CreativaImages

Introduction

In August 2021, I wrote a bearish article on SA about TSX and OTCQX-listed mining company NioCorp Developments (OTCQX:NIOBF) in which I said that I doubted that its Elk Creek project would be built anytime soon or maybe even at all as demand for scandium just isn’t there.

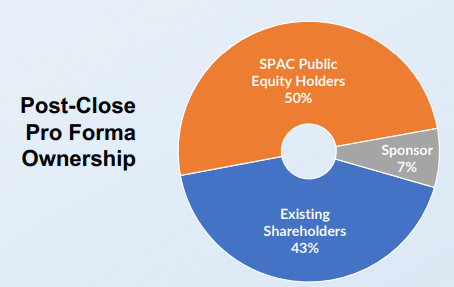

I was surprised to learn that NioCorp recently inked a business combination deal with a special purpose acquisition company named GX Acquisition Corp II (NASDAQ:GXII). You see, SPACs usually merge with unlisted companies and also this particular one had stated that it was looking for a business with an enterprise value of above $1 billion, which is several times higher than NioCorp’s.

Assuming there are no redemptions, the merger could generate net cash of up to $285 million for the combined company. However, this isn’t even close to enough to fund the $1.14 billion initial CAPEX for Elk Creek and the boost for the share price following the announcement of the deal seems to be fading. In addition, NioCorp still has a serious scandium pricing issue. Let’s review.

Overview of the recent developments

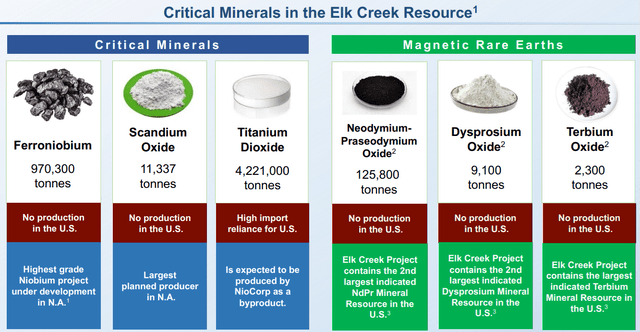

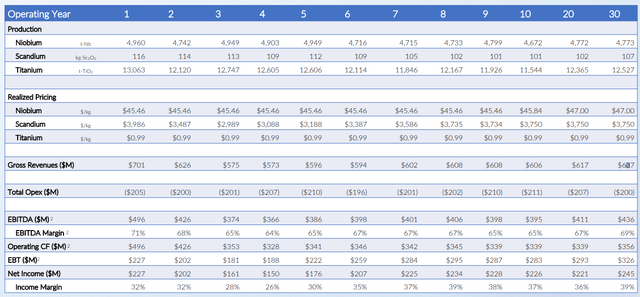

In case you haven’t read my previous article about NioCorp, here’s a short description of the business. The company’s main asset is the Elk Creek critical minerals project in Nebraska, which hosts large deposits of niobium, scandium, titanium, and rare earth elements. Scandium is key here as this metal is expected to account for almost two-thirds of the life of mine gross revenues.

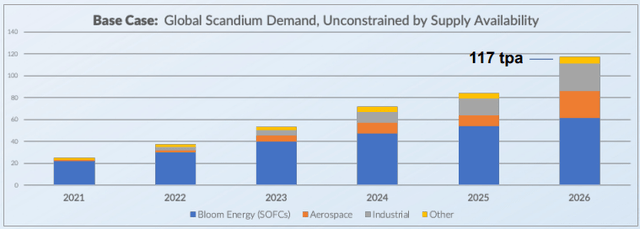

NioCorp

So, what is scandium? Well, it’s a little-known silvery-white metallic d-block element, which has historically been classified as a rare-earth element. It’s mainly used in solid oxide fuel cells and as an additive to aluminum. Major aircraft manufacturers have been researching for years how to use it in aluminum alloys to reduce weight. Fellow SA contributor Tim Worstall used to be major scandium wholesaler in the 00s and previously said that the global market is perhaps 20 tonnes a year maximum. Obviously, the current market is too small for scandium to be widely used in the aerospace industry. According to NioCorp’s latest corporate presentation, global demand would be close to 40 tonnes for 2022 if the market was unconstrained by supply availability and this would also lead to growing adoption over the coming years.

NioCorp

Unfortunately, this is a small and obscure market and it’s hard to tell where prices are going. You can easily find 99.9% scandium oxide listed on Alibaba (NYSE:BABA) at $800 per kg or lower as of the time of writing and that price is pretty much the same as when my first article about NioCorp came out. If annual demand is about 20 tonnes, this means the scandium market is worth only around $16 million per year.

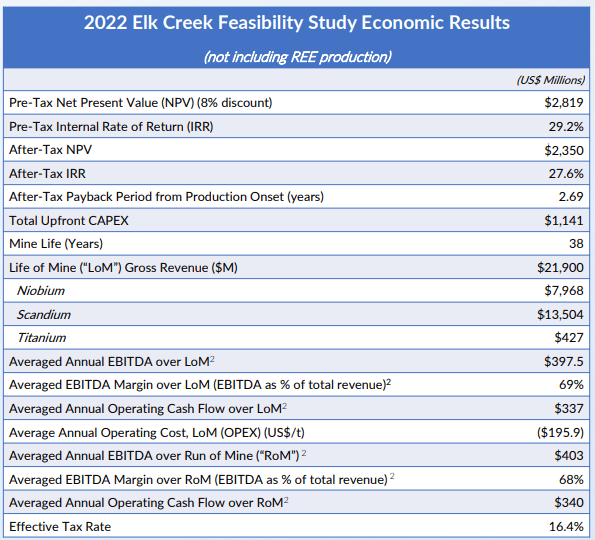

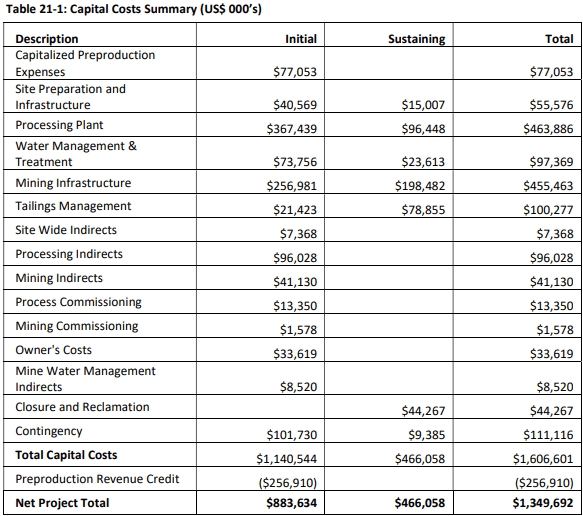

Turning our attention back to Elk Creek, this is a large project with initial CAPEX estimated at $1.14 billion and gross revenues of $21.9 billion over a life of mine of 38 years. According to the updated feasibility study, the internal rate of return [IRR] is estimated at 29.2% while the after-tax net present value [NPV] stands at $2.35 billion. In my view, any IRR above 20% for a mining project is solid. Scandium is expected to account for over $13.5 billion life of mine gross revenues.

NioCorp

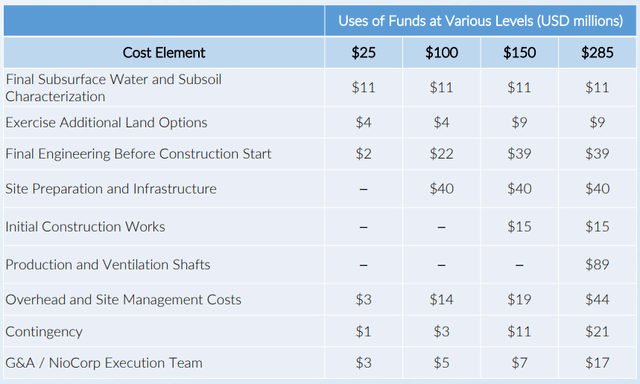

Turning our attention to the deal with GX Acquisition Corp II, NioCorp will receive up to $285 million in cash and its existing shareholders will keep a 43% stake in the company. Assuming there are no redemptions, NioCorp will have an enterprise value of $313.5 million at $10 per GX Acquisition Corp II share. NioCorp plans to use the fresh funds to move Elk Creek closer to the construction phase.

NioCorp

The company has prepared several scenarios for the use of the funds depending on redemption rate levels and it seems that the priority is final subsurface water and subsoil characterization. The transaction is expected to close in the first quarter of 2023.

NioCorp

Unfortunately for investors, NioCorp will need to find a lot more funding for Elk Creek even if there are no redemptions. The processing plant alone is estimated to cost over $360 million and the company hasn’t started funding or building it.

NioCorp

In my view, securing additional funding is going to be challenging considering NioCorp has made little progress in finding more offtake agreements for its scandium production. The company currently has commercial sales agreements covering up to 120 tonnes for the first decade of production, which means it hasn’t secured any new deals for more than 4 years (the only commercial sales agreement was inked in 2018). This amount is equal to just 12% of Elk Creek’s output in the first 10 years of commercial operation. Sure, demand for the metal would be much higher if supply was unconstrained but even those numbers don’t add up as Elk Creek is expected to have an annual output of 104 tonnes. The company would need to wait until at least 2026 for demand to increase enough to absorb production from the mine. And this is assuming no other major scandium project makes it to production in that timeframe.

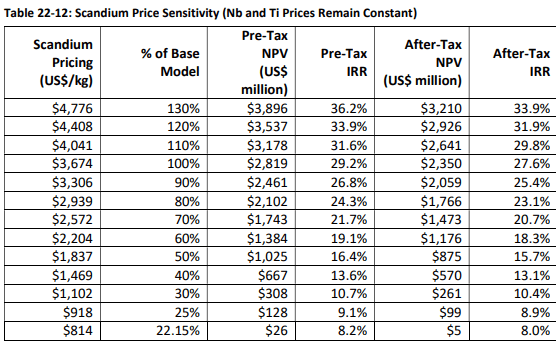

The other issue here is the selling price. You see, NioCorp estimates it will be able to sell scandium at above $3,000 per kg for the majority of the mine life and this price seems unrealistic. As Tim Worstall pointed out before, those prices are for the small amounts of scandium delivered into US factories. And as I mentioned, you can easily find 99.9% Scandium oxide in China for less than $800 per kg.

NioCorp

If NioCorp floods the market, it’s likely the price would go much lower. Elk Creek is set to be so large that the company could get a 100% market share if it drops prices to something like $500 per kg but it still wouldn’t be able to sell even half of its production (as a reminder, potential demand is estimated at about 40 tonnes for 2022). Even if the price of scandium somehow stays at $800 per kg when Elk Creek enters commercial operation, the situation looks bad. The project’s break-even after-tax pricing for scandium is $1,130 per kg. Even if the company somehow manages to sell all of the scandium it produces, the NPV drops below zero near $800 per kg.

NioCorp

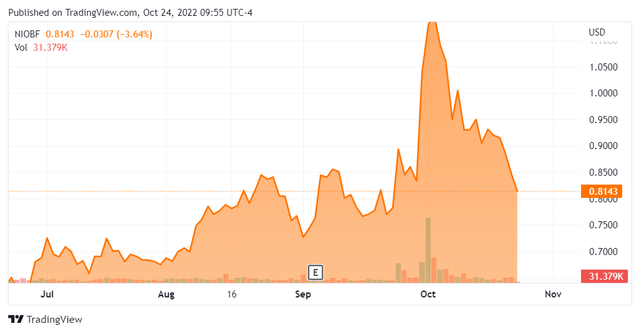

Overall, I think that NioCorp is unlikely to secure enough funding for the construction phase due to these numbers and this means that Elk Creek is likely to stall once again when the fresh funds from the SPAC deal are exhausted. And losing momentum is usually devastating for the market valuation of development-stage mining companies. NioCorp has limited cash at the moment which means that it’s unlikely there will be any significant developments related with Elk Creek before the merger closes in a few months and we can already see the share price gradually declining since early October. NioCorp was trading above $1.20 per share shortly after the announcement of the SPAC deal and is down below $0.85 as of the time of writing. In my view, it’s possible that the share price will return below $0.70 once again in the near future.

Seeking Alpha

However, short selling mining companies is dangerous as the commodities sector is notoriously volatile. I think that investors should avoid NioCorp’s stock.

Looking at the risks for the bear case, it’s possible that I’m underestimating the growth prospects for the scandium market or the ability of NioCorp to secure funding for the initial CAPEX. However, these risks are unlikely to matter much over the next year or two as unconstrained scandium demand won’t surpass 100 tonnes per year until 2026 according to NioCorp’s own corporate presentation.

Investor takeaway

NioCorp is uplisting to Nasdaq thanks to a SPAC deal which comes with up to $285 million in cash. However, this sum is nowhere near enough to fund initial CAPEX at Elk Creek and it’s possible it’s much lower when deal closes if redemptions are high.

In addition, NioCorp hasn’t secured any new offtake deals for its scandium production since my first article. Even if it did, the NPV of Elk Creek is negative below $800 per tonne and this is likely to make it challenging to get additional funding in the future. Avoid this stock.

Be the first to comment