Nikola Stojadinovic/E+ via Getty Images

Nikola Corporation (NASDAQ:NKLA) has clearly not been a great investment for shareholders in recent years. Nikola’s founder got into trouble with the SEC for over-promising on the electric vehicle (“EV”) company’s technological capabilities which resulted in an indictment and the stock price declining from a high of $79.73 all the way down to $4.41. However, the electric vehicle start-up is showing promising signs that it is getting its truck production ramp under control, and Nikola has delivered 48 Nikola Tre battery electric trucks in the second quarter. As production and deliveries ramp up, Nikola is in a strong position to see an upwards revaluation of its shares!

Production and deliveries

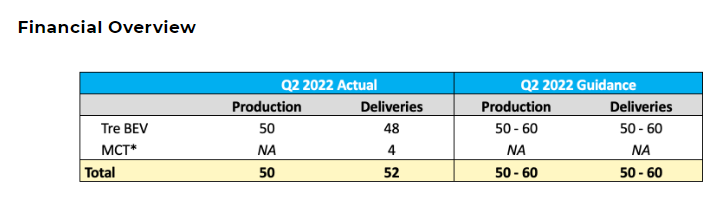

Nikola’s Q2’22 outlook called for the production and delivery of 50-60 Nikola Tre battery electric trucks, the company’s first EV truck product. The electric vehicle startup produced 50 Nikola Tre battery electric vehicles (“BEVs”) and delivered 48 of such trucks to dealers during the second quarter. Although Nikola did not fully meet its delivery guidance for Q2’22, deliveries came close enough to the company’s guidance to suggest that management’s projected production and delivery ramp is (mostly) going according to plan. Additionally, Nikola reported the delivery of 4 mobile charging trailers which were not part of the original production outlook.

Nikola: Q2’22 Production/Deliveries

Based off of Nikola’s delivery guidance from before earnings, the company expected to produce and deliver 300 to 500 Nikola Tre battery electric trucks in FY 2022. Nikola’s management confirmed this guidance in its second quarter earnings report which gives investors confidence that the company is indeed ramping up production of its Nikola Tre truck model as planned. Nikola also said that it sold an additional two Nikola Tre BEVs in July… revenues of which will be recognized, of course, in Q3’22.

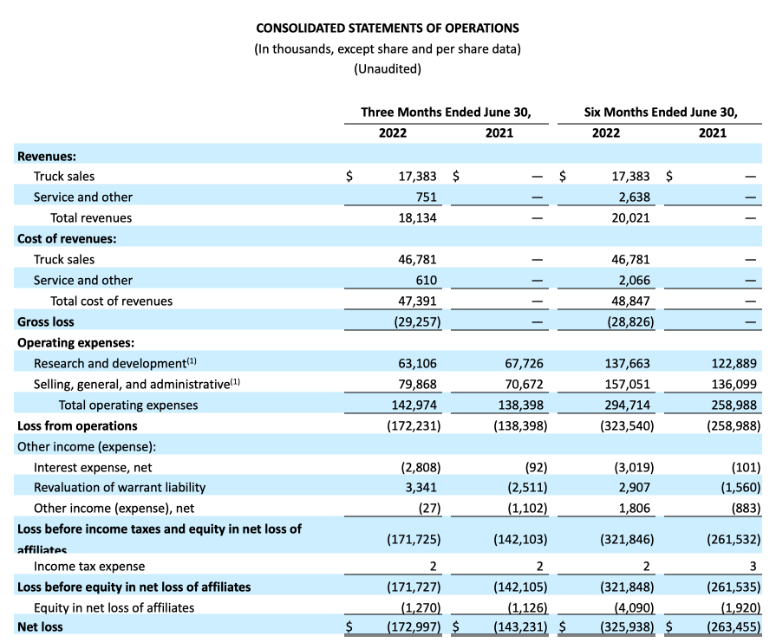

Equally important, the start of Nikola Tre battery electric trucks has led to the first recognition of revenues in the second quarter. The EV start-up recognized $18.1M in revenues which were generated from the sale of 48 Nikola Tre BEVs and 4 mobile charging stations. In the corresponding period a year earlier, Nikola did not have any revenues at all. The successful roll-out of the Tre and the start of revenue recognition are crucial milestones for Nikola and its shareholders.

Nikola: Q2’22 Profit And Loss

Nikola made a $173.0M loss on $18.1M in revenues, but the company is just about to ramp up production which means investors should expect Nikola to remain unprofitable at least for the next three years. By FY 2025, I can see Nikola achieve a scale that would support a base line level of profitability.

Production update

Nikola is expanding its production capacity in Coolidge, Arizona which has an annual output volume of 2,500 units. Phase 2 of the expansion project is ongoing and expected to be completed in Q1’23. The expansion will boost Nikola’s U.S. production capacity to 20,000 trucks annually on double shifts.

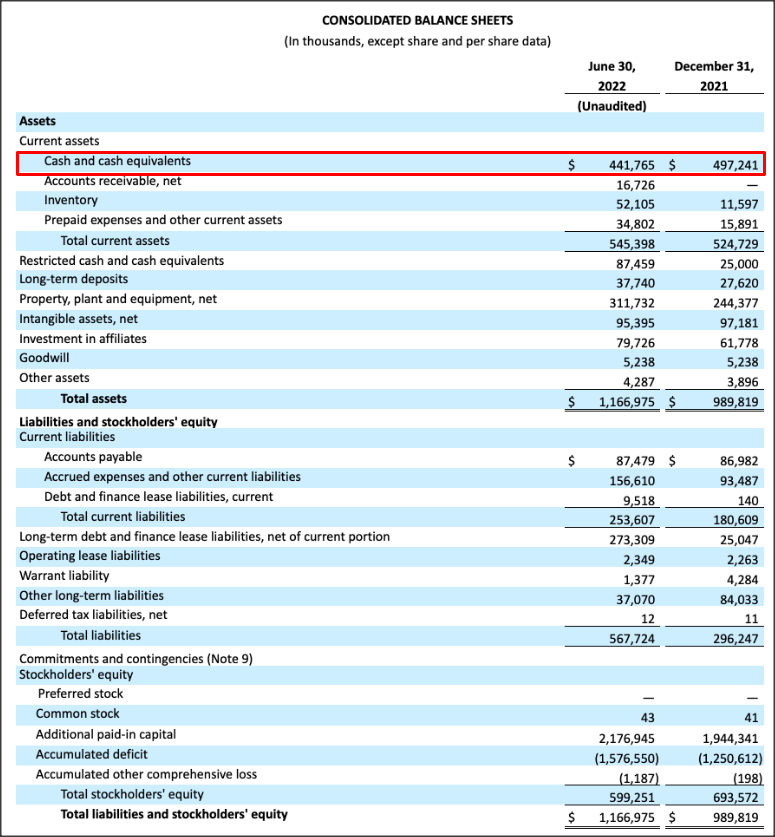

Balance sheet

Since the ramp of truck production costs a lot of money, the balance sheet is a lot more important for EV companies than the profit and loss statement, at least initially. Nikola’s cash and cash equivalents amounted to $441.8M at the end of Q2’22 and the EV start-up raised $200M in a Senior Convertible Note Offering in May 2022. The offering was meant to financially support the ramp of Nikola’s Tre battery electric truck production as well as testing of Nikola’s fuel cell electric trucks.

With current cash resources of $441.8M, Nikola has enough money to finance its production ramp for another 2-3 quarters — assuming approximately $170M each quarter in cost of revenue and operating expenses. This means that Nikola will likely have to raise equity capital in the near future which would dilute existing shareholders.

