Guido Mieth/DigitalVision via Getty Images

Recession. Inflation. Interest Rate Hikes. You name it and it has happened in 2022 so far. However, Dividend Investing is stronger than ever.

There is deep value out there in the stock market, to juice up your dividend stock portfolio. Many dividends stocks are out there to buy right now, as the stock market is down over 700 points in the S&P 500 heading into August 2022.

In addition, dividend increases have been aplenty. Dividend investors can argue that 2022 has been another fantastic year for dividend investors, despite inflation, a rising interest rate environment, the great resignation and fears of a recession.

Therefore, as I do every month, here is the Dividend Stock Watch List for August 2022!

Dividend stock watch list

Another dividend stock watch list! The stock market has been more volatile than ever since the pandemic of 2020. What does that mean? New undervalued dividend stocks are coming to light baby! It’s all about buying dividend income producing stocks – the best source of passive income source on your journey to financial freedom!

The stock market, specifically the S&P 500, is back above 4,000. I didn’t think we’d be here already. From the all-time highs of 4,800, dropping below 4,000 and holding steady now above 4,000 the last week. We were in recent bear territory, but have come back up from being down over 20% to now down 15%. What a volatile time period we are in! Chart is below:

Author

Interest rates are still low on your savings, including high yield savings, accounts, as well as money market accounts and funds. However, rates are rising, now that the fed has increased the fed funds rate again by 75 basis points. Ally (ALLY), where I hold a significant amount of cash, is yielding 1.40%, but I am using two accounts to boost my APY, one is SoFi, which offers a 1.80% checking and savings account, as well as Yotta.

I keep more savings in my Yotta Savings Account, that has earned consistently over 1.75% APY and earned 2.80% in June 2022. The account is FDIC-insured, of course. Definitely sign up if you want to have fun and earn more yield on your savings account!

Author

What else has been going on? I have been investing more and more into Fundrise, as of late – finally crossing over $10,000+ invested there. In addition, I have been loving the SoFi financial app and platform.

In addition, given the uncertainty, I continue to make smaller, weekly investments into Vanguard Exchange Traded Funds (ETFs). The specific ETF my wife and I have been loading up on is Vanguard High Dividend Yield (VYM). We are investing approximately $400-$500 per week into Vanguard (pending the VYM stock price), to stay invested in the market, during the uncertain times. In addition, I am also investing $60 per day into Vanguard S&P 500 ETF (VOO)! I was doing $50 but recently increased this to $60 on 7/25.

Therefore, on the road to financial freedom, acquiring assets that produce cash flow or income is the goal! Like I always say, there is always a diamond in the rough. How do I find an undervalued dividend stock? Time to introduce our beloved Dividend Diplomat Stock Screener!

Dividend Diplomat Stock Screener

If you don’t know already, we keep the stock screener metrics to three simple items. They are:

- Price to Earnings Ratio – We look for a price to earnings ratio < than the overall Stock Market.

- Payout Ratio – We aim for a payout ratio of less than 60%.

- Dividend Growth – We like to see history of dividend growth in a company.

Time to find the answer to… how did the dividend stocks on my watch list grade on the stock screener?

Dividend stock watch list

Here is the list of dividend stocks that are on my radar going into the month of July 2022. I typically like to keep it at 2-3 dividend stocks, keeping the focus locked in. Finding dividend stocks isn’t easy, but there are also other factors, such as composition of my portfolio by industry (such as – am I overweight/underweight in an industry), as well as exposure to one stock and the concentration there.

There, the dividend stocks on my list cater to those other facets when building a dividend stock portfolio. This is a fairly defensive, consumer-goods intensive, dividend stock watch list!

Diageo (DEO)

Diageo

Ah… Diageo. It has been forever since I have taken a look at DEO. They are in 180 countries, over 200 brands of alcoholic beverages with over 27,000 employees, based in England.

Here is a summary in picture form of some of their brands:

Diageo

Author

Diageo, since it sells and distributes alcoholic beverages, tends to fare better during recessionary and inflationary time periods. Most People continue to drink and consume, and Diageo passes on cost increases down to the consumer. In addition, the company recently released its latest earnings – net sales are up a staggering 21.4%!

First, however, we must run Diageo through the Dividend Diplomats Stock Screener, which is focused on these 3 metrics.

- Price to Earnings Ratio: Earnings is approximately $8.15 in earnings per share. Therefore, the stock is trading at approximately 23x current earnings. Next year, analysts do estimate to be approximately $8.75 in EPS. However, the stock is still trading a tad on the high side.

- Payout Ratio: Diageo’s dividend is paid 2x per year – once in April and the second dividend in October. This is an American Depository Receipt (ADR), since it is based in UK. Therefore, it announces its dividend in Pence, but the conversion is approximately $4.077 in a forward, total dividend. The company sticks to a 50% dividend payout ratio policy (i.e. 1.8 to 2.2 earning coverage). Therefore, it is always in that sweet spot, the perfect payout ratio range.

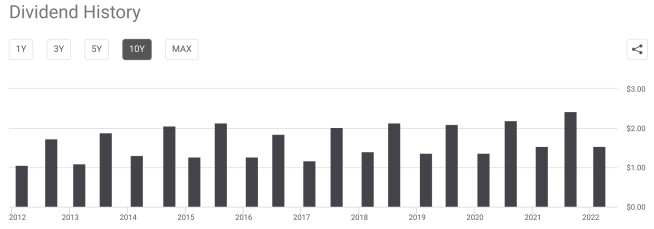

- Dividend Growth: Since it is an International based company, Diageo’s dividend growth is hard to say. Therefore, I thought the chart would be nice to showcase below. The trend is up needless to say, over the last 10 years. Drinks keep flowing and the dividend keeps growing!

Author

The dividend yield is at 2.15%, well above the S&P 500 and is a better yield on average than the majority of high quality stocks. I’ve owned them for years and this is definitely a recession and inflation proof stock – always being used and can pass on the costs to the consumer.

Intel

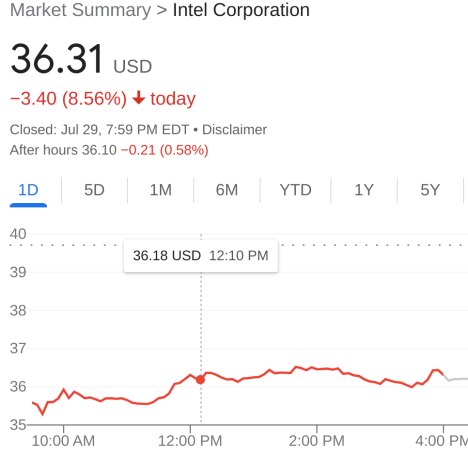

Intel had a brutal earnings release on July 28th / July 29th. Revenue was down over 20% for the quarter, just over $15 billion. In addition, the gross margin has been depleted, dropping into the low 30% range, when they used to be in the 50% range.

Intel had a net loss of $0.11 per share. The forecast is not looking great, but the CEO has stated the company should be at the bottom and that margins will continue to increase from here on out. Is this a buying opportunity? Check out what happened to the stock on July 29th – talk about a steep drop!

Author

Let’s run Intel through the dividend stock metrics, to see if this could be a dividend stock to buy now.

1.) P/E Ratio: Intel is expecting to earn approximately $2.57 in earnings per share for 2022. This is a 14x P/E ratio, which let’s hope this is a conservative metric. Analysts are actually anticipating into the $3.40 range for 2023. Therefore – could this be a sign of a legacy company, set to ramp up and is a steep discount right now?

2.) Dividend Payout Ratio: Intel pays $0.365 per share per quarter or $1.46 per share, per year. Therefore, based on what Intel thinks it will do for 2022, the current dividend payout ratio is 57%, still safe and in the perfect payout ratio range.

3.) Dividend Growth Rate: Intel has grown its dividend for 7+ straight years. The average dividend growth rate is over 6%. I do not anticipate that for 2023, but would believe the growth rate could be over 3%.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now? The yield for INTC is now over 4%! I am not sure I have ever seen Intel yield that level before. Almost 3x the S&P 500.

Again, it took a big hit after earnings – time to buy or time to stay away?

Other Dividend Stocks to buy

I am also considering, as a quick hitter approach here, Pepsi (PEP) and Aflac (AFL). Two dividend stocks with decent dividend yields above 2.6/2.7%. In addition, they are both dividend aristocrats and Pepsi is a dividend king.

Both stocks have gone through recessions, financial crisis, you name it. They continue to grow their earnings and increase their dividend at above average dividend growth rates.

I own both stocks and am constantly keeping my eye on both of these two dividend stocks.

Dividend Stock Watch List Conclusion

Dividend investing is real and is happening! Of course, prior to making any purchase, I definitely will make sure to run them through the Dividend Diplomat Stock Screener once more.

Two different industries and two completely different price points. One stock has been surging with Diageo and one has been taking with Intel. Look forward to seeing what value I end up picking up heading into August! Don’t keep your eye off of the dividend aristocrats, such as Pepsi or Aflac, though!

As you have noticed, I have trickled many articles on this page. The goal is to educate new dividend investors out there, or to sharpen the terminology for current dividend investors. As always, stick to your investment strategy and dividend stocks will be there. What do you think of these stocks above? Thank you, good luck and happy investing everyone!

-Lanny

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment