Bill Oxford/E+ via Getty Images

On Tuesday, November 8, 2022, natural gas utility Northwest Natural Holding Company (NYSE:NWN) announced its third quarter 2022 earnings results. The initial headline numbers here were quite attractive, as the company beat the expectations of its analysts in terms of revenue and earnings.

Unfortunately, though, the company still posted a net loss, which is not uncommon for the third quarter. Natural gas utilities tend to be a bit less steady in their earnings and cash flow than electric utilities due to the fact that natural gas is much more heavily used during the colder months of the year than it is during the warm months that dominate the third quarter. It still has many of the characteristics that we tend to appreciate about utilities when looking at the full-year numbers though, such as stable cash flows.

The company also boasts a reasonably attractive 4.12% dividend yield, although the company does not have the same track record of dividend growth as some of its peers. The company is also a bit pricy at the current level, too, so it admittedly may not be the first choice of investors. There are certainly a few things to like in these results, though, and despite the generally negative portrayal in the media, natural gas utilities are not going to be obsolete anytime soon. Therefore, let us look at the company’s results and determine the best way to approach it as an investment.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Northwest Natural Holding’s third quarter 2022 earnings results:

- Northwest Natural Holding brought in total revenues of $116.8 million in the third quarter of 2022. This represents a 15.19% increase over the $101.4 million that the company brought in during the prior-year quarter.

- The company reported an operating loss of $10.8 million in the most recent quarter. This compares quite favorably to the $17.7 million operating loss that the company reported in the year-ago quarter.

- Northwest Natural Holding added approximately 8,800 new natural gas customers in the trailing twelve-month period, which works out to a 1.1% growth rate.

- The company increased its dividend slightly to $0.485 per share quarterly ($1.94 per share annually).

- Northwest Natural Holding reported a net loss of $19.6 million in the third quarter of 2022. This compares rather favorably to the $20.7 million net loss that the company reported in the third quarter of 2021.

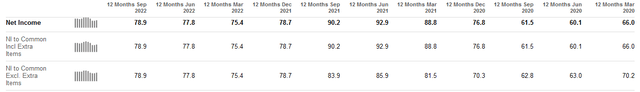

Utilities such as Northwest Natural Holding have long been popular investments among conservative investors for their stability regardless of economic conditions. The fact that Northwest Natural Holding reported both operating and net losses during the most recent quarter are thus likely to discourage some people from investing in it. However, this sort of performance is not unusual for this company. In fact, it nearly always reports losses during the third quarter of the year. This is because natural gas is primarily used as a heating fuel for both residences and businesses and there is much less need to run a natural gas-fired furnace during the summer months that comprise the third quarter of the year. This is why for these companies it is important to look at the trailing twelve-month periods.

As we can see here, Northwest Natural Holding has always reported net profits during any given twelve-month period:

This occurs regardless of whether we have a strong or weak economy. This is clearly evident from the chart above, as even periods that included the COVID-19 lockdowns and the brief recession that accompanied it were not sufficient to swing the company into a full-year loss. This is mostly because most people consider natural gas service to their homes to be a necessity if they use natural gas heat. The government tends to support this idea as people with strained incomes are generally able to get government assistance for heating bills and natural gas utilities are generally forbidden from shutting off service to homes during the coldest months of the year. As heating and by extension natural gas service is a necessity, most people will do everything in their power to ensure that their bill gets paid, even if it means sacrificing discretionary spending. This tends to result in generally stable finances for utility companies since they know roughly how much money they’ll bring in during a given period. This is something that could prove to be quite valuable considering the numerous signs that the United States will soon be entering a recession if it is not already in one.

Naturally, as investors, we need to see more than simple stability. We also want to see growth. Fortunately, Northwest Natural Holding is positioned to deliver that. As noted in the highlights, over the past twelve months the company has increased its customer count by 8,800. This is nice because this is one of the only two ways that a utility can generate growth. It is also not entirely within the utility’s control. After all, most utilities are regional monopolies that are generally confined to operating within a certain area. Thus, their ability to grow by adding new customers is limited to the population growth of a company’s service area. This is not as big of a problem for a natural gas utility as for an electric one since many people do not have natural gas service in their homes so if they can convince people within their general area to switch from oil or propane to natural gas heat then it is a win for them. However, it does not usually make financial sense to run a gas line to service one house so usually all the houses on a street or in a housing development need to be converted. Still, the fact that natural gas service is not nearly as universal as electric service is still an advantage that natural gas utilities have over electric ones when it comes to growth.

