Edwin Tan /E+ via Getty Images

Investment thesis

NICE Ltd. (NASDAQ:NICE) reported robust results for Q3 FY12/2022, highlighting its ability to sustain growth and generate high profitability. We revisit our initial buy rating from August 2021 and conclude that with the shares trading on a free cash flow yield of 4.5%, it is currently a buying opportunity.

Quick primer

NICE is an Israel-based software company specializing in contact center applications, financial command compliance, and criminal justice applications. The core geographic market is the Americas, making up 83% of Q3 FY12/2022 sales, followed by EMEA with 11%. Cloud revenues made up 59% of Q3 FY12/2022 revenues, growing at 26% YoY.

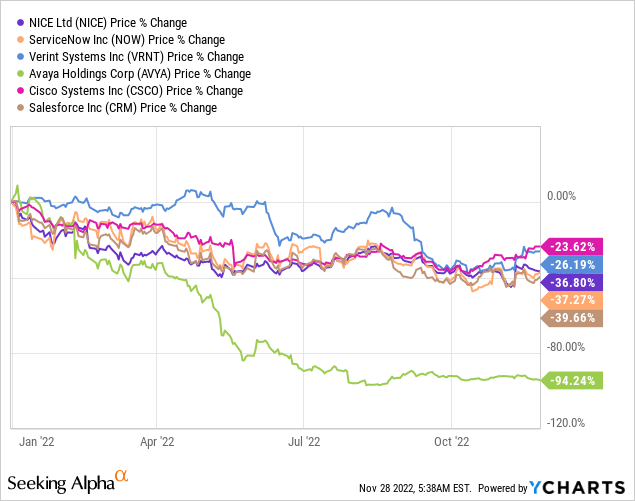

Core peers include Avaya (AVYA), Cisco Systems (CSCO), and Verint (VRNT) as well as other customer helpdesk solutions such as Zendesk (delisted), ServiceNow (NOW), Salesforce (CRM), and Oracle (ORCL).

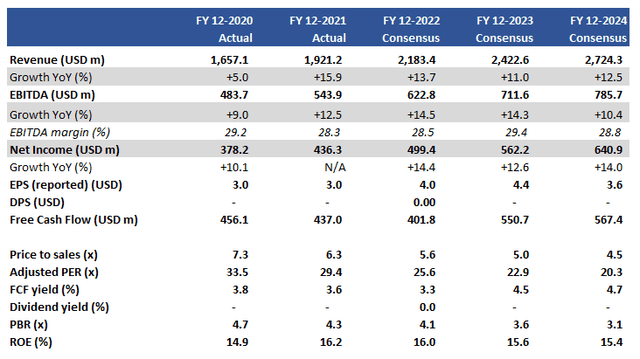

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

NICE’s shares have performed more or less in line with its customer experience peers, not escaping the market sell-off despite a stable earnings growth profile expected in FY12/2022. In this piece, we want to revisit our buy rating from August 2021, and to re-assess the growth drivers for the business.

Strong recent trading in Q3 FY12/2022

NICE exemplified a business demonstrating sustainable growth, with Q3 FY12/2022 revenues growing 12.3% YoY, driven by cloud revenues which grew strongly at 26.2% YoY. We believe this is impressive given the intense competition and macro headwinds, with management mentioning an ARR (annual recurring revenue) of USD 1.3 billion at the end of the quarter providing high earnings visibility YoY. Recurring revenues made up 82% of the total, again highlighting a stable income stream.

Although the company has loyal customers that continue to expand users and products with NICE, there appears to be a steady flow of demand from customers leaping on-prem systems to the cloud. There appear to be two drivers for this. Firstly, the need for digital transformation persists as businesses aim to simplify their technology stack as well as cost reductions to provide a better customer experience. Secondly, the need to address both the shortage and cost of labor for contact center operations is becoming more acute on a global basis, and the company provides automation functionalities that deliver high ROI. The company continues to gain market share, winning replacement deals as well as via land-and-expand business.

A relatively high level of customer diversification provides a stable addressable market. The core contact center business with the ‘CX’ platform is spread across 12 different verticals. The financial command compliance business caters to 90% of the large U.S. banks and over 70% of worldwide banks. And the justice system caters to a sector that is economically insensitive, allowing for a steady revenue stream.

The company raised FY12/2022 guidance by a small fraction after Q3 FY12/2022, which highlight to us that despite an uncertain economic climate, NICE continues to serve its customers well.

Continued innovation and a solid balance sheet

The choice of selecting a technology partner would center on the solution itself, and NICE’s track record of providing a differentiated service looks likely to continue given its steady investment in R&D. Although R&D costs fell slightly to 14.4% of Q3 FY12/2022 revenue (page 16) from 15.8% last year, this is a satisfactory level for a business that aims to balance growth with profitability (and meets the rule-of-40 for SaaS businesses when using EBITDA margins).

Constant investment is hard to accomplish without sufficient capital, and here the company stands out with USD1.0 billion net cash available via liquid short-term investments. This demonstrates the company’s strong ability to generate free cash flow, and how management can allocate it appropriately to grow the business. Potential customers would also like to see a strong credit profile from key software suppliers, and NICE would be seen as an ideal provider.

Valuation

When we initially recommended buying the shares, we did have some reservations about the valuation but felt that a free cash flow yield of 3.5% was attractive. Given the 16% drawdown experienced, in retrospect we should have waited for a cheaper valuation, but the equity markets have experienced significant volatility from rate hikes, FX movements, geopolitical risk, and a looming global recession.

Despite such challenges, we believe current valuations have become even more attractive, with consensus estimating (see Key financials table above) a free cash flow yield of 4.5% for FY12/2023. We do not think that consensus is too bullish, given the increasing recurring cloud revenue growth and the company’s focus on high profitability.

Risks

Upside risk comes from re-accelerating revenue growth into FY12/2023 as the company continues to gain market share. There is potential for some acquisitive earnings growth coming from M&A activity as the company deploys its ample capital.

Downside risk comes from a sudden cash burn profile with a huge spike in capex and operating expenses such as marketing – both unlikely given management’s focus on profitability and capital allocation. A sudden increase in customer churn or loss of market share would be detrimental to sustaining a growth profile, particularly in the key Americas geography.

Conclusion

NICE is a well-run business, with increasing market share, generating free cash flow on a sustainable basis, and well-capitalized to maintain investment into the business. The shares have not been immune to the market sell-off for tech and growth stocks, but we believe it is currently a buying opportunity with the shares trading at a free cash flow yield of 4.5%. We are underwater from our initial recommendation, but from a longer-term perspective, we believe the shares remain a high-quality investment.

Be the first to comment