fizkes/iStock via Getty Images

Another month, another step towards financial freedom (it never gets old typing that).

And while February included quite a bit of geopolitical and market related volatility, my dividend growth portfolio continued to do exactly what it is supposed to do: churn out a reliably growing passive income stream.

Before I get into my passive income results, I do want to beg for everyone’s pardon for publishing this piece a bit late. I’ve had a handful of readers reach out to me, asking whether or not I would be posting my February review and it means the world to me that there are people out there eagerly awaiting these articles. My content schedule at Wide Moat Research was changed this month, so that took some time to get used to. And frankly, with so much significant news (both macro and micro) hitting the headlines over the last month or so, I’ve been extremely busy staying on top of the markets and the various portfolios that I manage. It seems like every week, when I had a bit of free time to allocate towards this Monthly Portfolio Review piece, it was unexpectedly filled up with something. However, I finally found some time and I hope everyone who enjoys following along with my progress towards financial freedom enjoys this apologetically belated piece.

So, I suppose when it comes to the February review, I’m taking a “Better late than never” stance. I will do my best to get the March review out on time next month. But, please know that while the trades discussed in this piece are a bit out of date, the cost basis and asset allocation data included in the spreadsheets below is accurate as of 3/28/2022.

Now, back to the passive income results…

February was actually a banner month for my portfolio. My passive income increased by 36.62% on a year-over-year basis, continuing the trend of very strong double digit passive income growth (largely, built upon the back on steady cash inflows into the portfolio over the last year or so).

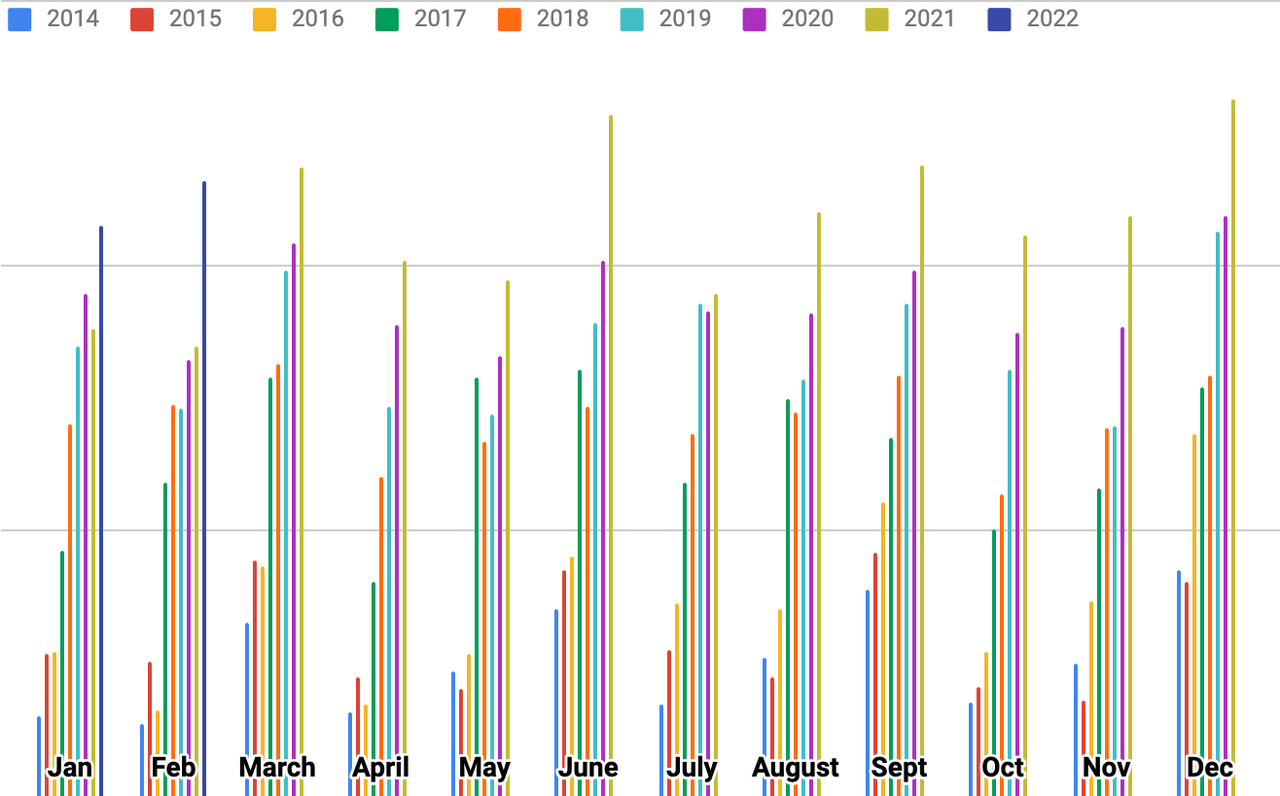

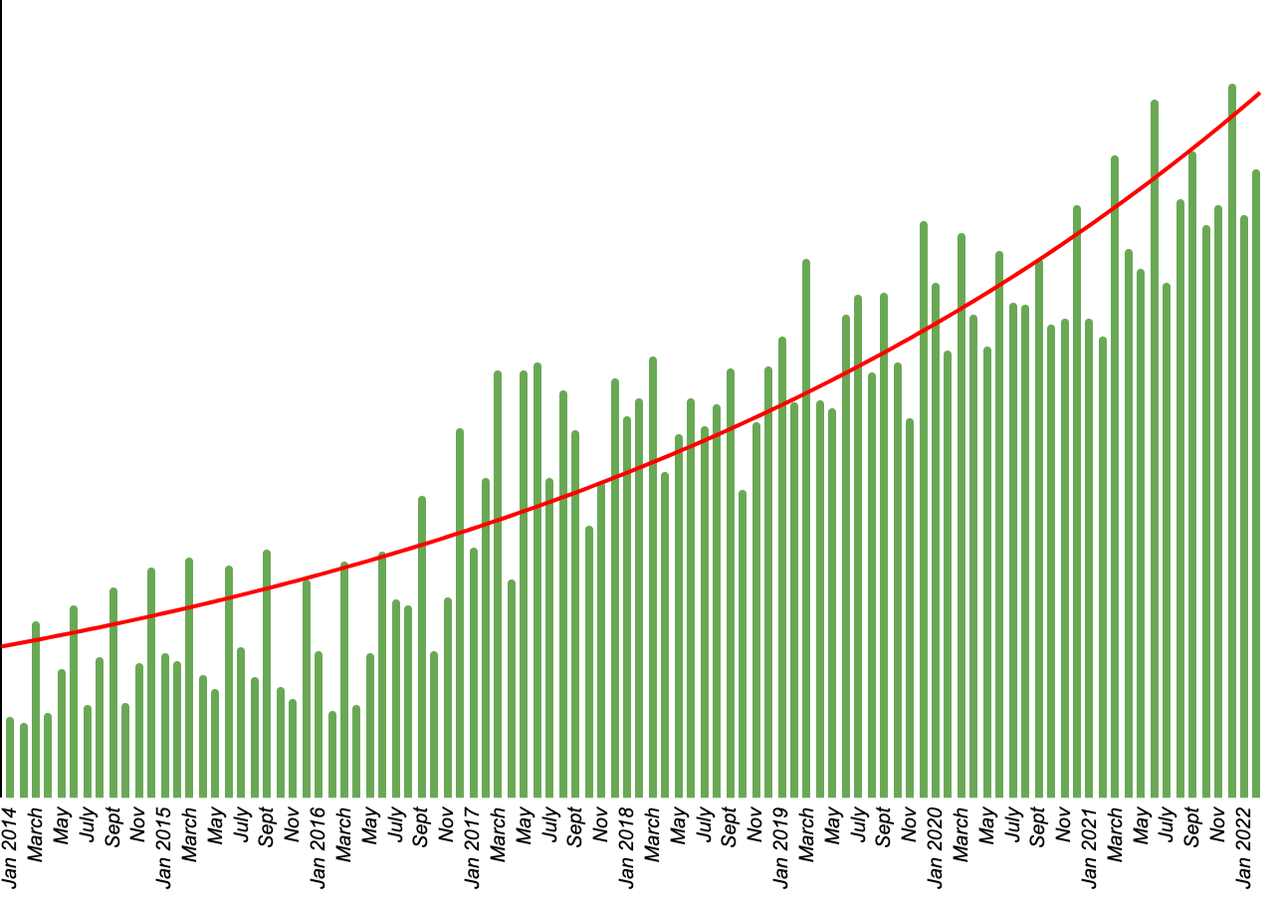

Nick’s Dividend Income (personal data)

36.6% is higher y/y growth than I produced during any single month during 2021. Looking back at the dividends that rolled in, I was aided by some new higher yielding positions in the portfolio that were being factored into the y/y comparisons for the first time, such as British American Tobacco (BTI).

February marked the 7th straight month of double digit y/y dividend growth. And, looking back, I’ve now produced 20%+ y/y monthly dividend growth during 7 out of the last 9 months.

On a year-to-date basis, my 2022 passive income is up 29.07% compared to the dividends I received during January and February of 2021. I don’t expect to see this ~30% growth trend continue throughout the entire year, but assuming that there are no major disruptions to my family’s savings rate between now and December, I believe that 20% y/y growth is very likely. This would be great because I’ve based longer-term retirement/financial freedom equations off of a ~10% annual dividend growth CAGR. Every year that I’m able to exceed that level of growth accelerates my journey towards financial freedom in a major way.

Nick’s Monthly Dividends (personal data )

Total Returns

As I’ve said many times before, my goal when managing my portfolio is not capital gains/total return-centric. First and foremost, I’m looking to generate a reliably increasing passive income stream. I do so by accumulating shares of the highest quality companies in the world when they’re trading at fair prices (or better). Generally, I’m looking to accumulate shares when they trade with an attractive margin of safety. Doing so not only reduces my downside risk, but also increases my dividend income because lower prices = high yields on cost. And, over the long-term, I’ve found that this quality/value oriented approach to dividend growth investing has also allowed me to generate market beating results. In short, the same reliable and predictable fundamental growth that the wonderful companies that I own generate not only supports sustainable dividend growth, but also, rising share prices. And, when you factor in margins of safety, I get to benefit from dividend income, fundamental growth, and multiple expansion via mean reversion. This triple threat approach to the markets has allowed me to beat the S&P 500 over the long-term (even though doing so is not one of my primary goals).

I always preface this “Total Return” section of the monthly results with a paragraph similar to the one you just read because when I look at the common mistakes that many investors make, they all seem to stem from an overzealous focus and concentration of short-term returns.

I always focus on fundamentals, largely ignoring share price volatility of the stocks that I own. So long as the dividends that the positions in my portfolio pay me continue to rise at an acceptable rate, I’m usually pretty happy to sit back, relax, and hold them (as I collect the dividends). But, I also know that many of my readers who follow along like to know how well the portfolio stacks up to the markets on a short-term basis, so even though I don’t pay attention to this data when making management decisions, I’m happy to post the results here.

During the 28 days of February, the capital gain/loss posted by my portfolio was essentially in-line with that of the S&P 500. The S&P 500 was down 3.14% during this period of time. The value of my holdings fell by 3.11%.

On a year-to-date basis, through the end of February, my portfolio was posting slight outperformance, relative to the SPY. I was down approximately 7.7% compared to the S&P 500’s -8.2% performance.

February 2022 Trades:

I’ll be quick here with the February selective re-investment trades because there are a few more significant moves that I made later in the month to discuss in more detail…

On 2/1/2022, I put my January dividends to work, adding to my existing positions in Microsoft (MSFT) at $306.62, Palantir (PLTR) at $14.09, Brookfield Asset Management (BAM) at $54.67, Brookfield Renewable (BEPC) at $33.83, Cummins (CMI) at $222.22, Hormel (HRL) at $46.78, and Block (SQ) at $126.12.

To me, this was a nice basket of stocks which bolstered several core-positions (such as MSFT, BAM, and HRL), some speculative high growth stocks (such as PLTR and SQ), and a couple of more cyclical names (such as CMI and BEPC). I didn’t really choose any high yielders during the February selective re-investment period; however, I heavily weighted my core holdings and I’m always pleased to add to very high quality positions like MSFT, BAM, and HRL.

Now, moving onto the trades that I made during the month…

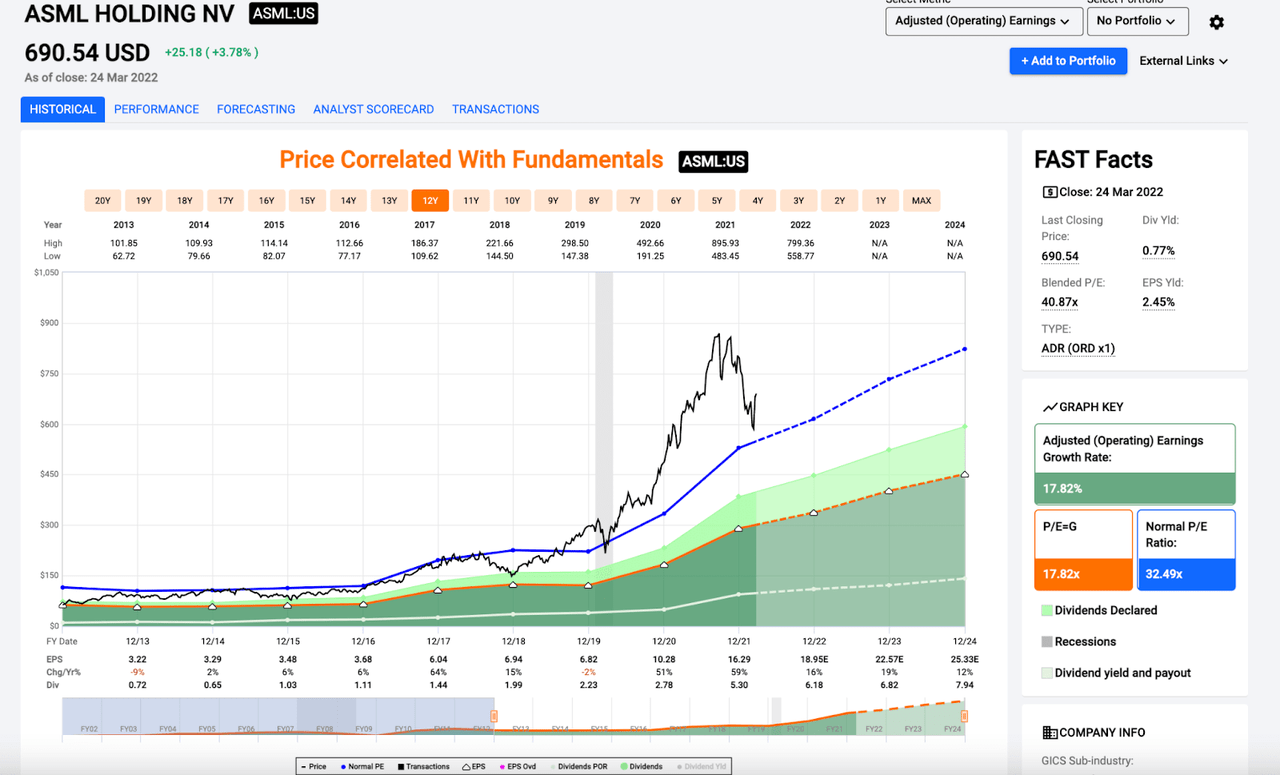

Also on 2/1/2022 I initiated exposure to ASML Holding N.V. (ASML) which is a pretty unique play in the semiconductor industry. This is a high growth stock; during the last 2 years, ASML has produced 50%+ EPS growth and moving forward, analysts are calling for continued double digit growth on the bottom line in 2022, 2023, and 2024.

ASML Fast Graph (F.A.S.T. Graphs )

CNBC recently published an article highlighting the unique nature of ASML’s products/services, which I think is worth a read for anyone looking to get acquainted with this company’s business; I’ll simply forward anyone looking to learn more about this company to that in-depth report instead of dedicating similar words to it here.

But, in general, I think this is a very high quality name that I’d been looking at in recent years (because of that enormous bottom-line growth in 2020/2021) and when the stock dipped I was pleased to finally add shares to my personal semiconductor basket. I bought shares of ASML at $672.15. Since then, the company’s sell-off continued to accelerate, recently making 52-week lows in the $560 area. Since this piece is being published so late, I’ll happily provide a bit of a spoiler alert for the upcoming March portfolio review article…on 3/4/2022 I went ahead and continued to average into this position, buying more ASML at $586.12. Today, my cost basis on the position stands at $643.47.

Now, we’ll move onto a series of trades that I made during February that involved trimming and/or selling assets and then replacing them with higher quality/lower valuation equities.

First, on 2/2/022, I sold my 3M Company (MMM) position at $163.80 and then used the proceeds from that trade to buy shares of Agree Realty (ADC) at $63.25, W.P. Carey (WPC) at $75.44, and Booz Allen Hamilton (BAH) at $75.49.

In the short-term, this trade has worked out very well for me, with MMM falling since my sale while all 3 of the companies that I bought with the proceeds rising (and sharply, in BAH’s regard).

I discussed this trade in retail on my YouTube channel. I also provided a real-time trade alert to Dividend Kings subscribers here at Seeking Alpha. Here’s the copy that those subscribers received on 2/9 when I sold MMM.

“I just sold my entire MMM position at $163.80, locking in long-term profits of approximately 5%. With dividends included, my total return here is roughly 19.5%. I hate parting ways with a blue chip Dividend Aristocrat like this…but, MMM’s recent sub-1% dividend increase was the final straw for me. This marks the 3rd year of low single digit annual raises (usually I sell after 2 bad years in a row…I gave MMM a bit more leash because of its historical quality). To me, that’s not acceptable for a stock with a yield like MMM’s (low single digit raises are only acceptable to me, for stocks in the ~6% area). I’ll be looking for a replacement(S) before the end of the trading day. I’ll keep everyone up to date on my use of the proceeds as soon as I make a final decision on that matter.”

Then, after putting the proceeds to work that afternoon, I said:

“All, I just finished up with my MMM trade…I put the proceeds from my sale to use buying a basket of 3 stocks…ADC at $63.25, WPC at $75.44, and BAH at $75.49. BAH is a new position for me – thanks to d1vid3nd.s33ker Justin.Law and wolf.report for putting this one on my radar…I really like the stock here trading at the 18x area (very strong historical support). BAH is a strong dividend grower (5-year DGR of nearly 20%), but it’s yield is lower than MMM’s (MMM’s yield was in the 3.7% area and BAH’s is in the 2.3% area)…so I had to use ADC and WPC to bolster the yield of the trade to ensure that I was growing my passive income stream. Overall, I used 27% of the MMM proceeds to buy WPC, and 38.5% to buy ADC and BAH, respectively. This trade basket increases my passive income by 4.49% and provides me much higher long-term dividend growth prospects than the roughly 1% raises that MMM has been providing in recent years (win-win). Because of my bullish stance on BAH at these levels, I also decided to dip into my February savings, using an additional pile of cash (roughly 30% of my monthly savings) to add more shares of BAH to my portfolio. The stock goes ex-dividend tomorrow, so I wanted to make sure that I got in today so that I would receive its 3/2/2022 payment. All in all, [I’m] very pleased with this trade. Happy to add BAH to the portfolio. And, I’m looking forward to putting the remaining 70% of my monthly savings to work in the coming days/weeks.”

All of that logic remains in place. I was disappointed with MMM’s recent dividend increase – the stock no longer met my portfolio’s dividend growth standards, and therefore, I was happy to move on to greener pastures. I haven’t regretted cutting ties with MMM since, and as I said before, I am very pleased with the near-term performance of BAH since I added shares (the stock is up 17.5% since I purchased it).

Up next, on 2/25/2022, I trimmed my AbbVie (ABBV) position at $149.60 and used the proceeds from that trade to buy shares of Realty Income (O) at $67.34 and Cummins Inc. (CMI) at $203.34.

Here is the real-time trade alert that I provided to Dividend Kings subscribers at the time:

“I just trimmed my ABBV stake, selling roughly 24% of my shares at $149.60, locking in profits of 122.65% on shares that I bought on 6/25/2019 at $67.19/share. I hope to put these proceeds back to work in the near-term. I recently lowered my FV estimate for ABBV from $147 to $144 (not all that long ago, my FV here was $156). The stock’s recent rally pushed my ABBV stake into overweight territory. Prior to the trade, my ABBV weighting was 1.75%. After the trade, my weighting sits at 1.33%. Now my position is in the “full” territory. I still think the dividend is safe and likely to grow. But, I was happy to take advantage of this rally and reduce single stock risk by locking in big profits. Now, I’m looking forward to using active management to increase my passive income stream. I’ll keep everyone updated when it comes to the buys I make with this new cash as soon as I make my mind up in that regard.”

Then, later that afternoon, after making purchases with the proceeds, I said:

“I just put my ABBV proceeds to work. I bought shares of Realty Income (before their ex-date) 67.34 (a discount to my $74.50 FV estimate) and CMI at $203.34 (a discount to my $265 FV estimate). Overall, this trade boosted my passive income stream by roughly 1.9%. Not a big jump there, but I was able to add to a couple of undervalued blue chips near the top of my watch list. I still have a bit of cash left over from this trade. I have 40% of my monthly savings left to put to work (hoping for a sell-off on Monday). And, if we see a bigger sell-off, I have the next batch of bear market funds ready to go into the brokerage accounts if/when the S&P 500 falls down to the -15% level from the recent all-time highs (so, right around the 4100 mark). My O position is now full (though, because of its high quality, I’d be happy to push it overweight into further weakness). I still have room for another 1-2 purchases or so before CMI is full, but we’re getting there.”

Then, a couple of days later, I finished off my February trading, by selling my Kimberly Clark (KMB) position at $130.60 and using those proceeds (along with the remaining cash from the AbbVie trim) to buy shares of Air Products and Chemicals (APD) at $234.48 and Owl Rock Capital Corporation (ORCC) at $15.02.

I highlighted my desire to begin building a position of APD on my YouTube channel several times in recent months and I was pleased to use the KMB proceeds to do so. I recently teamed up with Brad Thomas here at Seeking Alpha to produce a bullish report on ORCC; that article can be found here. Once again, this trade was baked upon poor dividend growth performance by KMB and my desire to reallocate capital to greener pastures.

Here is the trade alert that I sent to Dividend Kings subscribers regarding the KMB sale and the APD/ORCC purchases:

“I put in a pre-market order to sell KMB to ensure that I locked in profits…I didn’t get a notification that the sale went through, but I recently checked and even though I didn’t get the notification it does appear as though the shares were sold. So, I exited my KMB position at $130.60, locking in very small profits on the stake that I initiated at $129.96 last June (but a profit is always better than a loss; plus). I was strongly considering waiting a few days to lock in the next quarterly dividend (ex-date of 3/4/2022, but ultimately decided to take the money and run while I could). So, that was good news and I immediately put the replacement plan into place, initiating two new positions in my portfolio…ORCC at $15.02 and APD at $234.86 (53% of the proceeds went to ORCC and 47% went to APD). Overall, this trade allowed me to increase my passive income by 59.6% (largely due to ORCC’s 8.25% yield). Now, for a quick breakdown of the rationale…first of all, after doing some work on KMB over the weekend I agreed with the stance that several others brought up on Friday and KMB was likely to be “dead money” in the short-term. Inflation continues to hurt this company. Margins are compressed. EPS was down 20% in 2021 and is expected to fall another 4% this year. Analysts are calling for a nice 19% bounce back in 2023; however, even if that occurs, shares were trading for approximately 18.5x that forward 2023 estimate, which is above KMB’s long-term average, and therefore, points towards limited share price appreciation. This, combined with the company’s high payout ratio (~78%) and the recent sub-2% dividend increase inspired me to part ways with this blue chip in an attempt to upgrade my passive income stream. Now, why ORCC? Well, as I said in this week’s Nick’s Picks article, the company finally has the sort of NII dividend coverage that I’ve been looking for. I’ve been very impressed with ORCC’s management team. And, as I said in that article, I’ve been thinking about adding a high yielder like this to help further offset the dividend cut losses that I will experience in 2022 with AT&T. ORCC shares were trading slightly below my updated $15.07 FV estimate, so I went ahead and established a small, starter position. And, with regard to APD…well, as I said in my YouTube video highlighting my watch list last week, this is a wonderful company trading for a fair price IMO (22.8x 2022 EPS and roughly 20x my 2023 EPS target). Are APD shares extraordinarily cheap here? No, they’re not. But, the stock yields more than 2.7%. It just increased its dividend by 8%. And, I like some of the medium to long-term tailwinds at play here (especially with regard to blue and green hydrogen as an alternative energy source). I hope to average down into APD further if given the chance, but I was happy to initiate exposure here with shares down 25.8% from their 52-week high.”

That trade wraps up my February trading activity…now, let’s take a look at where my portfolio stands as of today (3/28/2022).

Nicholas Ward’s Dividend Growth Portfolio

|

Core Dividend Growth |

54.83% | ||

| Company name | Ticker | Cost basis | Portfolio Weighting |

| Apple | AAPL) | $24.26 | 15.43% |

| Microsoft | MSFT) | $60.71 | 4.58% |

| Broadcom | AVGO) | $234.30 | 3.46% |

| Qualcomm | QCOM) | $66.80 | 2.37% |

| BlackRock | BLK) | $413.84 | 2.10% |

| Bristol Myers Squibb | BMY) | $49.07 | 2.25% |

| Johnson and Johnson | JNJ) | $114.02 | 1.99% |

| Cisco | CSCO) | $32.67 | 1.93% |

| Cummins | CMI) | $217.77 | 1.37% |

| Brookfield Renewable | BEPC) | $33.49 | 1.27% |

| PepsiCo | PEP) | $93.35 | 1.22% |

| Brookfield Asset Management | BAM) | $34.97 | 1.22% |

| Lockheed Martin | LMT) | $346.87 | 1.19% |

| Raytheon Technologies | RTX) | $78.18 | 1.19% |

| Merck | MRK) | $73.71 | 1.13% |

| Honeywell | HON) | $126.18 | 1.05% |

| Coca-Cola | KO) | $39.88 | 1.02% |

| Amgen | AMGN) | $136.07 | 0.95% |

| Texas Instruments | TXN) | $95.19 | 0.94% |

| Brookfield Infrastructure | BIPC) | $39.19 | 0.91% |

| Pfizer | PFE) | $30.48 | 0.87% |

| Illinois Tool Works | ITW) | $130.90 | 0.79% |

| Deere & Co. | DE) | $363.15 | 0.77% |

| Intel | INTC) | $31.94 | 0.63% |

| Diageo | DEO) | $107.91 | 0.49% |

| AvalonBay Communities | AVB) | $148.29 | 0.48% |

| Essex Property Trust | ESS) | $215.29 | 0.48% |

| Medtronic | MDT) | $73.94 | 0.47% |

| Digital Realty | DLR) | $49.87 | 0.45% |

| Northrop Grumman | NOC) | $368.47 | 0.45% |

| Hormel | HRL) | $42.67 | 0.37% |

| McCormick | MKC) | $35.71 | 0.30% |

| Stanley Black & Decker | SWK) | $146.03 | 0.26% |

| Air Products and Chemicals | APD) | $234.86 | 0.25% |

| Tyson Foods | TSN) | $76.21 | 0.20% |

| Prologis | PLD) | $145.26 | <0.10% |

| High Yield | 14.01% | ||

| Realty Income | O) | $62.12 | 1.85% |

| Altria | MO) | $49.68 | 1.70% |

| AT&T | T) | $37.68 | 1.68% |

| W.P. Carey | WPC) | $64.65 | 1.43% |

| AbbVie | ABBV) | $79.08 | 1.38% |

| Agree Realty | ADC) | $65.85 | 1.18% |

| Federal Realty Investment Trust | FRT) | $115.13 | 0.71% |

| British American Tobacco | BTI) | $37.89 | 0.69% |

| Enbridge | ENB) | $34.14 | 0.61% |

| Store Capital | STOR) | $22.91 | 0.57% |

| National Retail Properties | NNN) | $36.57 | 0.56% |

| Philip Morris | PM) | $96.12 | 0.51% |

| Prudential | PRU) | $100.58 | 0.43% |

| Pinnacle West | PNW) | $81.67 | 0.36% |

| Verizon | VZ) | $45.20 | 0.35% |

|

High Dividend Growth |

12.79% | ||

| Visa | V) | $74.29 | 2.30% |

| Starbucks | SBUX) | $48.10 | 1.82% |

| Comcast | CMCSA) | $38.33 | 1.80% |

| Nike | NKE) | $59.52 | 1.68% |

| Lowe’s | LOW) | $137.51 | 1.41% |

| Mastercard | MA) | $81.40 | 0.98% |

| L3Harris Technologies | LHX) | $185.82 | 0.65% |

| Home Depot | HD) | $204.05 | 0.60% |

| Domino’s Pizza | DPZ) | $355.20 | 0.56% |

| Booz Allen Hamilton | BAH) | $75.49 | 0.37% |

| Roper | ROP) | $418.69 | 0.36% |

| ASML Holding | ASML) | $643.47 | 0.26% |

| Non-Dividend | 9.98% | ||

| Alphabet | GOOGL) | $741.39 | 5.39% |

| Amazon | AMZN) | $1,635.35 | 2.58% |

| FB) | $180.50 | 0.51% | |

| Adobe | ADBE) | $505.90 | 0.46% |

| Netflix | NFLX) | $391.91 | 0.34% |

| Square | SQ) | $179.39 | 0.26% |

| PayPal | PYPL) | $216.65 | 0.22% |

| Salesforce | CRM) | $233.58 | 0.22% |

| Palantir | PLTR) | $17.92 | <0.10% |

|

Special Circumstance |

6.64% | ||

| Walt Disney | DIS) | $91.69 | 2.40% |

| NVIDIA | NVDA) | $30.53 | 2.19% |

| Novo Nordisk | NVO) | $37.74 | 1.11% |

| Constellation Brands | STZ) | $172.19 | 0.35% |

| Owl Rock Capital | ORCC) | $15.01 | 0.21% |

| Scotts Miracle-Gro | SMG) | $153.56 | 0.16% |

| Carrier | CARR) | $20.97 | 0.12% |

| Otis | OTIS) | $58.65 | 0.10% |

| Viatris | VTRS) | $13.43 | <0.10% |

| Crypto | Diversified Basket | n/a | 0.92% |

| Cash | 0.83% | ||

| Most | Recent | Update: | 3/28 |

Be the first to comment