ArtistGNDphotography

NorthWestern Corporation (NASDAQ:NWE) is an electric and natural gas utility that services customers in Montana, South Dakota, Nebraska, and Yellowstone National Park. Admittedly, this is not a region that will immediately come to the minds of most investors when they are looking for a utility investment because it is one of the most rural areas of the country. The company still has many of the characteristics that have long made utilities a favorite holding among conservative investors, however.

The most important of these are that the company has remarkably stable cash flows that are independent of conditions in the broader economy and a very high dividend yield. NorthWestern Corporation boasts a 4.41% yield at the current market price, which is not only well above the broader market but the utility sector in general. This will almost certainly attract income seekers, but unfortunately, NorthWestern Corporation is incredibly expensive at the current stock price, so it might pay to be cautious before making an investment in the company.

About NorthWestern Corporation

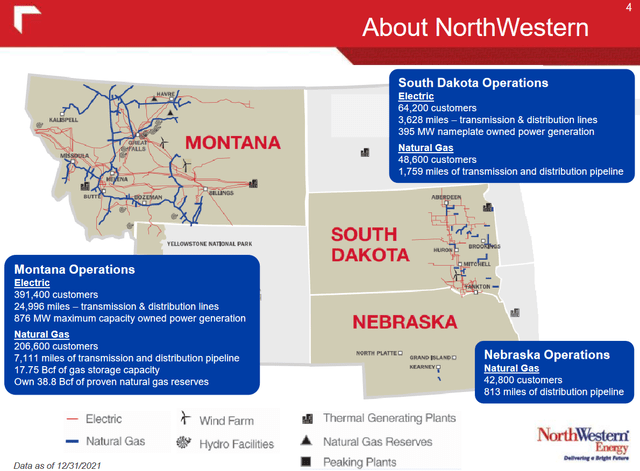

As stated in the introduction, NorthWestern Corporation is an electric and natural gas utility that operates in Montana, South Dakota, Nebraska, and Yellowstone National Park:

NorthWestern Corporation Investor Presentation

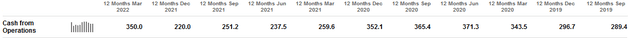

As we can clearly see, this is one of the most rural regions of the United States as the company’s operations cover most of Montana, but it only has 391,400 electric and 206,600 natural gas customers in the state. Likewise, the company only has 64,200 electric and 48,600 customers in South Dakota despite covering much of the eastern part of the state. This relatively small customer base does not stop the company from possessing the characteristics of utility companies that many investors appreciate, however. The most important of these is financial stability, which we can verify by looking at the company’s operating cash flows. This chart shows the company’s trailing twelve-month operating cash flows over time:

(all figures in millions of U.S. dollars)

The reason for this general stability should be fairly obvious. After all, NorthWestern Corporation provides a product that is generally considered to be a necessity for our modern way of life. As such, most of its customers will prioritize paying their utility bills ahead of other more discretionary expenses during times when money gets tight. This works well to protect the company against the financial impact of recessions. This may be important today since the Atlanta Federal Reserve is currently predicting that the national gross domestic product declined by 1.2% in the second quarter, which would mean that the country is officially in a recession. Investors in NorthWestern Corporation do not have to worry about this however since the company will keep on generating cash flow and paying its dividend.

