Black_Kira/iStock via Getty Images

Leveraging Li-Ion Anode Advancements

Novonix (NASDAQ:NVX) is an Australian battery technology company. The primary goal of this maturing company is developing high-quality graphite anodes that are competitive against unsustainable, low-quality Asian products. The platform is based on Li-ion battery pioneer Jeff Dahn’s research, now performed by an entire lab at Dalhousie University in Canada.

The team is currently developing a US-focused operations base to target the fast-growing EV battery industry, and already has multiple partnerships to allow for offtake as production ramps up. In fact, much of the cash on hand is thanks to a $150 million investment by none other than Phillips 66 (PSX), who now own 16% of NVX. This article will summarize the current production state of the company and highlight the risks and rewards from a financial standpoint.

NVX Presentation

NOT a Battery Manufacturer

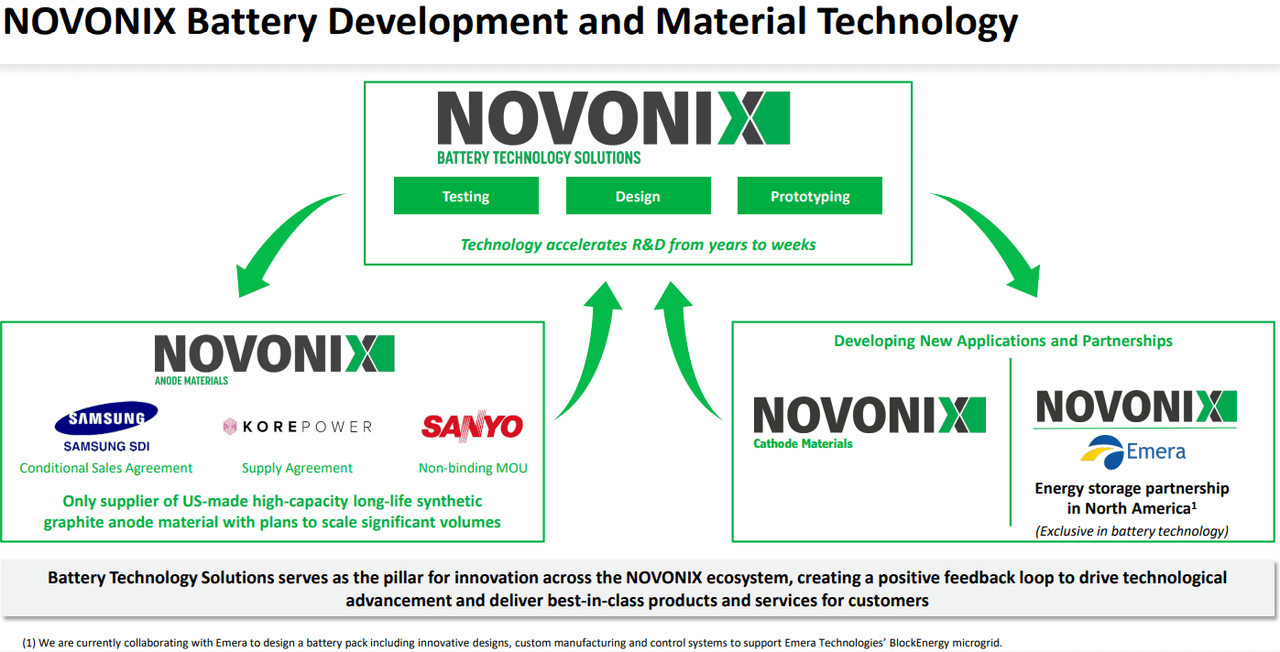

The first thing that investors must wrap their heads around in regards to NVX is that the company does not produce entire battery units. Instead, the company provides testing and R&D consulting with customers to increase the efficiency of anodes for the full batteries. All current revenues are from the “Battery Technology Solutions” segment (BTS), and this entails small-scale performance testing and prototyping, along with the sale of coulometric cyclers to test battery longevity. With optimal solutions found, the company is looking to expand production of their products for a few customers.

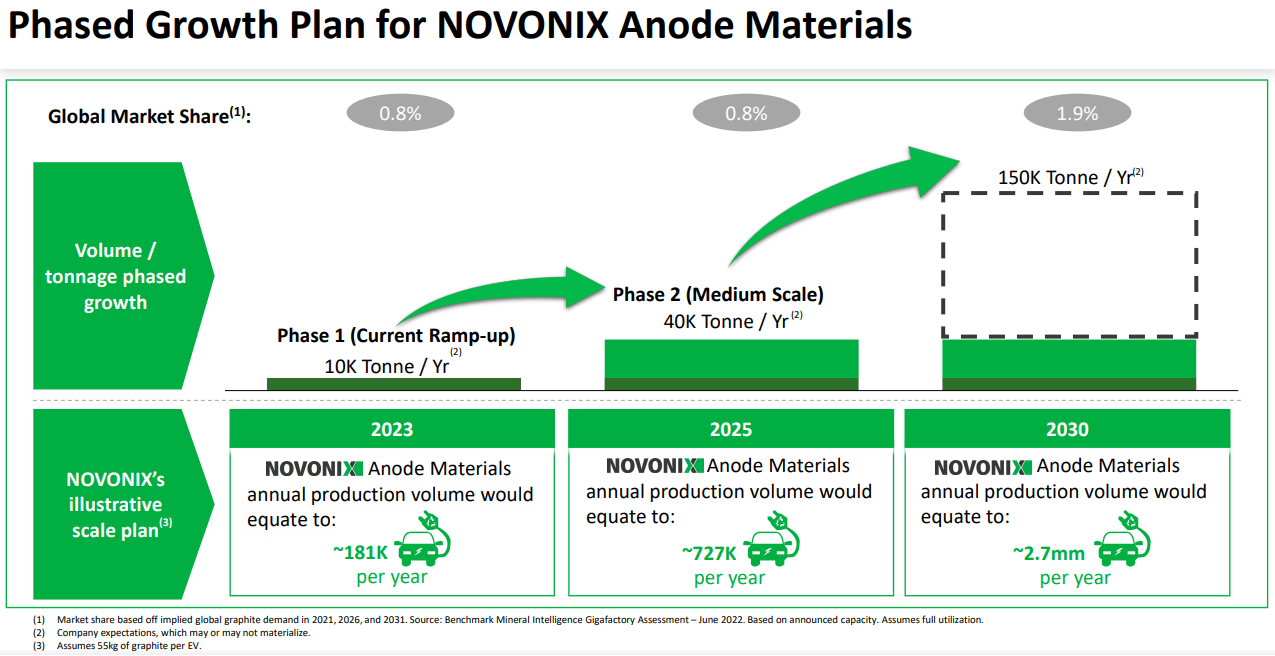

While the BTS segment sees high growth, revenues are negligible at less than $6 million per year. However, the company has recently purchased manufacturing facilities in Tennessee to begin full scale production of their anode materials. These materials will then be sent to battery OEMs for final construction. Being on the material supply side offers unique exposure for investors, and may be a key way to reduce risk when investing in speculative battery ventures. For NVX, look for initial mass product sales to commence in 2023, with a steep ramp up through the end of the decade.

NVX Presentation

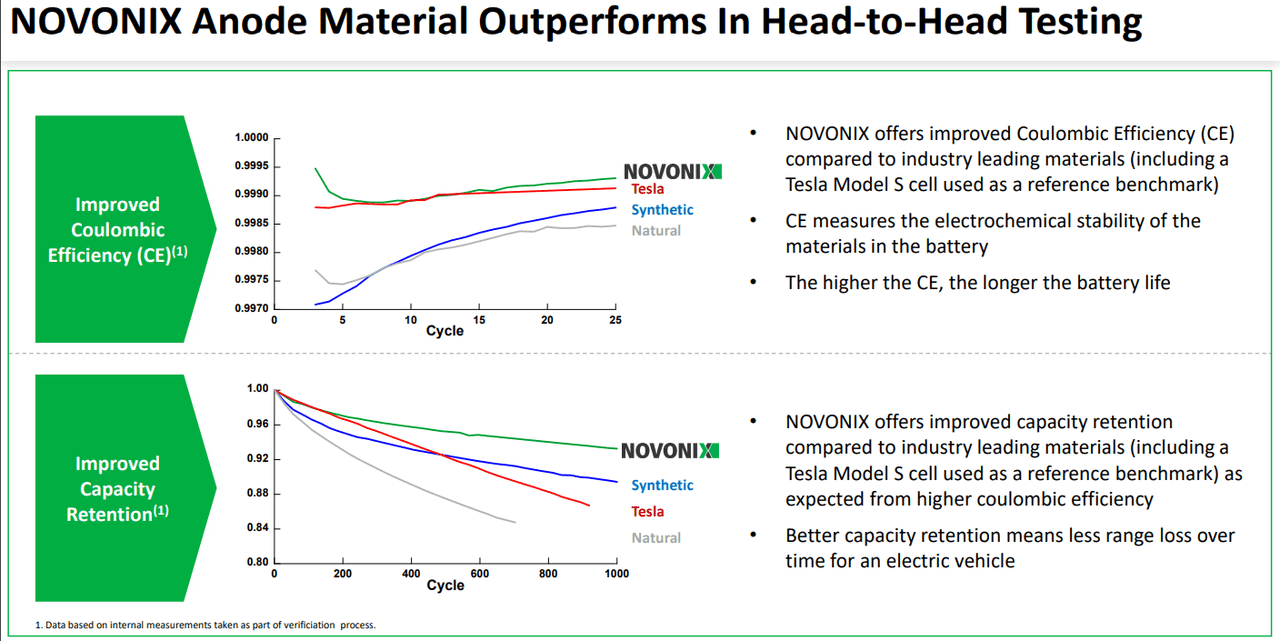

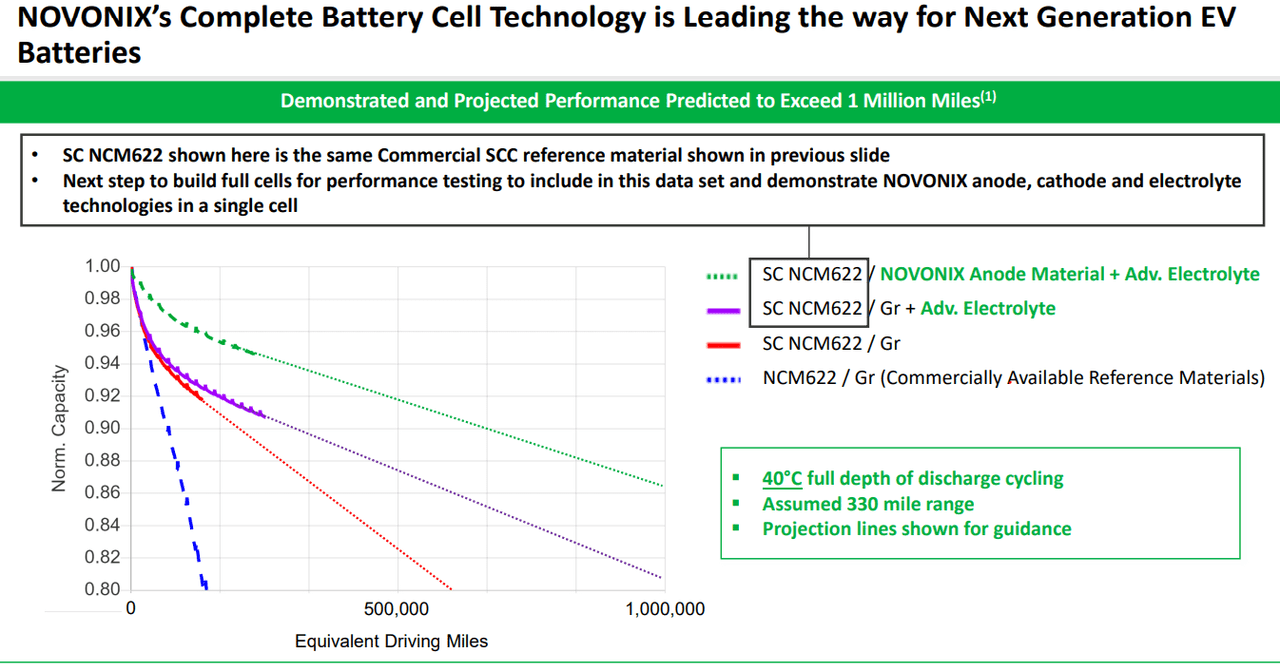

There are multiple positive catalysts beyond secular Li-ion battery market growth that Novonix can take advantage of. First, raw advantages in performance are reflected in coulombic efficiency and capacity retention compared to Tesla (TSLA) Model S, natural graphite, and synthetic anode materials. In particular, NVX seems to hold the greatest advantage in capacity retention, an important quality for the longevity of electric vehicles.

Other data points also suggest that NVX’s anodes offer significant advantage in terms of total available mileage from a single battery cell. If EV manufacturers want to be competitive with traditional ICE vehicles, utilizing Novonix anodes seems like an important first step.

