Michael Vi

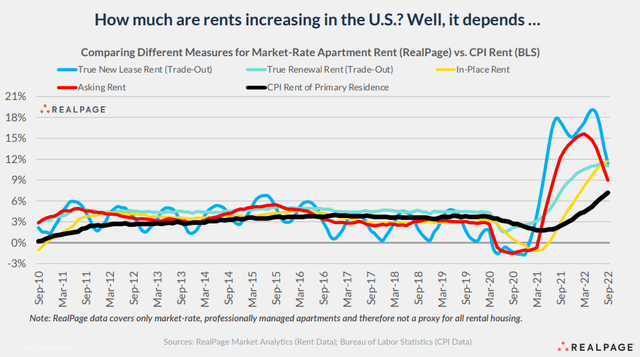

Reports out from Yardi Matrix and Apartment List concur that double digit apartment rent inflation is clearly in the rearview mirror. Not only did rent growth slow in September and October, in many hot markets rents reversed and saw modest declines. Multifamily REIT share prices have declined significantly and may now present an excellent entry point for fresh capital. In this article I will argue that NexPoint Residential (NYSE:NXRT) is cheaply priced and uniquely positioned to continue its impressive growth.

The Evolving Multifamily Market

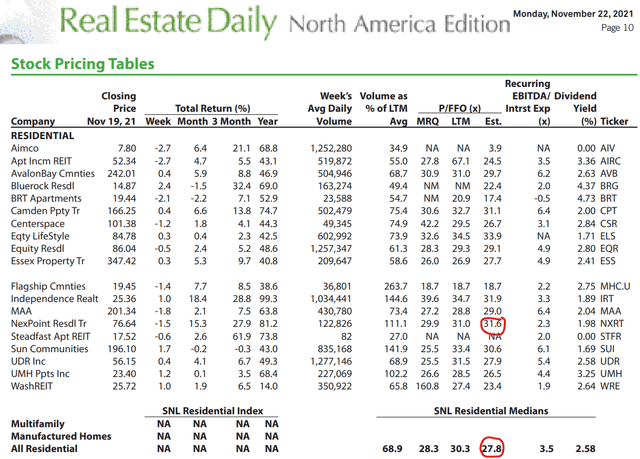

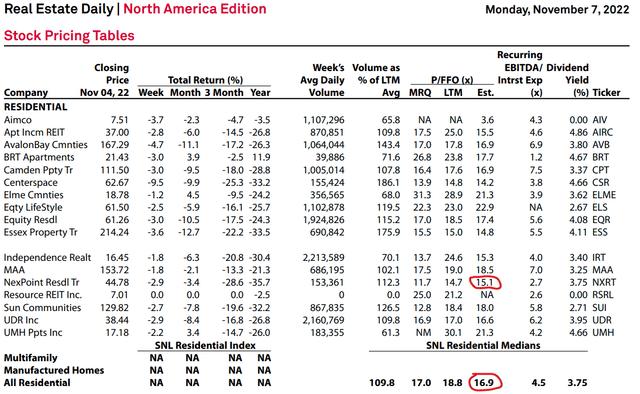

The work-from-anywhere migration out of expensive coastal cities to more spacious and affordable sunbelt locales was a boon to apartment owners from Las Vegas to Charlotte, letting landlords hike rents by as much as 15% on lease renewal. As they always do, investors extrapolated this trend toward infinity and multifamily REIT trading multiples reflected that pie-eyed optimism. Here is what pricing looked like a year ago.

A sector P/FFO multiple of 27.8x signals that sustained, strong earnings growth is anticipated. Four turns higher at 31.6x, NXRT was a rocket ship. Investing new capital at these valuations must always be done with prayer and crossed fingers.

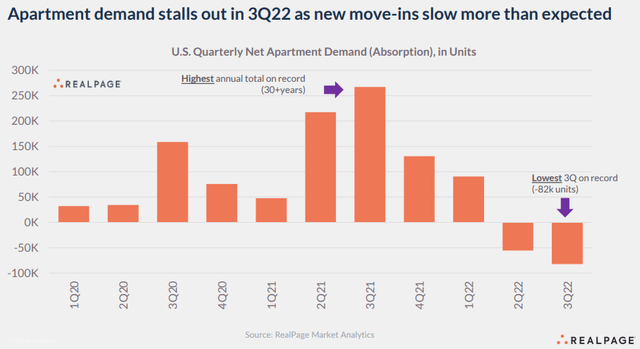

Just one year later, however, we see that investors are still extrapolating trends, but now it is in the opposite direction. Real Page Analytics recently reported a significant decline in new apartment absorption.

And this corresponds to surging new apartment deliveries which slows rent growth…

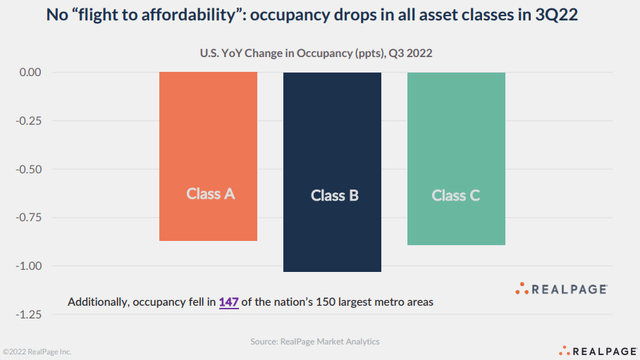

And rising vacancies.