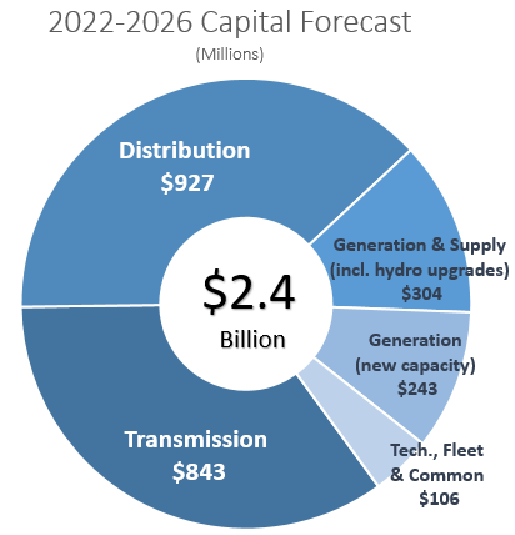

As investors, we are not satisfied with mere stability, however, as we want to see growth. Fortunately, NorthWestern Corporation is positioned to deliver that. One way in which it will accomplish this is by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow the company to earn a specified rate of return. As this rate of return is a percentage, any increase in the company’s rate base allows it to increase the price that it charges its customers in order to earn that specified return. The usual way that a company increases the size of its rate base is by investing money into modernizing, upgrading, or possibly even expanding its infrastructure. NorthWestern Corporation is planning on doing exactly this. The company is planning on investing approximately $2.4 billion into this task over the 2022 to 2026 period:

NorthWestern Corporation Investor Presentation

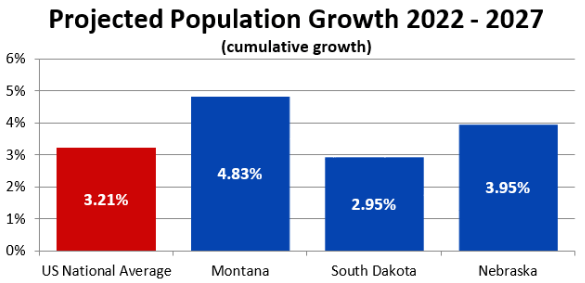

This capital investment program can be expected to grow NorthWestern Corporation’s rate base at a 4% to 5% compound annual growth rate over the period. This is not the only thing that will work to grow NorthWestern Corporation’s earnings in the period, though. It may be somewhat surprising to learn that the company’s service area is one of the more rapidly growing regions of the country. This is particularly true in Montana, which is where more than 80% of the company’s profits are sourced. This state is expected to see its population increase by 4.83% over the 2022 to 2027 period, which is quite a bit above the 3.21% population increase projected for the United States:

NorthWestern Corporation Investor Relations

This is actually quite nice since population growth in its service area is the only realistic way for the company to increase the number of customers that it has paying for its services. After all, NorthWestern Corporation is confined to a single geographic area and cannot really expand to other areas. It is not like we all have wires from multiple electric companies running to our homes, of course, The company’s ability to increase its prices also is somewhat limited because regulators only allow the company to earn a certain percentage of its rate base. Thus, it is much more dependent on population growth in its service area than many other firms would be.

Overall, the company expects the population growth and the rate base growth to allow it to increase its earnings per share at a 3% to 6% compound annual growth rate over the 2022 to 2026 period. When we combine this with the stock’s 4.41% current yield, investors can expect to earn a 7.5% to 10.5% annual total return over the period, which is certainly not unattractive for a conservative utility company. The low end of this range is a bit less than what some of the company’s peers will likely deliver, however.

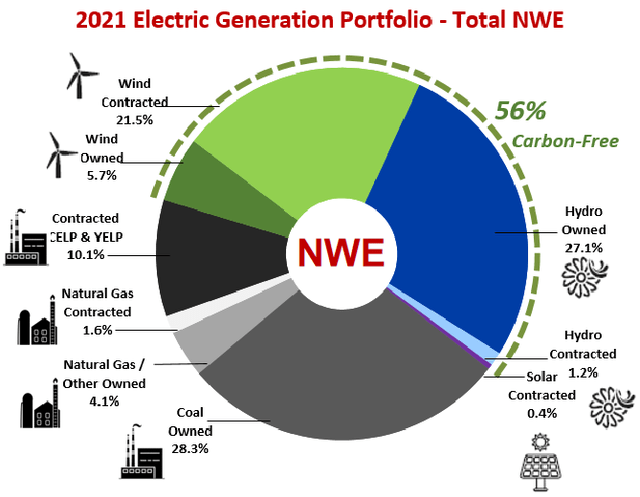

Over the past several years, we have seen a growing level of demand from both consumers and investors for the companies that they do business with to have sustainable operations. In the case of a utility like NorthWestern Corporation, this means replacing fossil fuel-driven power plants with renewable ones. NorthWestern Corporation has a bit less work to do than many of its peers in this area because the geography of its service area lends itself quite well to the generation of “clean” energy, especially hydroelectric power. NorthWestern Corporation currently derives 56% of its electric generation from carbon-free sources, which is quite a bit higher than the 40% national average among all utilities:

