TkKurikawa/iStock Editorial via Getty Images

Investment Thesis

Certainly compared to companies like Disney (DIS), Nintendo (OTCPK:NTDOY) doesn’t get as much credit as it deserves for the massive portfolio of intellectual property it has accumulated over the years, represented by gaming franchises (like Mario Kart, The Legend of Zelda and Pokemon). Over the next year or so, however, there are some obvious catalysts for wider appreciation of the company’s extremely valuable intangible assets. Given the company’s relatively low current valuation on the basis of both book value and earnings, now might well represent an attractive time to initiate a long-term position in the company’s stock.

Mario On The Big Screen

One of the first catalysts worth highlighting is the fact that we will soon be seeing one of Nintendo’s most famous characters in cinemas around the world, with the release of The Super Mario Bros. Movie on April 7th 2023.

While we can’t be sure how the movie will be received, what we do know is that the film is being produced by Illumination (the animators behind Despicable Me and Minions) who have achieved an average gross of $695.4 million per film. Six of their films are among the 50 highest-grossing animated films ever produced. So it’s quite clear that Nintendo has chosen to offer their intellectual property only to an extremely talented group of animators, who will do the source material justice. The film has also secured a high profile cast including Chris Pratt, Anya Taylor-Joy and Jack Black.

My personal view is that given the popularity of the Mario franchise and the quality of the studio producing the film, it’s likely to be one of the most popular releases of the year. While I’m excited about how much Nintendo will generate in royalties from the film, I think the main benefit of the movie is the “free” marketing for Nintendo around the world. I am in no doubt that this movie will help to cement further Nintendo’s position as the family video game brand.

A New Blockbuster Title

While you might be misled into thinking it is all about the movie for Nintendo next year, we do also have some significant game titles being released.

Chief among them is Nintendo’s latest instalment in the Legend of Zelda series, Tears of the Kingdom.

This comes as a sequel to Nintendo’s bestselling 2017 title Breath of the Wild, one of the most critically acclaimed video games to ever be produced, which has sold 27 million units (as of 30 June 2022).

From a wider perspective, games within the Legend of Zelda series are broadly agreed to be some of the best games of all time, and one title, The Legend of Zelda: Ocarina of Time (1998), is the best video game ever made, according to Metacritic, a game review aggregator.

Given the six year gap between the two titles (to allow for development time), I think we can be reasonably confident that this is also going to be a high-quality title, and Nintendo has a good track record of making effective and bestselling sequels. Super Mario Galaxy and Super Mario Galaxy 2 are good examples, and both also appear within Metacritic’s list of the top 10 games of all times, according to players and critics.

Management More Capable And Experienced Than Ever

While it’s great for a company to have masses of intellectual property or other intangible assets, an effective management team is essential for this to be properly exploited and monetized.

I think the very fact that we are seeing a new Mario movie is great evidence that the CEO and other executives are very serious about generating as much revenue as possible from Nintendo’s intellectual property goldmine.

The current CEO in particular, Shuntaro Furukawa, is in my view perhaps the best person that could have been chosen to lead the company at the present time. He has a long-term perspective on how the company can generate value for shareholders, having joined back in 1994 aged 22. And the fact that he was Director of the Global Marketing Department before becoming CEO also has likely highlighted to him the importance of the US market (representing more than a third of the company’s revenues) and perhaps led to his awareness that “mind-share” in the US market would be augmented by the approval of the new Mario movie.

The fact that the company has retained the original creator of the Mario and Zelda franchises, Shigeru Miyamoto, as a Representative Director and Fellow of the Board, only further emphasises that they are serious about exploiting their intellectual property portfolio. Mr Miyamoto has now been working at the company for more than 45 years. And in reality Nintendo employees when taken as a whole have almost a religious devotion to the company, as represented by their average term of service of 14.2 years.

Unchallenging Valuation

Given all of the above considerations, you would expect Nintendo stock to be rather expensive.

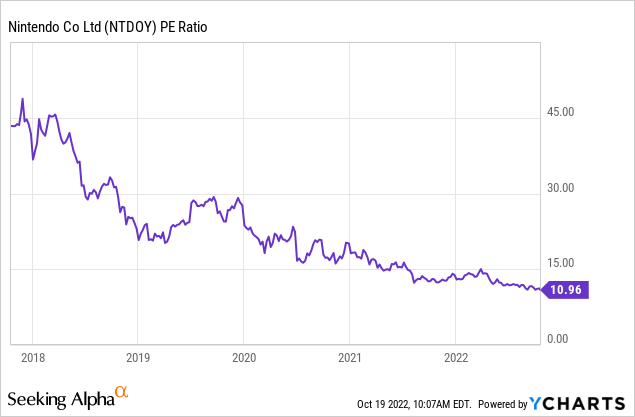

Unbelievably, however, the company now trades at a P/E ratio just under 11x, representing a fall of almost 80% over the last 5 years, which in my view reflects a rather significant degree of undervaluation.

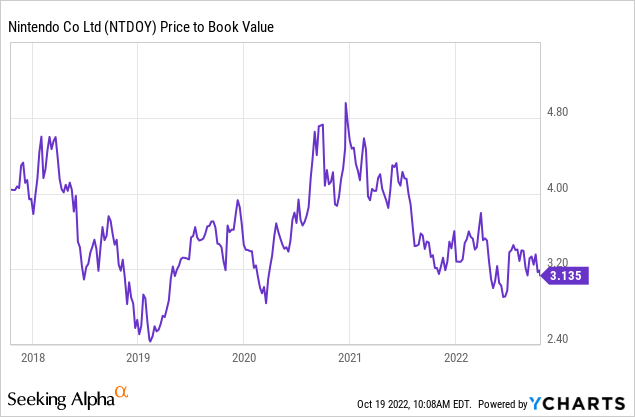

Considering the company’s assets also shows that the company is rather conservatively valued by the market, with the price to book value significantly lower than its average over the past five years.

Conclusion

In my view, there is no doubt that Nintendo is an extremely high-quality company, and there are now a number of catalysts arriving soon which will hopefully drive other investors to wake up to this reality over the next year or so. Given that the company is currently offering such a modest valuation on the basis of both earnings and assets, now perhaps represents a good time to establish a position in this potential wealth compounder.

Be the first to comment