JHVEPhoto

Dear Readers/Followers,

We do have slight changes with regard to the thesis for Novo Nordisk (NVO). There is plenty to like about the company as well as what it does, and despite a challenging macro, the company has managed some pretty noteworthy trends for the past 6 months that we’re going to be taking a look at here.

Let’s take a look – and see if I can explain to you why the business is still a “HOLD” for me despite some of these trends.

Revisiting Novo Nordisk

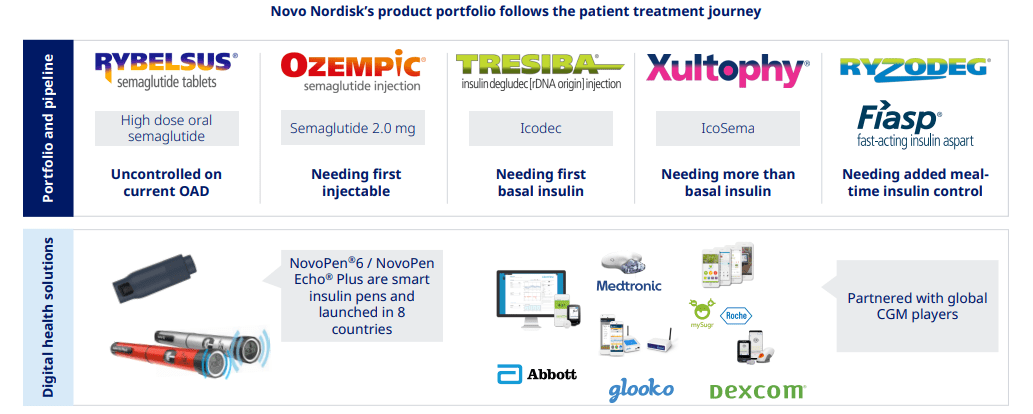

So, positives and good things first. Novo Nordisk remains an absolutely stellar sort of company that, to my mind, should be part of a conservative investor’s portfolio. Novo Nordisk leads diabetes, and diabetes leads sales with 80% of total sales, with adjacent growth areas in things like obesity and growth disorders, which are likely to be future important treatment areas, making them potential blockbusters for the business.

The company also hasn’t changed anything fundamentally – still a superb value and EPS grower over time, and despite market leadership, has averaged nearly double-digit sales growth for the past few years starting in 2011.

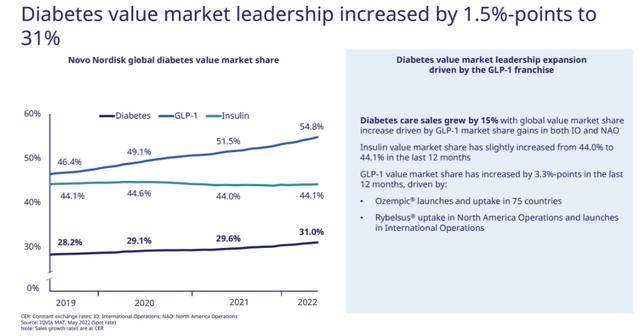

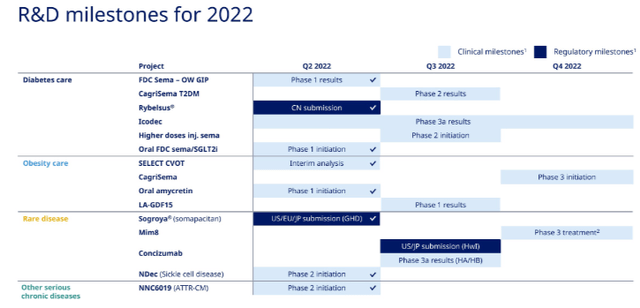

The recent results for 1H22 and 2Q22 more or less confirmed this. The company is further increasing its market leadership in diabetes by 1.5% to a full 31%. Its growth areas are skyrocketing, with Obesity care sales up 84% YoY, to around 7B DKK now. The company is initiating initial treatment phases for oral amycretin and is further strengthening its pipeline.