In the stock market, this information seems to have translated to significantly lower REIT share prices.

Today, the multifamily P/FFO has fallen almost 40% to 16.9x and NexPoint Residential’s has declined more than 50% to 15.1x (below the sector average).

So, are Apartment REITs Cheap?

Throughout 3Q earnings season, every REIT management team acknowledged that the rate of rental rate increases was slowing, but they universally asserted rents are expected to continue higher. In its quarterly Supplement, NexPoint estimated that rents would again rise double digits in the coming 12 months and deliver same store NOI growth of 12.9%.

In the same supplement they revised their 2022 Core FFO guidance to $3.08/share, up from $3.01/share in the 2Q guidance; that guidance translates to 15.17x 2022 FFO compared to the 17.0x sector average. They estimate their NAV/Share is $76.75 at mid-point under current market conditions (64% higher than today’s $46.73 closing share price). These metrics make NXRT look cheap.

Will NXRT Perform?

Three factors contribute to my anticipation that NXRT will outperform.

Debt: Earlier this year I opined that NexPoint’s large load of floating rate debt had created significant market anxiety. NXRT management is sensitive to concerns and has taken steps to “de-risk” their balance sheet. CFO Brian Mitts, from the earnings call:

we’re pleased to announce favorable improvements we’re undertaking to derisk our balance sheet, increase liquidity and improve our financial outlook. First, we’ve executed a loan application and in the process of refinancing 19 property-level mortgages for Keybanc and Freddie Mac. In aggregate, this transaction will refinance 46.7% of the company’s total outstanding debt that improved spread pricing of 150 basis points over 1-month SOFR and pushed the maturities out to 2032.

Additionally, NXRT has executed 12-month extension option on the revolving credit facility, extending that maturity to June 30, 2025. The company expects to use approximately $217 million of cash out mortgage refinancing proceeds to pay down outstanding principal balance on the credit facility, the most expensive debt on our balance sheet today. These improvements will increase the company’s weighted average maturity to 6.4 years, up from 3.3 years as of September 30. Additionally, this refinancing is expected to reduce NXRT’s weighted average interest rate on total debt by 39 basis points to 4.33% before factoring the impact of interest rate swap contracts. Accounting for the hedging impact of the swaps and caps. NXRT’s adjusted weighted average interest rate is expected to be reduced from 3.29% to 2.78%.

With the completion of refinancing, the company has no meaningful debt maturities until 2025, which is the revolving credit facility. But as mentioned, we’re using excess proceeds to pay down 65% of that facility this year using that maturity obligation. Through this guidance, we’re revising guidance as follows: same-store NOI, we’re estimating 14.9% on the low end, 16.1% on the high end with the midpoint of 15.5%, which is a 30-basis point reduction from the prior guidance of 15.8% due to higher turn costs.

The transactions are complex and murky, but it seems NXRT has bought time and contained costs.

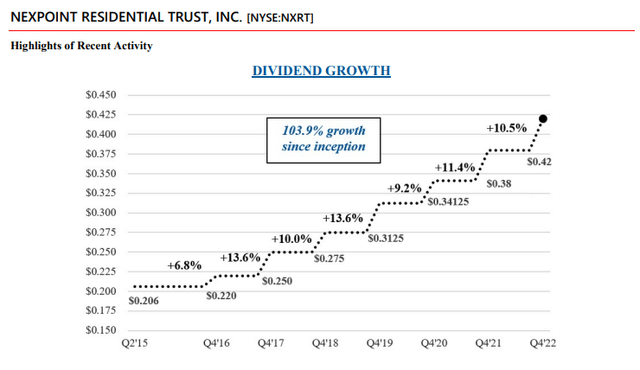

Dividend: NXRT aspires to status as a dividend aristocrat, and they are on their way. Coincident to their earnings release, they announced a 10.5% dividend increase in the quarterly dividend from $0.38 to $0.42/share. These increases seem to have become habit.

Share Buyback: NXRT knows the value of its portfolio and measures it in contrast to other investment opportunities. Historically, any time they have seen too great a discount relative to NAV, they have aggressively purchased their shares in the open market.

They are slated to complete a significant disposition in Houston and will use the proceeds to pay down debt and buy back their own shares. A fresh $100MM buyback has been authorized and considering the company’s $1.2B market cap, that sum will at least support, if not significantly improve, share prices.

In Conclusion

Every stock has been revalued lower in the face of soaring inflation, spiking interest rates, and the prospect of a not-so-soft landing. Apartment REITs face a surfeit of new supply in each of their markets. New supply, almost universally, is targeted at the top end of the pricing in any given market. The top of market faces significant headwinds with competing inflationary pressures. NexPoint estimates that they have between $450 and $650 per month “headroom” compared to new Class A supply and Single Family Rental pricing in their markets. That is real pricing power.

NexPoint Residential has deftly navigated historic winter storms in the sunbelt, the pandemic, and now, the rapidly shifting economic environment. NXRT shares are oversold.

Be the first to comment