Andy Feng

Thesis

I’ve written a few pieces on NIO (NYSE:NIO), with the most recent one published in early November with a focus on its Q3 earnings report . The main thesis in that article is:

Based on the Q3 results, I see too many headwinds in the next ~2 years to keep its prices in the single-digit range. These headwinds include political uncertainty, margin pressure, COVID restrictions, and uncertain EV subsidies.

That article, as a review on its Q3 results, attempted to cover all the above issues with broad strokes. In this article, I wanted to zoom in and focus on one issue in more depth: the margin pressure from the price war that Tesla (TSLA) started recently.

The NIO bull thesis is a textbook example of a growth story. However, like all growth stocks, shareholder returns eventually have to come from profit growth, not sales growth. A core weakness I’ve raised in the past is that NIO has only reported net losses, AND I want to further point out that the price war alone is a roadblock tall enough to block its profitability in the near term. Management recognized the profitability issue and set a goal for its core business to break even by 2023 during the Q3 earnings report.

Again, I see this goal to be very unlikely even just due to the price war alone. On top of the price war, all the other headwinds I pointed out earlier (policy uncertainties and the possibility of COVID resurgence) and also management mentioned (i.e., battery costs and foreign exchange rates) will very like persist into 2023 too. And next, I will detail my thoughts on the core thesis of this article: the impacts of the price cut TSLA started in Oct 2022.

Tesla’s price cuts

Tesla announced that it will cut its EV prices in China by up to 9%. And many analysts see this as a warning of a “price war” in the EV space according to the following Reuters report (the emphasis were added by me):

Tesla has cut starter prices for its Model 3 and Model Y cars by as much as 9% in China, reversing a trend of increases across the industry amid signs of softening demand in the world’s largest auto market. The price cuts, posted in listings on the electric vehicle (EV) giant’s China website on Monday, are the first by Tesla in China in 2022, and come after Tesla began offering limited incentives to buyers who opted for its insurance last month.

Shortly after Tesla’s price cut announcement, several other EV makers followed. They offered a variety of incentives ranging from direct price cuts to insurance rebates. In the meantime, the China government’s subsidy on EV purchases is scheduled to expire in 2023. Combining these effects, I anticipate cars in the RMB150k to 300k range to face the greater pricing competition and impact many of NIO’s lineups.

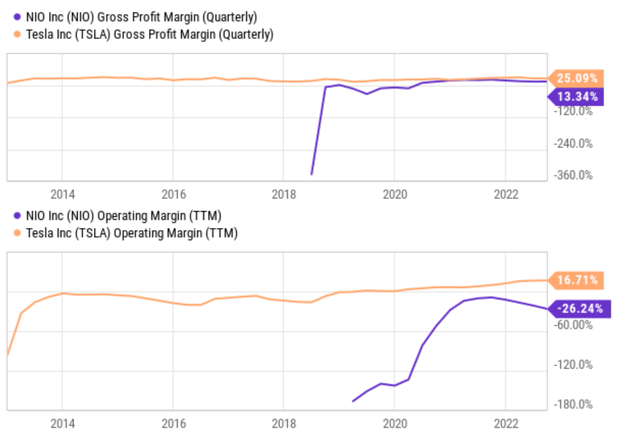

NIO is at a disadvantage in such a price war against TSLA due to brand image, margins, and profitability as you can see from the following chart. NIO has not been able to make a net profit yet as aforementioned. So here I’m comparing their gross profit margin and also operating margin. As seen from the top panel below, NIO’s gross profit margin has been around 13.3% in recent quarters, only about half of Tesla’s 25.1%. In terms of operating margin, NIO has been in the negatives so far and its current value is -26.2%, while Tesla’s operating margin is a positive 16.7%.

And next, we will see that there are headwinds that prevent NIO from translating sales growth into profit growth.

Source: Seeking Alpha data

Sales are not turned into profits

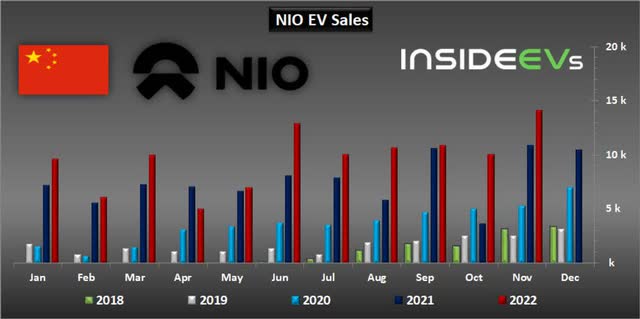

As a growth stock, NIO has been enjoying remarkable topline growth as you can see from the following chart from InsideEVs. To wit, it just reported record-high monthly delivery in November 2022. Its November total deliveries reached 14.1k vehicles, translating into a growth rate of 30.3% YoY and 40.9% MoM. More specifically, according to this SA report,

The deliveries consisted of 8,003 premium smart electric SUVs including 4,897 ES7s, and 6,175 premium smart electric sedans including 3,207 ET7s and 2,968 ET5s. Cumulative deliveries of NIO vehicles reached 273,741 as of November 30, 2022. NIO plans to further accelerate the production and delivery in December 2022.

Source: insideevs.com

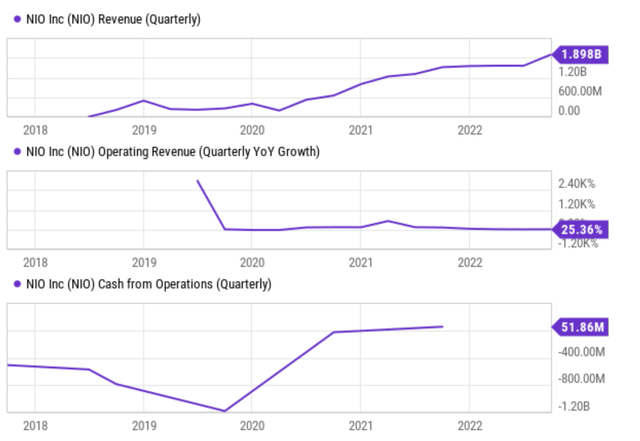

The delivery growth (and also the further anticipated growth) has certainly led to remarkable sales growth as seen from the plot below. NIO’s total revenues (on a quarterly basis) increased from below $400M in 2020 to the current $1.89B in less than 2 years. And the YoY growth rate of its total revenues is 31.11% and the 3-year CAGR is a neck-breaking 72.40%. Its operating revenues have also been growing at an impressive annual rate of around 25% as shown in the mid-panel too.

The problem is that NIO is yet to turn a profit as seen in the bottom panel of this chart. Its cash from operations is a mere $51.8M. As aforementioned, I anticipate the price wars started by TSLA alone to prevent it from growing its profits in 2023 in any meaningful way.

And as we will explore next, there are other strong roadblocks too.

Source: Seeking Alpha data

CAPEX and capital allocation problems

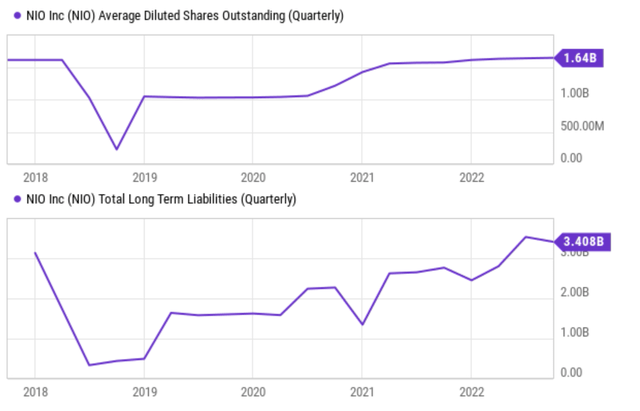

Due to the negative (or negligible) cash flow shown above, NIO has been relying on debt financing and also the issuance of new equity in the past. These issues are examined in detail in my past articles and here I will just quote the main points:

- As you can see from the top panel of the following chart, its diluted shares expanded by more than 64% since 2020, from about 1 billion outstanding shares to the current level of more than 1.64 billion shares.

- In the meanwhile, NIO’s total long-term debt have swollen substantially also. Its debt burden was the lightest during 2018 when its total long-term liabilities were only about $400M. And currently, it stands at $3.4 billion.

At the same time, its continued growth required years of continued CAPEX investment as the business expands its charging network construction, ramps up its production with new factories, and also extends its sales and product services centers in Europe. Besides the CAPEX expenses, the business’s cash problem is further exacerbated by the rising OPEX (operation expenses). To wit, its OPEX-to-sales ratio (currently at 43.1%) climbed up 2.4% in Q3 compared to Q2 and an alarming 12.7% compared to a year ago. The increase was caused by personnel costs, R&D activities, and marketing expenses for its expansion both domestically and in Europe. I see all these OPEX headwinds to persist given the current macroeconomic conditions.

Source: Seeking Alpha data

Final thoughts

To recap, my view is that it is very unlikely for NIO’s core business to break even in 2023 due to a range of headwinds. My last article has analyzed these headwinds (political uncertainty, margin pressure, COVID restrictions, and uncertain EV subsidies) in broader strokes. And this article focuses on a key issue in more depth: the price war started by Tesla recently. I see NIO at a tremendous disadvantage in this price war against TSLA due to brand image, margins, and profitability considerations. In a nutshell, I see the situation as NIO being forced into an unwinnable war.

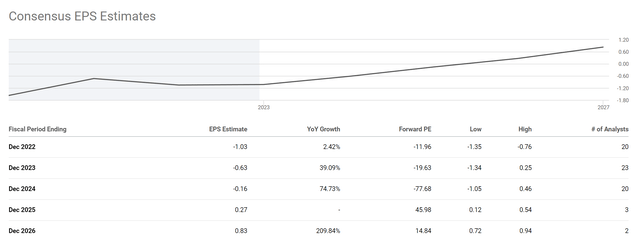

Besides, the price war, there are other speedbumps to consider as well, such as the 2023 expiration of the Chinese government’s subsidies, the higher battery costs, and also its higher CAPEX requirements amid negative or negligible operating cash flow. The consensus estimates seem to be pessimistic about this goal too as you can see from their following forecasts. The consensus estimates project negative EPS to continue into 2024, followed by a small positive EPS of $0.27 only in 2025 (which translates into a P/E of ~46x at today’s stock prices).

And I feel this consensus estimates on the optimistic side. For example, as just mentioned, its share count could be further diluted due to the need for additional capital (and the dilution could happen at low stock prices to make things worse). Such a dilution would cause the actual EPS to be even lower than the forecasts.

Source: Seeking Alpha data

Be the first to comment