Risto0

Investment Thesis

Nokia (NYSE:NOK) is continuing to execute on its turnaround strategy. The company reported strong topline growth in its Mobile Networks business. It reported impressive and improving profitability results in its core segments.

But two large contract disputes are a major headwind for Nokia’s intellectual property division. This has seriously hurt the business’s total profitability. I still think that shares are undervalued at the current price.

Solid Third Quarter Results

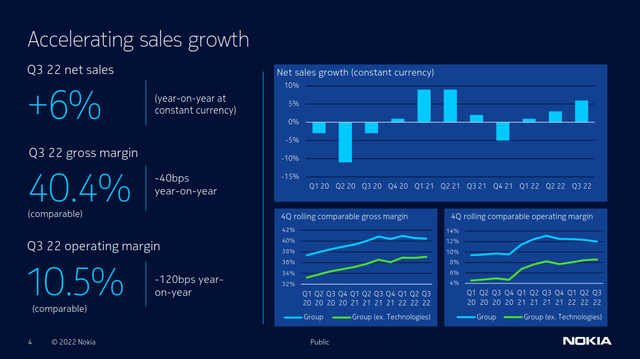

Nokia reported solid third quarter results in its core businesses. The company grew its topline by 16% year over year, or 6% in constant currency. It grew its comparable earnings by 19% year over year. Supply chain issues are starting to clear up. This allows the business to accelerate its topline growth.

Nokia Q3 2022 Investor Presentation

The company grew reported sales for its primary operating segments. Its Network Infrastructure segment topped a strong 2021 result. Reported revenue growth was 15%, and earnings grew 22%. The business also reported a solid result in its Cloud and Network Services segment. The segment grew reported revenues by 7%. Operating profit for the segment was down due to increased investment.

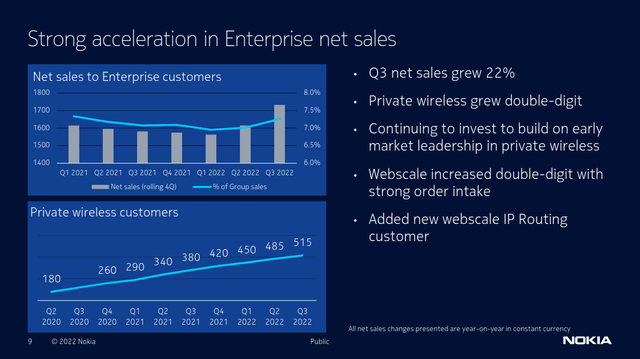

The company is doing a good job of diversifying its customer base. Nokia sells most of its products to communication service providers. But in recent years, the business has been focusing on enterprise sales. Revenue from these customers has grown almost 50% since 2018. The overall company grew less than 6% over the same period.

Nokia Q3 2022 Investor Presentation

The euro’s recent weakness against the U.S. dollar (USDOLLAR) has been a near-term tailwind for Nokia. A lot of the business’s income is from North America. At the same time, its expenses are denominated in euros. Recent currency shifts have increased the company’s revenue relative to its expenses, boosting margins. Management expects these tailwinds to moderate in the next few quarters.

A Great Quarter For Mobile Networks

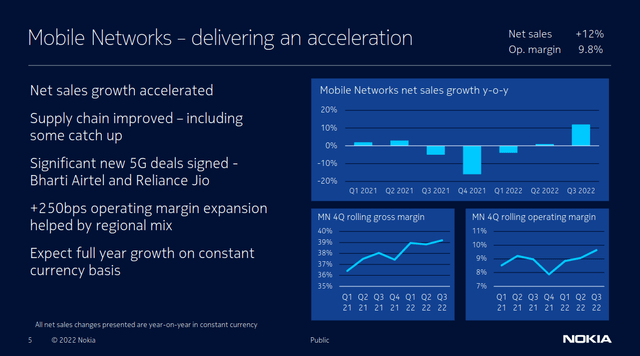

The standout performer this quarter was Nokia’s Mobile Networks segment. This segment is responsible for the company’s radio access network products. This includes Nokia’s 5G offerings.

Nokia Q3 2022 Investor Presentation

The segment reported fantastic topline growth. Revenues jumped by 12% in constant currency or 23% on a reported basis. This increased volume has allowed Nokia to drive down the segment’s operating costs. The business expanded the segment’s operating margins to 9.8%, a 250 basis point increase year over year. This is a fantastic result, above the high end of management’s long-term target for the segment.

This strong performance reflects increasing investments in 5G infrastructure. Nokia has focused heavily on this new technology, and its efforts are starting to pay off. Operators are starting to add capacity at high rates. Management specifically discussed the company’s strong performance in India. It was awarded a contract for 45% of Bharti Airtel’s planned 5G network. The business also announced a deal with Reliance Jio. This tailwind is set to increase as 5G adoption grows.

What’s Going On With Nokia Technologies?

The primary drag on this year’s results was the company’s Nokia Technologies segment. The segment manages Nokia’s patent and intellectual property portfolio. Historically, this has been the business’s main profit generator. In 2020, the segment was responsible for only 6% of Nokia’s revenue but 54% of its comparable operating profit.

But this segment has been hit with some major headwinds. Year to date, Nokia Technologies reported revenue down 21% in constant currency. Operating profit is down by 29%. This is because two major contracts expired in 2021 and are still being renegotiated. These contracts are with Vivo and Oppo, both Chinese smartphone manufacturers. So far, Nokia has been unsuccessful in its attempts to reach a deal. Management gave an update on their earnings call.

We are in both litigations with both but also renegotiations with both. So litigation doesn’t mean that we end the negotiations. That will continue anyway. So that’s the situation. And both of these ended during 2021, and that’s why when we didn’t see that there was a good enough traction on the negotiation phase, that’s why we had to enter into a litigation in different countries. And litigation is always the final step in when we see that negotiations do not bear fruit. So we try to avoid those as much as possible. But in these two cases, we came to conclusion that we believe that’s the best way to continue.

In earlier quarters, the company had written this off as a timing issue. But the situation has turned out to be much worse. The dispute has resulted in Nokia suing these companies. In August, a German court banned Oppo from selling its smartphones as a result of one of these lawsuits. Oppo cited “unreasonably high fees” as the reason for the dispute. These patent fights are likely to take place all over the world. If the companies don’t reach an agreement, this could drag on for years.

But Nokia remains optimistic about this segment. Management reaffirmed its 2022 revenue guidance of 1.4 billion to 1.5 billion euros for the segment. They insist that the company will receive catch-up payments at the end of these negotiations. But the longer this drags on, the more skeptical I become of this outlook. There’s no guarantee that these companies will comply with Nokia’s terms in the near future.

This could be quite bad since the segment is critical to Nokia’s profitability. It’s the primary headwind I see for the company going forward.

Outlook And Valuation

After a 9% decline in response to its Q3 report, Nokia’s shares are now trading at a forward P/E of 9.5 times. The company has a healthy balance sheet with $4.6 billion in debt offset by $5.2 billion in cash. Adjusting for net debt, the company has an LTM EV/EBITDA of about 7 times. I think that this is a cheap valuation considering the core strength of Nokia’s business.

Nokia is continuing to do a good job of investing its capital. The company generated an impressive 17.5% comparable ROIC in the quarter. This is down by 2.7 percentage points year over year, but I still believe that it is a strong result.

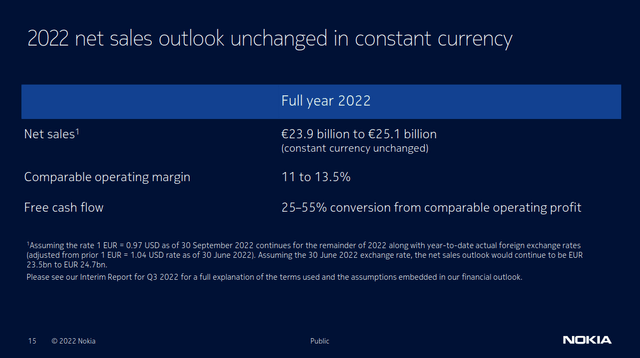

Nokia Q3 2022 Investor Presentation

Nokia left its guidance unchanged in constant currency. Its current results are on the low end of its comparable operating margin guidance. This is due to the headwinds in its Nokia Technologies segment. The business’s comparable Q3 margins dipped by 120 basis points year over year. This is likely to drag down the valuation in the near term.

Final Verdict

I think that this quarter’s results were strong from a fundamental perspective. Nokia is executing on its turnaround plan. Its margins are increasing in its core segments. The outlook for these segments is positive. But the company’s Nokia Technologies segment is likely to be a continuing headwind. Right now, we have limited visibility into these negotiations.

Overall, I believe that Nokia is cheap relative to its growth potential. The company is well-positioned to benefit from the accelerating 5G investment cycle. I think that shares are undervalued at the current price.

Be the first to comment