Scott Olson

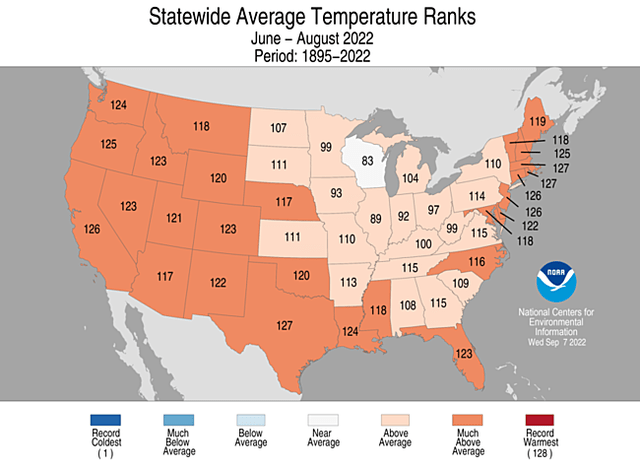

It was the third-hottest meteorological summer on record for the continental United States (CONUS). In Texas, specifically, July was exceptionally warm, but August verified a bit less hot than some had feared, though still above average. There were concerns that power market operations could have been at risk had prolonged heat waves lingered in the ERCOT market. One utility has a large presence in that region, and it avoided potential risks during what is both a hot month and a period when Gulf of Mexico hurricanes can threaten power demand, generating plants, and transmission lines.

A Long Hot Summer: 3rd Warmest On Record

NOAA

According to Bank of America Global Research, NRG Energy (NYSE:NRG) is an electric & gas-oriented retail company that owns generation and is an independent power producer (IPP) that is transitioning to a self-described consumer services company. NRG has a portfolio of over 5 million home customers, 150,000 business customers, and 17GW generation capacity as of December 2021.

There are downside risks to NRG’s profitability due to climbing wholesale energy prices and possible market share declines as a result. NRG has a decent generation asset portfolio, but it also must buy power in the forward markets to meet demand requirements during peak power usage periods. Moreover, its aging fleet is a fundamental risk. Still, if it can navigate and trade the volatile energy market well, there’s upside potential.

The Houston-based $9.6 billion market cap Electric Utilities industry company within the Utilities sector trades at a low 2.9 trailing 12-month GAAP price-to-earnings ratio, according to The Wall Street Journal, but normalized earnings and operating profits show a higher P/E.

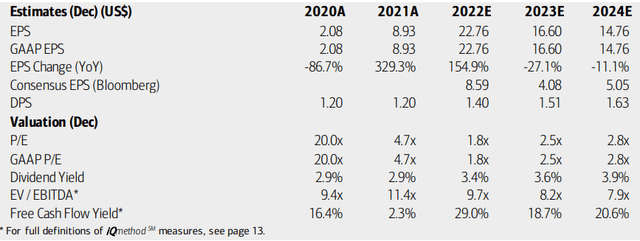

On valuation, BofA sees earnings peaking this year and declining rather sharply in 2023 and 2024. NRG’s dividend, though, is seen as increasing through the next two years. NRG has a fair EV/EBITDA multiple and its forward operating P/E, according to Seeking Alpha is a somewhat attractive 11.2.

NRG Energy: Earnings, Valuation, Dividend Forecasts

BofA Global Research

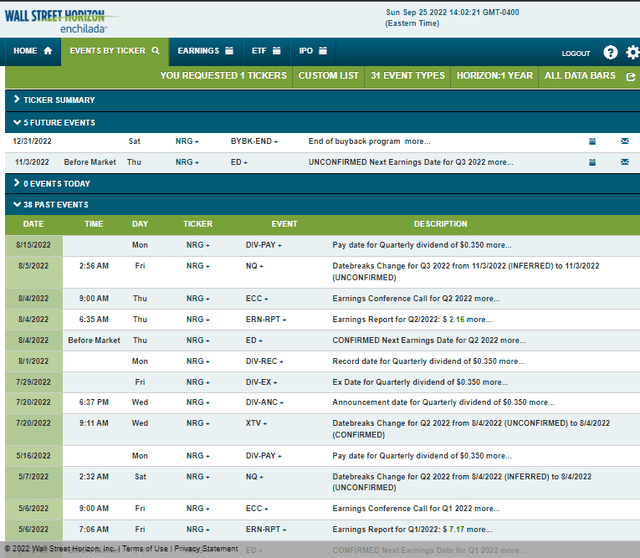

Looking ahead, Wall Street Horizon’s corporate event data show an unconfirmed Q3 earnings date of Thursday, Nov. 3 BMO. There’s also a buyback end date of Dec. 31.

Corporate Event Calendar

Wall Street Horizon

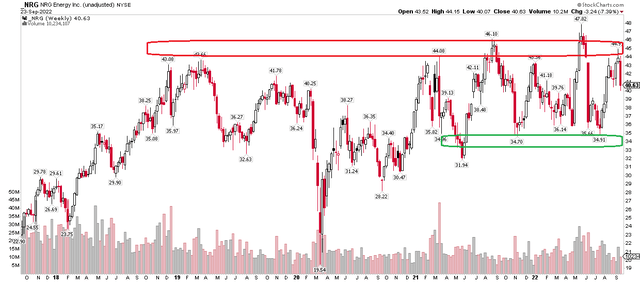

The Technical Take

NRG remains in a sideways trend. It continues to find sellers in the mid-$40s while shares often attract buyers in the mid-$30s. I think that remains the tradable range. Long-term investors should get excited when the stock breaks out in the upper $40s, but more downside can be expected should NRG break below about $34.

The upshot is the stock has been a relative winner this year. For 2022, NRG has returned –3% while the Utilities Select Sector SPDR ETF (XLU) is up a bit more than 2% (total return). The S&P 500 Trust ETF (SPY), by contrast, is down a whopping 21.6% year to date. So long as macro volatility persists, NRG should continue to hold up well on a relative basis.

NRG Stock: Trade the Range & Wait For A Breakout

Stockcharts.com

The Bottom Line

I reiterate my hold rating on NRG. It’s a stable stock during a volatile period, but challenges lie ahead for this Texas utility. Moreover, trendless price action is not a bullish feature on an absolute basis. Continue to look to scoop up shares on dips under $40.

Be the first to comment