Extra Space Storage’s 2010 data, we assume that a higher rental default occurred in 2010.

Compared to CubeSmart, Extra Space Storage’s management performed well during the Great Recession. Except for 2009 and 2010, its ROE remained above 5% and reached 9.8% in 2013. Also, ROI and ROA stayed positive throughout all seven years. In addition, unlike CubeSmart, whose equity per share has decreased while diluting shares, Extra Space Storage’s shareholders’ equity per share increased 32% from 2008 to 2013. Even during the financial crisis, Extra Space Storage had proliferated. This data indicates that self-storage can indeed weather recessions if they have plans to deal with a market downturn and manage their assets and investments efficiently.

Revenue Growth Was Strong During The Pandemic, But Most Likely It Will Be Unsustainable

For 2021, 2020, and 2019, CubeSmart’s revenue was $822 MM, $679 MM, and $644 MM, respectively, an increase of 5.5% in 2020 and 11% in 2021 YoY. Despite their revenue growth, the operating profit margin in 2021 decreased to 35.3% from 37.9% in 2020. However, the company managed to reduce other expenses by 33.52% resulting in a 35% YoY increase in net income. In addition, the total asset has increased by $1.7 B over last year, increasing shareholders’ equity per share from $9.3 to $12.90, a 38.70% increase. Although this is good news for CubeSmart and their shareholders, there is an issue with the profit margin. Even though the company’s revenue has grown significantly, the profit margin (25.2%) fell well below the average for the sector (39.22%), as well as their peers Extra Space Storage Inc. (49.80%), Public Storage (50%), and Life Storage, Inc. (32.40%) in 2021. This is not what one would expect from a company with increasing revenue. In addition, the company has also experienced annual declines in ROA, ROE, and ROI.

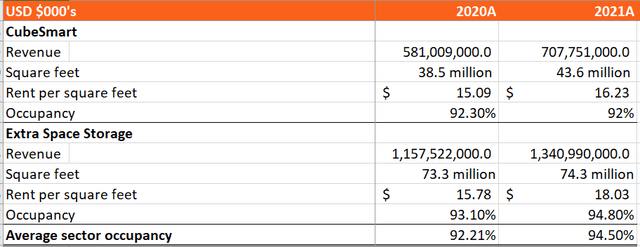

Exhibit 3

Author’s Spreadsheet/CubeSmart’s Annual Report

As illustrated in exhibit 3, ROA was 4.2%, 3.5%, 3.4% in 2019,2020,2021 respectively, with 16.67%, 2.8% declines YoY in 2020 and 2021. ROE and ROI showed a similar trend. Data shows that the more assets and investments the company received, the less efficiently it managed their business. This means CubeSmart may therefore be underpricing their rentals.

Exhibit 4

Author’s Spreadsheet/CubeSmart’s Annual Report

Rent per square foot for CubeSmart in 2020 and 2021 was $15.09 and $16.23, respectively. The rent per square foot was similar for both companies in 2020. Still, CubeSmart’s rent was approximately $1.80 less than Extra Space Storage, and their occupancy was 2.5% lower than the industry average and 2.8% lower than their rival in 2021. The difference of $1.80 might not seem significant, but when multiplied by the square feet, it equated to approximately 10% of the revenue in 2021. The difference in rent performance makes CubeSmart underperform their competitors. So, why is CubeSmart charging lower rent than Extra Space Storage? Let us find out.

Secret Shopping

To find out what makes CubeSmart underperform their competitors, we visited three CubeSmart facilities and one Extra Space Storage facility. The main things we looked for were occupancy, cleanliness, price, efficiency, and security. For CubeSmart, we will name each property A, B, and C to avoid confusion.

CubeSmart

Each store had 93-95% occupancy, with an average rent based on the local market. While all stores were clean, some landscaping work needed to be done. In addition, despite the company advertising a touchless entry system through their mobile applications, all three locations required a manual code entry to go through the gates.

Security:

We were concerned about the security at stores A and C. Although the passcode was required to open the gate at store C, there was no code required to leave the building. As no employee works after business hours, burglars can easily leave the facility without many limitations. Furthermore, two of the six security cameras were malfunctioning, leading to a blind spot.

The security camera was not even installed in store A. Despite the manager saying that CCTV was installed in certain parts of the facility, there was no CCTV monitor in the office. As such, we assume that those cameras the manager claimed did not work. The fact that we were able to find their security vulnerabilities easily means that anyone with malicious intent can exploit them without much difficulty.

