mantaphoto/iStock via Getty Images

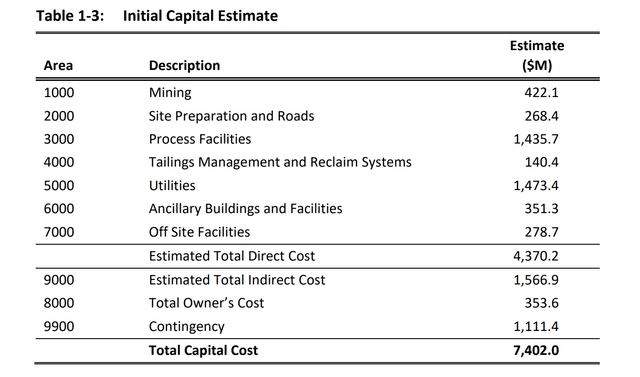

Just over three months ago, I wrote on NovaGold, noting that it made zero sense to chase the stock as it approached technical resistance in the $8.00 – $8.20 region. This is because the stock was extended and was not cheap by any means, trading at more than 1.0x P/NPV (5%) estimates when factoring in only minimal inflationary pressures. Since the article (April 6th), the stock has slid more than 45%, underperforming what’s already been a disappointing 35% decline in the Gold Miners Index (GDX). I believe this decline is mostly justified, especially based on what we’ve seen sector-wide. That said, the valuation is finally becoming more reasonable after this recent haircut. Let’s take a closer look below:

NG Daily Chart – April 2022 (Previous NG Article, Seeking Alpha Premium)

Q2 Results

NovaGold released its Q2 results in late June, reporting that its drill program was ahead of schedule, with 24,000 meters completed of a planned 34,000 meters. The program aims to tighten up drill spacing to inform geologic modeling for a new Feasibility Study (subject to board approval) and in-pit/ex-pit exploration. Notably, this was the largest drill program in 10 years for the mammoth-sized Alaskan project shared with Barrick (GOLD). This isn’t at all that surprising following the phenomenal intercepts reported last year, which included the following highlight hits:

- 92.0 meters at 7.8 grams per tonne gold

- 41.0 meters at 10.5 grams per tonne gold

- 47.8 meters at 9.0 grams per tonne gold

- 57.3 meters at 6.9 grams per tonne gold

- 24.4 meters at 14.7 grams per tonne gold

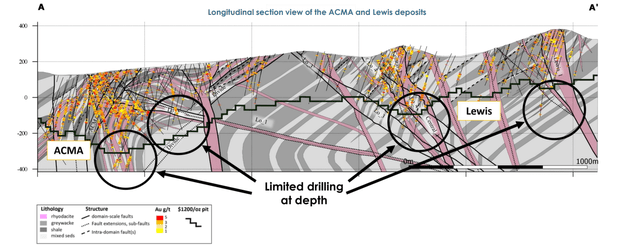

2022 Drill Program – ACMA/Lewis Deposits (Company Presentation)

As it stands, there remains considerable upside below the Lewis and ACMA pits, potentially pushing the reserve closer to 40 million ounces of gold (100% basis) from ~33.8 million ounces currently. This is in addition to the significant upside from a near-deposit standpoint, with ACMA and Lewis representing only 3 kilometers of an 8-kilometer mineralized belt. Importantly, this area of focus where there are multiple targets (Ophir, Dome, Quartz, Snow, Queen, Far Side) ignores the remaining 90% of the land package. Hence, this project could ultimately host 45+ million ounces of gold reserves (~22.5 million attributable to NovaGold) with the addition of another near-deposit or regional discovery.

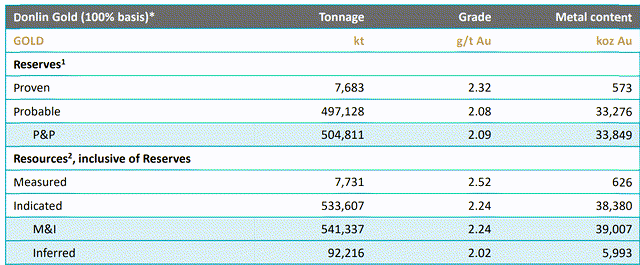

Donlin Project Reserves (Company Presentation)

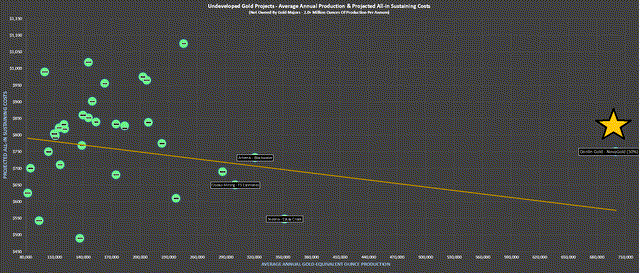

Given the Donlin Project’s size and grades, it’s no surprise that it has industry-leading project economics, with it expected to produce ~1.4 million ounces of gold per annum at costs below $650/oz (first ten years). This incredible future potential for NovaGold (50% owner) explains the allure of the stock, with this sub-$2.0 billion company having the possibility to have an attributable production profile similar to that of Detour Lake, which boasts this production profile on a 100% basis. That said, the one drawback of the project is that it’s remote, 450 kilometers west of Anchorage and 250 kilometers east of Bethel. The result is no rail or road access with personnel and supplies transported by air.

Undeveloped Gold Projects – Projected Production Profile & All-in Sustaining Costs (Company Filings, Author’s Chart)

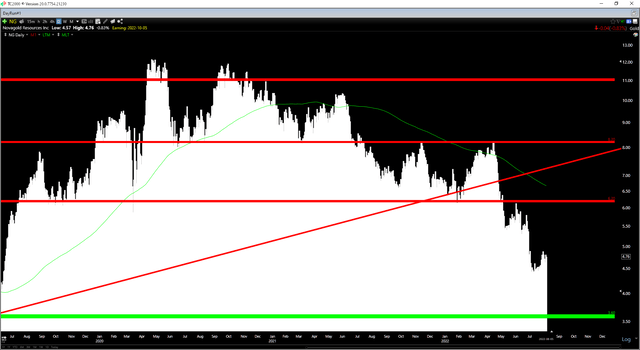

Capex & Recent Developments

Given the project’s remote location (500-kilometer natural gas pipeline with a 14-inch diameter needed for power) and its scale (a planned throughout rate of ~53,000 tonnes per day), building Donlin won’t be cheap. In fact, upfront capex was estimated at $7.4 billion in the most recent Technical Report completed in 2021. However, those who dig through this report will see that the capital cost estimate was based on updated Q1 2020 pricing applied to engineering designs and material take-offs from the previous 2011 study. This means the study included limited adjustments for inflationary pressures (H2 2020-H2 2022).

Investors following the sector closely will know that Argonaut (OTCPK:ARNGF) has seen a 60% plus capex blowout at Magino, and IAMGOLD (IAG) has seen capex more than double from initial estimates at Cote, initially estimated at just $1.15 billion. These are two extreme examples (exacerbated by recent strikes), and I would not expect a capex blowout of this magnitude at Donlin (assuming a positive construction decision), which has a relatively large contingency of $1.11 billion. In addition, these two companies have consistently overpromised and underdelivered to the point that their initial estimates should not have been trusted.

Donlin Project Capital Costs (Company Report)

In the case of Donlin, Barrick Gold would be primarily in charge of construction and has considerable experience selecting contractors and a phenomenal CEO at its helm known for delivering on promises. That said, even the better companies in the sector are seeing cost creep from 2020/2021 budgets, such as Newmont (NEM) at Tanami and Ahafo North. Hence, even if we give Donlin the benefit of the doubt and assume no capex blowout, it would be irresponsible not to model a minimum 20% increase to capex to be on the safe side. This would push upfront capital to ~$8.8 billion if done today, reflecting Q3 2022 pricing.

Some investors will argue that the upside for this project from an exploration standpoint is so tremendous it cannot be quantified and that at $2,500/oz gold and with new discoveries, the After-Tax NPV (5%) would climb to $11.0 billion. While the latter point is possible, I don’t see any value in making assumptions based on prices 45% above spot prices, and I think it’s best to err on the side of caution, given how erratic the gold price can be. From an exploration standpoint, the mine life is so long already (25 years) that while new ounces could be added, their value is limited.

The exception is if the mine plan was adjusted to bring new ounces forward in the mine plan. However, this would only make sense if they were significantly above the reserve grade. For this reason, while the recent drill results help, as would new near-deposit discoveries, new ounces won’t move the needle like the will for a project like Skeena (SKE) which has a 10-year mine life. This is especially true with commercial production at Donlin unlikely before Q4 2028 earliest.

So, what does this mean for project economics?

In addition to what I believe will be a sharp increase in upfront capital to at least $8.8 billion, we could see cost creep from an operating cost standpoint when factoring in increased labor, consumables, and possibly fuel costs. So, even if we use a higher gold price assumption of $1,800/oz over the mine life, the After-Tax NPV (5%) on a 100% basis is likely to come in below $4.5 billion. This is still a solid project, and ultimately it could produce into the late 2060s with Barrick leading exploration and making additional discoveries. That said, the estimated After-Tax NPV (5%) to Initial Capex ratio of ~0.50 leaves much to be desired.

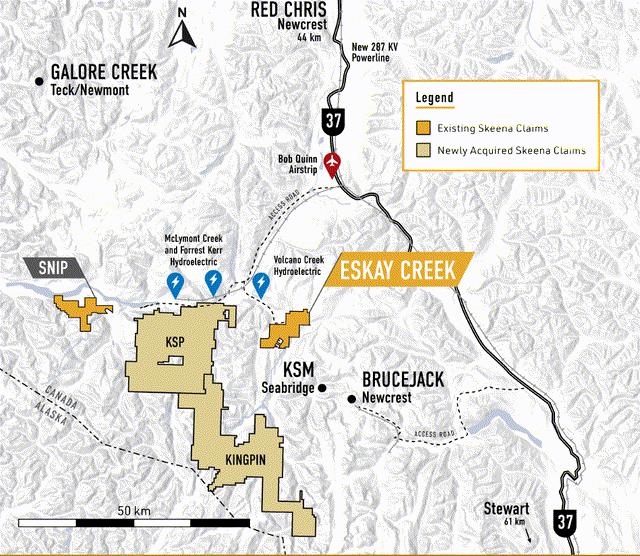

To compare this figure, I have estimated an After-Tax NPV (5%) of better than 2.06 to 1.0 for Eskay Creek, and this factors in a $1,625/oz gold price and $22.00/oz silver price, well below the assumptions for Donlin ($1,800/oz gold). These figures are based on an estimated upfront capex of $470 million and an After-Tax NPV (5%) of $970 million. They do not include low-hanging fruit (recent discoveries) that could easily boost the project’s NPV (5%). The reason for Skeena’s superior economics is that Eskay Creek is a brownfields project (past producer), benefits from existing infrastructure, and has much higher grades than Donlin (4.0+ grams per tonne gold-equivalent).

Skeena – Project, Claims & Infrastructure (Skeena Company Presentation)

I believe this makes Skeena a more likely takeover target than NovaGold (in terms of Barrick acquiring the other 50% or a major coming in for the other half of Donlin). It also makes Skeena a more attractive investment, given that Skeena has multiple avenues to enjoy share price appreciation. These include:

- a takeover offer at a large premium

- improving sentiment in the sector

- funding the project with debt/minimal equity and going into production on its own by 2026

In NovaGold’s case, I see a takeover offer at a large premium as unlikely, and the company has no hope of funding the project on its own without considerable share dilution. This is because the upfront capex for its attributable portion is likely to be roughly triple its current market cap. Finally, and most importantly, NovaGold does not control its own destiny. The reason is that if Barrick decides it wants to wait and see on the project or work on continued optimizations, we may not see the first production from Donlin. Simultaneously, Skeena will have generated cumulative after-tax free cash flow of $1.0 billion if it can take the project into production independently.

But what about NovaGold’s valuation? With ~16.9 million attributable gold reserves in a Tier-1 jurisdiction, isn’t it time to consider owning the stock? Let’s take a look at the valuation below:

Valuation

Based on ~344 million fully-diluted shares and a share price of US$4.76, NovaGold trades at a market cap of ~$1.64 billion. This is a very cheap valuation from an attributable reserve standpoint (~$96.00/oz). The problem was that the stock was not attractive from a P/NPV (5%) standpoint, which is why I noted that there was no need to chase the stock close to $8.00 per share in Q1. In fact, even at a $1,800/oz gold price assumption, NovaGold traded at more than attributable 1.0x P/NPV (5%) after adjusting for minimal inflationary pressures on capex (~$2.75 billion market cap vs. ~$2.70 billion attributable NPV estimate).