NVX Presentation NVX Presentation

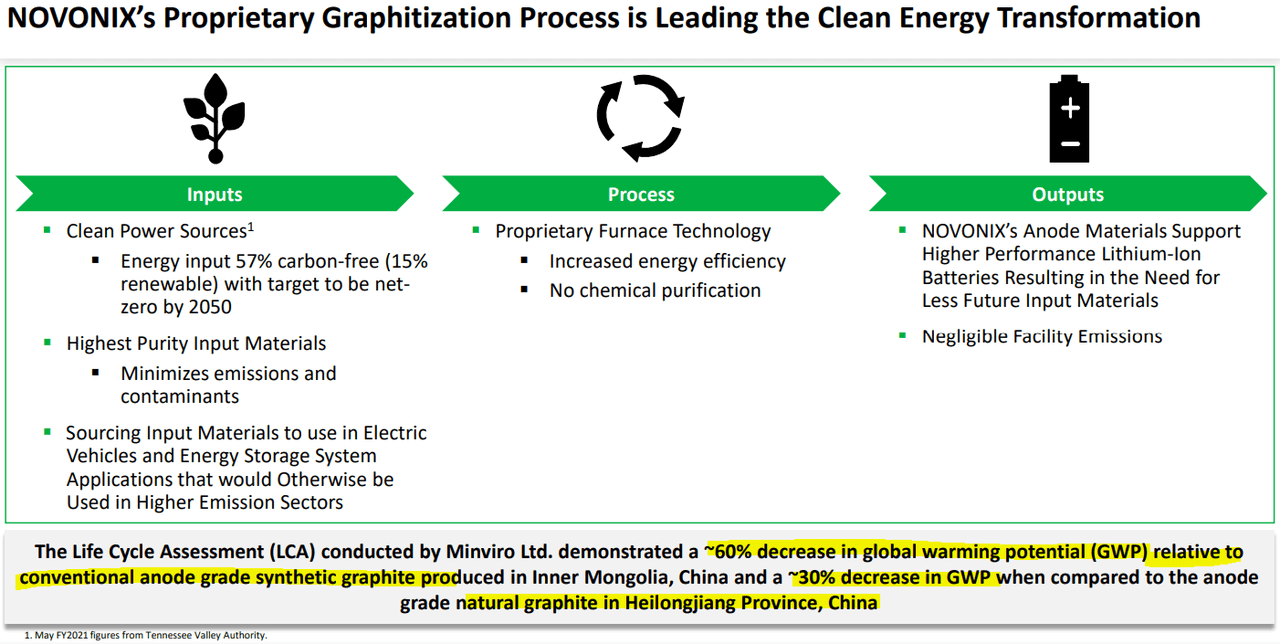

One additional consideration is that current graphite anode technologies are not very sustainable. With a main manufacturer base in China that involves extensive supply chain demand and utilizes brown coal, NVX’s US-based supply and manufacturer base is far less impactful. This includes an approximated 30-60% decrease in global warming potential when compared to legacy products. When considering performance advantages, supply chain and manufacturing costs, and sustainability, it seems that Novonix has the ability to lead the anode materials segment.

NVX Presentation

Teamwork Makes the Dream Work

Novonix offers investors what many other battery firms can’t: strong inter-industry relationships. These relationships have been formed thanks to the BTS segment that provides testing services to the industry. In fact, NVX has worked with a diverse range of industry participants including: 3M (MMM), Honda (HMC), Murata (OTCPK:MRAAY), and more. As a result, NVX knows the issues that need to be addressed, and knows the potential customers who will be able to offload production at a fair price.

NVX Website

At the moment, Novonix is working with three primary manufacturers as the first customers of the anode materials when production commences in 2023: Samsung SDI (OTCPK:SSNLF), Sanyo, and KorePower. These three companies are high-quality battery manufacturers that are already established, reducing risk that one goes under by the time that NVX is ready to ship. The partnerships also highlight the agnostic nature of NVX’s solutions, as each manufacturer is able to serve energy storage, EVs, and other diverse applications, rather than relying on a single industry.

This is similar to the extended relationship that NVX has with the utility Emera in working on energy storage solutions since 2019, although details on the exact financial implications remain limited. However, two major deals of late highlight the significant opportunity that is available when working as teams.

NVX Presentation

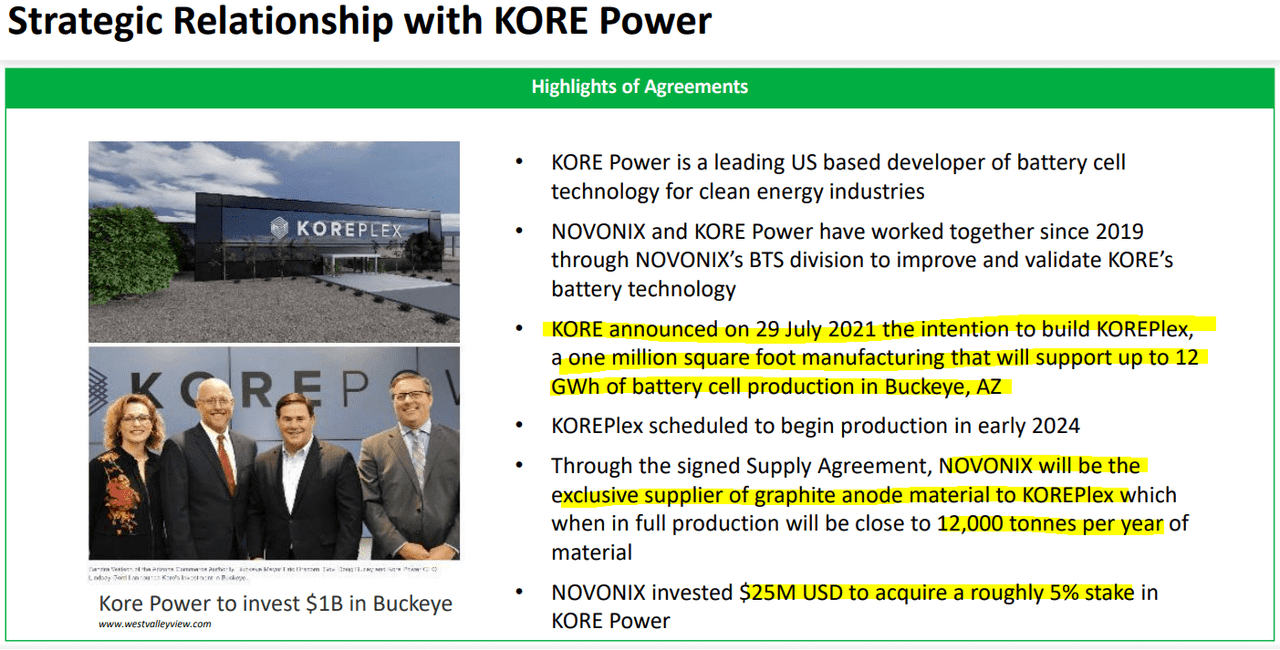

First, we have an update on the partnership with private KORE Power. Beginning with a relationship in battery testing, Novonix is now set to supply over 12,000 tons of graphite material to KORE’s new KOREplex, a 12 GWh manufacturing hub in Arizona. Set to open in 2024, the large facility will be a major player in grid-scale battery storage applications. Along with production offtake, NVX has the further benefit of a recent $25 million investment in the private company (~5% stake) that may end up fruitful as both companies grow.

NVX Presentation

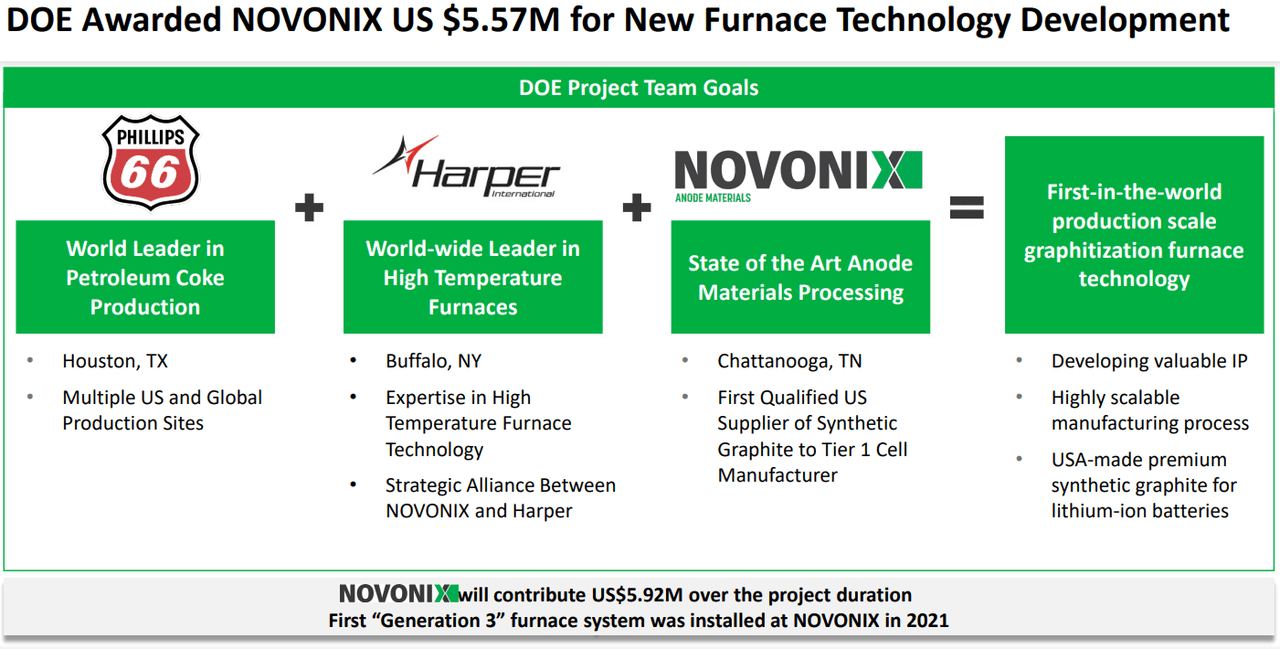

We can also see that Novonix has also worked on developing relationships for their own supply chain. Most importantly, NVX is now partnered with Phillips 66 and Harper International in order to obtain petroleum coke that is necessary for producing the graphite anodes. The partnership also involves $5.6 million in DOE funding in order to drive sales of more sustainable production technologies and to form the first synthetic graphite supply in the US.

‘This strategic investment enables Phillips 66 to directly support the development of the U.S. battery supply chain,’ said Greg Garland, Chairman and CEO of Phillips 66. ‘It advances our commitment to pursue lower-carbon solutions while leveraging our leadership position and expertise in the specialty coke market and supporting NOVONIX’s emerging position in U.S.-based anode production.’

With the deal, Phillips 66 invested over $150 million into NVX and are now major shareholders. With fossil fuel companies attempting to move towards more sustainable endeavors, PSX may be seen as a potential acquirer down the road.