NorthWestern Corporation Investor Presentation

NorthWestern Corporation is certainly not resting on its laurels with the status quo here, however. In fact, the company has the ambition of achieving fully net-zero carbon emissions across its entire business by 2050. One of the ways that the company is doing this is replacing some of its remaining fossil fuel-driven power plants, especially the coal-powered ones, with renewable sources of energy like wind and solar. Unfortunately, one of the biggest problems with wind and solar power is that they are unreliable. After all, solar panels do not produce electricity when the sun is not shining and wind turbines do not work when the air is still (or ironically when it is blowing too quickly).

NorthWestern Corporation is embarking on a project that is intended to correct this problem. This project is the Yellowstone County Generating Station. This is a natural gas-fired power plant that is capable of generating approximately 175 megawatts of power. NorthWestern Corporation will not be running the plant continually, though. Rather, the plan is to fire up each of the separate turbines contained in the plant on an as-needed basis in order to ensure that the grid remains reliable and able to support the needs of its customers when the company’s renewables alone are not able to accomplish this. The use of natural gas turbines to support renewable energy generation is a very common strategy being used in the industry, as I have pointed out in many previous articles. It seems likely that the company will be deploying more plants like this after the current 2026 planning horizon as it seeks to achieve its net-zero carbon emission goals but it has not revealed any plans to do this yet.

Fundamentals Of Electricity And Natural Gas

The utility sector in general has long been a favorite of conservative investors such as retirees, but lately it has been attracting attention from young investors that would normally not be interested in such a low-growth sector. This is especially true of electric utilities, but notably not natural gas ones, which may be one reason why electric utilities tend to trade at significantly higher valuations.

The reason for the interest among this group is the widely-promoted trend toward electrification, which has been frequently discussed by politicians and media personalities. At its core, electrification refers to the conversion of things that are historically powered by fossil fuels to the use of electricity instead. The most commonly cited things to be converted are transportation (electric vehicles) and space heating, but there are other things that could be converted as well. As space heating is the primary use of natural gas supplied by utilities, we can quickly see why such a conversion would significantly increase the consumption of electricity in favor of natural gas.

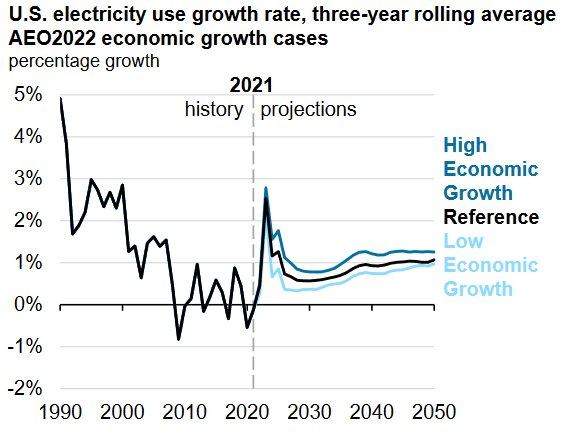

Unfortunately for the proponents of electrification, the United States Energy Information Administration (“EIA”) does not believe that the electrification trend will play out anywhere near as strongly as many believe. According to the agency, the national consumption of electricity will only increase at a 1% to 2% rate over the next thirty years:

EIA 2022 Annual Energy Outlook

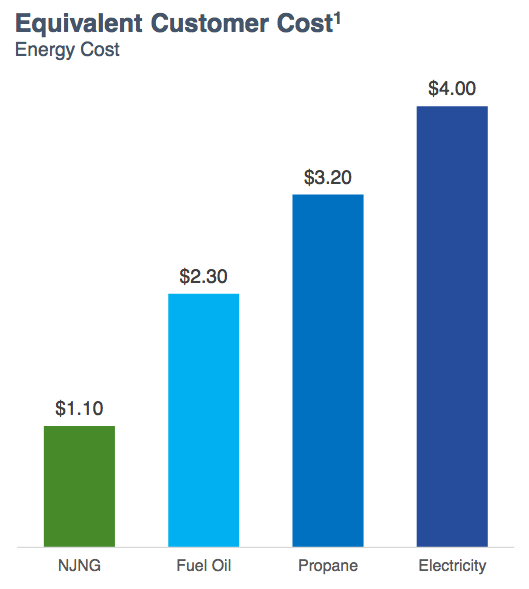

This is nowhere close to the growth rate that we would expect were wide swathes of the American economy to convert from fossil fuels to electricity. Indeed, I detailed the impact on consumption that electric vehicles alone would have in a previous article. The agency is most likely correct that the electrification movement will take longer than many people expect. One of the major reasons for this is basic economics. For starters, electricity is considerably less efficient at generating heat than fossil fuels so it is much more expensive to use for space heating purposes. According to the Energy Information Administration, it can cost nearly four times as much to heat a home with electricity as with natural gas:

New Jersey Resources/Data from EIA

It is highly unlikely that very many people will be willing to have their heating bills increase to this degree simply to reduce their consumption of natural gas. This is particularly true for people of limited means. Thus, it seems very unlikely that natural gas will be displaced by electricity anytime soon, which greatly weakens the investment thesis of those people that have been buying electric utilities in order to get access to the outsized profits that electrification would bring to these companies. However, it also means that NorthWestern Corporation’s natural gas utility business is in no particular danger in the near future. Overall, the company should continue to grow its earnings at a slow and steady rate going forward, just as we discussed in this article.

Financial Considerations

It is always important to look at the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As this is typically accomplished by issuing new debt to pay off the maturing debt, this can cause the company’s interest costs to increase following the rollover, depending on broader market conditions. This is a concern that may be particularly relevant today given the rising interest rate environment.

In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, any decline in cash flows may push the company into financial distress if it has too much debt. Although utilities like NorthWestern Corporation tend to enjoy remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector.

One metric that we can use to analyze a company’s debt load is the net debt-to-equity ratio. This ratio tells us the degree to which the company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2022 (the most recent date for which data is currently available), NorthWestern Corporation had a net debt of $2.5093 billion compared to $2.367 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.06. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity |

| NorthWestern Corporation | 1.06 |

| DTE Energy (DTE) | 2.08 |

| Eversource Energy (ES) | 1.39 |

| Exelon Corporation (EXC) | 1.57 |

| CMS Energy (CMS) | 1.62 |

| FirstEnergy Corporation (FE) | 2.61 |

As we can clearly see, NorthWestern Corporation has a much lower leverage ratio than that of its peers. This is a positive sign that should be somewhat comforting to more risk-averse investors. This is because this is a clear indication that the company is not using too much debt with regard to its financial structure. Thus, investors should not have to worry too much about the risks with the company’s leverage.

Dividend Analysis

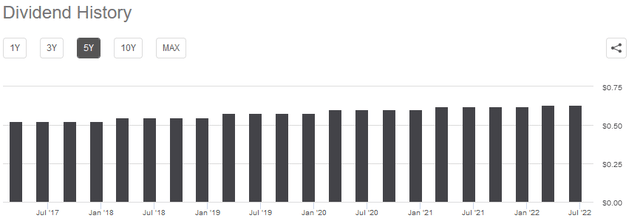

One of the reasons why many investors purchase shares of utility companies like NorthWestern Corporation is because of the high yields that they pay out. This company is certainly no exception to this as it yields 4.41% at the current price, which is significantly above the 1.53% yield of the S&P 500 index (SPY). It is also well above the 2.27% yield of the utility index (IDU), which only adds to its appeal. In addition to all of this, NorthWestern Corporation also has a history of raising its dividend on an annual basis:

