Andy Feng

NIO (NYSE:NIO) submitted its earnings card for the third-quarter last week and it showed an uptick in revenues. The outlook for the fourth-quarter is also surprisingly strong, indicating that the slowdown in deliveries that occurred due to wide-spread COVID-19 lockdowns is reversing. Unfortunately, NIO’s vehicle margins kept slightly contracting in the third-quarter which is a trend that could continue due to growing competition in the EV market and higher pricing pressure for electric vehicle products. Due to challenges with the supply chain and investors’ growing focus on profitability, I believe that the stock is likely to retest its last lows and may become a single digit stock in the near future!

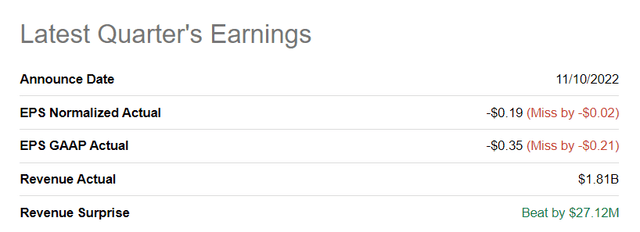

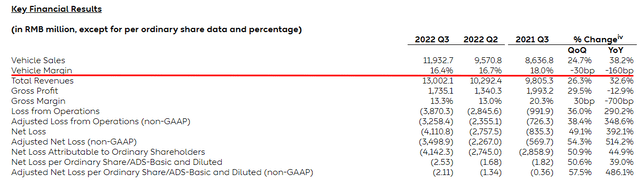

NIO’s Q3’22 earnings sheet

The Chinese EV maker reported third-quarter earnings that beat consensus predictions for the top line, but that missed EPS expectations. NIO generated revenues of 13.0B Chinese Yuan ($1.8B) in Q3’22 which beat the consensus by $27M. NIO’s adjusted EPS was $(0.19) which missed the prediction of $(0.17).

Seeking Alpha: NIO Q3’22 Results

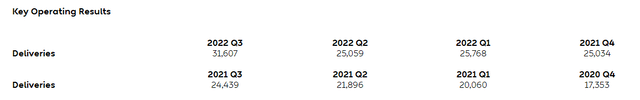

NIO issues a strong forecast for Q4’22

The biggest take-away from NIO’s earnings release was the strong outlook for the fourth-quarter. NIO projects 43-48 thousand electric vehicle deliveries in Q4’22 which would translate to a big year over year increase of between 71.8% and 91.7%. NIO delivered a total of 31,607 electric vehicles in the third-quarter, so according to the company’s fourth-quarter projection, delivery volumes are expected to surge at least 36.0% year over year. The optimistic forecast is due to NIO’s roll-out of its sedan products, especially the ET5 sedan which only launched at the end of September. Product demand for the ET5 and ET7 is strong and deliveries have started to ramp up nicely with NIO already delivering 1,030 ET5s in October. The ramp of the ET5 is going even better than the ramp of the ET7, as I explained here.

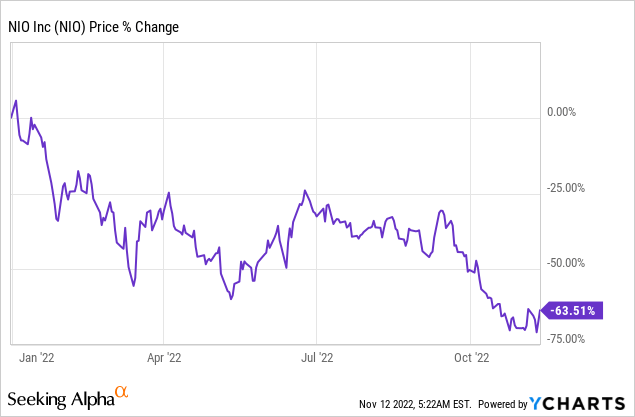

The delivery forecast for Q4’22 was by far the best piece of information that investors have received in a long time from NIO. The electric vehicle marker has seen a sluggish ramp in production and deliveries overall in FY 2022 due to COVID-19 factory lockdowns as well as other factors such as an ill-calibrated supply chain. As a result, NIO’s shares have been brutalized, slumping 64% year to date…

Pressure on vehicle margins

NIO’s vehicle margins once again trended down in the third-quarter, indicating that margin and profit pressure in the EV market is growing. NIO’s vehicle margins in the third-quarter were 16.4% and declined 1.60 PP year over year. NIO’s vehicle margins in Q2’22 were 16.7%, meaning NIO saw another 0.3 PP decline in margins quarter over quarter. Weakening vehicle margins are a big risk for NIO, especially because NIO has positioned itself as a manufacturer of higher-priced premium products.

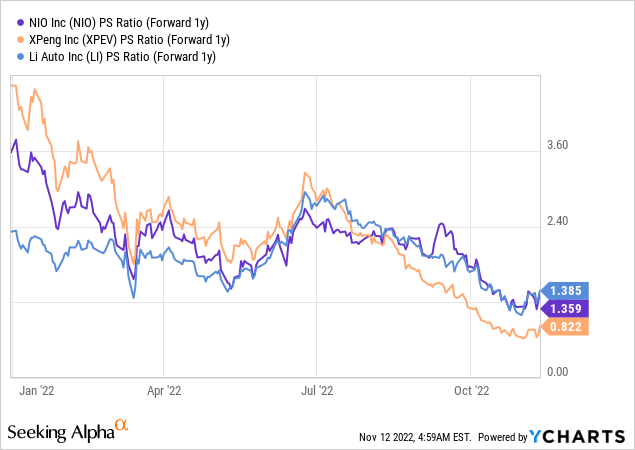

Valuation of NIO

NIO’s revenues in Q3’22 increased 32.6%, which is a very strong growth rate given the challenging economic situation in the third-quarter. Going forward, NIO is still projected to grow rapidly, but this growth will eventually moderate. The expectation is for NIO to grow revenues 94.8% from FY 2022 to FY 2023 which translates to a P-S ratio of 1.4 X. NIO’s P-S ratio is in a very similar category as Li Auto (LI), but due to risks associated with NIO’s production ramp, investors may see NIO drop back to the single digit territory.

Risks with NIO

Despite a strong increase in revenues in Q3’22, NIO has significant top line risks and the supply chain is still not working the way it should be. Shipping delays for casting parts, which affected the ramp of the ET7, have caused production problems for NIO over the summer and the supply chain will remain a risk for NIO going forward. The biggest risk, as far as I see it, is a continual decline in vehicle margins which would be set to weigh on NIO’s profitability and which could potentially be a reason for investors to not invest in the EV manufacturer.

Final thoughts

NIO’s third-quarter earnings sheet was good, but not great. The strong revenue increase year over year as well as the robust outlook for deliveries in Q4’22 were positives in NIO’s earnings card. After a tumultuous FY 2022, NIO may be looking at a rebound in delivery growth… which would be much needed to see a revaluation of NIO’s shares. However, the continual decline in vehicle margins, which indicates less pricing power in the market due to an increasing EV product line-up, is a threat to NIO. Considering that NIO still has considerable top line risks and is still not profitable, I believe NIO is going to see a retest of its lows and may even be at risk of becoming a single digit stock in the near future!

Be the first to comment