Since then, inflationary pressures haven’t cooled, and even some of the largest producers have had difficulty containing costs on development projects. After using more conservative estimates for capex and operating costs, I believe Donlin’s After-Tax NPV (5%) would come in below $4.5 billion (100% basis) if Donlin Gold completed a Feasibility Study [FS] today using Q3 2022 pricing. This translates to an attributable NPV (5%) of $2.25 billion for NovaGold based on its 50% interest. If we compare this to a market cap of ~$1.64 billion, this would leave NovaGold trading at less than 0.73x P/NPV (5%).

In my view, this is a very reasonable valuation, and if Donlin were green-lighted, in construction, and financed today, NovaGold could easily command a P/NAV multiple of 1.1. This is because Donlin is a world-class project in a Tier-1 jurisdiction, and most of the risk would be out of the story. That said, this is not green-lighted; it needs an updated FS, and we need to hope that inflationary pressures don’t worsen, which could further impact the project’s internal rate of return. Given this added risk, I think a more reasonable P/NPV multiple is 0.85x. After multiplying this by an estimated attributable NPV (5%) of $2.25 billion and adding $150 million in attributable exploration upside, NovaGold’s fair value comes in at ~$2.06 billion ($5.99 per share).

While this points to a 24% upside to fair value, I prefer to buy at a minimum discount of 40% to fair value for small-cap names. This is especially true if they are not currently generating free cash flow. So, for NovaGold to become interesting from a valuation standpoint, it would need to dip below $3.90 per share. This doesn’t mean the stock can’t go lower, and my opinion is irrelevant. Still, with several deals elsewhere in the sector and multiple companies returning considerable capital to shareholders, I don’t see much value in owning NovaGold other than for a short-term trade if it becomes oversold.

Technical Picture

Moving to the technical picture, NG has broken below critical support at $6.50 and now has a new resistance zone at $6.20. This is not ideal, and it’s likely to be a short-term ceiling for the stock on any sharp rallies, given that investors accumulating off this support zone might be anxious to exit at break-even if given the opportunity. Meanwhile, with support coming out from under the stock, the next strong support level doesn’t arrive until US$3.60. Based on a current share price of US$4.76, this translates to a balanced reward/risk ratio of 1.24 to 1.0, well below the 5.0 to 1.0 I am looking for to enter new positions.

Summary

For investors that want a piece of arguably the most impressive gold project globally at a small-cap valuation, it is understandable that they have gravitated towards NovaGold. However, several developments have made this investment thesis less attractive. For starters, many producers are now trading at a similar P/NAV multiple to NovaGold, and they control their own destiny and regularly return capital to shareholders. Second, inflationary pressures are worse/stickier than expected, likely impacting Donlin’s economics. Third, small-cap developers have been pummeled, placing them at a huge discount to NovaGold on a P/NAV basis.

Donlin Project – Alaska (Company Presentation)

Based on these developments, NovaGold has become much less attractive from a relative value standpoint despite its decline, and it’s also become harder to own, with it being even less clear whether this project gets green-lighted before 2025. In my view, this offers three options:

1. Own Barrick Gold at a similar P/NAV multiple for the exposure to Donlin with a 4.0% dividend yield and additional capital being returned through share buybacks

2. Own more attractive developers like Skeena Resources at less than 0.50x P/NAV with less capital-intensive projects that do control their own destiny and are more likely takeover targets

3. Wait for lower prices for NovaGold, where the stock would become oversold and offer a larger margin of safety at US$3.90 or lower

In summary, I see far more attractive ways to play the sector, but for an investor that can’t sleep at night without knowing they have exposure to this project, Barrick is the far more attractive way to secure this exposure. This is especially true given that between now and when this project goes into production (6+ years), it will have paid out over 30% in capital returns from its 4.0% dividend yield and buybacks.

Be the first to comment