imaginima

Northern Oil and Gas, Inc. (NYSE:NOG) has continued its acquisition spree, spending another $287.5 million on Delaware Basin bolt-on acquisitions in the last couple of weeks. These acquisitions are expected to add 5,500 BOEPD to 6,000 BOEPD (68% oil) in production in 2023. Northern may now end up with around 84,000 BOEPD to 85,000 BOEPD (62% oil) in 2023 in a maintenance capex scenario.

Northern is also issuing convertible notes to reduce the use of its credit facility to pay for these acquisitions. The potential dilutive impact of the notes will be partially mitigated by capped call transactions.

Northern is now projected to generate roughly $700 million in positive cash flow (before dividends) in 2023 at current strip in a maintenance capex scenario. Northern’s risk level has temporarily increased due to the additional debt it has taken on, although I’d still value it in the mid-to-high $30s in a long-term $70s WTI oil scenario.

More Acquisitions

Since I last looked at Northern Oil and Gas in late August, it has made two more acquisitions. The first of these acquisitions was a $157.5 million Delaware Basin bolt-on acquisition at the end of September. Those acquired assets were expected to produce around 3,000 BOEPD to 3,500 BOEPD (68% oil) in 2023 and includes 21.2 net future locations.

The second acquisition (announced a couple of days ago) was a $130 million Delaware Basin bolt-on acquisition, with assets that were expected to produce approximately 2,500 BOEPD (68% oil) in 2023. Another 17.2 net undeveloped location were included in this deal.

Thus Northern has spent $287.5 million in the last couple of weeks on Delaware Basin assets that are expected to produce approximately 5,500 BOEPD to 6,000 BOEPD (68% oil) in 2023. It is also acquiring 38.4 net locations for future development.

These assets can probably generate around $110 million in unhedged cash flow from operations in 2023 at current strip prices and around $50 million to $55 million in free cash flow.

Convertible Notes

To help pay for all its acquisitions, Northern is issuing $435 million in 3.625% convertible senior notes due 2029. These notes have an initial conversion price of $38.01 per share. The initial note purchasers also have the option (until late October) to purchase another $65 million in note principal, which would bring the total up to $500 million.

Northern is entering into capped call transactions that are generally expected to reduce the potential dilution or cash payments that may result from the notes being converted in the future. It is also spending $30 million to repurchase common shares.

Hedges

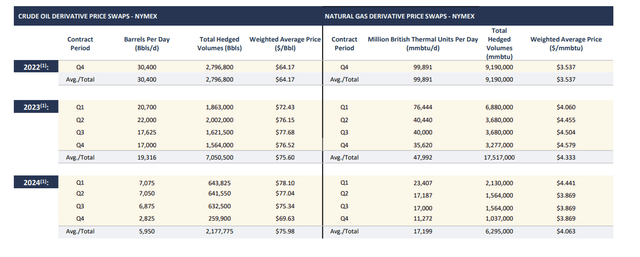

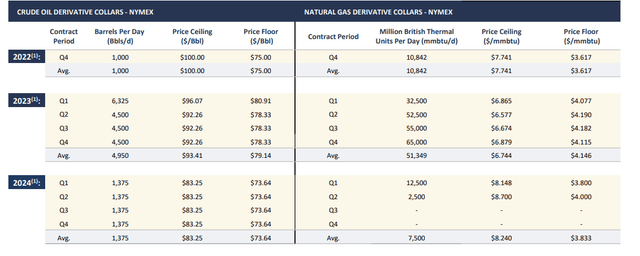

Northern Oil and Gas now has hedges covering approximately 46% of its 2023 oil production and 52% of its 2023 natural gas production in a maintenance capex scenario.

Northern’s Swaps (northernoil.com)

These hedges have around negative $58 million in value at current 2023 strip (approximately $80 WTI oil and $5.65 Henry Hub natural gas).

Northern’s Collars (northernoil.com)

2023 Outlook

Northern mentioned a 2022 exit rate of 77,000 BOEPD in early August. With its acquisitions since then, it may end up averaging 84,000 BOEPD to 85,000 BOEPD (62% oil) in production during 2023 in a maintenance capex scenario (which would involve roughly $550 million in capital expenditures).

In this scenario, it would generate $1.799 billion in oil and gas revenues after hedges at current 2023 strip.

|

Barrels/Mcf |

$ Per Barrel/Mcf (Realized) |

$ Million |

|

|

Oil (Barrels) |

19,122,350 |

$76.00 |

$1,453 |

|

Natural Gas and NGLs [MCFE] |

70,320,900 |

$5.75 |

$404 |

|

Hedge Value |

-$58 | ||

|

Total Revenue |

$1,799 |

Northern is projected to generate around $707 million in positive cash flow in 2023 at current strip prices before dividends. This doesn’t include the potential impact of cash income taxes in 2023.

|

$ Million |

|

|

Production Expenses |

$275 |

|

Production Taxes |

$158 |

|

Cash G&A |

$24 |

|

Cash Interest |

$85 |

|

Capital Expenditures |

$550 |

|

Total Expenses |

$1,092 |

This could translate into around $586 million available for debt reduction and/or share repurchases in 2023, assuming that Northern pays $1.40 per share in common dividends.

Conclusion

Northern has continued to make acquisitions, spending another $287.5 million to purchase Delaware Basin assets since I last looked at it in late August. This should boost its 2023 production in to the mid-80 thousands for BOEPD.

Northern is projected to generate approximately $700 million (before dividend payments) in positive cash flow in 2023 at current strip, which would potentially help it deleverage. This is dependent on what Northern does in terms of future acquisitions though, as it has made four acquisitions in the last six months.

Be the first to comment