Wen Sen Tan

The historical rivalry between NIKE (NYSE:NKE) and adidas (OTCQX:ADDYY) has lasted for decades, yet even today it is still not easy to declare a winner. Although consumers highly value both brands, in my opinion the difference between these two companies is stark, and in this article, I will compare their key metrics to support my argument. However, let’s first take a look at the short- to medium-term risks associated with an investment in both companies.

Consumers glimpse a recession

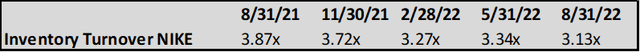

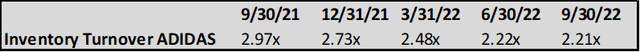

The business model of Nike and Adidas is very similar, which is why I expect that they will have to overcome the same difficulties in the event of a recession albeit of different magnitude. Technically, there are already some signs that suggest an economic slowdown for the sportswear market, first among them the inventory of the two companies in question.

Both Nike and Adidas have experienced gradually decreasing inventory turnover as the quarters go by. This means that both are unable to sell their assortment at the same rate as a year ago. If this performance continues to deteriorate, their warehouses could experience an overstocking problem due to reduced demand for their products.

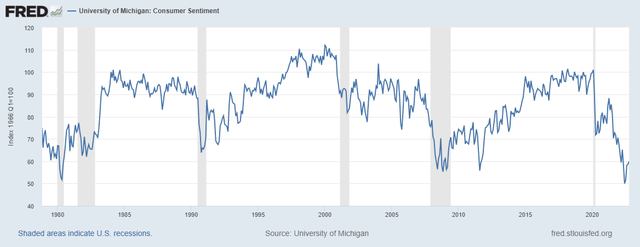

In itself, the sportswear market is not a high-growth sector being saturated and dated. In fact, according to the report discussed on globenewswire.com, it could reach $365 billion by 2027, registering a CAGR of only 3.70%. If we consider a recessionary scenario, I would not be surprised if it exhibits a negative growth rate in the coming years. The reason for my pessimism is mainly due to the consumer sentiment graph.

Federal Reserve Bank of St. Louis

This index is commonly used to understand how consumers assess their current financial economic situation. As of today, this graph is near its all-time lows, which means that consumers are extremely worried about how their propensity to consume will change in the near future. In times of concern, it is logical to expect a contraction in consumption, and this will particularly affect the revenues of companies that sell discretionary goods such as Nike and Adidas. Making discounts on products sold may not be enough to entice consumers to spend.

Nike vs. Adidas

Given the short-to-medium-term risks associated with these two companies, in this section I will make a comparison of their most important business metrics.

Currently, considering market multiples Adidas is significantly more at a discount than Nike, and this might suggest an undervaluation of the former relative to the latter. However, there are many other factors at play that could justify such a divergence. Here are the main ones.

Revenue

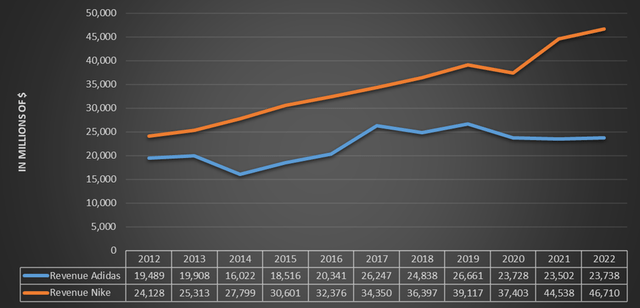

As a first aspect, we can see from this graph how Nike’s revenues over the past 10 years have performed better overall than Adidas’:

- Nike’s 2012-2022 revenue CAGR was 6.80%, while Adidas’ was 2%. A 4.80% growth rate differential for 10 years was a major factor in widening the gap between the two companies. In fact, today Nike makes about $23 billion more than Adidas while in 2012 the difference was “only” $4.60 billion.

- Nike’s revenues have been significantly more robust than those of Adidas. In fact, Nike’s growth only stalled in 2020 due to the pandemic, while Adidas is used to going through stalled phases. The last one has not yet been overcome: in fact, 2022 revenues are even lower than in 2017. In light of a potential recession, there is no doubt that Nike is more reliable in the eyes of investors.

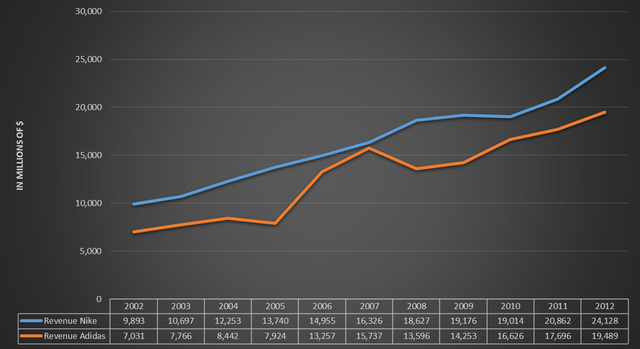

An interesting aspect is to note that in the previous 10 years the two companies did not show such a clear divergence. At times, in 2006-2007 it almost looked like Adidas was about to recover, but then there was the subprime mortgage recession that changed the game again. The way Nike managed at the time to juggle such a complex macroeconomic environment was crucial so that today we can see such a wide income gap with Adidas. The latter took years to recover from the recession, and being more exposed in Europe was also hit hard by the following sovereign debt crisis. Historically, the United States has often had a faster economic recovery than Europe; therefore, I am not surprised that Nike came out better having been more exposed to the notoriously more dynamic and consumerist U.S. economy.

At the time, just as today, about 40% of Nike’s revenues came from the U.S. For Adidas, the situation was far different. The latest data available to me is from 2013, where only 14% of Adidas’ revenues came from the United States. Currently we are around 21%, still too little. The next recession, whether it’s in 2023, 2024 or 2025 could prove once again to be a way for Nike to increase the gap.

Profitability and financials

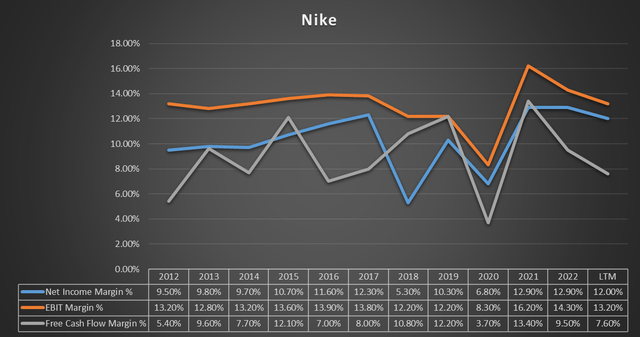

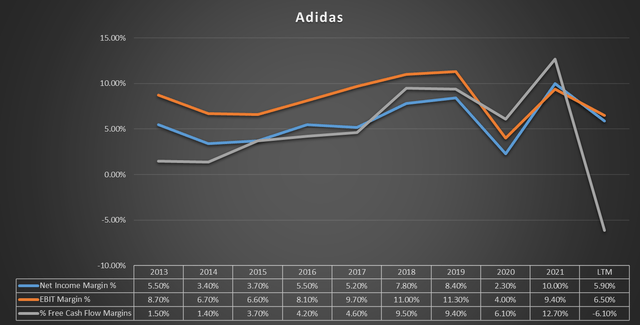

Although Nike and Adidas are two leading companies with a similar business model, there is a rather marked difference in profitability.

Comparing these two graphs, we can see that Nike’s margins are not only significantly higher but also less discontinuous. In the last 10 years, with the exception of 2018 Nike has always had a higher profit margin, sometimes even by quite a few percentage points. For the free cash flow margin, the situation is similar, and Adidas in 2022 is even experiencing cash outflow due to inventory problems and unaccrued receivables. So, not only is Nike making $23 billion more, but for every dollar of revenue it is also making more profit.

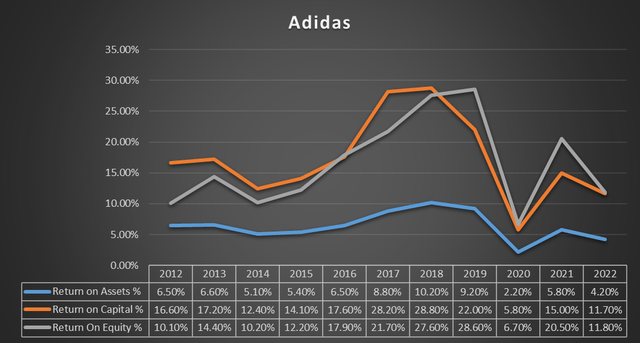

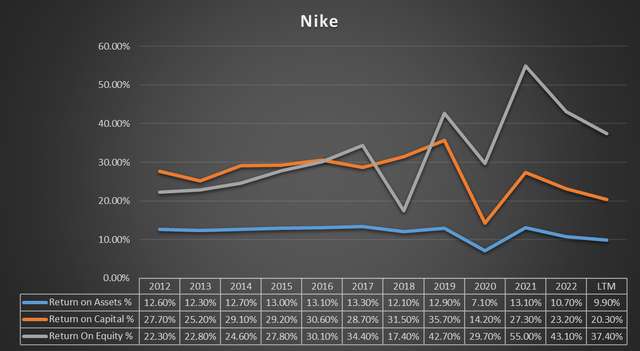

Comparing profitability ratios, the situation does not change; on the contrary, it makes Adidas’ position even worse. In this case, however, the problem is not that Adidas has ratios that are too low; it is Nike’s ratios that are out of scale. Since 2012, with the exception of 2020, Nike’s return on capital has always been above 20%, often close to 30% or more.

Capital allocation capacity is significantly lower for Adidas, and this is a major problem that could further widen the gap between the two companies. In addition, since economic performance also affects the financial/equity position, we can see evident differences in this aspect as well.

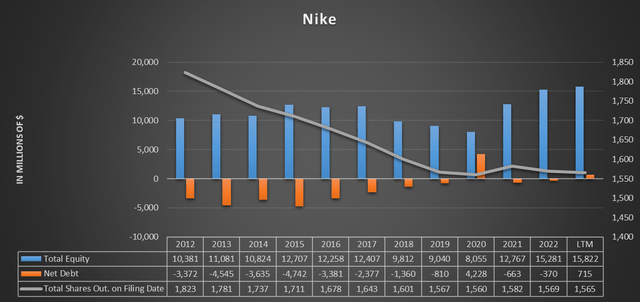

Nike has net debt of only $715 million, while total equity is growing over the long term despite expensive buybacks made in the past.

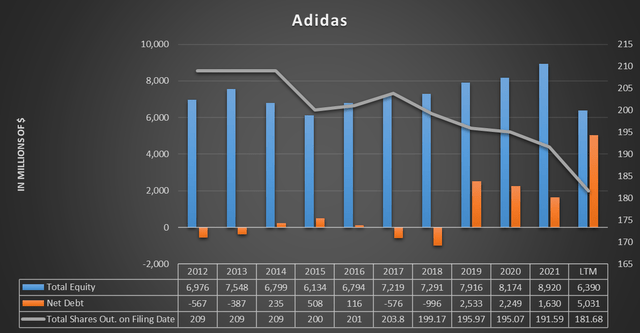

For Adidas, the situation is different. The company is continuing to make buybacks but total equity has not improved over the past 10 years. Net debt has never been higher, and with the current rising interest rates the cost of debt could further hurt corporate profitability. Overall, this is not an alarming situation but definitely worse than Nike.

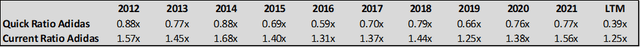

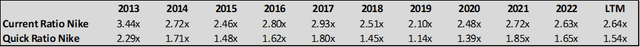

Finally, to conclude the comparison regarding the respective balance sheets, the quick ratio shows an imbalance regarding Adidas’ liquidity.

In the last 10 years this ratio has never been so low, a sign that inventory is piling too much weight on current assets. At the beginning of the article I was talking about the risk of excessive inventory, and the result of the quick ratio confirms this, also because the current ratio does not show abnormal values. On the other hand, Nike presents a quick ratio stably above 1x and in line with past results.

Consumer perception

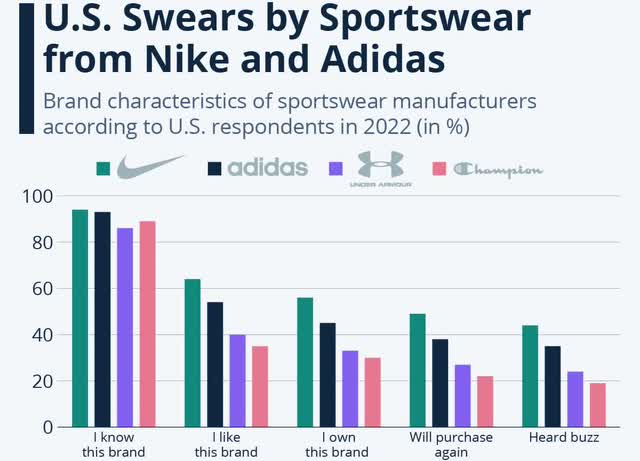

So far, we have seen that the numbers are all on Nike’s side, yet Adidas is the number 2 brand in the world in the sportswear market and does not offer inferior products. The reason for such a divergence is mainly due to consumers’ perception of the two brands, both valued for the quality of their products but not at the same level.

Statista Global Consumer Survey

In my view, there are two aspects that have strengthened Nike’s competitive advantage:

- The first concerns Nike’s ability to innovate and make winning collaborations on multiple fronts. Beyond the collaboration with Michael Jordan that is considered one of the best ever, the company has also managed to insert itself into high fashion by collaborating with brands such as Louis Vuitton. Adidas has also collaborated with high fashion brands such as Gucci, but in my opinion there has not been the same hype. My perception is that Adidas is always one step behind and trying to emulate the innovative modus operandi adopted by Nike. In addition, a few months ago, the collaboration between Adidas and West came to an abrupt end, significantly hurting Adidas’ present and future revenues. After losing the Yeezy line, the gap with Nike widens further.

- The second aspect concerns the recognizability of the Nike logo, considered one of the most important in history and synonymous with quality. Adidas, too, presents a logo that is well known to the public, but it does not hold a candle to the Swoosh. Nike’s numerous advertising campaigns have been a worldwide success and in recent years have further strengthened an already dominant brand. Forbes is also of the same opinion, in fact Nike is the 13th most valuable brand in the world while Adidas ranks only 51st.

Final thoughts

Overall, both companies are widely recognized as market leaders, yet consumer perception is better toward Nike. From a financial point of view, the comparison does not hold up, since Nike not only generates much more revenue, but also has higher and more consistent profit margins and significantly lower debt. In light of all these considerations, to the famous question “who is better between Nike and Adidas “in my opinion the Swoosh wins, by no small margin. The gap that has been created over the past 10 years at the moment seems to be too pronounced to expect it to narrow, especially after the loss of the Yeezy line. Everything is rowing against Adidas, while Nike doesn’t miss a beat.

In any case, despite my preference for Nike, however, I would not invest in it at the current price as I do not consider it undervalued. As detailed in a previous article, in my opinion a good price would be around $80-85 per share, so at the moment I consider Nike a hold bordering on a sell. Two months ago was the time to buy Nike, not now.

As for Adidas, on the other hand, I consider it a sell. I am pessimistic because of the ever-increasing inventory and because of its revenues that have not increased in years. Nike largely wins the comparison, and in the event of a recession the gap could widen. The next few years may not be good for Nike, but I doubt Adidas will do any better.

Be the first to comment