ZargonDesign

Introduction

Ever since suspending its preferred distributions in early 2021, NGL Energy Partners (NYSE:NGL) has been locked into a deleveraging mission to save the partnership, which even now still sees its unit price 80%+ lower than at the end of 2019 before the COVID-19 pandemic. Whilst my hopes were originally high for its recovery, by the end of 2021 the company’s results were disappointing once again and, thus, made it time to downgrade my rating, as my previous article discussed. Since well over half a year has now elapsed, it seems timely to provide a refreshed analysis that reviews the company’s subsequently released results and the resulting outlook, which conversely to what would normally be expected, sees that a recession might actually help.

Executive Summary & Ratings

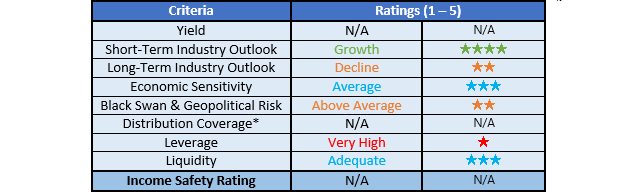

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into the company’s situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon the company’s financial position.

Detailed Analysis

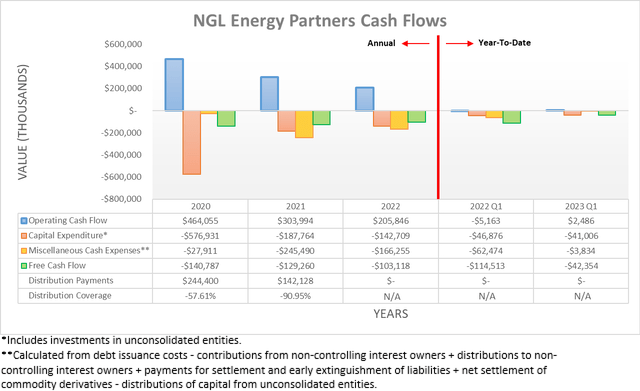

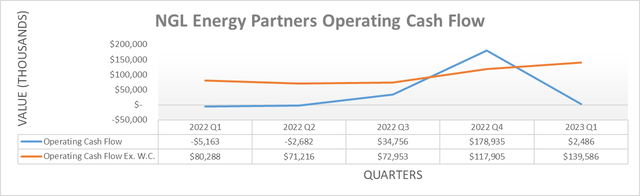

It does not matter whether the topic is distribution growth or deleveraging, the most important aspect is still cash flow performance as this holds the keys to achieving either goal and sadly in this case, it continues to hinder NGL’s deleveraging mission. When conducting the previous analysis, the primary reason behind downgrading my rating for NGL’s units was its weak cash flow performance and even after several more quarters, very disappointingly this still persists. Most notable, the company’s fiscal year 2022 results only saw operating cash flow of $205.8m that was down 32.29% year-on-year versus its previous result of $304m during its fiscal year 2021. Whilst NGL’s more recent result of $2.5m during the first quarter of fiscal year 2023 was higher year-on-year versus its previous result of negative $5.2m during the first quarter of fiscal year 2022, the difference is immaterial in the grand scheme for such a short length of time. Once again, the culprit remains a persistent working capital build with a sizeable gap evident compared to its underlying operating cash flow, as the graph included below displays.

Whilst NGL’s operating cash flow of $178.9m during the fourth quarter of fiscal year 2022 saw a working capital draw, thereby exceeding its underlying result of $117.9m, this was still insufficient to make up for the collective difference throughout the preceding nine months or the first quarter of fiscal year 2023. In fact, since the beginning of its fiscal year 2022, if these five quarters are aggregated, it sees NGL’s operating cash flow behind $273.6m versus its underlying results that exclude working capital movements.

Thankfully, there is still evidence of green shoots when examining the company’s underlying operating cash flow. The first quarter of fiscal year 2023 saw a result of $139.6m, which was a massive increase of 73.86% year-on-year versus the company’s previous equivalent result of only $80.3m during the first quarter of fiscal year 2022. Even though such a large increase is not likely to continue far into the future, NGL’s fiscal year 2023 guidance is encouraging that the year as a whole should be materially better than its previous fiscal year with adjusted EBITDA of $600m at minimum representing an increase of over 10% versus its previous result of $543 during its fiscal year 2022, as per slide nine of its first quarter of fiscal year 2023 results presentation. In theory, there should be a positive correlation between the company’s accrual-based adjusted EBITDA and underlying cash flow performance. Despite this stronger financial performance, it remains trapped on its balance sheet due to the working capital build that apparently stems from higher commodity prices, as per the commentary from management included below.

“The remaining majority of free cash flow generated in fiscal ‘22 remains on the balance sheet, driven by an increase in inventory values due to higher commodity prices. Should inventory values decrease, we should see this cash flow come back to us, at which time we expect it will be utilized for debt reduction of the 2023 senior notes.”

-NGL Energy Partners Q4 2022 Conference Call.

Quite ironically, the same higher commodity prices that have lifted the operating conditions of its industry to the best point in many years are also hindering NGL’s cash generation due to how its inventories are managed. Commodity prices are notoriously difficult to predict but considering the current global energy shortage, it would likely require the current recession fears to translate into an actual recession to see oil and gas prices revert materially lower. Despite possibly hurting demand for its services and thus its underlying earnings, since energy markets are very tight I suspect the impact would not be too severe. Even more importantly, NGL desperately needs the cash infusion to help with its deleveraging mission and thus in my eyes, it would be the lesser of problems right now but obviously, whether this eventuates is difficult to predict, which creates a cloudy outlook.

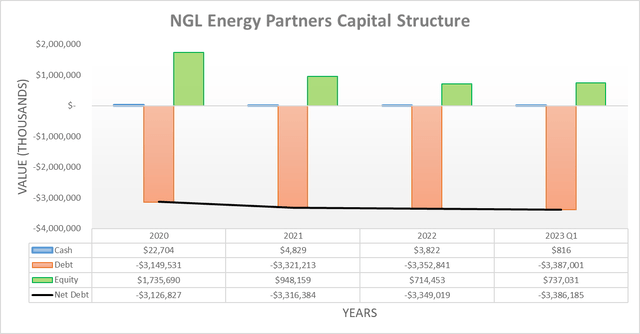

Due to its persistent working capital problems, NGL has made zero progress reducing its net debt, which obviously sits at the core of its deleveraging mission and as a result, its net debt is still $3.386b and thus at its highest level in history. Whilst this is very disappointing, if nothing else, at least it has not increased significantly with its previous respective levels of $3.316b and $3.349b from the end of fiscal years 2021 and 2022 quite close. When looking ahead, the commentary from management indicates that until commodity prices soften, NGL’s free cash flow will remain weighed down and thus as a result, its net debt will likely remain stuck around its current level.

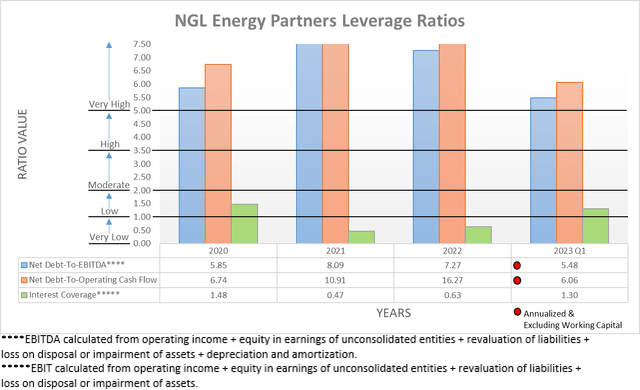

Even though the lack of progress reducing its net debt is problematic, thankfully NGL’s stronger financial performance still managed to push its leverage lower and thus see progress with its deleveraging mission. The company’s net debt-to-EBITDA and net debt-to-operating cash flow are both down to 5.48 and 6.06 respectively, which are now at their lowest levels since the end of the fiscal year 2020 that saw results of 5.85 and 6.74 respectively. Despite still being firmly above the threshold of 5.01 for the very high territory, this nevertheless still sees them moving in a positive direction.

When looking elsewhere, NGL’s ability to survive requires its leverage ratio to reach its target of 4.75 and thereby allow the reinstatement of its preferred distributions, which are suspended right now and accruing ever more burdensome each quarter. Whilst this has also seen improvements, it still currently sits much higher than its target at 5.96, as per slide four of NGL’s previously linked first quarter of fiscal year 2023 results presentation. To reach NGL’s target of 4.75 with its adjusted EBITDA guidance of $600m for fiscal year 2023, it requires debt of only $2.85b, which represents a decrease of $536m versus its current net debt. In theory, the company would instantly close half this gap if it could release its $273.6m working capital build, which highlights the benefit it could possibly see from a recession. Since this working capital build was accrued during five quarters, by extension, this also indicates that the company could potentially reach its leverage target in another five quarters, which would be during the second half of calendar year 2023, although this obviously remains dependent upon seeing its working capital builds cease.

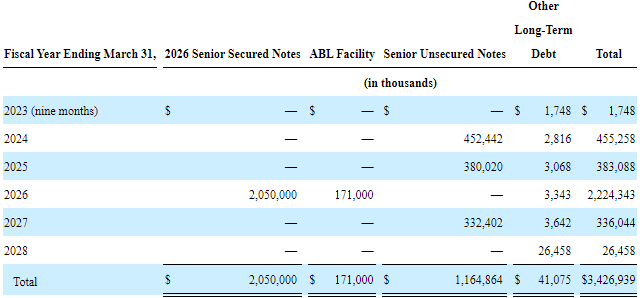

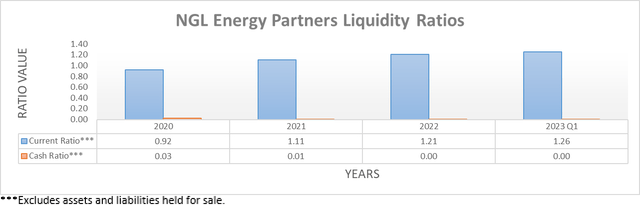

Despite its stubbornly high net debt, it was positive to see that the company’s liquidity remains adequate with a current ratio of 1.26, which is effectively unchanged versus its usual level seen throughout previous results. Even more importantly, NGL still sees no material debt maturities during the remaining nine months of its fiscal year 2023, as the table included below displays. Whilst this alleviates short-term solvency issues, the company nevertheless has sizeable maturities totaling $455.3m during the next fiscal year, which could prove very dangerous if its working capital build fails to be released because refinancing is not guaranteed given its overleverage, especially if monetary policy continues tightening.

NGL Energy Partners Q1 2023 10-Q

Conclusion

It seems very odd to say but in this rare situation, a recession might actually help due to how the company’s inventories are managed with management flagging that lower commodity prices would help release cash from its working capital build. Since NGL desperately requires this cash to make a sizeable difference with its deleveraging mission, the benefit would likely outweigh the downside of weaker operating conditions. Whilst the company has seen underlying improvements, given the lack of tangible progress and associated risks with this cloudy cash flow outlook, I believe that maintaining my hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from NGL Energy Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment