Petmal

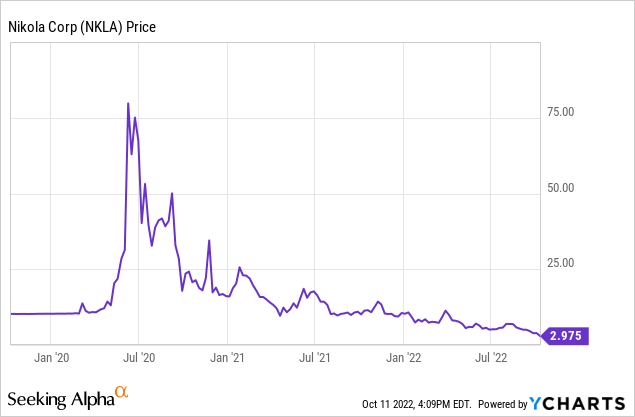

Nikola (NASDAQ:NKLA) has somehow managed to survive countless news-worthy scandals over the past few years. Despite Nikola’s tenacity, the company is in an even worse position than it was in 2020. As a reminder, explosive fraud allegation was levied against the company during that year, which has caused the company’s valuation to drop ever since.

While Nikola has eliminated the main source of its issues, that being former CEO Trevor Milton, the company is still in an incredibly weak state. Nikola is still working with a relatively unproven technology and is competing with clean energy transport heavyweights like Tesla (TSLA). To make matters worse, Tesla announced that it is starting Semi electric truck production, which means that Nikola will be competing directly with Tesla.

Nikola has seen its valuation plummet in the wake of numerous scandals.

Competing with Heavyweights

Gone are the days when Nikola had a real chance at being a top player in the clean energy transportation industry. Now that it has become increasingly clear that the days of ICE vehicles are numbered, traditional car companies have flooded the clean energy transportation industry. Nikola will have to worry about competition more than ever before as giant traditional automakers like GM (GM) and Toyota (TM) (OTCPK:TOYOF) start to invest more heavily in electric vehicles and hydrogen technology.

These traditional auto manufacturers are investing tens of billions of dollars in clean technology, much of which will go to improving their own hydrogen technologies. GM, for instance, is planning to spend a whopping $20 billion over the next five years to reach its zero emissions goal. This amount is alone worth ~7x Nikola’s entire market capitalization.

What’s more, policy appears to be favoring electric vehicle development over hydrogen vehicle development, which is not surprising given the growing popularity of EVs domestically and globally. This will put Nikola at a disadvantage as the company’s primary differentiator is its hydrogen technology.

Lack of Infrastructure

Even if Nikola’s technology proves to be viable in the long term, the company lacks the resources to build a truly competitive infrastructure. Nikola is currently partnering with TC Energy (TRP) to build out its own hydrogen infrastructure with stations known as “hydrogen hubs.” While Nikola clearly has grand ambitions for a country-wide hydrogen infrastructure, the current hydrogen refueling infrastructure is minimal at best.

Not only will a nation-wide hydrogen infrastructure take countless billions of dollars to roll out, but it is also competing against established EV charging infrastructure. To make matters worse, policy makers will almost certainly prioritize subsidizing an EV infrastructure as we are already witnessing. After all, most of the investments and attention from the auto industry is now laser focused on EV.

Nikola’s lack of infrastructure will be a major roadblock to its long-term ambitions.

NikolaMotor

Potential Upside

While EVs appear to be the wave of the future, there are compelling arguments to be made that hydrogen fuel cells would work better for higher mass vehicles like trucks. The higher energy density of hydrogen could make it better suited to handle heavier loads. In this regard, Nikola is very well positioned given that it is at the forefront of this industry. Moreover, the company has developed a loyal following that could help drive hype for its products.

The trucking industry is fairly large, with the market being worth $732.3 billion in the US alone according to Statista. If Nikola is able to get even a piece of this sizable market, the company could see its share price skyrocket. Unfortunately, this scenario seems incredibly unlikely given the company’s current state.

Conclusion

Nikola is dealing with issues on many fronts, from a stained reputation to ramping competition. To make matters worse, the company has an incredibly shaky balance sheet. In fact, the company was so low in cash in 2021 that it had to scrap some of its plans. The company only had $841.8 million in total liquidity in Q2, which does represent a modest increase from $794.0 million in Q1.

Nikola’s downward slide will likely continue even at its current valuation of $1.4 billion, which stands in sharp contrast to its inexplicitly high valuation of ~$32 billion at its peak. The clean energy transportation industry is simply far too crowded and competitive for Nikola to effectively compete in over the long term.

Be the first to comment