Andy Feng

Shares of electric vehicle manufacturers surged last week despite Chinese EV firm XPeng (XPEV) issuing a light delivery forecast for the fourth-quarter. Chinese electric vehicle start-ups also released their monthly updates for deliveries which saw recovering growth, especially for NIO (NYSE:NIO) and Li Auto (LI). Although NIO’s delivery card for November was good, I believe the sector is headed for more trouble in the short term, largely because the Chinese economy is weakening rapidly!

Delivery update for the month of November

The good news first: NIO saw a strong recovery in delivery volumes in the month of November and reported record deliveries of 14,178 electric vehicles. NIO’s delivery volumes increased 30.3% year over year, chiefly due to the company’s impressive ramp of sedan models which continued to accelerate in November. NIO saw the second-strongest month-over-month rebound in its industry group after Li Auto.

Li Auto delivered 15,034 electric vehicles in November which was also a monthly delivery record and the highest total delivery volume in the industry group. XPeng continued to struggle in the third quarter as well as in November: the start-up, which is currently in the process of ramping up production for the mid-size G9 sport utility vehicle, delivered just 5,811 electric vehicles, mostly P7 smart sport sedans and the company saw just 13.9% month over month growth. XPeng also issued a very light delivery forecast for the fourth-quarter to which I am getting further below.

The delivery comparison table for the top-three Chinese EV start-ups looks like this.

|

Deliveries |

September |

Sep Y/Y Growth |

October |

October Y/Y Growth |

November |

Nov Y/Y Growth |

M/M Growth |

|

NIO |

10,878 |

2.4% |

10,059 |

174.3% |

14,178 |

30.3% |

40.9% |

|

XPEV |

8,468 |

-18.7% |

5,101 |

-49.7% |

5,811 |

-62.8% |

13.9% |

|

LI |

11,531 |

62.5% |

10,052 |

31.4% |

15,034 |

11.5% |

46.6% |

(Source: Author)

Sedan delivery share now approaching 50%

If we dig a little deeper into NIO’s monthly delivery update, we can see that the start-up continued to make remarkable progress with its sedan production in November. The company only started to deliver the all-electric ET5 sedan in late September and NIO already ramped monthly deliveries up to 2,968 ET5s in November. In total, NIO delivered 6,175 sedans in November (including 3,207 ET7s). NIO’s total sedan deliveries soared 51.3% compared to October 2022 and sedans accounted for a delivery share of 43.6% last month, showing an improvement of 3 PP month over month. Considering how strongly NIO is ramping up production of its sedan products, I estimate that NIO could exceed a 50% sedan delivery share in Q1’23, meaning every second EV rolling off of NIO’s factory belts by then could be a sedan, not a sport utility vehicle.

|

NIO ET7/ET5 Metrics |

July |

August |

September |

October |

November |

|

Total Deliveries |

10,677 |

10,878 |

10,878 |

10,059 |

14,178 |

|

NIO Sedan Deliveries |

2,473 |

3,126 |

3,149 |

4,080 |

6,175 |

|

M/M Growth |

-43.1% |

26.4% |

0.7% |

29.6% |

51.3% |

|

Sedan Delivery Share |

23.2% |

28.7% |

28.9% |

40.6% |

43.6% |

(Source: Author)

XPeng’s depressing Q4’22 delivery forecast, market challenges are real

XPeng delivered mixed results for Q3’22 last week but shares nonetheless soared almost 50%. However, XPeng issued a forecast for fourth-quarter deliveries that calls for a delivery volume of only 20-21 thousand EVs, showing a decrease of 49.7-52.1% year over year.

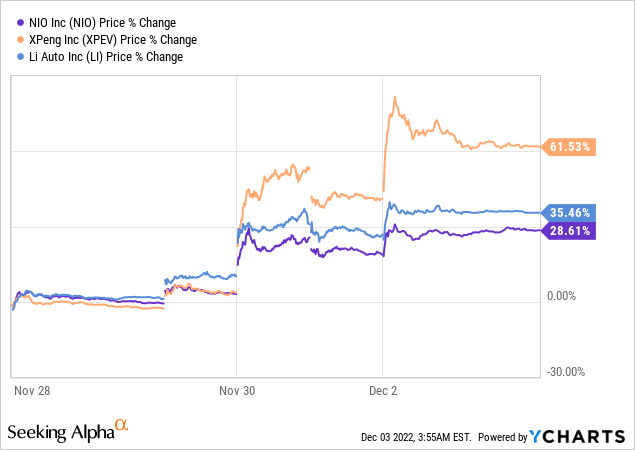

Despite the light outlook, shares of EV companies, especially XPEV, soared last week due to speculation that China could ease COVID-19 limitations.

I believe that the market overreacted last week and that there is a strong possibility that valuations will correct to the down-side again. The reason is China’s economy is slowing down and that Beijing has given no indication that it will ease COVID-19 restrictions. China’s economy is slowing on multiple fronts simultaneously including in real estate, industrial production and retail. The IMF also warned in October of a “sharp and uncharacteristic slowdown” in China and down-graded its forecast to just 3.2% annual growth… which is the “second-lowest level [of growth] since 1977”.

What is cheap may get cheaper

My opinion on NIO has evolved in 2022 (my rating has changed from a strong buy to a hold) and although I believe NIO has a great product line-up and a long-term growth opportunity in the Chinese EV market, shares could retest their lows if the Chinese economy continues to slow down in 2023.

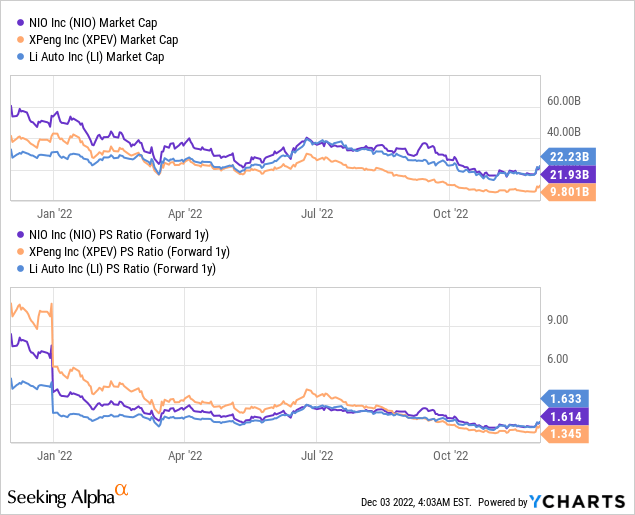

NIO’s market cap has declined about 64% this year and shares currently have a P/S ratio of 1.6 X. Li Auto and XPeng trade at about similar P/S ratios.

Risks with NIO

NIO’s production ramps, especially for the ET7 and the ET5, look promising as the company is closing in on reaching a 50% sedan delivery share in Q1’23. However, the economy in China is dangerously slowing down, meaning demand and product pricing could become problems for NIO just now that the company has navigated supply-chain trouble and finally got on top of its production situation. Weaker product pricing and declining demand could add to already growing pressure on NIO’s vehicle margins.

Final thoughts

Although valuations of XPeng, Li Auto and NIO soared last week, I believe the market’s reaction was just ridiculous. Given XPeng’s mixed results for Q3’22, weak Q4’22 delivery guidance and the context of a weakening Chinese economy, I believe investors are overly optimistic and the surge in valuations, from NIO to XPeng, is likely not deserved or sustainable.

NIO did see record monthly deliveries in November, which is great news, especially after the company struggled throughout the entire year. However, China’s economy is not in a good spot and at risk of slowing down further which could create demand, pricing and margin issues for NIO and other electric vehicle makers in the short term!

Be the first to comment