courtneyk/E+ via Getty Images

(This article was co-produced with Hoya Capital Real Estate.)

Readers of my most recent article here on Seeking Alpha were treated to an explanation as to why I recently raised the overall cash level in my personal portfolio to just under 25%, and closer to 40% in the segment with which I am funding day-to-day living expenses as a recent retiree.

In the article, I enumerated 5 factors which lead me to agree with several investment professionals that the market may have gotten a little ahead of itself. If this proves to be the case, we may be in for some turmoil over the next 6-12 months.

Related to this, ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL) may be worth a look for investors who want to stay invested in the U.S. market, but play a little defense at the same time.

Let’s take a closer look at the details of this exchange-traded fund (“ETF”). I will then conclude with my thoughts on both the short- and long-term outlook for NOBL.

ProShares S&P 500 Dividend Aristocrats ETF – Digging In

The very name of this ETF, which includes the phrase “dividend aristocrats,” gives you an immediate clue as to its intent.

What, exactly, does this refer to? Here is an explanation from the fact sheet provided by ProShares:

S&P Dividend Aristocrats Index

- Invests in the S&P 500 companies that have increased dividends each year for at least 25 consecutive years

- Contains a minimum of 40 stocks, which are equally weighted

- Limits the weight of any single sector to no more than 30% of the index

- Is rebalanced each January, April, July and October, with an annual reconstitution during the January rebalance (Bold mine, for emphasis).

Digging a little further, I found one additional clarification from the fund’s summary prospectus that these companies “meet certain market capitalization and liquidity requirements.” I got a little curious as to whether I could discover exactly what those capitalization and liquidity requirement are. I found the answer in the methodology document for NOBL’s underlying index. Here are the key data points:

- Have a minimum float-adjusted market capitalization (FMC) of at least US$ 3 billion as of the rebalancing reference date.

- Have an average daily value traded (ADVT) of at least US$ 5 million for the three-months prior to the rebalancing reference date.

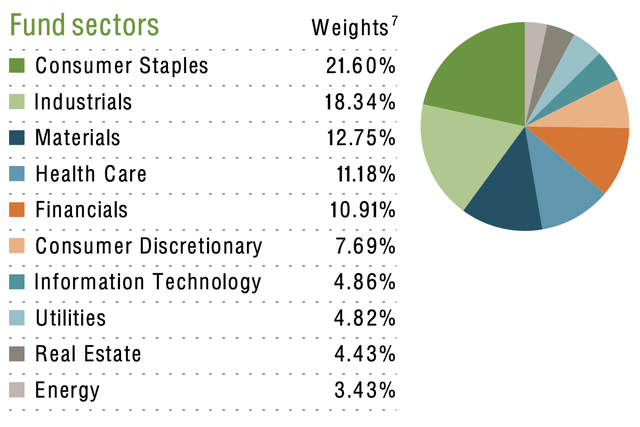

How does all of this play out in terms of sectors, and individual stocks? Here are two very helpful graphics from the same fact sheet linked above. First, the sector weightings.

NOBL: Sector Weightings (ProShares)

Right off the bat, you notice that Consumer Staples is the largest sector in the fund. Here’s a little tidbit. When thinking about my outlook for the year ahead, I had considered reviewing a couple of ETFs in the Consumer Staples space. While I may yet do so in a future article, I decided to start with NOBL because some quick back-testing appeared to reveal that NOBL offered virtually the same downside protection as a pure Consumer Staples ETF, but slightly better opportunity to the upside.

On the flip side, note NOBL’s relatively small exposure to the Information Technology sector.

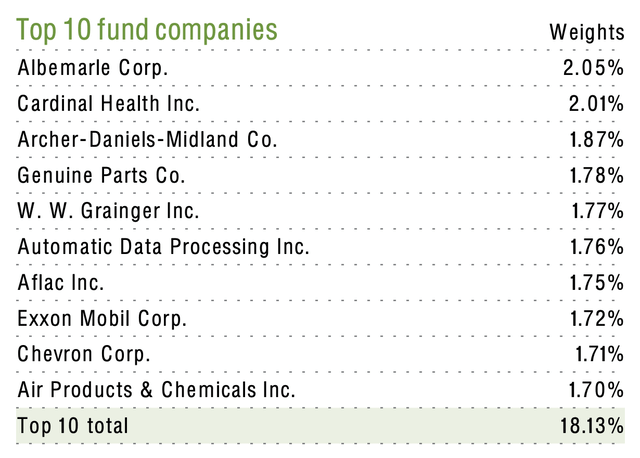

Next, let’s turn to the fund’s Top 10 holdings:

NOBL: Top 10 Holdings (ProShares)

As you look at the list, you quickly realize that these aren’t the “darlings” of the investment landscape, the ones your coworker or neighbor will brag about owning the next time you see them at a cocktail party. No, as you might intuit from the fact that these are dividend aristocrats, this is an extremely conservative fund.

I have to admit that, while I recognized several of these companies and what they do, there were 3 or 4 names in the list that I was unfamiliar with. Here are very brief synopses of just 3, from their respective profiles right here on Seeking Alpha:

Albemarle Corp (ALB) – ALB develops, manufactures, and markets engineered specialty chemicals worldwide. In short, those chemicals are used in everything from lithium batteries to rubber soles to disinfectants and sanitizers. The company serves the energy storage, petroleum refining, consumer electronics, construction, automotive, lubricants, pharmaceuticals, and crop protection markets.

Archer-Daniels-Midland Company (ADM) – ADM procures, stores, cleans, and transports agricultural raw materials, such as oilseeds, corn, wheat, milo, oats, and barley. As such, ADM engages in the agricultural commodity and feed product market, as well as offers products for food, feed, energy, and industrial customers.

Automatic Data Processing, Inc. (ADP) – ADP provides cloud-based human capital management solutions worldwide. These include payroll, benefits administration, talent management, HR management, workforce management, insurance, retirement, compliance services, as well as HR outsourcing solutions.

As can be seen, these are companies that provide necessary “behind the scenes” products and services to other companies that might be the “darlings” your neighbor brags about owning.

Let’s go a step further though. On top of all of this, the fund takes an equal-weighting approach. In contrast, most ETFs take a market-weighting approach. As a result the Top 10 holdings of even total-U.S. market ETFs such as Vanguard Total Stock Market ETF (VTI) are in the range of 22%. In “sector” or “specialty” ETFs, this can often rise to 40-60% of the fund. As a result, poor performance from even a couple of the top holdings can have an outsize effect on the overall fund.

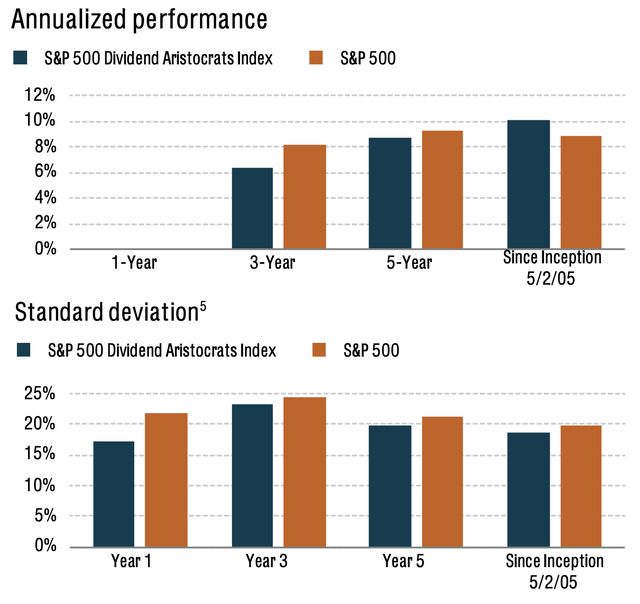

What is the effect of all of this on NOBL’s performance characteristics? Again, in the fund’s fact sheet, ProShares offers this interesting graphic.

NOBL: Performance Characteristics (ProShares)

In that graphic, ProShares purports to show that NOBL offers the potential for capturing most of the upside of the overall S&P 500, but with a measure of protection against downside risk.

My Short-Term and Long-Term View of NOBL

Here’s the bottom line for me. In line with the outlook shared in my last article, linked in the first paragraph of this article, I believe that NOBL may be a nice option for the year ahead. The specific investor I have in mind is one who wants to wants to “hedge their bets” to a certain extent. This investor wants to maintain exposure to the U.S. stock market in the event that things do not turn out to be as difficult I think they could be, but still have a solid footing if they do.

In that case, I believe NOBL has something to offer. Both the type of companies featured in the fund, as well as NOBL’s equal-weighting approach, should offer a measure of downside protection while still allowing opportunities for moderate growth.

Over the longer term, however, I believe there are better options. While this is the first time I have mentioned it, NOBL carries an expense ratio of .35%. That alone puts it a competitive disadvantage when compared to somewhat similar ETFs such as Vanguard Dividend Appreciation ETF (VIG), iShares Core Dividend Growth ETF (DGRO), and my personal favorite Schwab U.S. Dividend Equity ETF (SCHD). In addition, each of those other ETFs offer greater opportunities for growth over the long term.

I might summarize things this way. If one is more interested in downside protection than upside opportunity, I might move funds into NOBL at this point in time. However, if the market downdraft I believe possible over the next 9-12 months actually transpires, I would then look to move out of NOBL and into either one of the ETFs I have referenced above or, if one is looking for even greater growth, a total-U.S. market fund such as Vanguard Total Stock Market ETF (VTI).

What do you think? Please take a minute to share your thoughts in the comments section below. I think it is a most interesting discussion, and I welcome all viewpoints.

Be the first to comment