Robert Way

Investment Thesis: Nike, Inc. (NYSE:NKE) could see further upside from here as inventory issues abate and revenue growth remains strong.

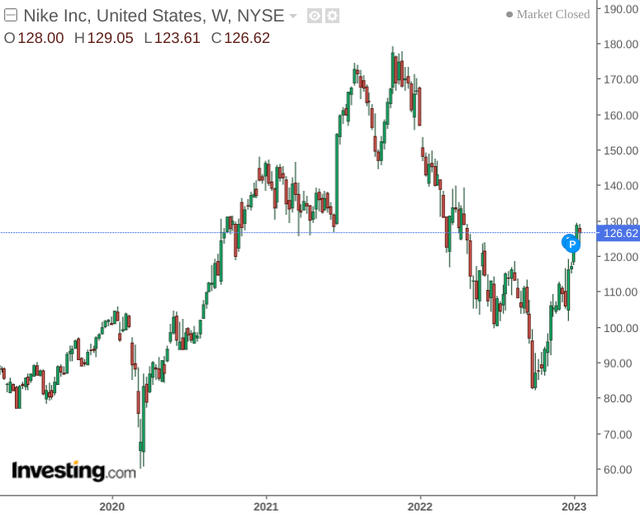

After a strong post-COVID recovery, Nike, Inc. saw significant downside in 2022.

Despite inflationary pressures and supply chain concerns having placed significant strain on the apparel industry – Nike stock started to see a strong rebound at the end of 2022. The purpose of this article is to assess if Nike could see a potential rebound this year.

Nike Performance

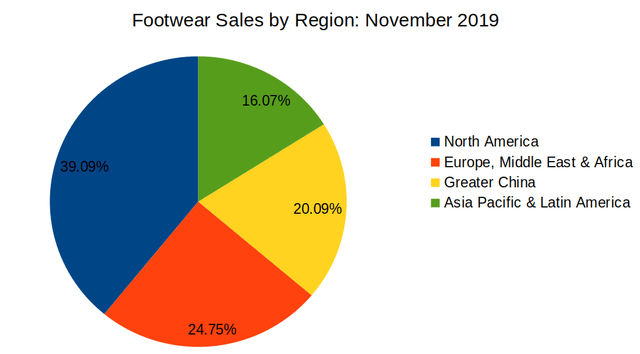

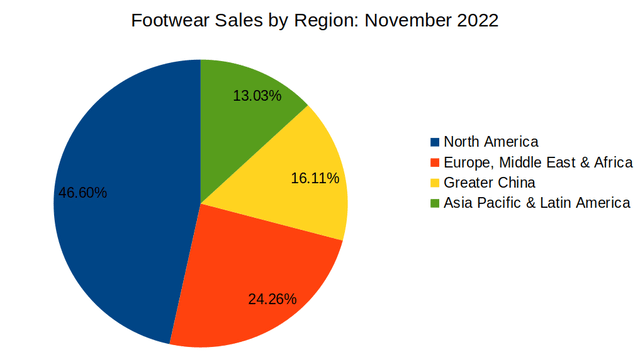

With footwear sales having comprised the majority of sales for Nike’s four geographic regions of operations – it is notable that North America now comprises a larger portion of overall sales, while that of Greater China and Asia Pacific & Latin America have declined.

We can see that 39% of footwear sales came from North America in November 2019.

Footwear sales figures sourced from Q2 FY20 Nike Earnings Report. Pie chart and percentages generated by author.

By November 2022, this had increased to over 46%.

Footwear sales figures sourced from Q2 FY23 Nike Earnings Report. Pie chart and percentages generated by author.

Moreover, footwear sales in North America are up from $2.4 billion in November 2019 to $3.9 billion in November 2022 – with overall sales up from $6.2 billion to $8.5 billion over this period.

From this standpoint, Nike has seen a strong recovery in footwear sales post-COVID, in spite of continued pressures with respect to inflation and supply chain issues.

From a balance sheet standpoint, we can see that while the long-term debt to total assets ratio has decreased slightly in the past year – it still remains significantly higher than that of November 2019.

| November 2019 | November 2021 | November 2022 | |

| Long-term debt | 3,462 | 9,417 | 8,924 |

| Total assets | 26,602 | 38,917 | 39,647 |

| Long-term debt to total assets ratio | 13.01% | 24.20% | 22.51% |

Source: Figures sourced from Q2 FY20 and Q2 FY23 Nike Fiscal Quarterly Results. Figures provided in USD millions, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

However, when looking at the company’s quick ratio (calculated as total current assets less inventories less prepaid expenses and other current assets all over total current liabilities), we can see that the Nike quick ratio has increased substantially from 1 to 1.57 from November 2019 to November 2022 – indicating that Nike is in a better position to meet its total current liabilities than previously:

| November 2019 | November 2022 | |

| Total current assets | 16,369 | 27,447 |

| Inventories | 6,199 | 9,326 |

| Prepaid expenses and other current assets | 1,876 | 2,063 |

| Total current liabilities | 8,264 | 10,199 |

| Quick ratio | 1.00 | 1.57 |

Source: Figures sourced from Q2 FY20 and Q2 FY23 Nike Fiscal Quarterly Results. Figures provided in USD millions, except the quick ratio. Quick ratio calculated by author.

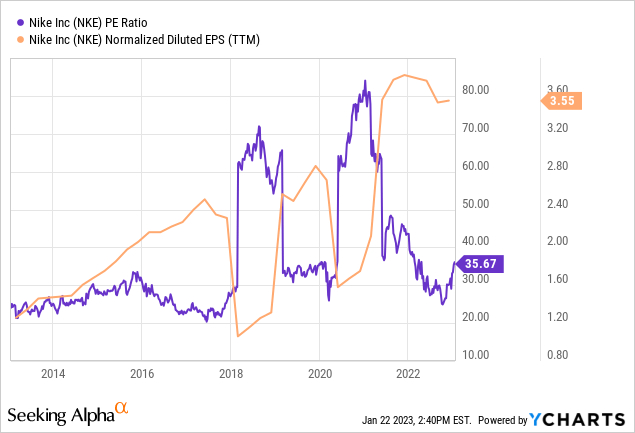

When looking at Nike’s 10-year P/E ratio, we can see that the ratio has descended back to levels seen before 2020, while earnings per share (on a normalized diluted basis) is near a 10-year high.

ycharts.com

From this standpoint, I take the view that Nike could have significant room to rebound going forward if earnings growth continues.

Looking Forward

Going forward, NIKE, Inc. is in a good position to bolster net sales given the strong performance in North America in spite of macroeconomic pressures.

Moreover, with the stock having increased by nearly 15% at the end of December – an abating of inventory challenges as well as continued strong demand were significant growth drivers in this respect.

With inventory levels still remaining significantly higher than that of 2019, the main risk for Nike at this point is a drop in consumer demand which may result from recessionary activity. A high inventory level would be a risk in the sense that Nike may not be able to sell such inventory fast enough to justify the costs of holding such inventory.

While this is a risk – it is one that affects the apparel industry more generally and is not necessarily specific to Nike. Additionally, with COVID-19 lockdowns having been lifted across Greater China, a revival in sales growth across that region could provide a significant boost to net sales going forward.

Conclusion

To conclude, NIKE, Inc. has seen a significant recovery in net sales and the stock looks attractively valued on a P/E ratio basis. Should we see growth in revenues and earnings continue, then I take the view that Nike has the potential to rebound to the range of $150-180 that we previously saw in 2021.

Be the first to comment