Nikola: Q2’22 Balance Sheet

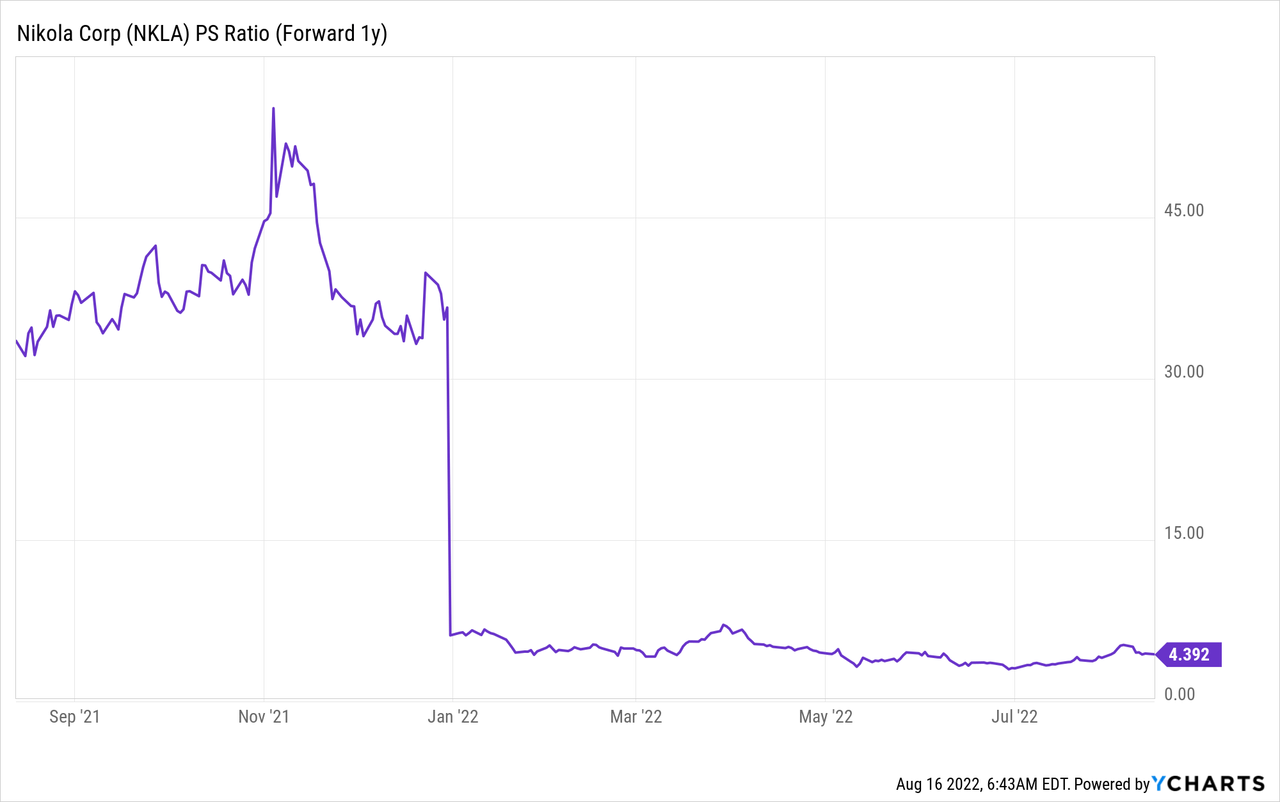

Expected revenue ramp

Nikola is expected to have revenues of $113M in FY 2022 and grow revenues 490% in FY 2023 to $663M, assuming that Nikola sticks to its production and delivery timeline and there won’t be any further production delays. Sales are expected to further ramp up to $1.69B in FY 2024. Based off of FY 2024 sales, Nikola has a P-S ratio of 1.7 X… which gives Nikola a lot of revaluation upside in case the production ramp goes according to plan. The forward (FY 2023) P-S ratio is 4.4 X.

Risks with Nikola

Nikola’s biggest risk, as I see it, relates to the production and delivery timeline. The EV company has guided for the production and delivery of 300-500 Nikola Tre BEVs in FY 2022, but Nikola has repeatedly pushed out its forecast due to production challenges. Other EV companies, like Lucid Group (LCID) or Rivian Automotive (RIVN), have recently reduced their production outlooks for FY 2022 due to supply chain headwinds.

A slower than expected production ramp is a serious risk for Nikola and its stock. Additionally, Nikola’s balance sheet is not as well-funded as the balance sheets of Lucid or Rivian, meaning the company faces liquidity pressures that may result in a dilutive capital offering.

Final thoughts

Nikola made progress with its production ramp in Q2’22 and met its second quarter production goal of 50 BEV trucks. The electric vehicle company also started to record its first revenues from the sale of its first Nikola Tre BEVs which provides proof that Nikola can actually sell its product in the market. Because Nikola has now reached a point where it ramps up production, shares of the EV company could revalue higher. Even an equity offering may be viewed as a positive catalyst for the company since a successful capital raise would ensure the continual ramp of Nikola’s truck production!

Be the first to comment