On a high financial level, growth here is impressive for the company.

NVO IR (NVO IR)

This sales growth isn’t driven only by diabetes, but by almost all operating units that the company has, as well as different geographies. The only geography that saw any sort of decline was China – and that decline was a mere 5%, it also being the smallest sales geography for the company.

We should continue to look at the company’s impressive market leadership – that’s where a lot of the positive is here, with solid top-line growth for diabetes care.

Ozempic is now the leading global brand for global GLP-1, with nearly 40% of all GLP-1 patients using the product. New prescriptions are accelerating, especially in the US, and this contributes to an ongoing GLP-1 class expansion. In short, the company’s diabetes care leadership is currently as I would say, unchallenged.

Moving onto the other area – Obesity. Now, healthcare usually doesn’t treat obesity like something such as diabetes – but it’s still a very interesting field the company is going into here. And results so far have been superb for the company. With 84% top-line sales growth, there isn’t in question that the company’s products are currently in significant demand. The expectations for the once-weekly Wegovy semaglutide injection that’s available in 2.4 and 1.7mg dosages are high – and expectations are to make all varieties of dosages available by the end of 2022. On the international front, Wegovy recently received launch confirmation in France, with the current release expected towards the year-end of 2022.

So, obesity is going well.

The company is also going into rare diseases – but results here were mostly flat. A small sales decline in NA was offset by a small sales growth in the International segment, and some increase in sales for rare blood disorders, offset by drops in endocrine disorders.

So, some slight movements. Novo is still a market leader here – especially in human growth disorders, where it has a market share of 34%, but for the time being, these are slow-moving segments and products. The company continues to push heavily into R&D, with plenty of results and initiations expected for the remainder of the year.

Fundamentals and capital allocation remain attractive here. Novo Nordisk has stellar credit and is rated AA- by S&P Global with similar ratings across the board. Still, the company is not a high sort of dividend payor, coming in at a historical 1-2%, which is below what I am typically looking for when investing in a company such as this. I also believe the shareholder and ownership structure warrants a second mention here, as 28.1% is owned by the Novo Nordisk foundation, which in turn owns voting-class strong sharers that amount to 76.7% of the voting rights, meaning a majority decision-making power in the company. No matter which way you lean here, this company has committed, long-term owners, and you will not be part of the decision-making – neither will anyone else. This is not unique to Scandinavia, but it is fairly unique for a global company of this size.

The future for the company is bound to center around more diabetics, its obesity medication, and the rare diseases it continues to work with. You may think these are somewhat disassociated in their logic – but the fact is, NVO follows a fairly logical chain/journey for the patient, starting with obesity and going into diabetes and associated rare diseases.

NVO IR (NVO IR)

And the company isn’t short in terms of growth vectors. The use of GLP-1 treatments is already increasing on a global level, yet only 6 million are, as of yet, being treated, meaning only 3% of all diabetes scrips use the technology, leaving a huge potential market to address – and NVO, in most geographies, own the leading GLP-1.

China continues to be a massive opportunity, but one I’m more hesitant about than I was 6 months back. As things stand right now, I’d prefer to discount and impair any expectations that center around China, based on the sheer uncertainty in the nation as an investment geography. That includes these sorts of treatments. China is different for NVO than for other companies – because 140 million people in China live with ongoing diabetes, coming to nearly 25% of the worldwide number of patients.

Therefore, NVO cannot afford to ignore China. The ongoing picture that the company wants to give us is that Novo Nordisk is only at the beginning of increasing its sales, thanks to its portfolio of excellent products. There is a lot of truth in this, but also a lot of truth in the fact that competition is increasing.

Still, risks still exist.

