RenatoPMeireles/iStock Editorial via Getty Images

Note: Noble Corporation (NYSE:NE) has been covered by me previously, so investors should view this as an update to my earlier articles on the company.

Last week, leading offshore driller Noble Corporation (“Noble”) reported less-than-stellar fourth quarter results and released a new fleet status report both of which have already been discussed by fellow contributor Vladimir Zernov.

Accordingly, this article will mostly focus on statements made my management on the subsequent conference call and the company’s outlook following the proposed merger with Maersk Drilling later this year.

While the fourth quarter certainly didn’t play out as initially expected by management, Noble Corporation is entering FY2022 in great financial shape.

The recent sale of four jackups to ADES International resulted in net debt being reduced to just $22 million at year-end.

Liquidity amounted to $869 million, consisting of cash and cash equivalents of $194 million and the company’s undrawn $675 million revolving credit facility.

Noble only has $216 million in long-term debt.

The company’s fleet status report largely confirmed the trend witnessed at competitor Transocean (RIG) last week: The Gulf of Mexico (“GoM”) is hot right now with limited availability of ultra-deepwater drillships resulting in ongoing dayrate increases. Unfortunately, activity in most other regions of the world continues to lag behind, particularly in Asia.

In fact, ongoing weakness in this region has caused Noble to retire its last remaining semi-submersible rig “Noble Clyde Boudreaux“.

West Africa doesn’t look much better at this point but according to management, there’s been a recent increase in tendering activity with “a bulk of opportunities in Ghana and Nigeria“.

Even Norway won’t see much of an uptick this year as “the activity lull created by the pandemic works through the pipeline of projects“. That said, customer Equinor (EQNR) exercised options on the company’s flagship asset “Noble Lloyd Noble” which will keep the world’s largest jackup rig working until February 2023 with nine one-well options still remaining.

The UK part of the North Sea remains highly competitive with additional idle time expected for the company’s three jackup rigs in the region. Currently, only the Noble Hans Deul is contracted while the Noble Houston Colbert and Noble Sam Hartley are warm-stacked.

Management provided a more constructive view on Brazil with the active fleet expected to increase by 10 floaters or approximately 50% over the next several years.

Guyana continues to be a bright spot for Noble thanks to the company’s long-term commercial enabling agreement (“CEA”) with ExxonMobil (XOM). During Q4, Noble was awarded an additional 7.4 rig years which will keep the ultra-deepwater drillships Noble Tom Madden, Noble Sam Croft, Noble Don Taylor and Noble Bob Douglas working until November 2025.

Assuming at least stable dayrates, I would conservatively estimate the resulting backlog addition at $700 million and potentially much higher, depending on market developments as the dayrates earned by each rig will be updated twice per year to the projected market rate at the time the new rate goes into effect, subject to a scale-based discount and a performance bonus.

As the award is still subject to government approvals and final sanction for the Yellowtail development project, Noble has not included this most recent extension into its year-end backlog of approximately $1.2 billion.

In the U.S. Gulf of Mexico, the company has seen customers exercising options in the $300,000 range for the drillships “Noble Faye Kozack” and “Noble Stanley Lafoss” while the drillship Noble Globetrotter I will become available for work in the GoM in July 2022.

At this point, the company does not consider a near-term reactivation of the cold-stacked former Pacific Drilling drillships “Pacific Meltem” and “Pacific Scirocco” due to a lack of long-term contract opportunities at sufficient rates.

While not exactly a surprise, this is somewhat in contrast to statements made by the management of NOV Inc. (NOV) during the company’s recent conference call which pointed to “reactivation discussions on more than a dozen stacked floating rigs“.

Keep in mind that reactivating a cold-stacked drillship could require upfront capital investment of up to $100 million.

Given limited spot exposure to the currently red hot GoM, additional idle time expected for some of the company’s jackup rigs in the North Sea and the retirement of the Noble Clyde Boudreaux, the company’s FY2022 guidance for revenue and adjusted EBITDA has remained unchanged at $1.050 to $1.125 billion and $300 to $335 million, respectively.

As the proposed merger with Maersk Drilling is expected to close within the next couple of months, initial focus will likely be on consolidation and achieving the projected $125 million in annual run-rate synergies.

The acquisition will add a fleet of 19 rigs (11x jackup, 4x semi-submersible, 4x drillship) with an aggregate backlog of almost $2 billion. Just like Noble, Maersk Drilling currently has two warm-stacked jackup rigs (Maersk Resolve and Maersk Highlander) in the North Sea while a lower-specification semi-sub (Maersk Explorer) remains warm-stacked in Azerbaijan.

The remainder of the fleet is working. The company just recently signed a new framework agreement with AkerBP for the provision of two rigs offshore Norway over a five-year term with a total contract value of approximately $1 billion.

Unfortunately, Maersk Drilling does not have exposure to the Gulf of Mexico.

For FY2022, the company expects adjusted EBITDA in a range of $210-$250 million, down from $346 million last year. Keep in mind that the company recently sold the jackup rig “Maersk Inspirer” for $373 million including its high-margin long-term contract with Repsol (OTCQX:REPYY) which resulted in a $440 million backlog reduction. Depending on the rig’s operating expenses, I would estimate an adjusted EBITDA hit of up to $50 million annually.

At the end of December, Maersk Drilling’s liquidity was close to $1 billion, consisting of $557 million in cash and the company’s undrawn $400 million revolving credit facility. Net debt calculated to $505 million.

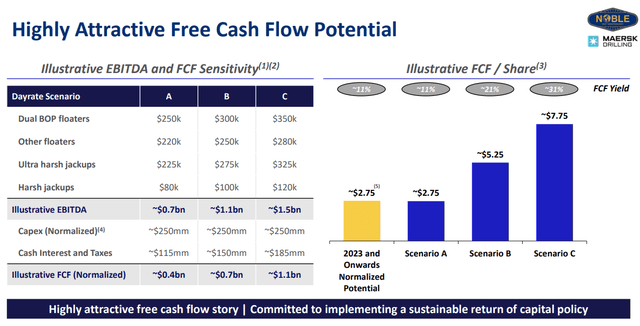

Excluding merger-related costs and assuming no immediate synergies in FY2022, adjusted EBITDA for the combined company would be north of $500 million with more optimistic scenarios provided in the merger presentation now looking increasingly realistic:

Please note that the new company remains committed to implementing a sustainable return of capital policy which could very well result in Noble to become the first offshore driller to resume dividend payments next year.

Given the improving market environment and assuming the company achieving projected synergies, FY2023 Adjusted EBITDA should easily exceed $700 million which would calculate to an EV/Adjusted EBITDA ratio of 5.5, pretty much in line with my estimate for industry leader Transocean next year but in contrast to Noble Corporation, Transocean still has to deal with more than $400 million in annual interest expense.

In addition, Transocean is facing considerably uncertainty with regards to the so-called “CAT-D” rigs Transocean Equinox, Transocean Endurance, Transocean Encourage and Transocean Enabler, a series of purpose-built semi-submersible rigs contracted to Equinor. The rigs currently account for more than 25% of Transocean’s annual revenue and an even higher percentage of the company’s adjusted EBITDA with contracts currently scheduled to end between Q4/2022 and Q1/2024. Extending these contracts at sufficient rates will be crucial for Transocean given the requirement to address large amounts of debt and extend the company’s credit facility next year.

On the flip side, Transocean has some decent exposure to the Gulf of Mexico and recently secured a new short-term contract for the drillship Deepwater Asgard at a multi-year high rate of $395,000.

At least in my opinion, the rising tide is going to lift all rigs which keeps me bullish on the entire industry. At this point, I continue to prefer restructured players like Noble and Valaris (VAL) given their ability to generate sizeable amounts of cash at considerably lower dayrates than debt-laden players Transocean and Borr Drilling (BORR).

But should the recovery in the floater market start to gain some real steam with sufficient terms for the reactivation of cold-stacked rigs, a highly- leveraged player with an ample number of cold-stacked drillships like Transocean would likely start to outperform peers.

I remain somewhat hesitant to recommend jackup pure play Borr Drilling as the shallow water market remains competitive and the company still needs to address near-term debt maturities. In addition, liquidity is likely to remain tight.

Bottom Line:

With the first major market finally showing some decent improvement, I remain positive on the offshore drilling industry.

Noble Corporation remains among my favorites given reasonable valuation, good contract coverage, a clean balance sheet and strong liquidity.

In addition, the upcoming merger with Maersk Drilling should result in the combined company generating material free cash flow over time.

At this point, I firmly expect the new Noble Corporation to be the first US-exchange-traded offshore driller to announce a dividend policy next year.

As industry shares tend to trade in correlation with oil prices, I would consider using days of oil price weakness to initiate or add to existing positions.

Be the first to comment