Efficiency:

We also found it interesting that stores A and B did not have functioning golf carts. The managers at both facilities asked their district managers to fix or replace it a few months ago, but nothing was done. Both properties were approximately 12,000 square feet and 45,000 square feet (about half the area of a Manhattan city block), respectively. Can you imagine walking back and forth across the 45,000-square-feet facility without a golf cart? These front-line employees must assist tenants, clean the storage unit, make collection calls, prepare for auctions, and maintain the facility.

We also discovered a disconnect between company policy and employee behavior. For example, despite the company’s guidelines establishing eviction procedures after 30 days past due, two facilities failed to follow them. According to property C’s manager, one of his tenants was four months late, so he had to put the storage unit for auction, which they only recovered $350 out of $1600 owed to them. The property manager at property B related a similar story about a customer who had not paid rent for eight months. It is critical to consider each unit as an inventory item. The longer it takes the company to auction the unit, the more losses it incurs, resulting in underperformance. Though this does not guarantee that all other facilities may be mismanaged, an analysis of two facilities revealed a lack of consistency in management practices.

Exhibit 5

Scale from 1 to 10

|

Staff’s friendliness |

10 |

|

Cleanliness |

6 |

|

Security |

3 |

|

Rate |

8 |

|

Efficiency |

4 |

|

Occupancy |

8 |

|

Location |

9 |

Based on our experience at three facilities, it makes sense why the company undercuts their rent to attract new tenants. Although strategically located in a high-density area, these facilities were not up to standard regarding quality or security. All three facilities had minimal curb appeal and attracted price-conscious clients who needed a place to put their stuff. Of course, this hinders the ability of the company to have pricing power over their competitors. For CubeSmart to be competitive, these facilities need to be remodeled with modern technology, focusing more on quality and offerings and managing the facility efficiently. Further, improved communication between front-line employees and upper management would be necessary.

Extra Space Storage

We visited a storage facility located close to a major highway exit. It had two entrances: the front door by the office and the back door by the dumpster and loading dock. For the convenience of loading large items, the company separated those two entrances. The units were all climate-controlled and well-maintained. Each unit had the option of installing up to two locks, and there was no obvious sign of dust in the building. In addition, multiple cameras were installed on each aisle to ensure the security of the property.

During our visit to the store, we looked at their inventory list and the price for each unit. They had a 96% occupancy rate and slightly higher rent than their local competitors. Since the facility is high-end with top security and well-trained staff, the company has the pricing power, which attracts quality-conscious customers.

We found almost everything to be in order. Customer service was excellent, employees followed management’s guidelines, stores were impeccable, security was top-notch, and technology was cutting edge. For example, the entire aisle was illuminated by sensor motors, including the storage unit. Considering the manager told me that upper management gave him full support regarding maintenance, security, and inventory requests, it makes sense that the facility was being handled accordingly.

Exhibit 6

Scale from 1-10

|

Staff’s friendliness |

10 |

|

Cleanliness |

8 |

|

Security |

8 |

|

Rate |

9 |

|

Efficiency |

9 |

|

Occupancy |

9 |

|

Location |

9 |

Pandemic Fueled Demand

So, why did the self-storage sector thrive during the pandemic, contrary to the Great Recession? Pandemics accelerated the need for more space for several reasons as well as the traditional drivers of self-storage, such as death, divorce, density, and dislocation.

- As a result of the pandemic, approximately 22 million people relocated from cities to suburbs due to financial reasons.

- Most individuals who worked from home required more space to accommodate their home offices, so they stored discretionary items in self-storage facilities.

- As of late 2021, there were approximately 800,000 deaths due to the pandemic. During the estate administration process, many surviving families used self-storage facilities.

- Although unemployment surged to 13% in the second quarter of 2021, Americans saved 8.7% of their disposable incomes due to government stimulus and lack of leisure activities during lockdowns, according to the Bureau of Labor Statistics. A rising saving rate and a more extended lockdown period increased demand for discretionary items such as R.V.s, boats, ATVs, electric bikes, etc. Because some homeowners’ associations have strict policies about parked vehicles in driveways and sideways, the demand for self-storage has increased.

Future/Catalysts

Although the self-storage industry is renowned for being recession-resistant, not all self-storage facilities fit that description. For example, in the 2008 financial crisis, CubeSmart’s underperformance compared to their peers was evident due to poor management. After reviewing the past and present, we will explore what might happen in the next recession and how CubeSmart might underperform.

Oversupply

In the self-storage sector, there is a sign of oversupply, followed by mass development. Approximately 5 billion dollars was invested in developing self-storage facilities in 2018, and Yardi Matrix predicts the growth to decelerate in 2022. Consequently, during 2019 and the first half of 2020, self–storage rent growth plateaued, and occupancy started declining for the first time in years. Nevertheless, approximately 50.3 million more square feet of self-storage will be delivered by the end of 2022, adding more supply to the market.

Exhibit 7

Reit.com

Many metro areas, including Charleston, South Carolina., Dallas, Austin, Houston, San Antonio, and Nashville, have a 50% higher net supply than the national average. However, due to an unexpected pandemic that swept the world, storage unit demand has surged, leading to rapid rent increases. Although the industry has benefitted from the pandemic, it is unrealistic to expect the same growth in the coming years as demand is decreasing and the effect of the pandemic is subsiding.

As we mentioned, CubeSmart generates 9% of total revenues from Texas. However, once you look at the demographics in Austin, TX, where the company either owns or manages 17 stores representing a 14.2% market share, the population growth has been diminishing, showing only 0.2% 1-year population growth compared to 3.6% 3-year growth. In addition, the SF/Capita is 10.54, which is 50.57% higher than the national average, 7. Therefore, when the short-lived pandemic-driven demand subsides we may start seeing higher vacancy rates unless the company has a competitive edge, with high-quality amenities and offerings. This could lead to a decrease in the rental rate and a rise in the cap rate when new developments penetrate the market as they did in 2019.

How about New York, where the company generates 19% of total revenues? Particularly in Brooklyn, NY, where the company owns or manages 23 stores, the population has decreased by 3.1% in the last year and 4.8% over the previous three years. Despite 3.4 SF/Capita, 48.57% less than the national average, the company’s properties had an occupancy rate of just 89.5% in 2021, lower than the average national occupancy of 92%. The cause of under-underperformance could be the technology-driven on-demand pick-up and drop-off services that are expanding their market share in these areas. On top of the diminishing population, these competitors could cause the company to lower their rental rates. For the company to sustain their growth, CubeSmart has to focus on the quality of the facilities and technology-driven innovative services to attract quality-conscious clients willing to pay top dollars. In addition, they need to find a way to increase profit margin and efficiencies by reducing debt and expenses.

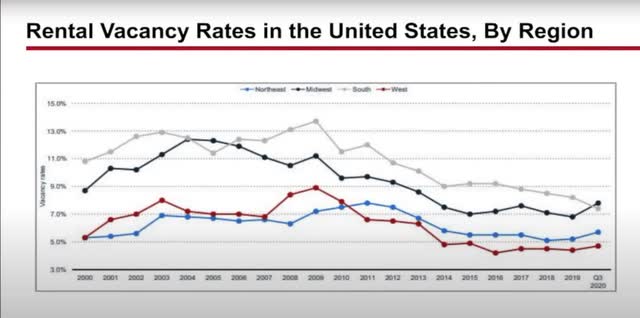

Macro Trends

Exhibit 8

Statista, Residential Housing Market / IBIS 2021, Storage % Warehouse Leasing in the US

Rent Cafe reports that 50% of tenants use self-storage because they are moving. This data indicates that the self-storage demand changes based on how often people move. One of the most significant factors that contributed to the self-storage growth during the pandemic was the high frequency of moving due to unprecedented home sales due to its low-interest rate. However, this trend is likely to change.

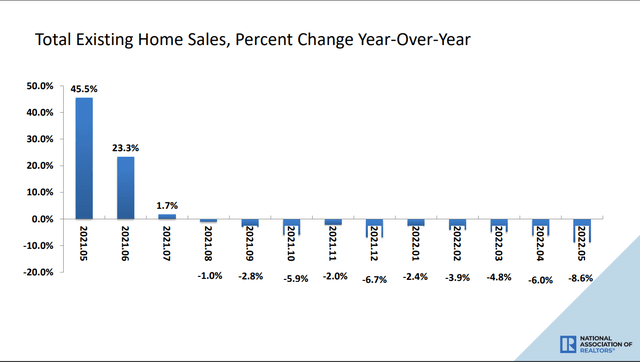

Exhibit 9

National Association of Realtors

With the interest rate increase, existing home sales have started to decline. As of May 2022, the National Association of Realtors reported an 8.6% decline in existing home sales YoY. As a bonus, Federal Reserve Chair Jerome Powell testified during congressional hearings on 06/22/2022 that ongoing interest rate hikes are necessary to tame the hottest inflation in 40 years. This could result in another 50-75 basis point interest rate hike in July 2022, leading to a potential recession in the U.S. economy.

CubeSmart released their earnings report for the period ended March 31, 2022. Due to the addition of 85 more stores, revenue increased 26% YoY the same period in 2021. However, EPS declined 23% YoY after expenses increased 37%. It is alarming to see net income declining because expenses are outpacing revenue growth. In addition, their management efficiency remained low even during the greatest occupancy and rental rate growth in the company’s history. As a result, compared to their peers, the company has the lowest ROA, ROE, gross margin, operating margin, and profit margin, while their P/FC was the highest.