Insulin pricing remains under pressure, and this pressure is likely to ratchet up further. the USA is a huge market for Novo, with over 45% of sales. Recent presidential cycles in 2020-2022 have focused on starting to pressure the prices on some of these medications. Despite the companies already offering discounted refills, the pressures in this segment are definitely here to stay. Besides pricing, competition has intensified via Eli Lilly’s (LLY) competition through its GLP-1 candidate Trulicity, which has been in the market since 2014 and is taking market share (primarily new patients) from Novo’s Victoza (2010 US approval). These headwinds and potentials do bear remembering when you go into NVO.

The question isn’t if people need NVO products and medications, or if NVO is an attractive business. They do, and it is. The question is if NVO will be able to meet the demands and adapt to a changing market, as they’ve done before.

For now, I say that they will – though we shouldn’t pay just about any price for the cash flows this company generates, and that’s where we run into trouble.

Novo Nordisk – The valuation

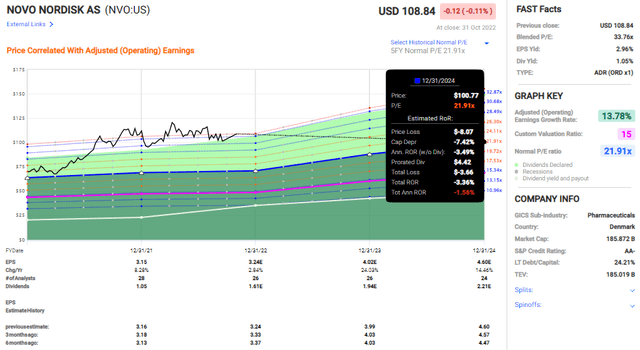

Despite everything and despite the market, Novo Nordisk remains at record-high valuation ranges. Looking at where the company, AA-rated, is trading, I’m continually unwilling to pay this sort of premium for this company.

The current P/E is around 33.7x, which is downright insane, even with a 13.7% annual growth forecast. The 5-year average is no higher than 22x and using this P/E as a forward target, we get a PT of $100/share for the ticker NVO, which at current valuations comes to a total ROR of negative 3.36%, in a rising inflation environment.

This is why, in current circumstances, investing in NVO for me is an absolute no-go.

Allow me to reiterate and update my previous stance on the current circumstances. Even if this company’s average 12-13% currently assumed growth rates do materialize (and I believe closer to 4-7%), there’s no way I’m paying a 32-35X P/E premium for a company like this.

Not even one that’s AA-rated. I continue to forecast NVO at closer to 5-year averages, which come to around 22X P/E. Based on a 22X P/E forward valuation, the company’s potential RoR is actually negative there.

Now, to be fair and give the devil his due, I’m also showcasing analyst forecasts. S&P Global analysts believe NVO to be undervalued here. Taking the native share price of currently 820 DKK per share, this comes to around a 3% undervaluation to the overall analyst target of 851 DKK per share by analysts, meaning that things are actually considered slightly lower here.

However, that 10-12% premium is something these analysts have held for a couple of years at least, and it has never materialized as such for a long time.

Any target above 720 DKK for the native, and above 30x P/E for the NVO ticker assumes a premium for the company that I’m very uncomfortable with – and would not invest in. That’s why I myself sold the company after waiting around for a long time, at close to 800 DKK some time ago. I will continue to wait for the company to drop to a level that I consider more interesting prior to getting “back in”.

Novo Nordisk Is overvalued here.

Therefore, my answer to you is still “HOLD” here.

Thesis

My thesis for Novo Nordisk is as follows:

- Novo Nordisk is a great business that can really be bought into virtually any long-term investor’s portfolio.

- However, the company’s specifics dictate that you should be careful about NVO and when to buy it.

- I believe Novo Nordisk will come down from its lofty heights, and normalize closer to 20-25x P/E, at which point savvy valuation investors, such as myself and yourself, potentially can pick it up if our portfolio allows for it. I see no reason to go in at this time.

- My target for the company is no more than 720 DKK here – so still an overvaluation in the double digits.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment