shaunl

The mortgage insurance business is not sexy, but it is an integral part of our housing industry infrastructure. The industry got ravaged in the Financial Crisis, crushed by shoddy and fraudulent underwriting, a housing bubble of unprecedented proportions in this country, and the worst U.S. recession since the Great Depression. Like with banking, the industry was totally revamped and recapitalized, and is far less risky moving forward. NMI Holdings (NASDAQ:NMIH) has a very strong insured portfolio that should continue to produce robust recurring revenues for many years into the future, and the stock is trading far too cheaply relative to its future cash flow prospects.

NMIH has benefitted from not having the legacy pre-Financial Crisis exposure of some of its larger peers, which surprisingly still account for a large percentage of defaults and losses. I wrote about the company in December of last year and while the outlook might be a bit murkier for the general economy, I think the discounted current valuation of the stock makes for a better buy at current prices. 2020, the year of Covid-19 and the dreaded lockdowns, was an unprecedented challenge in many ways.

Defaults rose rapidly as mortgage forbearance was a key part of the government’s strategy to halt an economic collapse. Somewhat astonishingly, housing prices went through the roof as the dynamics of a supply shortage, work-from-home, and families simply wanting more space to live bore fruit. Default rates have plunged lower and lower as people became current on their mortgages once again, but now this inflation-driven recession is likely to have ramifications, and stocks have taken a beating in response.

Housing prices in many markets are starting to come down slightly, which is not a bad thing in that affordability has never been worse than it has been, especially with the increase in mortgage rates. Most homeowners have equity given the appreciation of the last few years and even if they are pressured with a job loss, they likely would have the option to sell their home before defaulting. The Great Recession combined a truly historic housing bubble, littered with systemically fraudulent underwriting.

While ZIRP policies have inflated assets, the huge supply shortage from reduced building in the years following the recession have created a far healthier housing market than it was then, when there was huge oversupply. Mortgage underwriting is far more stringent, which I believe we’ll really see proven once again in this next year or so, like we saw in 2020 already. This is unlikely to be a typical recession in that it is starting from peak unemployment.

Many areas of the economy are still pretty strong, including consumer spending. Car manufacturers have huge waiting lists, which is not something I’ve ever seen industrywide in my lifetime. Many commodity prices are starting to roll over, which gives me hope that we have seen the worst of inflation, which would greatly reduce the risk of a major recession, assuming the Federal Reserve was able to stop raising rates after maybe one more hike. The Treasury bond market is sending a message with its substantial decline, and I’d expect mortgage rates to follow, as spreads are historically wide. This could be a good situation for mortgage insurers as they’ll have high persistency, but housing would likely be reasonably strong given better affordability for those still in the market.

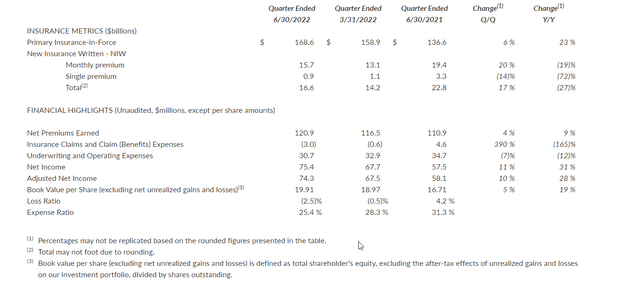

On August 2nd, NMI Holdings reported net income of $75.4MM, or $.86 per diluted share, which was up from $67.7MM, or $.77 per diluted share in Q1, and up from $57.5MM, or $.65 per diluted share at the same time last year. Primary insurance-in-force at quarter end was $168.6B, up 6% from $158.9B in Q1, and up 23% compared to $136.6B in Q2 of 2021. Net premiums earned were $120.8MM, up 4% sequentially, and 9% YoY. Underwriting and operating expenses were $30.7MM, down 7% sequentially, and 12% YoY. Insurance claim and claim expenses was a benefit of $3.0MM, compared to a benefit of $.6MM in Q1, and an expense of $4.6MM in Q2 of 2021.

