Vertigo3d

Investment Thesis: While Nexstar Media Group could see significant growth in Political Advertising revenue in the upcoming quarter, I take the view that investors will also want to see a rebound in growth across the Core Advertising segment, and the prospect of a rebound in upside for the stock may be significantly determined by this factor.

In a previous article back in August, I made the argument that Nexstar Media Group, Inc. (NASDAQ:NXST) could likely see further upside going forward – owing to anticipated strong growth in Political Advertising as the U.S. midterm elections approach.

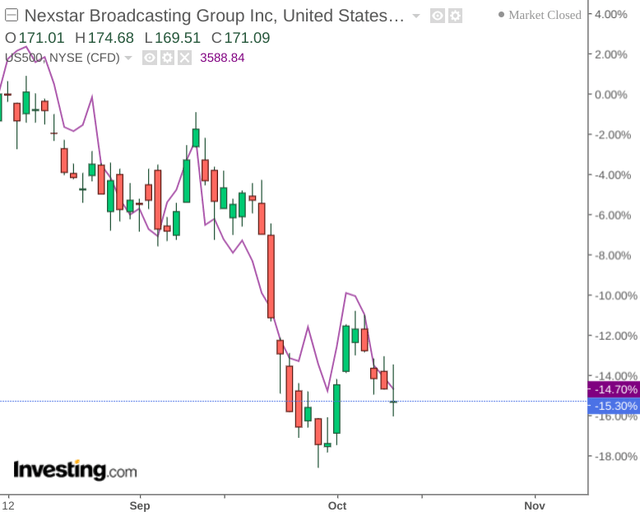

With that being said, the stock is down by just over 15% since my last article – in line with the decline seen across the S&P 500:

The purpose of this article is to investigate whether the decline in Nexstar Media Group is an overreaction to broader market events and whether the stock could have reasonable scope for a rebound at this point.

Performance

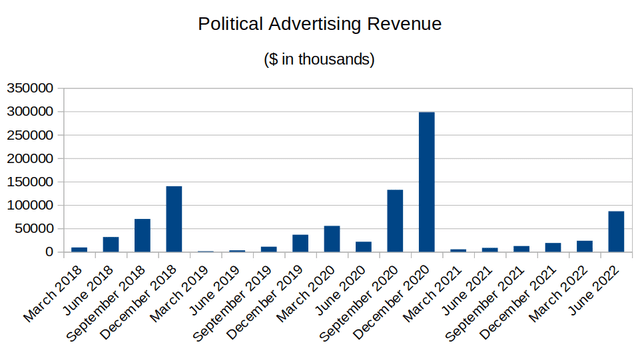

When looking at historical trends in political advertising revenue – it is interesting to note that the revenue we have seen for June 2022 significantly exceeds the revenue figures for the month of June from previous years (2018 – present).

Figures sourced from Nexstar Media Group’s historical quarterly reports. Graph generated by author.

Looking back at 2018 when the last U.S. midterms were held – we see a spike in revenue for September and December of that year – albeit substantially lower than in September and December of 2020, which of course was the U.S. Presidential Election year.

From this standpoint, political advertising revenue does appear to be moving in the right direction for this year – and if past is prologue – then we could expect that revenue will grow significantly for the months of September and December.

The decline in the stock that we have seen over the past couple of months could be down to a broader market decline – or investors might be taking profits on the stock on fears that revenue figures might come in lower than anticipated.

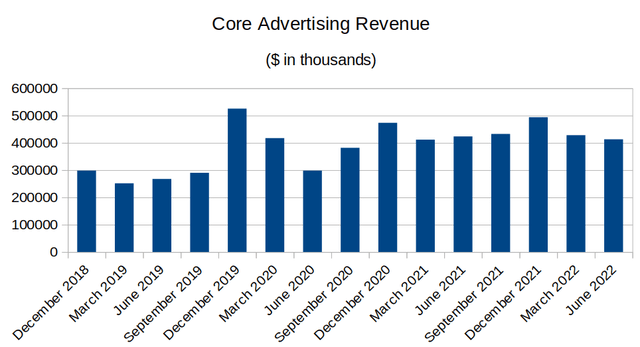

Moreover, it is worth noting that while Political Advertising can be a lucrative revenue stream during major elections – Core Advertising continues to remain the company’s primary revenue earner.

Figures sourced from Nexstar Media Group’s historical quarterly reports. Graph generated by author.

We have seen that while Core Advertising saw a significant boost after 2019 – coinciding with the COVID-19 pandemic – revenue growth has largely been stagnant since then.

In Nexstar Media Group’s most recent quarterly earnings report, the company notes that Core Advertising saw a decline as a result of a decline in spending across insurance, automotive, direct response, packaged goods, and government spending related to COVID-19.

In contrast, segments such as home repair, entertainment, fast food/restaurants saw an increase in advertising spend.

From this standpoint, Nexstar Media Group is still significantly exposed to the broader economic situation in that if inflation and recessionary fears cause companies across certain industries to pull back on advertising spend – then there is the possibility that the boost in Political Advertising may not be sufficient to make up for this shortfall.

Looking Forward

Looking ahead to Q3 2022 earnings on November 8, investors are likely going to pay attention to the degree to which the company can increase Political Advertising spend while preferably growing Core Advertising spend once again.

Should we see a scenario where Political Advertising revenue shows little growth from June figures – then this might make investors more apprehensive on the stock.

Additionally, Core Advertising revenue will likely be more of a focus in the upcoming quarter. Investors would preferably like to see some evidence of growth across the company’s main revenue segment – lack of growth here could make investors doubt whether this segment can sustain growth post-COVID and might anticipate downside for the stock once Political Advertising revenue experiences a seasonal decline once again.

Conclusion

To conclude, Nexstar Media Group could be set to see growth in Political Advertising revenue coinciding with the U.S. midterm elections. However, I take the view that investors will also want to see a rebound in growth across the Core Advertising segment, and the prospect of a rebound in upside for the stock may be significantly determined by this factor.

Be the first to comment