Exhibit 10

|

CubeSmart |

Extra Space Storage |

Public Storage |

Life Storage |

|

|

ROA |

3.4% |

8.2% |

11.20% |

4.6% |

|

ROE |

7.7% |

26.90% |

35.40% |

8.70% |

|

ROI |

5.5% |

10.50% |

13.20% |

5.40% |

|

Gross Margin |

70% |

75.40% |

73.70% |

72.70% |

|

Operating Margin |

31.90% |

58.40% |

49% |

42.80% |

|

Profit Margin |

25.20% |

49% |

50% |

32.40% |

|

P/FC |

1166.46 |

336.01 |

57.58 |

81.18 |

Source: Author’s spreadsheet/Companies’ Annual Report

CubeSmart had underperformed their competitors even when self-storage demand was at their peak. However, their access to financing and investing activities supported their growth and reaped the benefit of sector growth. Nonetheless, there is a danger that CubeSmart’s underperformance could worsen in the coming years due to the combination of high-interest rates, oversupply, and a recession. Therefore, the company could experience an increased vacancy, expenses, default rental, and downward pressure on rents. This may result in the company having to sell or refinance their properties to maintain their business, potentially decreasing the revenue and return for the investors.

Valuation

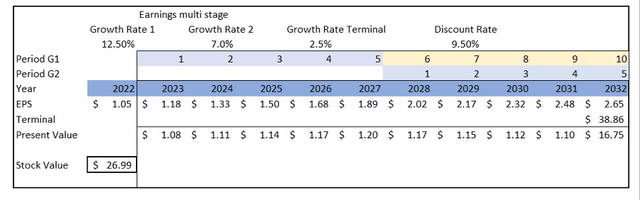

Exhibit 11

Author’s work

With a P/E ratio of 40.61, CubeSmart is 8 points overvalued compared to the sector average. CubeSmart’s competitor, Extra Space Storage, has a P/E ratio of 28.04 even though they outperformed CubeSmart by a wide margin. Based on the sector P/E ratio, the fair value of the stock would be $33.28.

Additionally, we used a multistage DCF model with EPS. DCF analysis was calculated using a 5-year average EPS growth rate of 12.50%, a terminal rate of 2.5%, and a discount rate of 9.5%. While the WACC is lower than the discount rate selected in the DCF model, we ultimately decided on a 9.5% discount rate to reflect CUBE’s high volatility and level of risk despite a low beta coefficient. Based on this analysis, the fair value of CUBE is $26.99.

Careful: Shorting CUBE stock is not without its risks

The following are valid counterpoints to the short thesis and should be viewed as potential risks of opening a short position on this stock:

- Self-storage has the advantage of constant demand regardless of the economy. So, for example, when there are high foreclosures or evictions during a prolonged recession, CubeSmart’s growth could be boosted by strong demand for self-storage.

- As many companies end remote working, some people who moved to suburban or rural areas are likely to re-migrate to metro areas. With more people moving to cities, there could be an increase in the demand for self-storage units, which could result increased earnings for CubeSmart and positive impact on their stock price.

- Approximately 80% of self-storage facilities are owned and operated by individual operators. During the next recession, businesses at a low cap rate with high leverage might struggle because their expenses are high compared to their revenue. In addition, these operators do not have access to the same financing options as REITs. This could lead to the closure of many self-storage facilities. Due to CubeSmart’s better financing options, it may be possible to purchase these facilities at a high cap rate, allowing the company to expand their market share further and exit the recession in a stronger position.

- Therefore, we recommend hedging strategies to mitigate risks for any short position.

Conclusion

CubeSmart focused on rapid expansion while neglecting their existing business. This resulted in lower rental and occupancy rates compared to their competitors. Consequently, the stock has underperformed. CubeSmart returned -9.32% (1-year total return), whereas Extra Space Storage and Public Storage returned 4.13% and 3.74%, respectively, as of market close on 06/22/2022. CubeSmart consistently underperformed their peers despite using similar leverage and financing options.

We believe CubeSmart is significantly overvalued. The market has placed a higher value on the stock than it is worth due to the overwhelming optimism in the sector. In reality the self-storage industry could face a lot of headwinds due to oversupply and a possible recession. While even in recessions and there will still be a demand for self-storage units, companies with weak fundamentals and low efficiency like CubeSmart could encounter many challenges navigating the situation. Therefore, we recommend closing any long positions on the stock and exploring hedged short positions.

We would like to thank M. Lee for this piece.

Be the first to comment