AscentXmedia

Published on the Value Lab 22/7/22

Norsk Hydro (OTCQX:NHYDY) is facing some headwinds with the price declining another 20% since we last covered it. While it is clear that the commodity cycle is turning on the demand side, for most producers it won’t be turning for the supply side, which advantages Norsk Hydro with its vertically integrated power. Caution around the stock is reasonable, but its competitive advantage makes it a stock to follow, especially with capacity at risk. While gas rationing is the only major concern for the company, and it’s a remote risk thankfully, management and investors should be confident in the robustness of the business, naturally expecting its commodity-based model to take a hit with the oncoming recession. Superior to peers, Norsk Hydro remains interesting.

Q2 Update

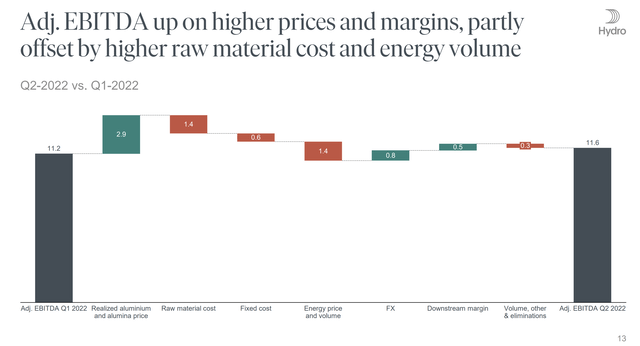

The Q2 update has come out recently and it gives us a fair bit to look at. Primarily exposed to aluminium metals, realized prices had continued to rise and create EBITDA growth for the company, even excluding derivative gains from 11.2 to 11.6 billion NOK. Raw material pressure from some coal and gas inputs affected the company, especially as hydrological conditions limited some of the volume effects from its own assets and mitigating the benefits of its vertical integration. Nonetheless, a certain portion of locked in prices and its vertical integration continue to be a major source of competitive advantage, that puts its capacity in the safe-zone while competitor capacity is quite meaningfully at risk.

Also outside Europe, in the U.S., we have seen supply side reactions. In light of the high energy prices, there is significant capacity at risk and we see around 900,000 tonnes of European and U.S. capacity curtailed.

EBITDA Evolution (Q2 2022 Pres)

Management acknowledges that current prices are not very sustainable, and with the recession but also supply chain issues making it difficult to find demand sinks for aluminium in the next quarters, Norsk Hydro results are bound to peak. However, with input prices not at all peaking, still exposed to speculative and geopolitical factors keeping them high, Norsk Hydro competitors which cannot hide from those risks are not only likely to curtain production, but may have to do it for an enduring period of time. Naturally this advantages Norsk Hydro in the long-term and is why low-cost assets are the most important competitive advantage for manufacturing and especially commodity manufacturing businesses.

In addition to the price effects that we expect to see on the aluminium metals business, which accounts for about 70% of the company’s normalized EBITDA, we’re a bit worried about extrusions too which is around 20% of EBITDA as construction markets become iffy; as well as automotive with a more closed financing situation and continued issues with the supply chain. The current multiple of 7.4x P/E clearly reflects the market’s understanding that it is late in the cycle, and the continued selling of the stock despite record results does so as well.

Conclusions

The company traded up on earnings day particularly because of management messaging around the capital allocation policies. Being able to tolerate more debt even in what investors see as a downcycle has meant a special dividend that 2xes the overall dividend payout to 6.85 NOK per share. That puts it at about a nice yield above 10%. Moreover, they are planning on buying back shares totaling 2.5% of the market cap. This puts this year’s total payout at above 12% with more or less a third being a buyback effort, which is nice to see as the price declines. With the net debt target being 25 billion, and this year’s payout at most bringing it to 12 billion, there’s about another 2 years after this year in 12% payouts that would be possible to bring that net debt up, unless they choose to use that money on CAPEX as part of Hydro Rein to develop the renewable energy portfolio or other ESG products within its aluminium business.

Norsk Hydro is robust from an asset point of view. No one can oust them as long as aluminium is a key product. The only risk is gas rationing which would affect almost 30% of their assets to whatever extent the rations limit their ability to utilize capacity. With concerns over Russian supply ongoing, keep this in mind. Those volumes to Europe do matter for Norsk Hydro’s extrusion, recycling and other businesses. Nonetheless, the big news for potential investors is the scope for shareholder remuneration. Consider it around 12% comprehensively across buybacks and dividends for 2022, with the chance of it being the same in 2023 and 2024 rather high given the pretty big departure from their previous balance sheet regime. Makes sense to lock in rates now, and it’ll be a good head start on returns for investors looking also to play the competitors’ capacity risk as well.

Be the first to comment