Nature, food, landscape, travel/iStock via Getty Images

Introduction

It has been a while since I first published about Nomad Foods (NYSE:NOMD). On August 25 this year, I published my article about great fishing in troubled waters, describing the stock’s great value while the company was experiencing temporary headwinds. The stock has been performing poorly since I wrote my article and fell 10%. The war in Ukraine-Russia caused the high inflationary environment we are in now. The Ukraine-Russia war caused supply problems for Nomad Foods. Recent quarterly earnings were very strong and the medium-term growth outlook remains intact. The stock is again a strong buy.

Impressive Third Quarter 2022 Earnings

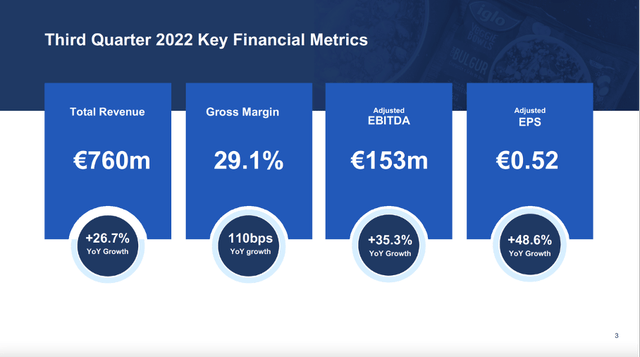

Third quarter 2022 key financial metrics (Nomad 3Q22 investor presentation)

Third quarter 2022 earnings were strong with revenue growth of 27% (7% organic revenue growth). The strong revenue growth reflected the successful execution of Nomad’s pricing strategy and the inclusion of the recent acquisition in the Adriatic region. Double-digit net prices in the third quarter helped offset commodity inflation for the year. Gross margin increased to 29.1% from 28.2% last quarter, mainly due to higher prices and the inclusion of the Adriatic region (which has the highest margins during the summer). Adjusted EBITDA rose 35.3% year-on-year.

Although I was concerned about the large debt profile in my previous article, Nomad Foods has extended the debt maturity profile to 2028 – 2029 by refinancing $916 million principal amount of the term loan through 2024, with approximately $830 million term loan maturing in 2029. A good move by Nomad Foods to refinance at attractive interest costs.

The company performed strongly as the Adriatic region showed good performance, boosted by strong sales of its ice cream brands. Green Cuisine is gaining market share and achieving high single-digit sales growth. Green Cuisine’s market share is high at nearly 17% and is No. 2 in the plant protein category.

Although the company showed strong sales growth, volumes declined during the quarter. Nomad Foods will adjust prices to offset input cost inflation and expects full-year prices to offset the decline in the volume mix.

Nomad continues to sail in a challenging economic environment with high energy prices, rising inflation and political disruption. Nomad is a good captain because they managed to pass through higher costs in their products. Nomad is sailing away from the political turmoil in Russia by diversifying their high-quality farmed fish to other producers who are ASC compliant. Nomad Foods is in good shape and maintains its fiscal year 2025 outlook of €2.30 earnings per share.

17% Buyback Yield Is Waiting

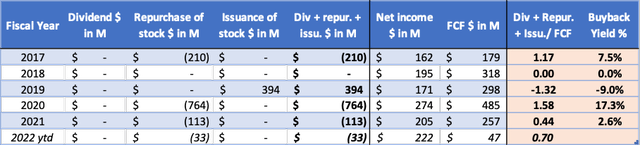

The management of Nomad Foods chooses not to distribute dividends, but instead returns cash in a tax-efficient way by repurchasing shares in the open market. Nomad believes share buybacks are central to boosting shareholder value.

In 2020, the stock traded favorably after the market crashed. The company acted quickly by buying back $764M worth of shares, which represented a high buyback yield of more than 17%. The share price rose 14% in 2020.

Nomad Foods repurchased $33M worth of shares in the first quarter of this year but was silent on the second and third quarters. The $500M share repurchase program (17% return!) remains in effect until August 2024, and the company will act quickly if management believes the repurchases will add value for shareholders at a given point in time.

Nomad Foods’ cash flow highlights (Annual reports and author’s own calculations)

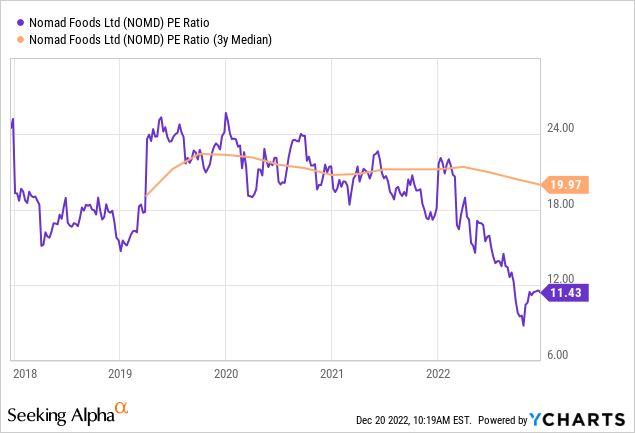

The Stock Is Extremely Cheap

For the long term, Nomad Foods anticipates adjusted earnings per share of €2.30 in fiscal 2025 (converted to US dollars = $2.45). At the share price level of $16.80, this means a forward P/E ratio of only 6.9. So, investors apparently have little confidence that Nomad Foods can deliver this growth.

Supply problems have been of great concern in recent quarters, but Nomad has acted quickly by diversifying its producers. Still, the share price has not fully recovered. Investors could also demand that Nomad Foods pay a dividend like many other companies in the consumer non-durables sector.

Nomad’s P/E ratio is very attractively valued at 11.4, well below the average of 20. If we multiply the average P/E ratio of 20 by the expected earnings per share in 2025 of $2.45, we arrive at a share price of $49. This represents a high return of 192%.

Still, I do not expect the P/E ratio to quote 20 in 2025 because interest rates will be raised sharply to curb inflation. Take a more conservative P/E ratio of 15 and we end up with a share price of $36 (up 119%).

To conclude, Nomad is very attractively valued, and both estimates for fiscal year 2025 show strong share price appreciation. The recent quarterly numbers show strong improvement and high growth figures. Therefore, the stock is a strong buy.

Conclusion

Despite the difficult economic environment with high energy prices, rising inflation and political disruption, Nomad managed to sail well through it. This year, Nomad Foods passed on cost inflation in their products, resulting in strong sales growth despite slightly reduced net volumes. Political unrest in Russia caused problems in the supply chain. Nomad acted quick by diversifying their high-quality farmed fish to other ASC-compliant producers. Third-quarter sales rose sharply by 27% and earnings per share also rose 49%. Nomad Foods maintains its projected earnings per share for fiscal 2025 of €2.30. Nomad does not pay a dividend but buys back its own shares. The $500 million share repurchase program (repurchase yield = 17%!) remains in effect until August 2024. The recent share price decline has made the valuation very favorable. Robust recovery in growth figures, strong growth prospects, high buyback yield and favorable valuation metrics make Nomad Foods a strong buy.

Be the first to comment