NVX Presentation

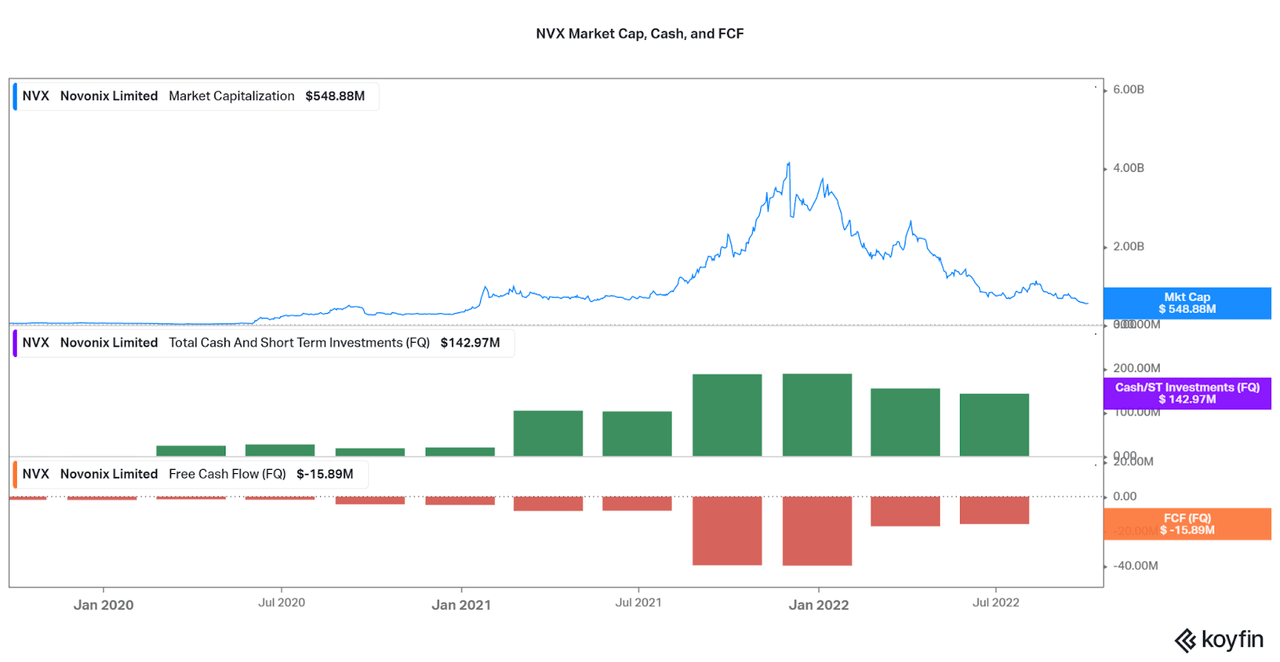

While Novonix seems strong from a qualitative standpoint, it is also important to consider the current finances. Most importantly, cash on hand is over $140 million USD while quarterly losses have seen a maximum of $40 million. However, the high cost acquisitions of land/factories and initial infrastructure is now over, and losses should be less than the recent peaks moving forward.

While not as capitalized as say a Freyr (FREY), the current market cap of only $550-$600 million USD is also far below Freyr’s $1.6 billion valuation. Considering that Freyr’s battery tech provider, 24M, is a customer of Novonix, I would say that NVX offers a more compelling valuation at the moment.

Koyfin

Conclusion

From multiple angles, Novonix looks like a leader in the burgeoning speculative battery tech segment. With a focus on supplying and designing high-quality materials solutions, NVX will also face less risk than consumer facing manufacturers. However, the risk-reward profile is more conservative, so do not expect groundbreaking performance. At the moment, I believe that it will be important to watch for initial production to commence, then assess the rate of growth from there.

If partners Samsung, Sanyo, or KORE Power provide more investment capital, then I would look more favorably on the long-term probability of success for NVX. Even now before production has even begun, NVX offers one of the better investment profiles in the industry. But as always, there is plenty of time to assess the company and watch for issues to arise, but I may soon be slowly establishing a position.

Be the first to comment