Andy Feng

Back in June, I detailed how Chinese electric vehicle maker NIO (NYSE:NIO) was set for massive growth later this year. Between the launch of new models and additional production capacity coming online, expectations were calling for a huge jump in vehicle sales and total revenues. On Monday, the company released its July delivery figure, and the result was another disappointment that makes me wonder a bit about this short term growth trajectory.

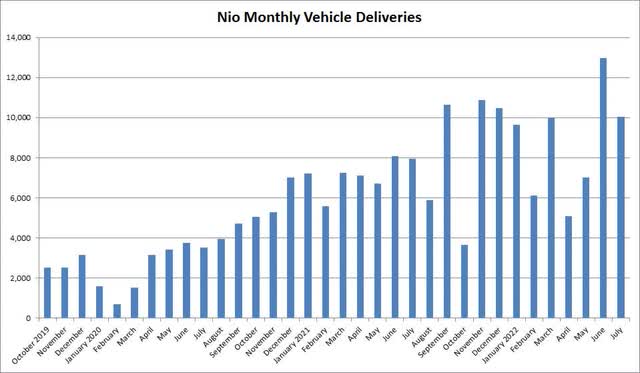

For the seventh calendar month of 2022, NIO announced that it had delivered 10,052 vehicles. The year over year growth rate of nearly 27% did come in ahead of peer Li Auto (LI), which grew by 21%, but both of these names significantly trailed XPeng (XPEV) which saw 43% growth. In the graphic below, you can see NIO’s monthly delivery history going back to late 2019.

NIO Monthly Deliveries (Company Releases)

While that mid to high 20s growth rate seems nice as a headline, it doesn’t tell the entire story. Production of ET7 and EC6 models were constrained by the supply of casting parts. Don’t forget, the company signed a major agreement over 14 months ago to get to 20,000 units of monthly production, and it also has an extra model available this year that it didn’t have last July. Thus, this was only the company’s 5th best month for deliveries, and the July 2022 figure didn’t even beat the one from September 2021 despite production lines seeing multiple upgrades since. Also, key electric vehicle rival Tesla (TSLA) is reportedly able to produce 2,000 Model Y SUVs a day at its Chinese plant now, which is remarkable growth in less than two years. When adding in production of the Model 3, Tesla is approaching a million vehicles per year run rate in Shanghai, while NIO is struggling to top 10,000 units a month.

It just seems right now that there is always some sort of major issue at NIO that’s impacting deliveries. This is the 5th quarter in a row where at least one month saw some sort of significant disruption. In Q2 2021 some of the lost May production supposedly came back in June, but the end result was still a sequential quarterly delivery increase that wasn’t that impressive. Q3 of last year saw supply chain issues that resulted in a guidance reduction, the following two quarters saw production lines down for upgrades at times, and then Q2 of this year saw major issues due to Covid shutdowns.

Management said in its July 2022 release that it expects to accelerate vehicle production in the following months of the third quarter of this year. The key question here is by how much? NIO is supposed to start deliveries of two new vehicles during this quarter, and as I said in my previous article, management has guided to reaching 30,000 units a month either late this year or very early in 2023. If the company is having problems getting casting parts for the production of its ET7 sedan, will there be issues also for the ET5 sedan that’s supposed to hit the market in September?

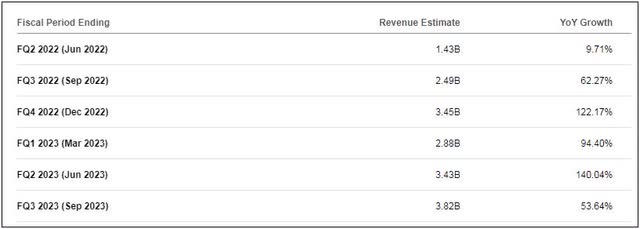

Again, I bring up the questions about near term production problems because expectations are calling for massive growth in the next couple of quarters. As you can see in the graphic below, starting with the current quarter, the street is expecting five straight quarters of more than 53% revenue growth, with three of those estimates being over 94%. On a sequential basis, analysts are calling for more than a billion dollars of revenue growth in Q3 of this year with nearly a billion more in Q4.

Current Analyst Revenue Estimates (Seeking Alpha)

I mentioned in my previous article that analysts were extremely bullish on the stock, with the average price target calling for NIO shares to double from then current levels. We have seen that average has come down a couple of bucks since, and NIO shares have risen as well, so current projected upside is down to around 65%. I’m sure that many investors would love to see those kinds of gains, but let’s remember that a lot of that upside is based on this significant growth in revenues moving forward.

In the end, NIO reported its best delivery figure for July in company history, but the number still seems a bit disappointing. Production of two models were impacted by the supply of casting parts, so the month’s total couldn’t even top last September’s number despite multiple line upgrades and an extra model for sale this year. With NIO seemingly having production issues every quarter now, it’s logical for investors to start questioning the company’s expected growth surge in the back half of this year a bit. Street analysts still see a lot of upside in this stock, but for those gains to materialize, the company is going to have to be a lot more impressive moving forward.

Be the first to comment