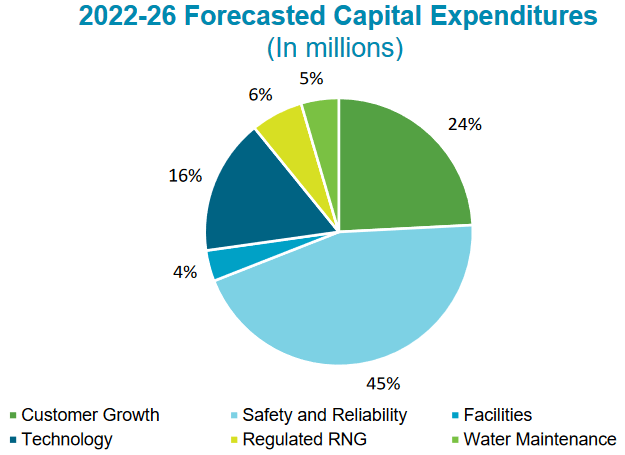

The other way that Northwest Natural Holding can generate growth is by increasing its rate base. The rate base is the value of the company’s assets upon which regulators allow the company to earn a specified rate of return (in Northwest Natural Holding’s case it is 6.9% to 9.5% depending on the state). As the allowed rate of return is a percentage, any increase in the rate base allows the company to increase the price that it charges customers in order to earn that rate of return. The usual way that a company increases the size of its rate base is by spending money on upgrading, modernizing, and possibly even expanding its utility-grade infrastructure. Northwest Natural Holding is in the process of doing exactly this. Over the 2022 to 2026 period, Northwest Natural Holding is planning to invest $1.3 billion and $1.5 billion into its infrastructure:

Northwest Natural Holdings

This should grow the company’s rate base at approximately a 6% compound annual growth rate over the period. This does not mean that the company’s earnings per share will grow at the same rate. One reason for this is that the company may have to issue new common stock to finance its growth plan, which partially offsets the impact of the rate base. In addition, regulators may not allow all the rate hikes that the company would otherwise need to impose to maintain its rate of return on the rate base. However, the company is still projecting a 4% to 6% earnings per share growth rate over the period. When we combine this with the company’s current 4.12% dividend yield, we get an 8% to 10% projected total return over the five-year period, which is certainly not bad for a sleepy utility company.

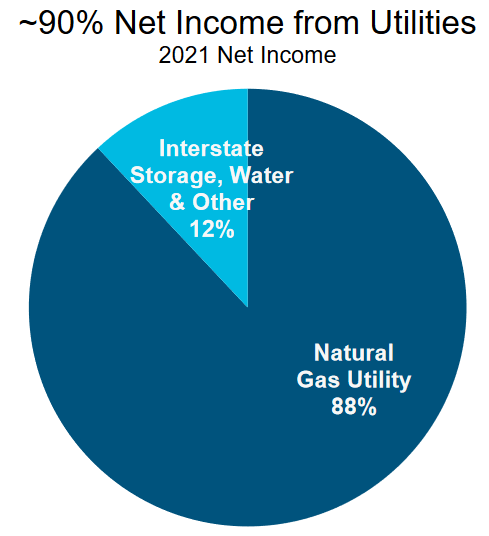

Another way in which Northwest Natural Holding grows is through acquisitions, one of which the company consummated during the third quarter. In late December 2021, Northwest Natural Holding agreed to purchase Far West Water & Sewer in Yuma, Arizona. The transaction closed during the most recent quarter, increasing the customer base of the company’s water utility by about 70%. Despite this acquisition, the natural gas operation still accounts for the overwhelming majority of the company’s net income. In fact, about 88% of its trailing twelve-month net income came from the natural gas utility:

Northwest Natural Holdings

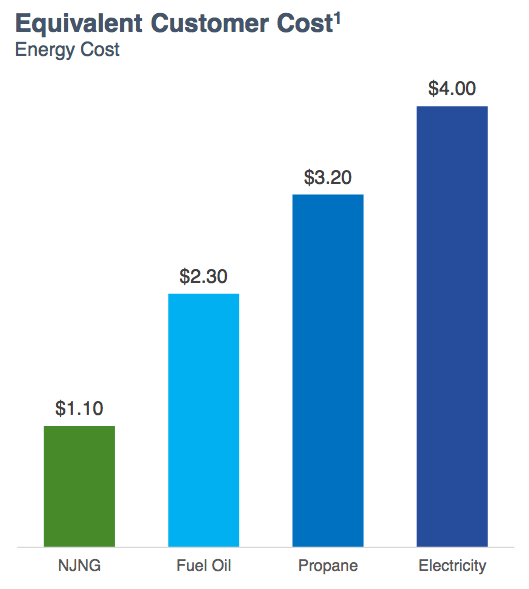

Thus, the company can largely be thought of as a natural gas utility despite the fact that the company does not exclusively derive its revenue and net income from this operation. As many of those reading this may know, we have been hearing a lot of discussion from politicians, activists, and various media personalities regarding electrification. Electrification refers to the conversion of things that are currently powered by fossil fuels to the use of electricity instead. As one of the areas commonly cited for conversion is space heating, numerous people have begun to believe that the days are numbered for natural gas utilities like Northwest Natural Holding. A more sober look at the situation reveals that this is highly unlikely to be the case. One of the biggest reasons for this conclusion is that natural gas is far more efficient at producing heat than electricity. This makes it much cheaper to use, even considering the huge run-up in natural gas prices that we have seen so far this year. In fact, according to the United States Energy Information Administration, heating a home with electricity can cost four times as much as heating the same house with natural gas:

New Jersey Resources/Data from EIA

It seems highly unlikely that anyone will be willing to see their heating bills go up to that degree just to reduce their consumption of fossil fuels. This is particularly true for those people of limited means. In fact, this was confirmed by a survey conducted by Escalent in December 2020. In that survey, eight out of ten people said that natural gas was preferable to electricity for both heating and cooking. Furthermore, survey respondents said that they’d be willing to pay an average of $50,000 more for a house that had natural gas heat as opposed to an all-electric house. Thus, despite the efforts of politicians to push electrification, it appears that the citizens in general do not want it. This is good for us as investors in Northwest Natural Holding since it indicates that the demand and need for the company’s primary product are not going away anytime soon.

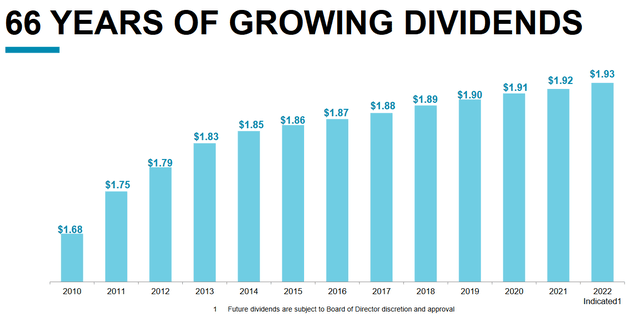

One of the biggest reasons why investors like to invest in utilities is because of the high yields that they historically possess. Northwest Natural Holding is certainly not an exception to this as the stock currently yields 4.12%, which is substantially higher than the 1.56% yield of the S&P 500 Index (SPY). Northwest Natural Holding also has a long history of raising its dividend as the company has increased its dividend every year for 66 years:

With that said, the increases in recent years have been incredibly small, particularly when compared to the dividend growth that other utility companies have delivered. As is always the case though, it is critical that we determine the company’s ability to pay its dividend. After all, we do not it to be forced to reverse course and cut the payout since that would reduce our incomes and most likely cause the stock price to decline.

The usual way that we examine a company’s ability to pay its dividend is by looking at its free cash flow. Free cash flow is the money that was generated by a company’s ordinary operations and is left over after it pays its bills and makes all necessary capital expenditures. This is the money that can be used for things such as reducing debt, buying back stock, or paying a dividend. In the trailing twelve-month period, Northwest Natural Holding had a negative levered free cash flow of $186.2 million. This is obviously not enough to pay any dividend, let alone the $60.5 million that the company paid out during the period. At first glance, this is certainly not encouraging.

However, it is not uncommon for utilities to finance their capital expenditures through the issuance of equity and especially debt while financing its dividend out of operating cash flow. This is due to the incredibly high costs involved in constructing and maintaining utility-grade infrastructure over a wide geographic area. In the trailing twelve-month period, Northwest Natural Holding had an operating cash flow of $144.6 million. This is easily enough to cover the $60.5 million that the company paid out in dividends during the period with quite a bit of money left over for other purposes. Overall, it does appear that everything is fine here and the dividend is likely to be sustainable.

As I mentioned in the introduction, Northwest Natural Holding is currently looking a bit expensive relative to its peers. This is important because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Northwest Natural Holding, we can value it using the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. However, there are very few companies with such a low ratio in today’s overheated market so the best way to use this ratio is to compare Northwest Natural Holding with a few of its peers to see which company offers the most attractive relative valuation.

According to Zacks Investment Research, Northwest Natural Holding will grow its earnings per share at a 4.30% rate over the next three to five years. That is roughly in line with what we calculated earlier so it is likely fairly accurate. This gives the company a price-to-earnings growth ratio of 4.30 at the current price. Here is how that compares to a few of the company’s peers:

|

Company |

PEG Ratio |

|

Northwest Natural Holding |

4.30 |

|

Atmos Energy (ATO) |

2.50 |

|

New Jersey Resources (NJR) |

3.10 |

|

Southwest Gas (SWX) |

3.27 |

|

NiSource Inc. (NI) |

2.64 |

As we can clearly see, Northwest Natural Holding is looking rather expensive compared to its peers. It’s important to note, though, that Zacks’ earnings estimate is on the low side of the company’s guidance. If we use the high-end estimate of 6% earnings per share growth, we get a price-to-earnings growth ratio of 3.10, which is still more expensive than some of the company’s peers but it is much more in line with a few of them. Overall, investors may want to wait until the price comes down a bit before buying in.

In conclusion, Northwest Natural Holding is a fairly solid natural gas utility and its results were much better than might be expected simply by looking at the net income loss. The company is likely to be somewhat overlooked by some investors due to being a natural gas utility, but these utilities likely have a reasonably positive future as natural gas is not about to be replaced as a fuel source. With that said, Northwest Natural Holding does appear to be a bit expensive relative to its peers, although the high yield may be difficult to pass up.

Be the first to comment