Emma McIntyre

Did you know that my mother was a former beauty queen?

She was a Miss South Carolina contestant and also the winner of the Miss Sun Fun pageant in Myrtle Beach, SC.

She was supposed to meet Elvis Presley once, but he cancelled his trip at the last minute. I joke with her that if she would’ve meet him, my last name could’ve been Brad Presley.

So, about you?

Are you an Elvis fan?

Who couldn’t like Elvis, right?

One of my favorite songs, Blue Christmas, goes like this:

I’ll have a blue Christmas without you. I’ll be so blue just thinking about you. Decorations of red on a green Christmas tree. Won’t be the same, dear, if you’re not here with me

And when those blue snowflakes start fallin’. That’s when those blue memories start callin’. You’ll be doin’ all right with your Christmas of white. But I’ll have a blue, blue, blue, blue Christmas

You’ll be doin’ all right with your Christmas of white. But I’ll have a blue, blue, blue, blue Christmas

So, let me be perfectly clear…

I don’t want any of you to have a “Blue Christmas,” which is why I decided to provide you with this timely article…

As we go through our list of real estate investment trusts (“REITs”) on the list, you will notice a few things:

- They all trade at a great valuation

- They all have strong Balance Sheets

- They are all leaders within their respective sectors

- They all have Buy or Strong Buy ratings at iREIT on Alpha.

Christmas REIT #1: Prologis, Inc. (PLD)

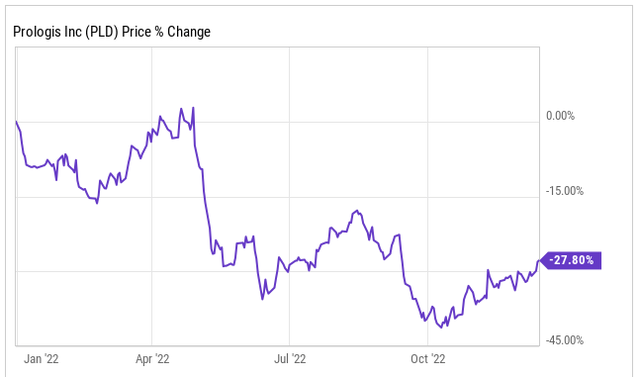

Let’s begin with a warehouse leader in Prologis, which started off the year great, easily outpacing the S&P 500 (SP500) until the wheels fell off in the spring. That is when a lot of negativity started surrounding the company, much of which we believe was far too exaggerated.

On the year, shares of Prologis are down nearly 30%, but they have been climbing off their October lows of late. Shares are up 22% since hitting their October lows, and we have been making investors aware the entire time.

This blue-chip REIT is one that should be on everyone’s Christmas list. Prologis has an A rated balance sheet, which has allowed them to continue to expand at a low cos. This is even more of an advantage in a period of rising rates.

During the period when the stock started its descent in the spring, a couple of things happened.

First, Amazon.com, Inc. (AMZN) came out with an earnings report and had some commentary about being overstretched in terms of its warehouse space. This impacted stocks, but like we have seen in subsequent report, Amazon has not lowered its exposure to PLD because they have the best warehouses in the business.

On top of that, the company announced their acquisition of Duke Realty, which many investors questioned at the time due largely to valuations, which was a valid gripe.

Both of those things hitting at the same time, in addition to the stock being priced to perfection, led to the sizable sell-off we saw in PLD shares.

The acquisition of Duke Realty will have an immediate impact on a portfolio already sitting with a 99% occupancy rate. This will allow more pricing power for PLD moving forward.

After all that has gone on, we now are getting a great opportunity to add shares of a blue-chip REIT at a much more reasonable price.

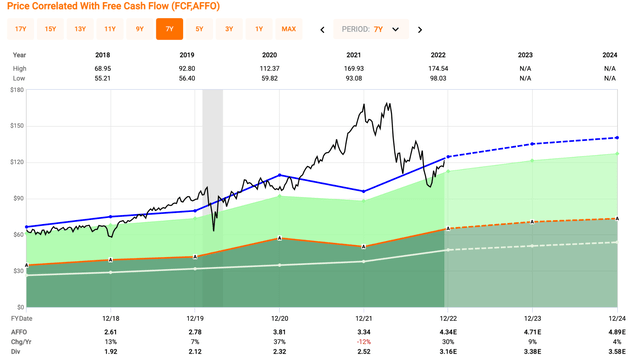

Shares of PLD are currently trading at a forward P/AFFO of 25.8x as analysts are looking for 9% AFFO growth in ‘23. Over the past five years, PLD shares have traded with an average AFFO multiple of 28.7x.