The company’s track record of steady dividend growth is particularly attractive during inflationary times, such as the one that we are currently encountering in the United States. This is because inflation is steadily reducing the number of goods and services that we can buy with the dividend. This is something that anyone that has been to a grocery store recently has seen firsthand. The fact that the company pays us more money each and every year helps to offset this effect and assists us in maintaining our standard of living. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want to be the victims of a dividend cut since that would both slash our incomes and most likely cause the stock price to decline.

The usual way that we analyze a company’s ability to afford its dividend is by looking at its free cash flow. A company’s free cash flow is the money that is generated by its ordinary operations and is left over after the company pays all its bills and makes all necessary capital expenditures. This is therefore the money that can be used for things such as reducing debt, buying back stock, or issuing a dividend.

During the first quarter of 2022, NorthWestern Corporation had a levered free cash flow of $52.9 million but it only paid out $33.9 million in dividends. This is a positive sign, but it is important to remember that the first quarter of the year is typically the best for this company. This is because of its natural gas operations, which tend to be much more seasonal than its electric utility operations. Thus, it may make sense to look at the company’s trailing twelve-month cash flows instead. In the twelve-month period ended March 31, 2022, NorthWestern Corporation reported a negative levered free cash flow of $175.7 million. This is unfortunately not enough to pay any dividend, but the company still paid out $131.3 million over the period.

It is, however, not uncommon for utilities to finance their capital expenditures by issuing both equity and debt while paying their dividends out of operating cash flow. This is mostly due to the incredibly high costs involved in constructing and maintaining utility-grade infrastructure over a wide geographic area. In the trailing twelve-month period, NorthWestern Corporation reported an operating cash flow of $350.0 million, which was more than enough to cover the $131.3 million that the firm paid out in dividends with quite a bit of money left over to use for other purposes. Overall, it appears that the company is generating sufficient cash flow to cover the dividend so the company’s current dividend is likely safe.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a utility like NorthWestern Corporation, one metric that we can use to value it is the price-to-earnings growth ratio. This ratio is a modified form of the familiar price-to-earnings ratio that takes the company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its earnings growth and vice versa. However, few companies have a ratio that low in today’s overheated market. This is particularly true in the slow-growth utility sector. Thus, it makes sense to compare the company’s ratio with that of its peers to see which offers the most attractive relative valuation.

According to Zacks Investment Research, NorthWestern Corporation will grow its earnings per share at a 2.27% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 7.37 at the current price, which certainly looks fairly expensive. Let us see how this compares to some of the company’s peers:

| Company | PEG Ratio |

| NorthWestern Corporation | 7.37 |

| DTE Energy | 3.37 |

| Eversource Energy | 3.23 |

| Exelon Corporation | 3.06 |

| CMS Energy | 2.73 |

| FirstEnergy Corporation |

2.47 |

As we can see here, NorthWestern Corporation appears to be incredibly expensive relative to its peers. This is quite disappointing as there is certainly a great deal to like about this company. Unfortunately, though, that high price does likely mean that the returns here could be somewhat worse than we hoped for, although the high dividend yield offsets it a bit. Overall, I would recommend waiting for the price to come down a bit before buying in to improve your total return here.

Conclusion

In conclusion, NorthWestern Corporation has a lot to like for a utility that is far from a familiar urban or suburban name. The company operates in one of the fastest growing areas of the country and it is expanding its infrastructure to adapt to this, which could position it well for growth. It also has a very strong focus on renewables, which have proven to be a popular investment theme in recent years. When we combine this with its rock-solid balance sheet and high dividend yield, there appears to be a lot for an investor to like.

Unfortunately, an investor has to pay through the nose for all these good things, as the stock looks tremendously expensive at its current level. This could very well be a stock to keep on your radar, but it makes sense to wait for the price to come down before actually buying in.

Be the first to comment