Cat keeping its ear to the ground liebre/iStock via Getty Images

Introduction

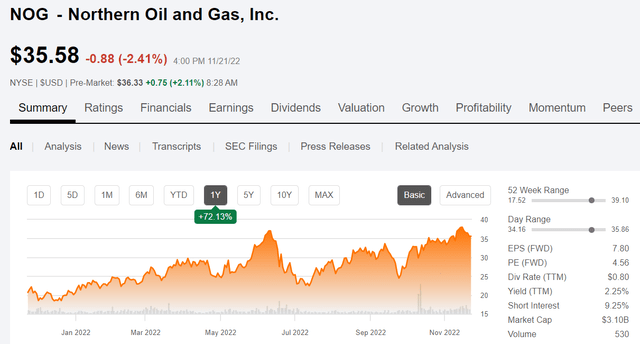

Well, we’ve taken a bit of bruising in the oil bull camp the last couple of weeks. A lot of the companies we cover have taken a big leg down. Northern Oil and Gas, (NYSE:NOG) has dropped as well, but to a somewhat lesser degree. It’s down just a couple of bucks from recent highs, and hasn’t really lost a stitch since mid-October. That’s interesting!

NOG price chart (Seeking Alpha)

NOG has a slightly different approach to the oilfield from most of the companies we follow. They buy into existing development projects as Working Interest-WI, partners. Meaning, for an investment they get a proportional percentage of revenue and pay proportional percentages of field costs. They just don’t have the headache (or opportunity, perhaps) to make the final call on operational decisions. They do have input as owners, as to how drilling and completion operations will be carried out.

Let’s see what’s insulated NOG from the full impact of this sell off.

The thesis for NOG

You would think dirt was going out of style with the pace Northern Oil and Gas has set with bolt-on pickups this year. A follower turned me on to this one, saying a buddy of his thought it could be a double. Mud engineers love gossip, and are always keeping our ‘ears to the ground,’ hoping to pickup a juicy tidbit. Sometimes our ears just get dirty, but this one looks like a winner.

The grapevine has always been the best way to get information, as Gladys Knight documented nearly 60 or so years ago with her hit R&B single titled, “I Heard It Through The Grapevine.” (Do yourself a favor if you are under 40, you’ve probably never heard this Rock and Roll Hall of Fame (2018) classic. Follow the link and give it a listen.) Now Gladys was almost assuredly not talking about oil and gas, as we are, but the principle remains the same. Let’s see how it holds up in this case. A double candidate always gets our attention.

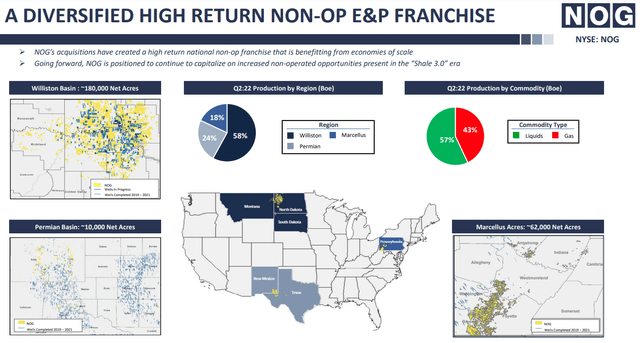

NOG has their corporate fingers in several key shale plays and rely on the quality of operating partners to ensure returns. Originally working in the Williston basin, it is still their anchor. Recent buys have taken them into the Marcellus and only this year, into the Delaware sub-basin of the Permian. They associate themselves with top operators like, ConocoPhillips (COP), Marathon Oil (MRO), Continental Resources (CLR), and others. These companies know how to do it. NOG’s viewpoint is, save the office staff expense and focus on the dirt.

NOG Footprint (NOG)

The year so far for NOG

The company has been on a tear with bolt-on acquisitions, following their guidelines of choosing top tier inventory and operating partners. These acreage buys all come with production and a well defined opportunity scope for near term future work.

One component of that strategy which certainly makes sense, is the ability of larger operators to leverage suppliers. In this era of rapidly increasing prices strategies like this have an impact.

This late entry to the Delaware seems to have a gas spin on it. The Delaware was already gassy and as the industry starts drilling more Tier II acreage, the gas/oil ratio-GOR, will only increase. The company seems to be taking a long view toward the gas export opportunities developing in the Texas and Louisiana Gulf Coast. NOG President, Adam Dirlan comments:

As LNG has scaled up and diversified over the last 18 months, the breadth of opportunities that we are able to pursue is also expanding.

Further the company is keeping its opportunity basket full, with an active approach to reviewing new acreage pickups. Dirlan comments here:

I’ll remind our investors that NOG’s balance sheet is built to handle most acquisition targets we’re analyzing without external equity financing. NOG is fully on the offensive. We have the firepower, the scale and perhaps the broadest set of opportunities in the company’s history. With every high commodity cycle comes some newfound competition, but in the end, it will be our disciplined, analytical rigor and balance sheet strength that will set NOG apart more than anything else through the cycles.

Catalysts in the Permian

The move into the Permian seems to be ahead of a wave. The company has aligned itself with busy operators with compatible development strategies. An example would be the Delaware basin pickups from Mewbourne Oil and Gas, a leading private operator, were highlighted in the call.

In the case of the Mascot acquisition, the JDA structure gave NOG quite a bit of control in this 6-zone stacked pay project. It includes the right to stop and start activity and oversight of drilling operations. It also appears to be a template that is being applied to other prospective M&A opportunities. Adam Dirlan, President comments in this regard:

The expansion of the JDA structure establishes a new set of opportunities that will be unique to a scaled Northern and we will continue to drive value with a disciplined approach that is focused on returns.

Risks

To provide funding for all of these acquisitions, Northern has issued $435 million in 3.625% convertible senior notes due 2029. These notes have an initial conversion price of $38.01 per share. Purchasers who got in early also had the option through October, to purchase another $65 million in note principal, which would bring the total up to $500 million.

The company is using capped call options to reduce the potential dilution or cash payments that may result from the notes being converted in the future. That sounds good, it’s hard to buy in at one level, knowing somebody else has a better deal.

They are also dependent on their operating partners for growth and maintenance income. The non-op advantage can become a curse if the industry takes a down turn.

Hedges

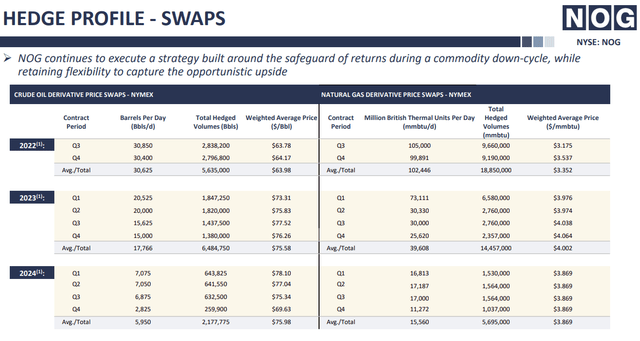

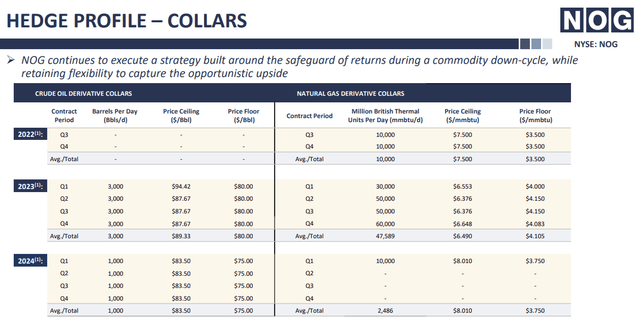

Hedges comprised of swaps and collars account for about half of NOG’s annual oil production, and a little over half of their gas output.

NOG Hedging profile (NOG)

Settlement of hedges are on track to run about $300 mm on an annual basis. The improving price of the NYMEX strip could impact this 5-10% either way.

NOG Hedging profile (NOG)

Q-3 Financials and Guidance

Q-3 average daily production increased 2% sequentially over Q2 and increased 32% over Q2 of 2021. Adjusted OCF was $276.5 million, up 7% from Q-2, and which exceeded the consensus estimates and was a record for NOG. Free cash flow was robust at $110.3 million, but slightly below Q-2.

Capital spending for the third quarter was $154.5 million, which was slightly above Street expectations. This was the result of pulling forward drilling activity and additional ground game activity late in the quarter.

The balance sheet is solid with no timebombs. While the revolving borrowings ended only slightly lower quarter-over-quarter, that’s a function of the $17 million deposit on the Williston acquisition as well as over a $13 million reduction in 2028 notes. They forecast their revolver to be undrawn by mid next year despite funding the Williston acquisition this year.

Updated 2022 guidance, saw Q3 average daily production increased 9% sequentially over Q2 and topped 79,000 BOE per day, a 37% increase compared to Q3 of 2021. Oil volumes were up 8% sequentially over Q2. They increased the midpoint of full year 2022 production guidance by 1,250 BOE per day and now expect to exit December at over 83,000 BOE per day which includes the Midland transaction that closed in October.

The company pays an attractive dividend of $1.20 on an annual basis, and they are buying back stock at a rate of about $100 mm per year, with ~$100 mm remaining on their authorization.

(Source)

Your takeaway

I think NOG is a solid bet. Currently they are trading at about 4.5X EV/OCF and at ~$38K per flowing barrel, as of Q-3. Both are competitive figures. If they maintain their current torrid pace of growth these metrics should only improve,

They are growing production and controlling costs even with the inflation other operators are seeing. Companies they work with are drilling longer laterals to drive efficiencies in this environment. Their average AFE rose to $8.6 million but only up 5% from the prior quarter based on normalized lateral lengths. On a weighted average well proposals remain within their per well estimates that have been included in CapEx guidance.

Investors looking for growth and income should put NOG on their list for entry points. The company has just made a 40% run from the middle $20’s to the upper $30’s. I am not inclined to chase it. A pullback into the lower $30’s might justify pulling the lever for this one.

Be the first to comment