CinemaHopeDesign

I fared well getting stopped out of most gold producers in June. I also suggested selling Newmont (NYSE:NEM) from my Millennium Index early this year when it was around $76. It’s time to buy Newmont back.

Investment Thesis

Gold (GLD) prices will soon turn around with a new uptrend. We don’t have to be perfect picking a bottom because we can enjoy over a 5% yield with Newmont Mining while we wait.

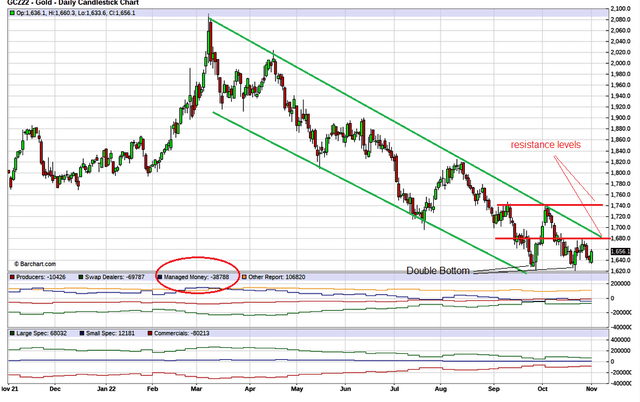

Managed money (MM) is short 38,788 contracts, and this is their highest short position since the 2018 bottom below $1,200. Back then, MM was short around 83,000 contracts. Gold is within its downtrend channel since the March peak, but it does show a double bottom around $1,620. Will this double bottom hold as a big question? Regardless, I believe we are close enough to a bottom if we don’t have one already to start buying back some gold producers.

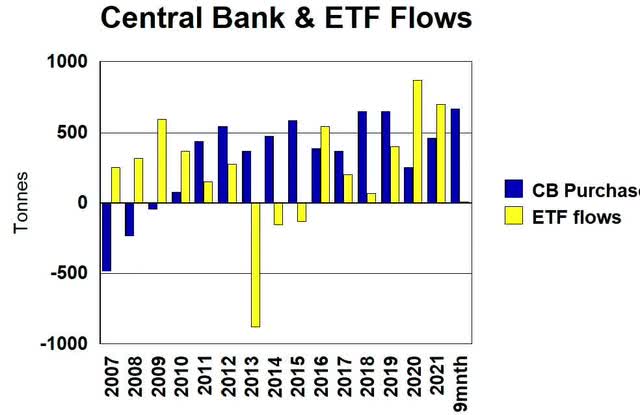

Investor sentiment in gold is very low, but the central banks stepped up and bought a record amount of gold last quarter as they diversified foreign currency reserves, with a large chunk of the purchases coming from as yet unknown buyers. Almost 400 tons were scooped up by central banks in the third quarter, more than quadruple the amount a year earlier, according to the World Gold Council. That takes the total so far this year to the highest since 1967, when the dollar was still backed by the metal. Investment demand was down -47% year over year. What do Central Banks know that investors do not? My guess is a bargain price.

I update my Central Bank and ETF chart and with the Q3 data, ETF flows barely show at + 7 tonnes. ETFs saw outflows of 227t in Q3 – the largest since Q2 2013.

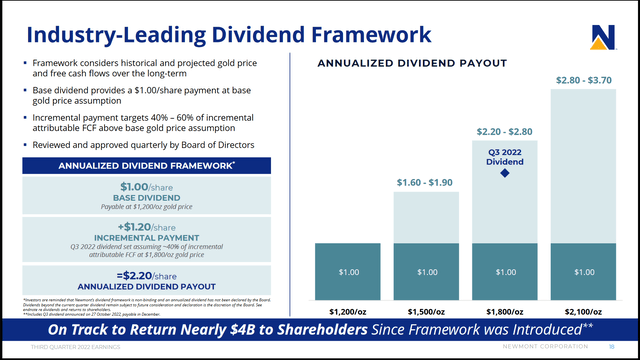

Now, with Newmont, we can collect a 5.2% dividend while we wait for the gold bottom and the next bull market.

Newmont Mining Recent Price – $41.80

Dividend – $0.55/qtr. Current Yield – 5.3%

Newmont will pay 40% to 60% of incremental cash flow above their forecast of the annual base gold price. I show their current framework below, and this should be updated with new input costs and such this December. At the current framework, they are using a $1,800 base. If gold prices go a fair bit higher, the dividend will go higher. I expect the December framework could use different base gold price forecasts.

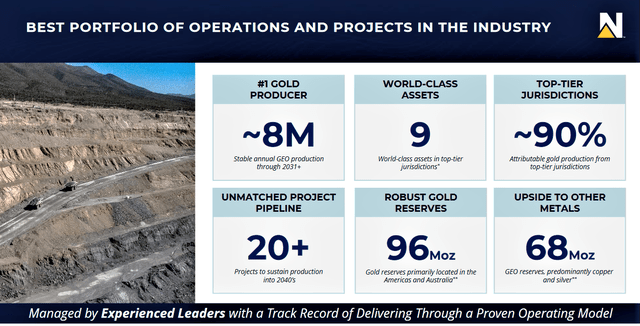

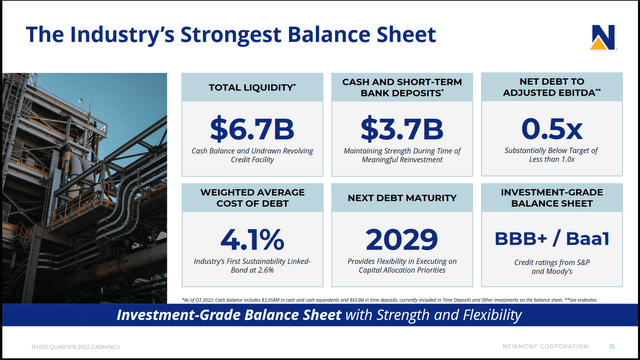

For investors that know little of Newmont, I would suggest their video presentation at the Denver Gold forum. I have picked a few of the slides above and below.

Newmont is a very solid gold company with great assets, they released their Q3 results Tuesday, here are some highlights:

-

Produced 1.49 million attributable ounces of gold and 299 thousand attributable gold equivalent ounces (GEO) from co-products; due to timing of shipments at Peñasquito, 38 thousand attributable gold ounces and 20 thousand GEOs of third quarter production will be sold in the fourth quarter;

-

Reported gold Costs Applicable to Sales (CAS)* of $968 per ounce and All-In Sustaining Costs (AISC)* of $1,271 per ounce;

-

On track to achieve full-year guidance of 6.0 million ounces of attributable gold production with Gold CAS of $900 per ounce and Gold AISC of $1,150 per ounce, as well as 1.3 million gold equivalent ounce production from copper, silver, lead and zinc with Co-Product CAS of $750 per GEO and Co-Product AISC of $1,050 per GEO;

-

Generated $466 million of cash from continuing operations and reported $(63) million of Free Cash Flow*, impacted by one-time working capital payments totaling $210 million and the timing of concentrate shipments at Peñasquito with an approximate sales value of $80 million;

-

Reported Adjusted Net Income (ANI)* of $0.27 per share and Adjusted EBITDA* of $850, impacted by lower metal prices and timing of sales;

-

Declared third quarter dividend of $0.55 per share, calibrated at a $1,800 per ounce gold price;

-

$1 billion share repurchase program to be used opportunistically, with $475 million remaining;

-

Ended the quarter with $3.1 billion of consolidated cash, $653 million of time deposits with a maturity of less than one year, and $6.7 billion of liquidity; reported net debt to adjusted EBITDA ratio of 0.5x;

-

Announced the delay and review of the Yanacocha Sulfides project and appointment of Dean Gehring to Chief Development Officer – Peru to lead operations and strategy in the region;

-

Advancing profitable near-term projects, including Tanami Expansion 2, Ahafo North, Pamour and Cerro Negro District Expansion 1;

-

Announced and closed the sale of Newmont’s 18.75% stake in the MARA project joint venture to Glencore International AG for $125 million, with a minimum $30 million deferred payment upon successfully reaching commercial production.

Newmont is in a strong financial position with $3.7 billion in cash. In the last quarter alone, they generated $466M of CFFO that easily covers dividends.

Conclusion

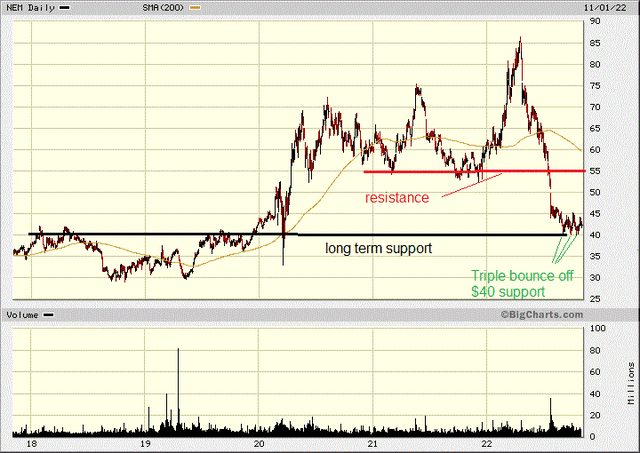

Newmont has always been one of the first gold stocks to respond well to a rising gold price. They have a very strong balance sheet and free cash flow to support a premier dividend among their peers. The downtrend in gold will not last forever, and the bottom might be in or close to it. I expect Newmont will gradually increase in value if gold stays around these prices, but a move in gold would quickly reflect in Newmont’s stock price. In the meantime, we can collect over a 5% yield while we wait. What I like best about Newmont is the stock chart.

The stock has come down to long-term support at $40 and has bounced off this three times in the past two months.

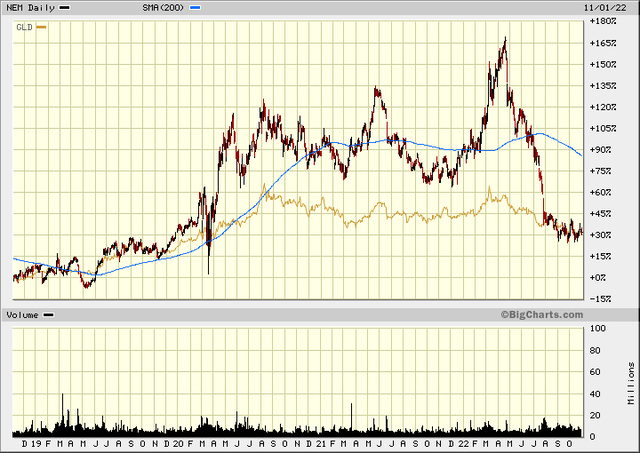

I also show a chart here comparing Newmont to Gold. From late 2019 until the high this March, gold gained +60%, and in that same time period, Newmont gained 165% showing good leverage to rising gold. This year gold corrected but is still +30% above the late 2019 levels, and at the same time, Newmont gave back all its previous leverage. Although mining costs have risen for Newmont with the current inflation, I believe the stock is oversold.

Speculators might prefer Call options. I like the January 2023 $45 Call at $1.65.

Be the first to comment