Loans in default have dropped to 4,271, from 5,238 in Q1, and 8,764 in Q2 of 2021. This makes for a paltry default rate of .77%. Annual persistency rose to 76% in Q2, up from 71.5% in Q1 and just 53.9% in Q2 of last year. This is a result of higher rates making refinancings unviable for most, allowing for a stable revenue and earnings stream for the company. The net premium yield has been dropping over the last year but stabilized in Q2 at .3%. I would expect for rates to perk up a bit as the macroeconomic environment becomes more dire.

NMIH Q2 Financial Results Press Release

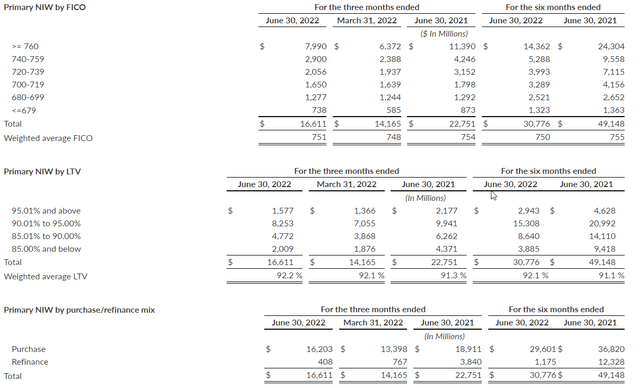

When you look at the credit quality as exhibited by high FICOs and relatively low LTVs in NMIH’s insurance portfolio, you can see the steps taken by the company and the industry to reduce risks. With the unemployment rate at 3.6%, although likely to go higher, the stage is not set for a complete housing collapse like 2008. I actually think the current outlook is far better than it was in 2020 for the mortgage insurance industry and I’d be shocked if the industry didn’t remain solidly profitable, despite a likely increase in defaults as the economy weakens. NMIH made just as much money in 2020 as it did in 2019, then followed up the lockdown year with huge earnings growth.

The company is healthily reserved for the current environment and could deal with far worse. One of the major industry changes has been the risk redistribution with tools such as insurance-linked notes, which kick in when losses breach a certain level, while also serving the purpose of reducing capital charges. Earnings before taxes were $297MM in 2021 and are on pace to be much higher this year, so dealing with a little increase in provisioning is really not going to change the picture much for a long-term investor, as it is simply the cost of doing business.

Shareholders’ equity was $1.5B at the end of the quarter, while book value per share was $18.01. These figures were negatively impacted by losses in the investment portfolio like many other financial companies. If it weren’t for those losses stemming from higher rates, book value per share would have been $19.91, up 5% sequentially and 19% YoY. With the rather significant decline we have seen in interest rates since the end of the quarter, there is a good chance some of these losses should reverse themselves in Q3, but there is still a lot of time for things to change.

NMIH and its peers have been generating impressive returns on equity, with NMIH attaining an annualized ROE of 19.7% in Q2, and an adjusted annualized ROE of 19.4%. At the end of Q2, total PMIERs available assets were $2.2B and net risk-based required assets were $1.2B.

NMIH Q2 Financial Results Press Release

Based on 86.577MM shares outstanding and a recent price of $18.75, NMIH has a market capitalization of roughly $1.6233B. The forward P/E is a paltry 5.8 and the stock trades at just 1.04x an AOCI-depressed book value. The company made $231MM in 2021 and should make more than that this year and next, while also growing book value per share ex-AOCI. This is a better business than it is given credit for and unless you believe this is 2008 all over again for the housing market, you should give these stocks consideration.

I believe the stock should earn at least $3 per share in 2022 barring a major collapse in housing, so putting a 10 multiple on that would make this a $30 stock. The earnings power is definitively growing with the insured portfolio, and this will be another good stress test that validates the changed industry model. I expect ROEs for NMIH to stay healthily in the mid-teens, which makes the current price far too cheap.

Be the first to comment