At iREIT on Alpha, we currently rate shares of PLD as a STRONG BUY.

Christmas REIT #2: Realty Income Corporation (O)

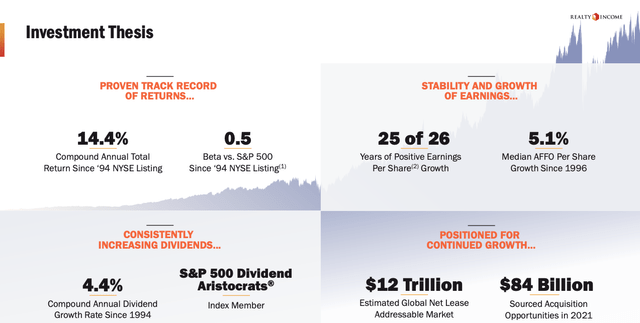

We cannot have a Christmas wish list without mentioning the monthly dividend darling, which is Realty Income. Realty Income went public back in 1994, and has been what seems to be a fan favorite ever since.

Since going public, this net-lease REIT has generated 14.4% in compound annual returns, and has had positive earnings every year except one. This is bringing good cheer to investors.

Realty Income Investor Presentation

Realty Income is known for their Monthly Dividend, something that became so popular they trademarked themselves “The Monthly Dividend Company.”

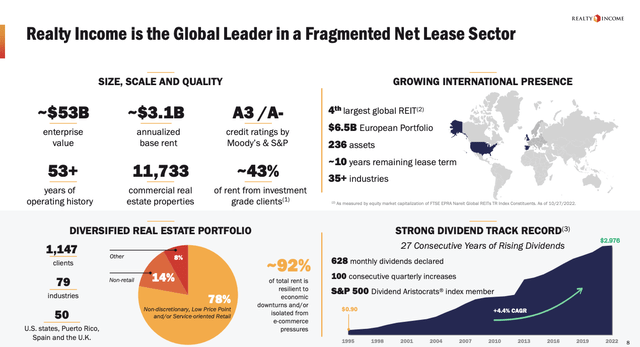

However, they are much more than just a REIT that pays a monthly dividend. That is great and all, but the strong portfolio is what allows them to do this. Realty Income has a portfolio that consists of over 11,700 properties, nearly 1,150 customers within 79 industries. The company has a well-diversified portfolio of high-demand properties in all 50 states.

Realty Income Investor Presentation

Similar to PLD, Realty Income also operates with a high occupancy rate of 98.9%. Management has guided for a rate above 98% throughout the year, which is a benchmark the company has met every year since 2013. The lowest we have seen was 96.6% at the depths of the Great Recession.

One unique angle, when looking into Realty Income, has been their movement into the gaming space. In the past year, the company has acquired multiple gaming properties, including a Wynn Resorts (WYNN) property they recently acquired for $1.7 billion.

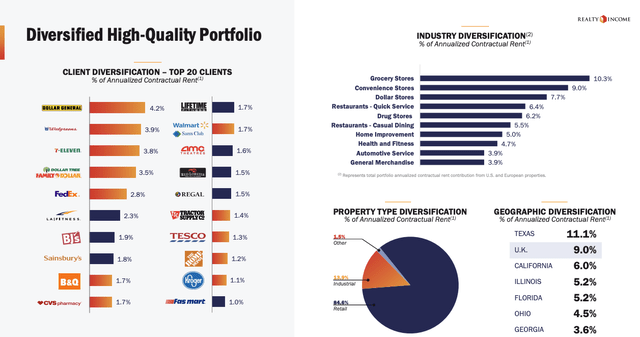

Given where things are in terms of the U.S. economy, the portfolio is very resilient to economic downturns as well as the threat of e-commerce, given their exposure to the retail sector. Although they have exposure to retail, it is a focused retail that is in need regardless of the economic cycle, such as grocery stores that are their primary exposure.

Here is a look at their top tenants.

Realty Income Investor Presentation

Also similar to PLD is the fact that Realty Income sports an A-rated Balance Sheet, which helps differentiate themselves within their sector. The company’s fortress balance sheet has a net debt of 5.2x to annualized Pro-forma adj. EBITDAre along with a 5.5x fixed charge coverage ratio.

Consistent results, strong portfolio, superb management team, and their A credit rating all leads to Realty income trading at a premium to its peers.

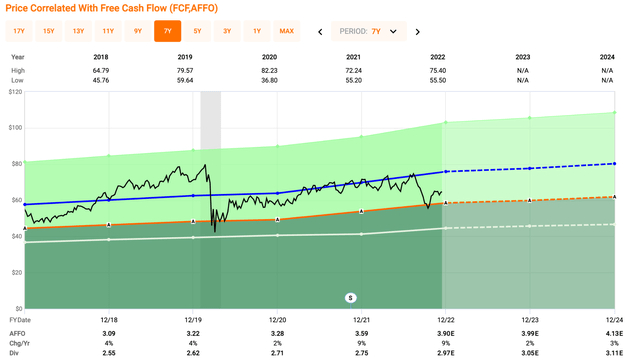

Speaking of that premium, shares of Realty Income have traded at an average AFFO multiple of 19.5x over the past five years. Currently, shares of O trade at a forward AFFO multiple of 16.2x.

iREIT on Alpha rates shares of Realty Income as a Buy.

Christmas REIT #3 – Digital Realty Trust, Inc. (DLR)

The final REIT on our Christmas List has found itself on the naughty list in 2022 for many investors. When speaking of quality, Digital Realty is just a notch below the first two REITs on our list today, and when discussing safety, it is again well below Realty Income and Prologis.

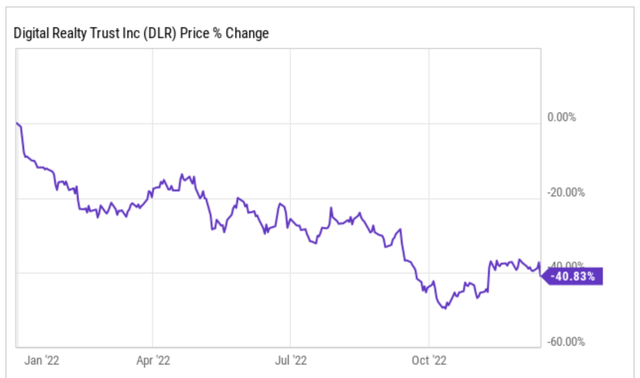

Digital Realty is a data center REIT, and a leader within its space, but has fallen on tough times. Shares of the data center REIT are down 40% on the year.

Data centers have largely been in demand for a number of years, but the pandemic sent demand through the roof as more businesses moved online and became more remote.

However, given the run these REITs saw during the pandemic, famed short seller Jim Chanos came out with a short report against data center REITs, including Digital Realty.

Valuation was a component, but even more was the idea that big tech giants, such as Microsoft (MSFT), Amazon, and Alphabet (GOOG, GOOGL), would soon turn away from these REITs in favor of their own buildings.

This is true, there is no disputing that, but there are some holes in the thesis. It is going to take years for those buildings to be built and for the companies to bring everything in-house. A lot of time and capital would need to be allocated. Do we really think that big tech wants to shell out all that money and put all reliability on their own properties? I am not convinced.

DLR is one of the largest Data Center REITs on the market today, and the largest global provider of cloud and carrier-neutral data center and interconnection solutions.

Demand continues to be strong, and we do not foresee that demand changing anytime soon. One way to analyze this is by looking into the company’s bookings, which have been growing for over a decade now.

DLR has over 4,000 global customers and over 300 data centers across the globe, making them one of the top 10 largest U.S. REITs on the market today.

Given the strong pullback in shares of DLR, the company now yields a dividend of 4.7%. The dividend is easily covered with an AFFO payout ratio of 82%.

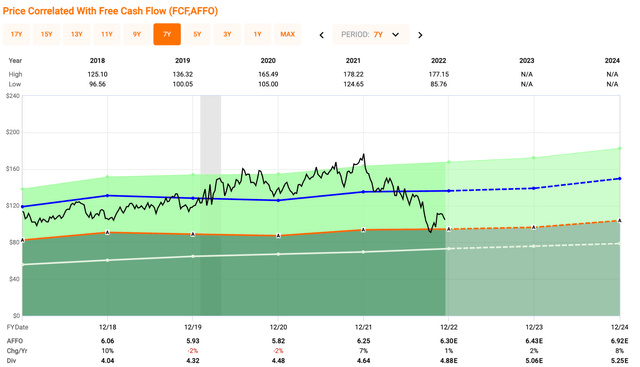

In terms of valuation, with shares trading at levels last seen 2016, DLR trades at a forward AFFO multiple of just 16.3x. Over the past five years, shares of DLR have averaged a multiple of 20x, suggesting shares are very undervalued at the moment.

At iREIT on Alpha, we currently rate shares of DLR as a STRONG BUY.

In Closing…

Special thanks to my mother, who inspired me to become a real estate investor. Although it would’ve been fun to be associated with the legendary “King of Rock n’ Roll,” I’m thankful for being the son of a hard-working mother who taught me how to always insist on quality and to live life to the fullest.

Happy Holidays and Merry Christmas to All!

Brad Thomas

Be the first to comment