ASMR/E+ via Getty Images

Last time I covered DigitalBridge (NYSE:DBRG) in April, I was optimistic that the company would buy data center services provider Switch, instead of Equinix (EQIX) which operates in the same industry vertical, or 5G infrastructure company American Tower (AMT).

This has been proven to be accurate and, as part of the $11 billion acquisition, DigitalBridge has partnered with IFM Investors, a provider of investment services.

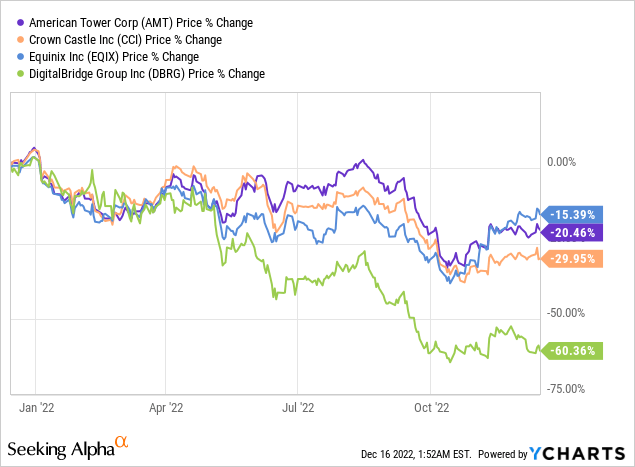

However, as shown by the green chart below, investors have punished the company’s stock more than others that operate in the real estate sector including Crown Castle (CCI) during the last year.

Now, my objective with this thesis is to understand the reason for this underperformance and I will also take this opportunity to assess whether value can still be created in an intensely competitive ecosystem amid deteriorating macroeconomics whereby customers, faced with high inflation, are readjusting the way they spend in information technology.

I start by providing insights about DigitalBridge’s areas of focus together with the growth strategy.

Digital Infrastructure as an Asset Class

First, this is a real estate services company that focuses on digital infrastructures like towers, fiber networks, and data centers. It was born in June 2021 from Colony Capital’s sale of its non-digital assets and rebranding to its current name. Going into details, it is constituted of DataBank, Scala data centers, Landmark Dividend LLC, and PCCW data centers. It also includes significant holdings in Vantage Data Centers and AtlasEdge, and the global infrastructure equity investment management business of AMP Capital. As such, it has a global footprint.

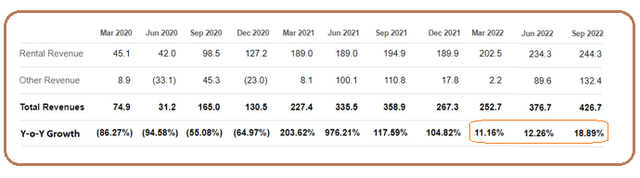

Second, profiting from the Covid-driven digital transformation to both grow organically and through acquisitions, its revenues have surged since March 2021 when sales had skyrocketed by over 200% Y-o-Y, driven by thematics like cloud migration, 5G, and edge computing.

This is shown in the table below, and after the revenue regression seen in 2020, the 976% growth enjoyed in the June 2021 quarter shows that the company’s bet that digital infrastructure could emerge as a separate asset class in the same way as residential and commercial has paid off handsomely.

Quarterly Revenues and Revenue Growth (seekingalpha.com)

Furthermore, $174 million of sales were obtained by Switch in the third quarter of 2022 compared to DigitalBridge’s $244.3 million (above table). Thus, with the transaction expected to close in the fourth quarter, get ready to see growth skyrocketing again when the revenues for the quarter ending in December (Q4-2022) are added together. For this matter, Switch obtained $161.4 million in the fourth quarter of 2021. When this amount is added to DigitalBridge’s $189.9 million (above table), this would mean an 85% (161.4 & 189.9) growth for Q4-2022, and this is even when ignoring the organic growth of both companies.

Therefore, after the less-than-20% growth for the first three quarters of 2022, at least 85% growth for Q4-2022 could crack the wall of pessimism which has hampered the performance of the stock this year. In this case, empowered by Switch, GD Towers from Deutsche Telekom (OTCQX:DTEGY), and some other acquisitions, the company should boost AUM (assets under management) from $50 billion to $65 billion from the third quarter to the fourth one, or boost its scale of operations by 30%.

Stock Volatility Amid Rising Rates

Going deeper into the operating model, the company started to initially diversify away from residential and commercial properties to the tower business, leased to telcos under inflation-adjustable contracts. It then expanded into data centers, fiber, and small cells. This reminds us of companies like AMT which acquired CoreSite to enter into the data center edge space or Crown Castle with its extensive fiber network and small cells for 5G transmission.

Also, contrarily to Switch which was an IT company, all these companies are classified as real estate companies that perform well when interest rates are persistently low in the words of DataBridge’s own CEO, Marc Ganzi about 11 months back. Now, nearly one year later, things are very different, and with the Federal Reserve hiking interest rates by 75 basis points during recent occasions and planning to continue tightening monetary policy albeit at a more moderate pace, the era of cheap money corporations were used to is rapidly coming to an end.

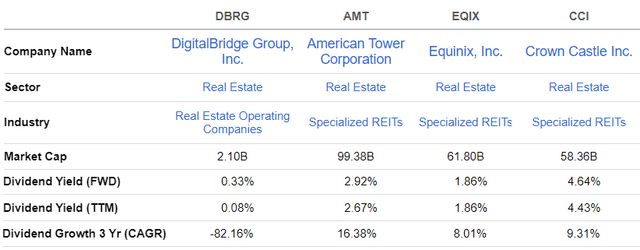

In these circumstances, a rising rate environment is characterized by a higher cost of capital, and, mostly as income stocks, the dividend yield provided by real estate companies generally moves in tandem with risk-free rates such as the U.S. 10-year treasury. Now, with treasuries’ yields rising, investors expect the risk premium (differential with treasuries) to stay the same. Thus, as per the table below, AMT, Equinix, and CCI, all have increased the dividends they pay.

Comparison of Dividend Metrics (seekingalpha.com)

This has not been the case for DigitalBridge, which has consequently suffered from a high degree of volatility. Now, the company did reward shareholders through $50 million of share buybacks, which directly goes into increasing the EPS since about 2.4% of shares outstanding were retired. However, this did little to stop the downtrend, given investors’ appetite for dividends in a rising rate environment. Also, this is a company that was previously structured as a REIT (real estate investment trust) which could also explain why its stock has suffered from more volatility than peers.

However, for those who are prepared to look beyond dividends to invest in building, owning, and operating digital real estate, the asset-light investment approach makes sense.

Explaining and Valuing the Asset-Light Investment Model

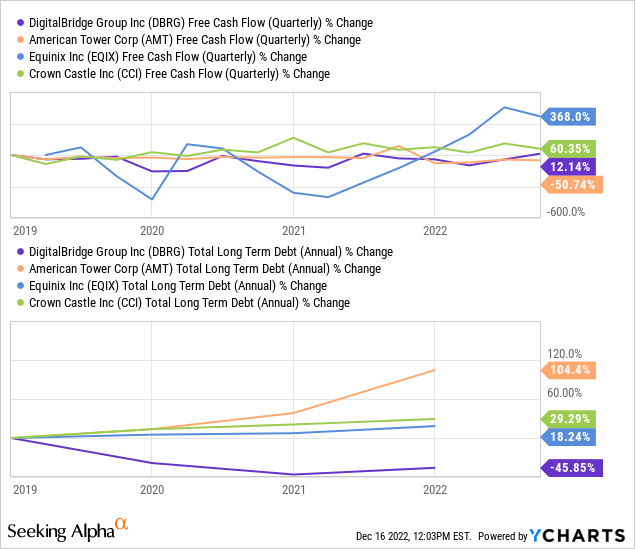

Now, whether it is to pay dividends or perform share buybacks, a company needs to generate predictable FCF (free cash flow), and this, without increasing its debt level, especially at a time when the cost of capital is on the rise. In this respect, compared to AMT, Equinix, and Crown Castle, DBRG’s quarterly FCF, as shown in the deep blue chart below has been quite stable, while its debt level has gone down quite sharply. This contrasts with peers whose long-term debt has gone up. I specifically chose to start the chart in 2019 as that year, the company took the first steps to become a major player in digital real estate infrastructure.

This feat of achieving exponential growth and delivering incremental free cash flow, by 12.14% as of 2019, while not increasing the debt burden is attributed to its “asset-light investment management model”. This model, according to research by Ernst and Young, includes the transfer of capabilities (people, process, and technology) to owners with the aim of transitioning from a fixed to a more variable cost structure.

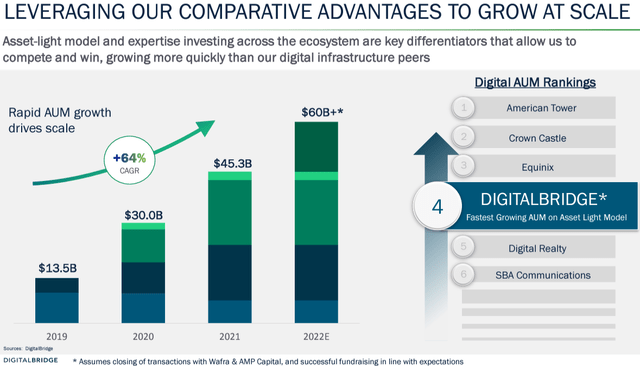

Pursuing further, being asset-light has proved to be a key differentiator for DigitalBridge which has allowed the company to grow rapidly at a CAGR of 64% and outpace digital infrastructure peers like Digital Realty Trust (DLR) and SBA Communications (SBAC) as shown in the figure below.

Growing in Scale and Surpassing Peers (ir.digitalbridge.com)

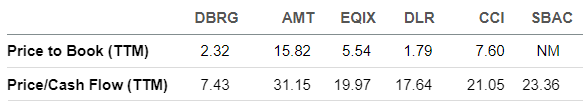

The valuations of the above six companies are compared in the table below, where two main conclusions can be drawn.

First, DigitalBridge’s higher price to book multiple compared to Digital Reality is justified given that the former has a higher AUM. Second, DigitalBridge’s lower price-to-cash flow is not normal, especially compared to AMT whose quarterly free cash flow has decreased by more than 50% during the last three years as shown in the above chart. Making a moderate adjustment in the Price/Cash flow multiple and considering it to be at 10x, (but which is still a third of AMT’s), I obtain a target of $16.4 (10/7.43 x 12.2) based on the current share price of $12.2.

Comparing the Valuations (seekingalpha.com)

Conclusion

After having its share price thrashed in such a way, it is not surprising to see valuations down, despite the company exhibiting some good financial metrics. The market also seems not to be aware of its asset-light investment model, which is excelling at generating a stable FCF, which can also prove to be more sustainable in creating value in a highly competitive marketplace, where the cost of capital is increasing and prospects for organic growth becomes limited as customers spend less.

On the other hand, investors seem to be more focused on dividends. There is profitability too, as the company has been operating at a loss for the last four quarters while the management is focused on returning “profits back to shareholders”. Therefore, volatility should persist as in a rising rate environment, investors should continually focus on the value strategy.

Finally, if you are looking to invest in digital real estate through a stock that can increase its value (“AUM”) in an unconventional and exponential manner but, without perceiving REIT-style dividends, then DigitalBridge is the one to opt for. Also, with the Switch-driven growth, the share price should surge when fourth-quarter results are announced in February in my view, but in the meanwhile, volatility reigns.

Be the first to comment