nicescene/iStock Editorial via Getty Images

Nintendo (OTCPK:NTDOY) is one of the most recognizable brands on the planet, and it also constitutes an interesting investment opportunity. With valuable brands going rather untapped, but also improving economics for its videogame products, it appears attractive at single-digit multiples bolstered by large cash balances. With required returns needlessly high due to poor balance sheet optimization, but also franchises that rival Disney’s (DIS), we think that there is long-term upside in the stock in addition to decent resilience in a recessionary environment.

The Nintendo Economics

Whereas Xboxes and PlayStations usually both have most of the same titles, Nintendo has always taken a different approach where their own brands release on their own consoles exclusively, eschewing partnership with most of the titles that get released on the Xbox and the PS. This has always been the model and it ends up working because the Nintendo brands and titles are so relevant, in some cases the most relevant, in the world. While in the past the company ran with more consoles per generation, divided between handheld and home consoles- in earlier days the GameCube and the Gameboy and later the Wii and the DSes – now everything is focused on one console that manages to do both very well, the Nintendo Switch. With online gaming on the switch requiring a subscription, the success of switch sales is critical to grow a profitable installed base, both traditionally as a medium to play Nintendo titles on, but now also for the subscription revenue for Nintendo online.

Q4 Earnings

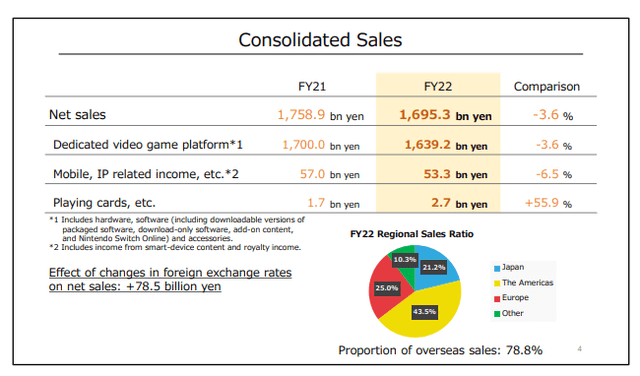

The sales of the switch devices in terms of volume have fallen 20% YoY. The effects are that 2021 is a remarkably tough comp for the videogaming industry, but it’s also due to some issues with the supply-chain hampering unit sales. This of course impacts the growth in the installed base and growth in subscription revenues, but be aware that billing vs revenue recognition effects are in play here, where revenues recognized on subscription income lags the actual revenue commitments made. New releases have been selling well. Pokemon: Arceus, my personal favorite so far, has been a substantial hit, being outsold only by the combination of Brilliant Diamond and Shining Pearl of Pokemon franchise releases. New Mario and Zelda titles are selling decently as well, and the release of Nintendo Switch Sports in April will appear in the next earnings slated for presentation in August. Overall, we get minimal declines in net sales, with some catch-up being awaited from subscription income.

Sales Highlights (FY Charts 2022)

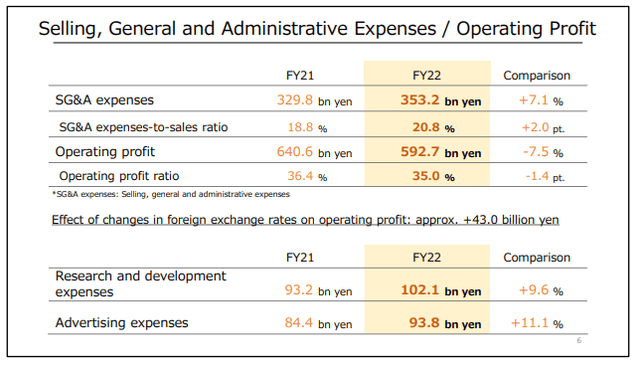

The other thing to pay attention to is FX effects. The Yen is weakening rapidly as of the divergence in tightening policies between Japan and the West. FX effects have already impacted the income statements as of the FY report, causing SG&A to rise with some incurred costs from US operations in dollars reflecting negatively in the presentation currency.

Valuation

The company generates massive cash flows. EBITDA to OpCF conversion is more than 100%, and the biggest investments are expensed as R&D and marketing. EBITDA to FCF conversion is about 80%. The cash balances are substantial, and the company carries a net cash position equal to 25% of its current market cap. There is no leverage to speak of. This constitutes some of the upside we see in the company. Balance sheet optimization would go a very long way for a company that generates an operating profit margin of 36% with almost total cash conversion from accrual figures. With high debt capacity but no debt to speak of, the opportunity for Nintendo to improve its cost of capital is certainly there, especially in Japanese denominated debt, which is still trading at low yields due to the BoJs continuing monetary accommodation. Cost of capital could fall as much as half for Nintendo, and because of the compounding effect of discounting, the fair value of the stock could grow by much more than 2x.

So the low rate leveraging opportunity is still somewhat available to Nintendo and it would be of great benefit to shareholders. The company trades at an 8.31x multiple on forward EBITDA, and with the base effects going to be fully digested by the end of the coming fiscal year, growth should be back on track at consistent and attractive organic rates reflecting its successful platforms and its continuing incumbency in videogame brands. With a revaluation of the stock under a more aggressive balance sheet, the multiple should at least double if not more, considering that Activision Blizzard (ATVI), whose goodwill in the industry is actually in the deep negative balances now, was acquired for almost 17x, despite its more ailing franchises and a very concerning state of its Overwatch League, with Overwatch 2 promising almost nothing in way of matchmaking or game improvements.

Conclusions

There are some risks. The yen continues to depreciate, which means you could see depreciation of your Nintendo holdings as the Yen weakens with the BoJs position on monetary accommodation continuing and backed by very strong conviction. However, while their Yen denominated cash balances, SG&A expenses and other expenses incurred in USD may continue to inflate with the Yen depreciation, Nintendo sales are much greater than their costs, and their sales are likely more skewed towards the Americas than their costs would be with scale achieved in America as this is their largest market. Therefore, the depreciation of the Yen actually benefits the company overall. The question is whether this benefit will be reflected in how the share price develops. With the recession being another concern, albeit a lesser one since Nintendo sales should be rather inflation resistant, especially to the extent that its sales and subscriptions come from children accounts, volatility should be expected in the price. With Japan still being an important market for Nintendo, and one that does not risk a consumer deleveraging due to continued monetary accommodation, there are further offsets for Nintendo that make it attractive.

Finally, its franchises can continue to be leveraged. The theme-park and IP opportunity is large, where current IP based revenues are still very small. As reopening proceeds, there are opportunities to leverage its IPs, including Mario and Pokemon which it substantially owns, into a Disneyesque ecosystem. With the IPs being core to Disney’s business model, and a massive source of premium in their shares, we believe Nintendo can replicate that one day. While a latent source of profit, the IPs enable this for Nintendo, and the optionality there shouldn’t be ignored.

Overall, with the fundamentals being very solid, and the opportunity for shareholder value creation coming from low-hanging fruit, we think Nintendo is a buy.

Be the first to comment